Abstract

As the Ethereum networks get ready to launch Phase 0 of Ethereum 2.0 at approximately the end of June, we discuss the importance of this new technology and its impact on the price of ETH1. During Phase 0, the Beacon chain will be released, which will play a crucial role in implementing the Proof of Stake (PoS) protocol in the network. Its structure incentivises ETH holders to migrate to the new network and become transaction validators on Ethereum 2.0. We examined the price impact of Ethereum 2.0 release on ETH, both from the demand and supply side. According to the analysis, we expect to have an overall positive price impact on ETH in the short to medium-term. However, a long-term price prediction is difficult, as this transition is one of the most ambitious and challenging tasks in the blockchain industry with the potential to revolutionize decentralised networks.

What is Ethereum 2.0?

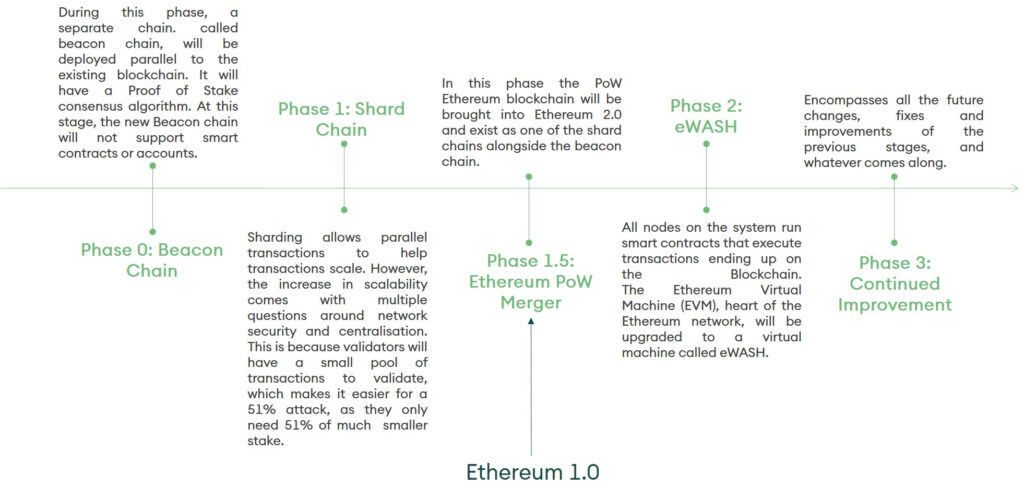

In simple terms, Ethereum 2.0 or Serenity, is a network update that aims to make Ethereum more scalable by introducing new PoS protocols along with upgrades such as, sharding, virtual machine, and more. In this article, we guide you through the updates and changes in Ethereum and the expected price impact. Ethereum was the first-ever blockchain designed for smart contract usage on its platform, enabling individuals to build decentralised apps (Dapps) on top of the blockchain platform, similar to an application on an Android or iOS system. Inspired by Bitcoin, Ethereum incorporated proof-of-work (PoW) as its consensus mechanism; however, with a high rate of Dapp usage (Crypto Kitties), PoW caused the Ethereum blockchain to bloat2 , slowing down the network. To overcome this scalability issue, Ethereum is set to transition from the PoW to PoS consensus mechanism along with other network upgrades such as sharding3 and eWASH. Ethereum 2.0 is set to be rolled out in phases (Figure 1), and the expected release date for Phase 0 is approximately June 30, 2020, whereas the dates of other releases have not been announced yet.

