Abstract

In this issue of the Digital Investor, we focus on Ethereum – the second largest blockchain by market capitalisation. It is set to transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus algorithm in order to improve its throughput and position itself as a global platform for smart contracts and decentralized applications.

This transition will be a long journey. Transitioning from PoW to PoS is a task similar to switching the engine of a car from combustion to electric while driving it! We explore here the way this transition is set to take place.

PoS has advantages and drawbacks. For investors, the transition is important as it offers the option of staking, i.e. the possibility to earn a yield, which is an attractive value proposition in the current environment of low interest rates and low yield.

To help navigate in this new world, we provide a detailed yield analysis of the different monetary policy conditions that will prevail once the Ethereum PoS transition is completed.

Why is Ethereum moving to proof-of-stake?

Building new and more complex structures using old tools may lead to limitations. A platform for hosting applications needs to be scalable, and Ethereum suffered congestion when a game called CryptoKitties became famous. This event severely underscored the need for Ethereum to scale.

One of the major concerns about the PoW network is their rising energy requirements to maintain network security. This is not a practical approach for a system that intends to be a global smart-contract1 platform for applications, because such a contract needs to have high throughput while maintaining security. Ethereum founder Vitalik Buterin and other key network developers detected this problem and asserted that PoS is a viable alternative to these problems.

The current state

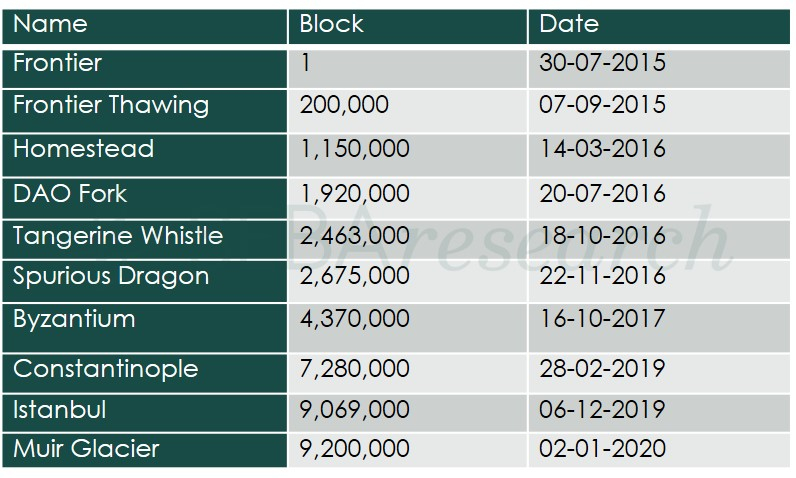

The concept of Ethereum was first introduced in 2014 followed by a 42-day presale which raised about 31,000 bitcoins. Since then, Ethereum has come a long way as a platform within the digital assets ecosystem. In figure 1 we list the major network upgrades that Ethereum undertook and can see what exactly they were aiming towards.

Figure 1: Timeline of Ethereum upgrades

After Frontier – the genesis block for Ethereum – the development team rolled out two updates, namely Frontier Thawing and Homestead, which helped set up operational parameters for Ethereum’s network.

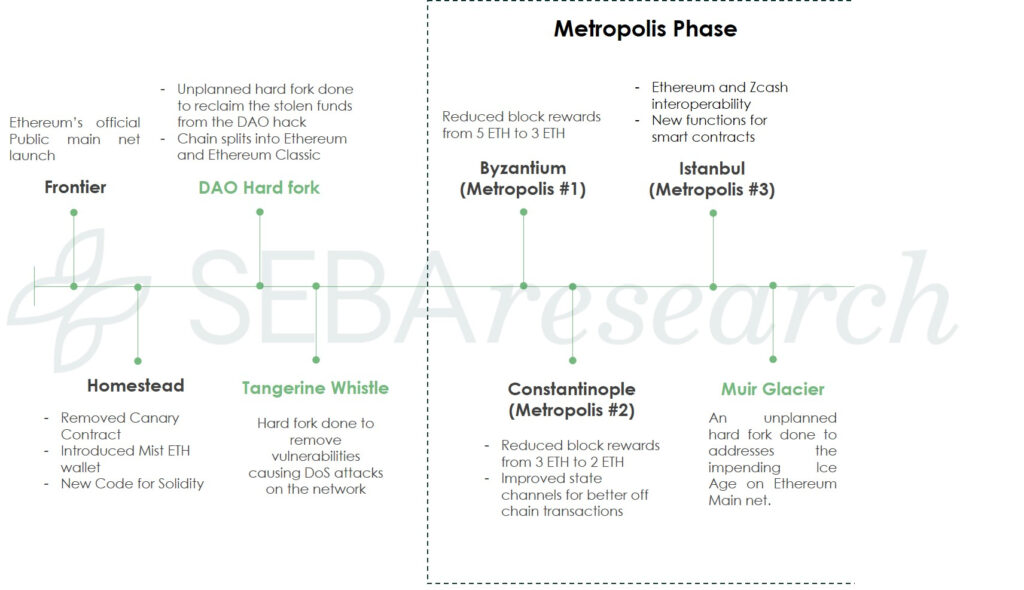

Later, a decentralised autonomous organisation project called The DAO was created through a crowdfunding campaign on the Ethereum network. The DAO was able to raise USD 150 million. The following month, The DAO suffered a major hack that drained almost one-third of the funds. To retrieve the lost investor funds, the DAO Fork was implemented. This proved a controversial move as it resulted in rolling back the chain. The chain which implemented the fund restoration is known as Ethereum (ETH), while the original unforked blockchain was maintained as Ethereum Classic (ETC).