Figure 1: Ethereum 2.0 timeline

Ethereum 2.0 Operation Simplified

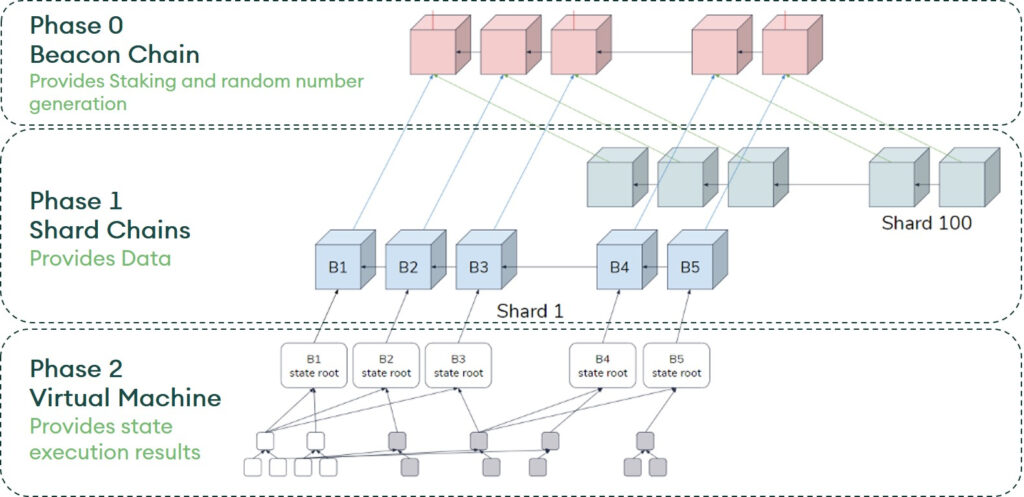

From an architectural standpoint, Ethereum 2.0 will appear similar to Figure 2. Each transaction and smart contract execution will occur via the Virtual Machine (eWASH). The execution results generated through the virtual machine will be kept in a block within a shard chain. Multiple4 shard chains will exist and operate in parallel. In the final stage, all shard chains will be connected to a beacon chain where different shards will be compiled and stored. In the following section, we learn about Ethereum 2.0’s beacon chain.

Figure 2: Ethereum 2.0 Architecture

Phase 0: Beacon Chain and its Conditions

The Beacon Chain will be the first release of the Ethereum 2.0 update. It will implement PoS mechanisms and manage the registry of validators within the network. During this phase, both the Ethereum (current blockchain) and Ethereum 2.0 blockchains will exist in parallel. In Phase 0, the Beacon chain will be of limited use, as no transactions, smart contracts, or Dapps will be running. This is to ensure that the PoS mechanism undergoes rigorous live testing and attracts sufficient validators for the later phases. During this phase, anyone who intends to become a validator on the network can convert their 32 ETH to 32 ETH2. Validators must keep a minimum of 32 ETH2 in their staking wallets, and an excess number will result in no added return on investment. Therefore, validators are recommended to stake ETH in multiples of 32. The network also requires that at least 16,384 validators which translates to minimum 524,288 ETH2 are staked on the network before validators begin receiving staking rewards. Another network requirement is that once ETH is converted to ETH2, it cannot be converted back to ETH and all ETH2, and the rewards staked in the beacon chain cannot exit the system until Phase 2 (release date unknown). In the following sections, we describe Ethereum 2.0’s token economics and how it might affect the price of ETH.

Economics of Ethereum 2.0

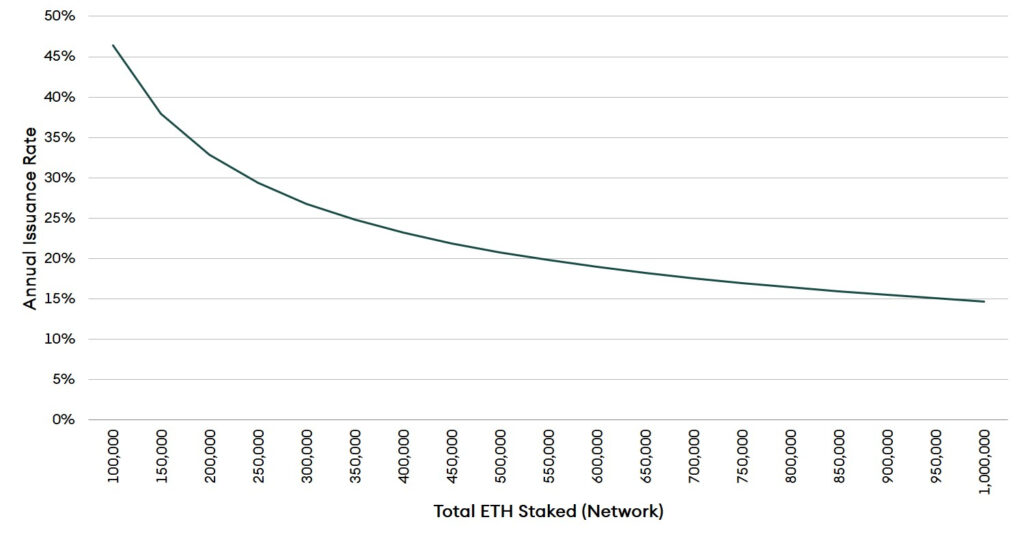

During Phase 0, two Ethereum chains will exist simultaneously, one PoW and another as PoS, which will run independently. Both networks will have their own supplies and inflation rates; therefore, with the introduction of Ethereum 2.0 the overall inflation rate of Ethereum (i.e. Ethereum 1.0 and 2.0 combined) will increase until both chains merge (i.e., Phase 1.5). Ethereum 2.0’s rate of issuance will directly depend on the number of ETH2 staked in the network at any time. The relationship between the supply and number of ETH staked in Ethereum 2.0 is defined as follows:

S = 181 × √SETH2

where S is the number of ETH supplied and SETH2 is the number of ETH2 staked. A higher rate of initial supply (when there are few validators) will incentivise ETH holders to move to Ethereum 2.0’s Beacon chain and earn higher rewards. Figure 3 shows the relationship between the supply and number of ETH staked. The number of ETH2 staked is directly proportional to the validator reward (supply).