Following the DAO Fork, the Ethereum network suffered multiple instances of denial of service attacks (DoS attack), where the attackers dumped millions of useless transactions into the network to flood the system. This required the Ethereum developers to implement two-fold hard forks, namely Tangerine Whistle and Spurious Dragon. These hard forks resolved the issues that led to the DoS attack.

To incentivise miners to move from a PoW to a PoS-based Ethereum network, a difficulty bomb was created. It is intended to make mining on the Ethereum network exponentially difficult and less profitable over time. Over the next three years, the Ethereum network entered the Metropolis Phase and implemented Byzantium, Constantinople, Istanbul and Muir Glacier upgrades, which systematically worked towards the following:

- Updating the network to increase efficiency

- Implementing security fixes

- Paving the way for migration from PoW to PoS

- Managing difficulty bomb according to expected time for the next update

Figure 2 illustrates all the updates that have been undertaken. The DAO hardfork, Tangerine Whistle and Muir Glacier were done as part of an unplanned or emergency fork to deal with immediate network threats. The Metropolis Phase is currently underway, with Berlin as its next update.

Figure 2: Past Ethereum upgrades

The road to serenity (what lies ahead)

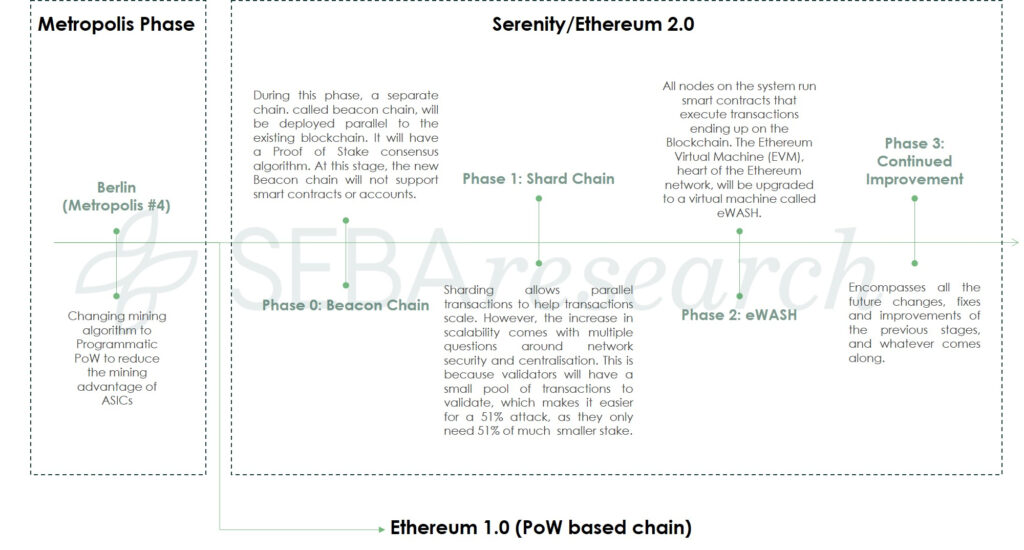

Serenity (also known as Ethereum 2.0) is the last stage of Ethereum’s migration from a PoW to PoS-based consensus. Serenity is further broken down into smaller phases, as illustrated in figure 3.

Figure 3: Forthcoming Ethereum network upgrades

Enter Serenity

Serenity is the fully-fledged PoS implementation of Ethereum. It has a significant impact on the circulating supply of Ether, the native crypto-currency, and the existing economics of Ether (ETH).

Impact of Serenity on the circulating supply and inflation

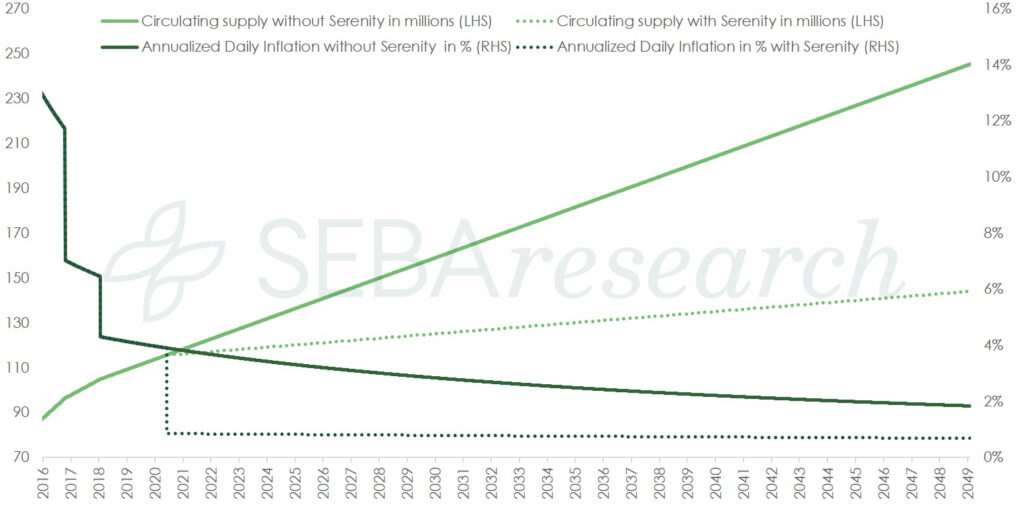

The issuance mechanism of Serenity depends on the total ETH at stake. The supply issuance is decided in a manner that at a steady state, the annual inflation will settle below 1% per annum (figure 4).