Figure 3: Validator Economics – Phase 0

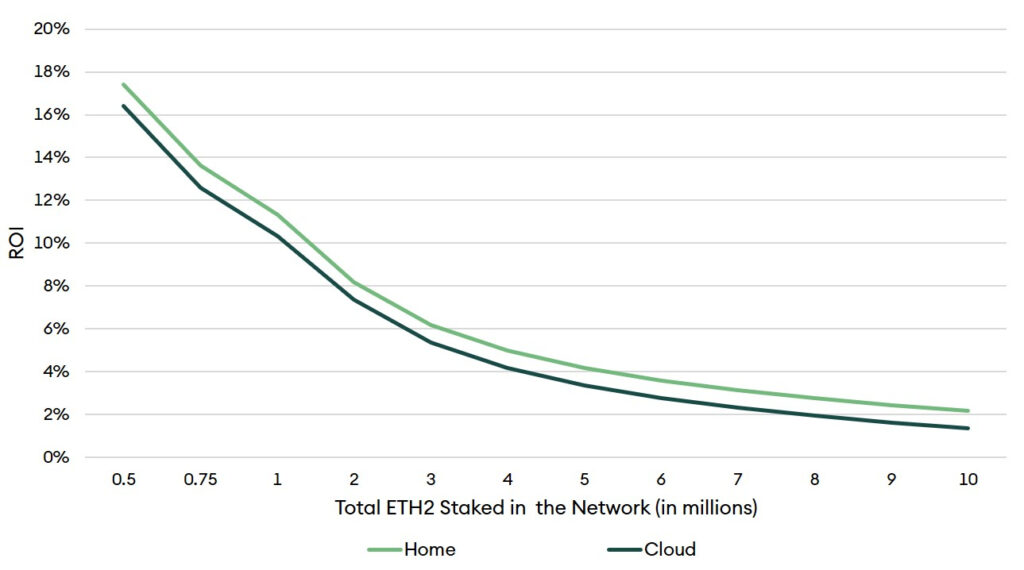

Ethereum 2.0 staking can be performed either at home using a personal or dedicated computer or through cloud computing. Both methods have their advantages and disadvantages with respect to fixed costs, variable costs, uptime, reliability, etc. Figure 4 shows how much a validator is expected to earn under both home and cloud-based operations given various levels of total ETH2 staked and other assumptions5 . Readers can refer to the staking calculator sheet to better understand and customize other assumptions according to their requirements. These rates are subject to variable changes, and the reader can refer to our February Digital Investor, Ethereum 2.0: Where the rubber meets the road, to better understand these variables.

Figure 4: Staking Return on Investment

Impact of Ethereum 2.0 on ETH

Now that we understand the working dynamics and conditions within the Ethereum 2.0 Beacon Chain, we discuss how the launch of Phase 0 can impact the price of ETH. Multiple factors may increase the price of ETH in the short run, some of which are described below.

Supply

Ethereum 2.0 requires validators to convert ETH to ETH2 and transfer them to the new PoS blockchain; further, ETH2 will be locked until Phase 2 is launched. This will result in a decrease in Ether’s circulating supply in the PoW chain. In the Ethereum community, the Ethereum Improvement Proposal (EIP) 1559 suggests decreasing the supply of Ethereum on the PoW network by burning a major chunk of the transaction fee. Which will reduce the fee that miners receive for validating transactions, whilst the fee paid by users remains the same. This is intended to incentivise users to move to the PoS-based blockchain. However, this proposal has not yet been implemented. In case it gets implemented before Phase 1 is launched, a reduction in the supply rate may occur in the PoW-based Ethereum. Overall, a reduced circulating supply of ETH should put upward pressure on ETH’s price.

Demand

In Phase 0, the Beacon chain has zero real-world usage, as no transactions, smart contracts, or Dapps can be executed. Because of this, the demand for Ethereum will not decrease. On the contrary, the demand for Ethereum may show an increase in the short-term, as investors, speculators and validators begin purchasing ETH before the Beacon chain launches. This interest in accumulating Ethereum can already be observed: year-to-date, Grayscale has purchased approximately 873,723 ETH.