Figure 4: ETH supply with and without Serenity

Serenity economics

If one wishes to be a validator, the following variables need to be considered:

- Total ETH at stake

- Total number of validators

- Average number of uptime2 (of all the validators as well as the of the individual validator)

- Different slashing3 conditions

- Network fees

- Hardware and other costs such as Internet, electricity for running the software, etc.

The economics relating to Ethereum 2.0 (Serenity) can be broadly categorised into two major categories, namely punishments (slashing conditions) and incentives (validator rewards).

Slashing conditions

The most common scenarios under which a validator’s stake is slashed are: misbehaviour and being offline

- Misbehaviour: The network design forgives honest mistakes but severely punishes coordinated attacks. In case the validator behaves maliciously (for example, signs invalid transactions) the minimum amount slashed will be 1 ETH. However, if more validators behave maliciously at the same time, it may lead to the slashing of the entire stake.

- Offline: A similar pattern follows when the validators are offline. If a validator is offline, when more than two-thirds of the network is online, it leads to a small penalty. However, if a validator is offline when more than one third of the network is offline, inactivity leak4 kicks in with harsher penalties. Validators may lose up to 50% of their stake in this case.

Validator rewards

As with the current PoW design, rewards can be broadly divided into two parts: transaction fees and base rewards. While transaction fees are similar to fees paid by the users on the network, base rewards are analogous to miner rewards in the PoW design. However, the difference is that with Serenity, the reward model moves away from the fixed reward model to a variable issuance model. The transaction fee component remains the same, but the base reward varies depending on the total ETH at stake and the base reward factor – a sensitivity factor – set at a default value of 64.

Validators will not be able to earn transaction fees until phase 2 of Serenity is launched. Until then, validators must rely on rewards other than fees.

In general, the Ethereum 2.0 validator reward design philosophy stems from four major drivers:

1. Total ETH at stake

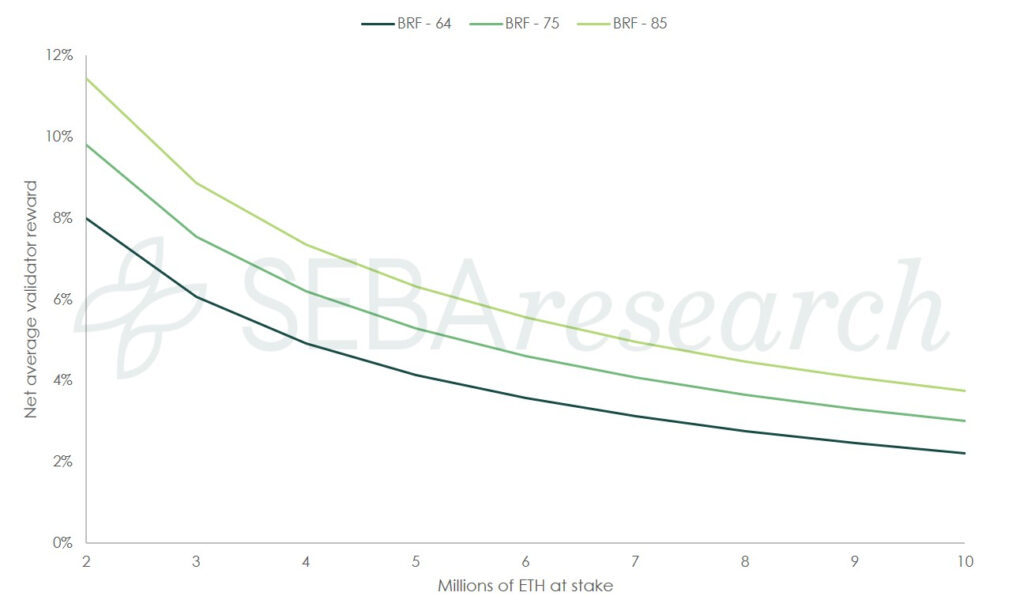

Keeping the demand supply in mind, the more ETH is at stake, the lowerthe net average validator return5 on staking will be, as illustrated in figure 5.

Figure 5: Validator rewards decrease as total number of ETH at stake increases

2. Base rewards factorBase rewards factorlink1

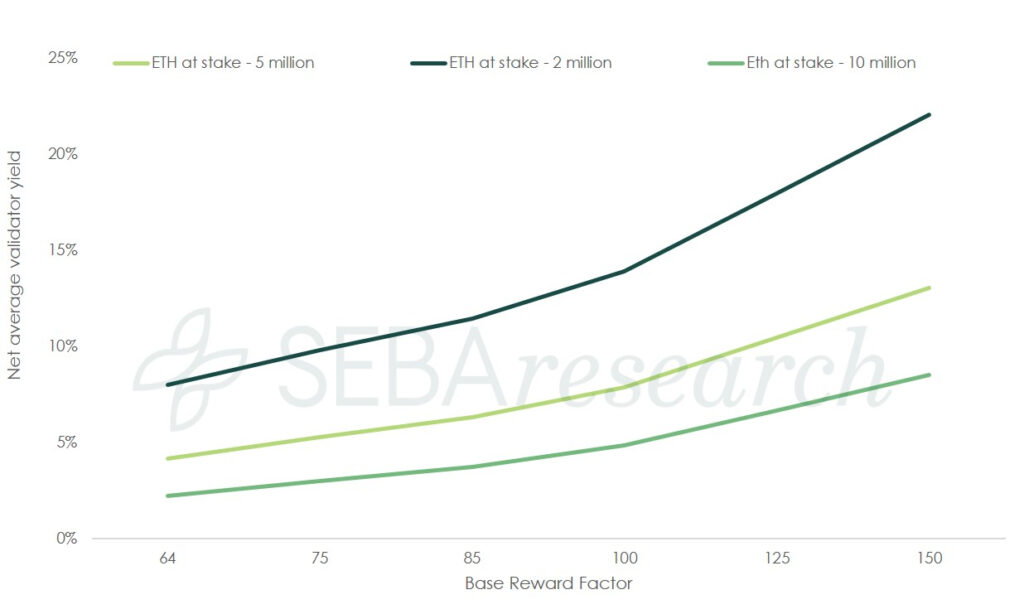

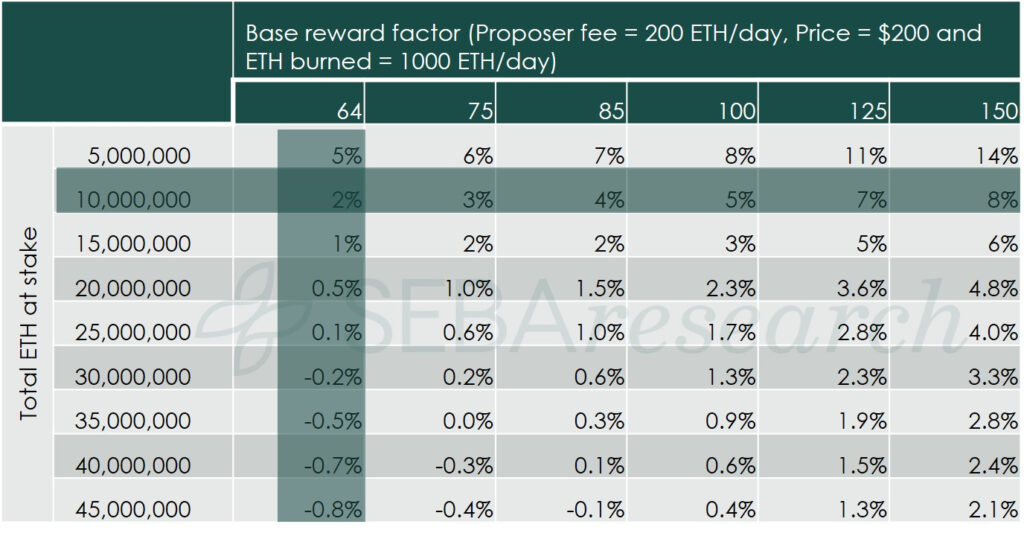

Base rewards serve as an incentive for the validators to propose and attest blocks on the Ethereum network. Base rewards are inversely proportional to the total ETH at stake and directly proportional to base rewards factor6. As the base reward factor increases, the expected reward also increases. The base reward factor is decided in a manner that allows yearly issuance to be controlled. At a constant number of ETH staked as the base rewards factor (BRF) increase, the expected returns increases, as shown in figure 6.

Figure 6: As the base reward factor increases, the net validator reward increases at a constant number of ETH at stake

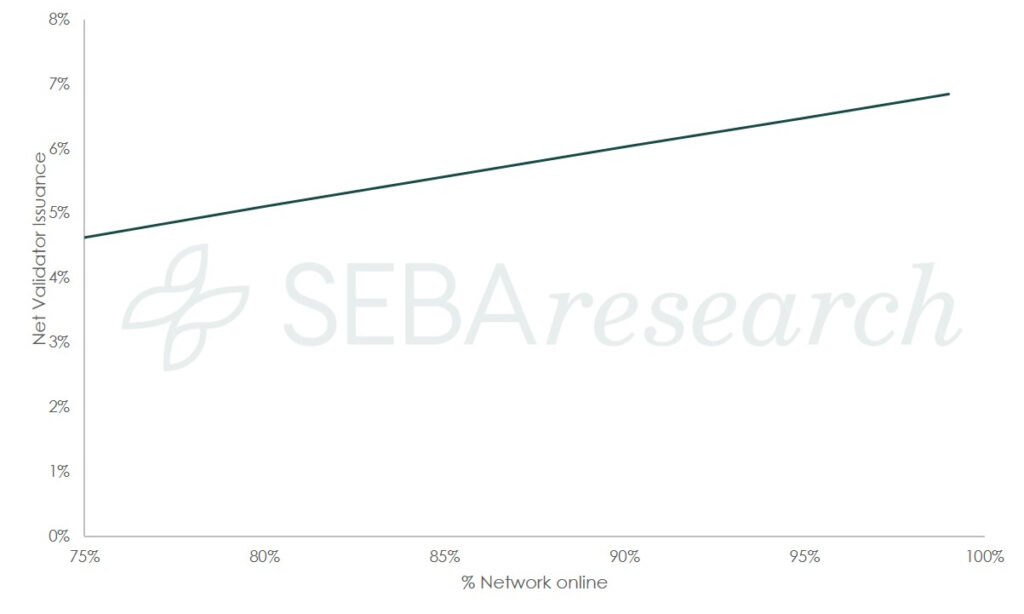

3. Average up time of the network

The rewards and penalties are designed in a manner to incentivise validators to remain online for the maximum amount of time (figure 7).

Figure 7: As the % of up time increases, the validator issuance increases

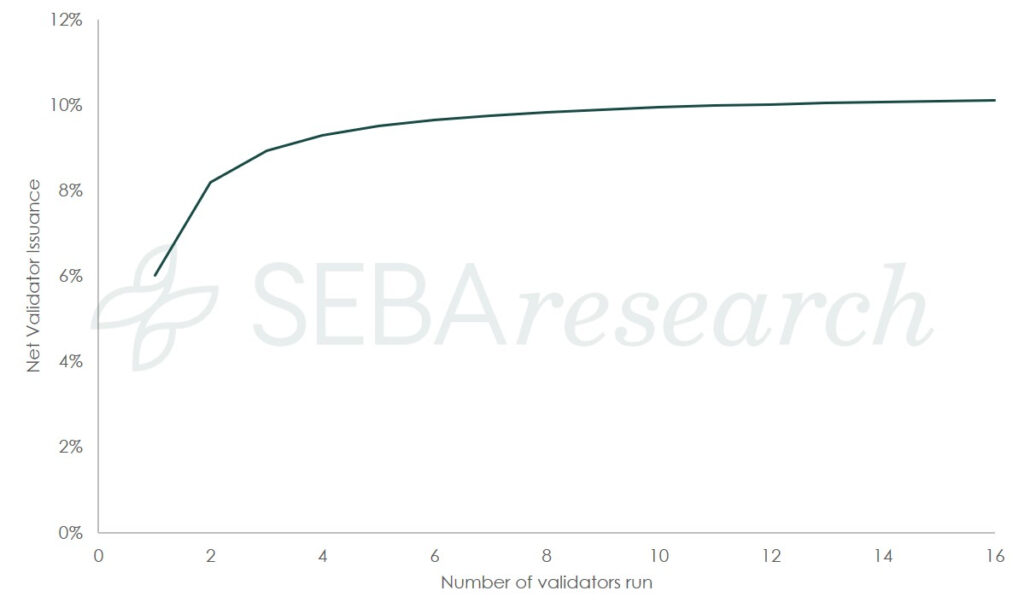

4. Incentivising decentralisation

Validator rewards are designed in a manner to ensure that economies of scale are only marginal (figure 8). This is key for maintaining a decentralised system. A significant component of staking costs is the actual cost to acquire Ether which does not scale. Therefore, cloud staking services cannot reap the benefits of scale beyond a certain point. It will ensure that small scale validators are kept in the game all the time.

Figure 8: Economies of scale kick in only up to a certain extent

Why does the right balance of incentives matter so much for the network? Because the number of validators determines the number of shards7, which in turn determines the success of the network. Therefore, if the incentive is too low, the minimum number of validators needed to keep the desired number of shards will not be met. If the incentive is too high, the network will be overpaying for the security as it will inflate at a rate that is detrimental to the network.

Sensitivity analysis of Ethereum 2.0 rewards

There are multiple factors that decide what the validator rewards will be. We analysed how these factors affect the network incentives by taking two factors at a time and keeping the rest of the parameters fixed. We used the Eth2 calculator developed by Consensys and the Ethereum foundation to analyse various scenarios along the following equation:

Net validator issuance = Validator rewards + Transaction fees8 – Costs to run validators

Validator rewards depend on the factors mentioned earlier, and the cost to run a validator depends on whether the validator chooses a cloud-based set-up9 or a hardware set-up10. The first solution is ideal for an investor who does not have the technical knowledge to run a validator themselves. Validators cannot increasingly benefit from economies of scale as the price of Ether is a dominant factor. As the number of validators increase, the cost needed to acquire the corresponding number of ETH catches up and therefore makes it difficult to obtain an advantage with scale.

Phase 0

At phase 0, there are no transactions. Therefore, transaction fees = 0 by default. Two types of analyses can be carried out here for average or at-home validators and for the cloud-based model.

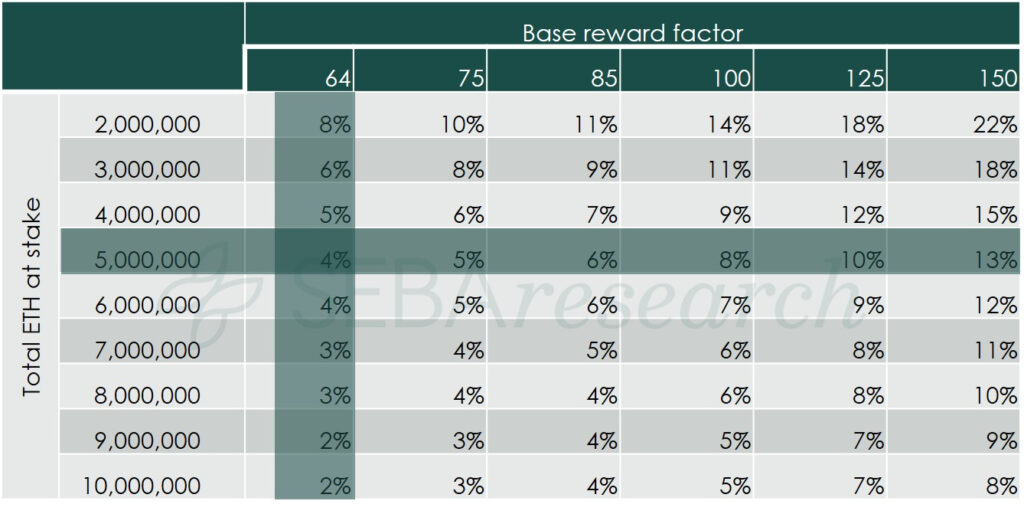

1. At-home validators

Let’s take the example of a validator staking at home. Imagine that he has a 5-million ETH at stake, that the base reward factor is set at 64 ( the default value), and he will earn a yield of 4% according to our estimates.

Figure 9 – Net validator yield: as the base reward factor increases, the validator’s net yield increases

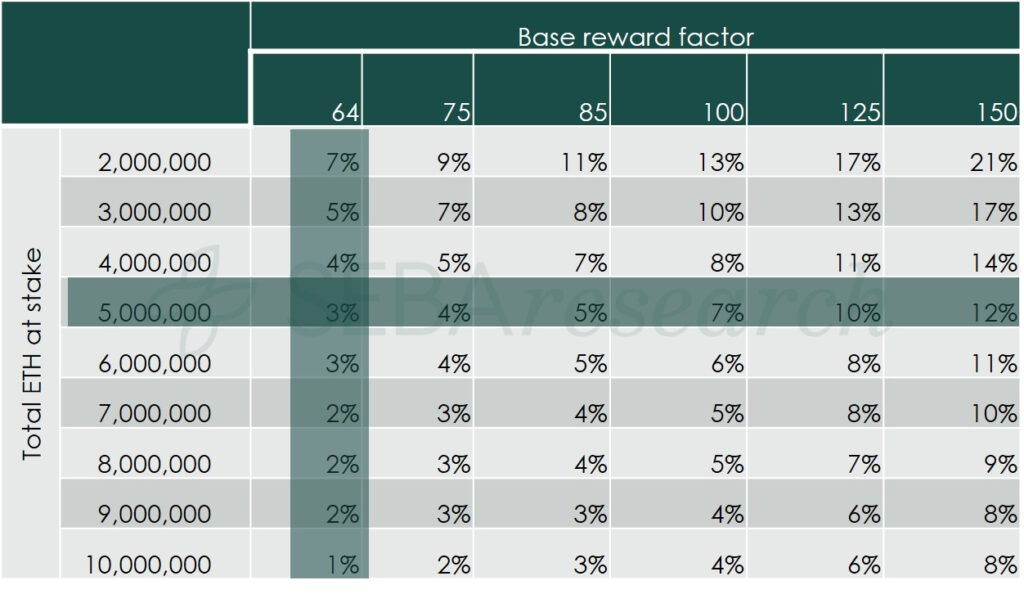

2. Cloud model

In a similar way to the at-home model, the net yield increases with the base reward factor in the cloud model. The home model provides superior yields as the validator pays for the service the cloud model offers.

Figure 10: Net validator yield: similar to at-home model, the net yield increases with the base reward factor

Beyond phase 0

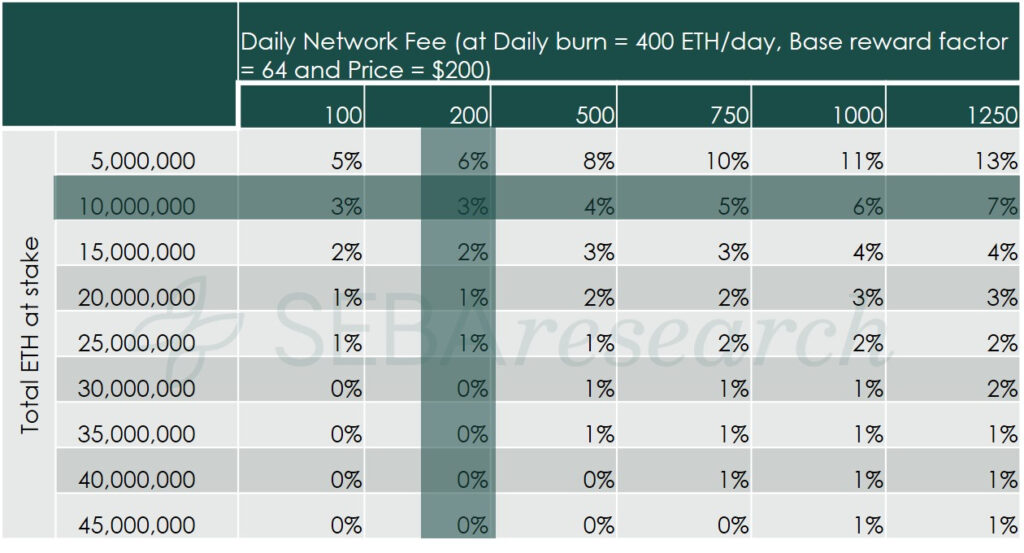

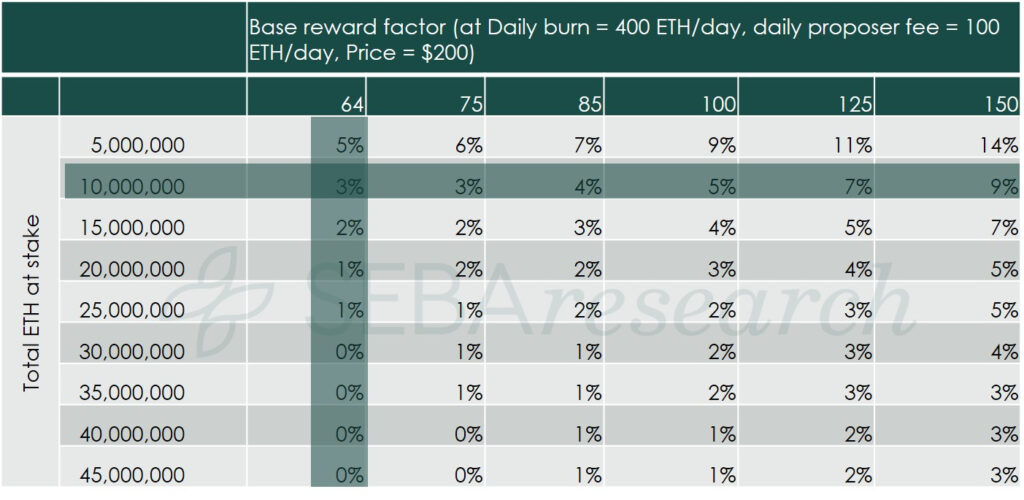

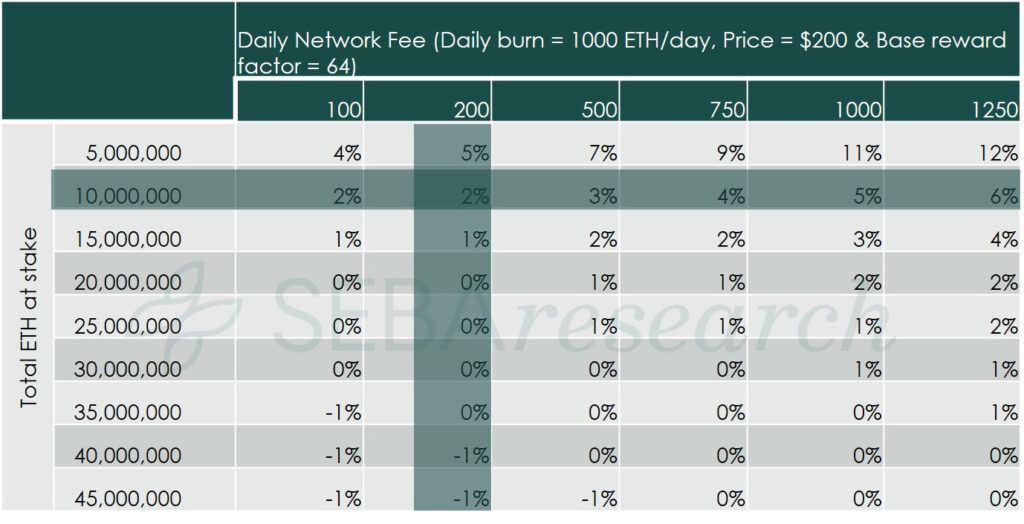

Beyond phase 0, as the beacon chain (the name of the blockchain running on PoS) is established and the network is ready for transactions, the transaction fees kick in. For most of the scenarios, we have assumed the total ETH at stake is 10,000,000, as it is an assumption across most of the discussions.

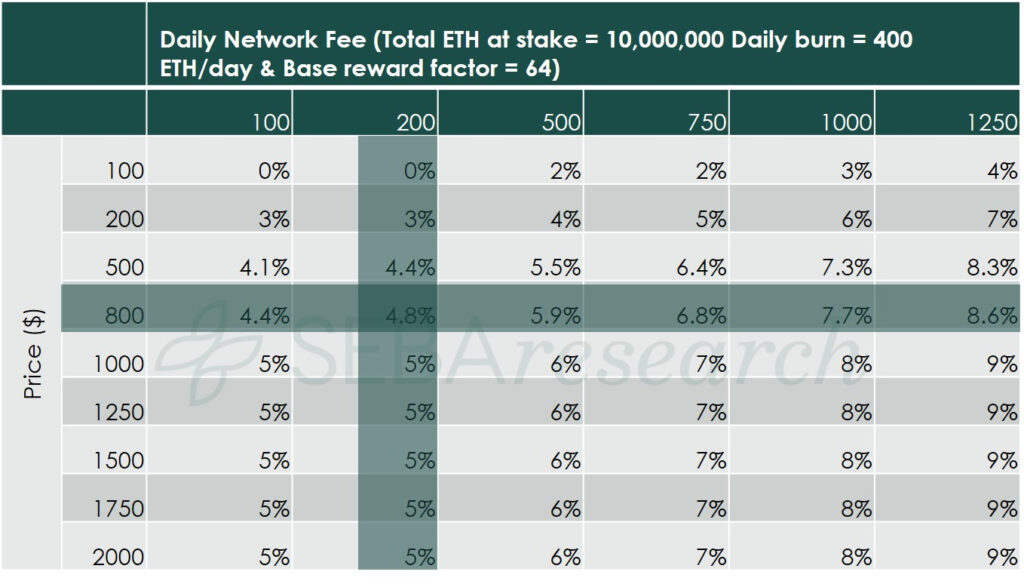

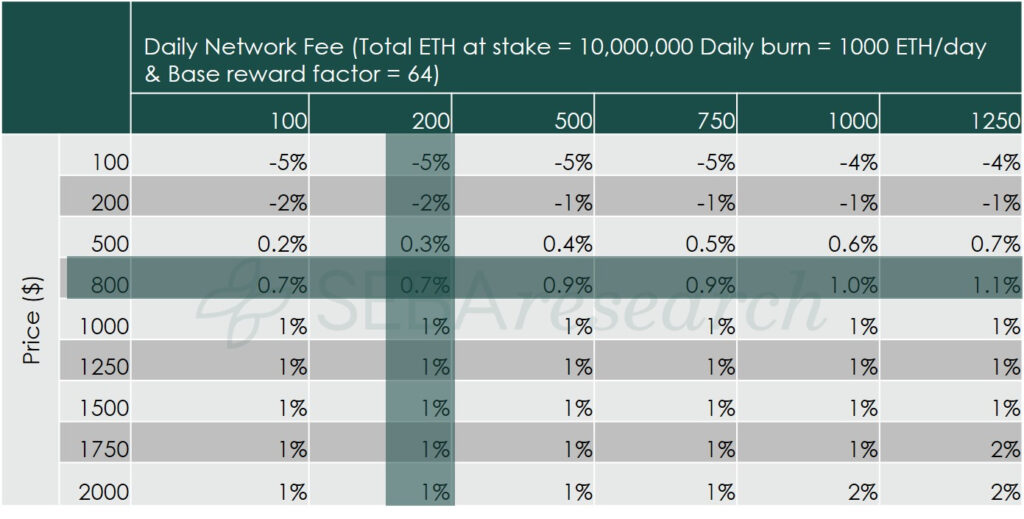

We look at three different pairs for an average validator and cloud model, which are relevant for this analysis. Note that to perform this analysis, we need to consider a proposer fee (i.e. how much the validators will receive by the users to validate the transactions), a daily burn rate due to slashing11 and the price of ETH in USD (the yield is estimated in USD).

1. For an average home validator

Figure 11: Net validator yield based on total number of ETH staked and the base reward factor for an average validator

Figure 12: Net validator yield based on total number of ETH staked and the proposer fee per day for an average validator

Figure 13: Net validator yield based on ETH price and the proposer fee per day for an average validator

2. For the cloud model

Figure 14: Net validator issuance yield based on total number of ETH staked and the base reward factor for the cloud model

Figure 15 – Net validator yield based on total number of ETH staked and the proposer fee per day for the cloud model

Figure 16: Net validator yield based on ETH price and the proposer fee per day for the cloud model

In an optimistic scenario where the price of ETH is around USD 1,500 and the proposer network fee is approximately 400 ETH per day, the net annual yield will be between 5% and 6%. BlockFi currently offers 3.6% on Ethereum interest accounts. The majority of the scenarios do not bode well for stakers beyond phase 0.

At phase 0, if the total ETH staked is between 2 million and 3 million, the validators will make a comfortable 6% to 8% yield. There is reason to believe that after phase 0 the validators may be able to deploy their ETH elsewhere so as to generate more returns.

For now, the response seems to be enthusiastic. In the current Ethereum 2.0 testnet12, about 70,000 ETH are locked. This is encouraging because the phase 0 launch is a few months away and validators seem to be keen on staking, at least in phase 0.

With new ways of earning interest emerging, such as DeFi and interest-bearing accounts, including BlockFi and Celsius, we believe that the Eth 2.0 network incentives need to be improved in order to increase the stickiness of validators as we move beyond phase 0.

Effect of Ethereum’s shift on the mining ecosystem

As Ethereum moves to PoS, the existing hash rate will no longer be usable on the network. In this case, we believe Zcash and Ethereum Classic will be the biggest beneficiaries as far as the hash rate is concerned. Though it is difficult to say how much hash rate gets divided between these two, given the fact that Ethereum Classic’s existing hash rate is just about one tenth of that of Ethereum, even a small percentage of Ethereum’s hash rate will give a significant boost to the Ethereum classic network.

1A smart contract is contract that executes itself once the trigger conditions are met. ↵

2Uptime refers to percentage time for which the validator is online. ↵

3Slashing refers to punishments for different offences on the network. ↵

4When more than one third of the network is offline, blocks are not finalised (i.e. the network comes to a standstill). Therefore, to ensure that the network is functioning all the time, harsher penalties are imposed. ↵

5The validator return is net of all the costs they incur, such as hardware, electricity, etc. ↵

6The base reward factor is currently fixed at 64 according to the latest Ethereum 2.0 spec. ↵

7Sharding is a technique used to break the Ethereum network into small components to allow parallel processing to increase the throughput. A shard is one such small component of the network. ↵

8Transaction fees will come into the picture when phase 2 of Serenity is launched. ↵

9With virtual private server (VPS). ↵

10Individual validators. ↵

11Mechanism designed to punish misbehaviour. ↵

12Current testnet requires validators to stake 3.2 ETH instead of 32. With the current 70,000 ETH, this potentially means 7000,000 ETH when the phase 0 begins. ↵

Conclusion

The testnet participation of validators bodes well for Ethereum in the short term. However, the presence of better and certain alternatives require improvements in the network economics for validators in the long term. As the Ethereum 2.0 specification is still in the development phase, we believe an adjustment to the base reward factor to ensure validators are compensated enough is a good way to begin beyond phase 0 of Serenity.

From an investment point of view, the PoS staking incentive mechanism offers a new way of generating a yield. According to our analysis, the annualised yield should start at about 6-8% at the beginning of phase 0 and decline gradually as more validators become involved. Ultimately, we expect it to stabilise at about 1-2% per annum in the last phase of development.