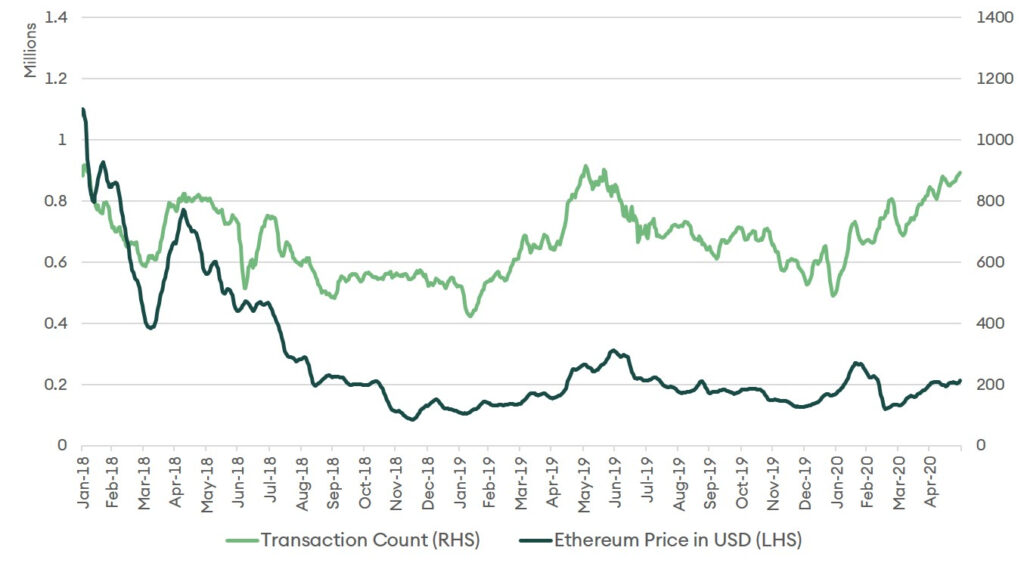

Furthermore, the network currently shows a two-year high in terms of the network transaction count and at a lower price (Figure 5).

Figure 5: Ethereum daily transaction count and daily price

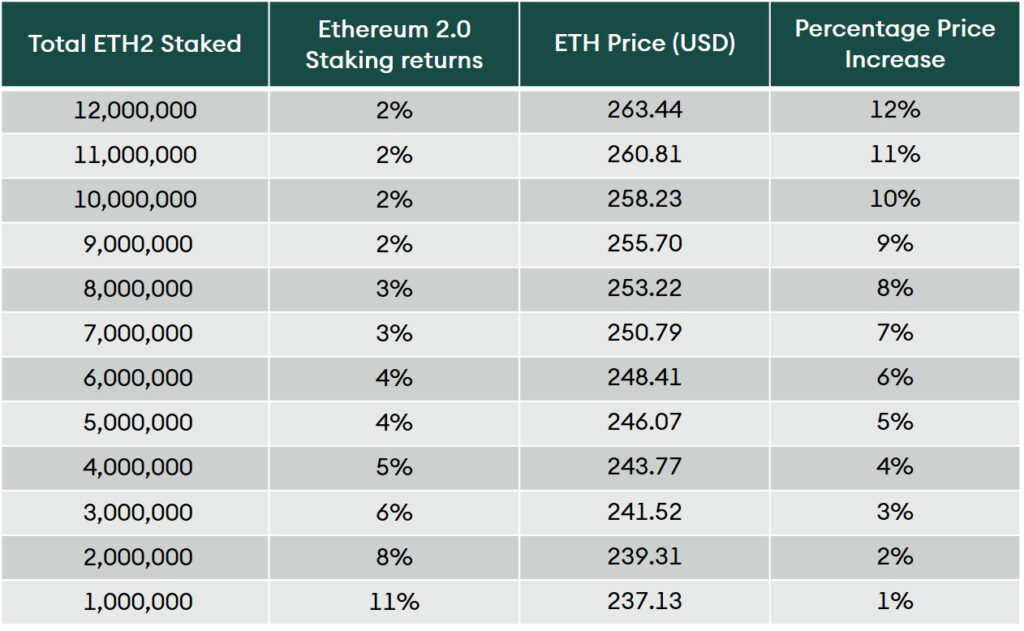

In the short to medium-term, the demand side is creating bullish pressure. The supply side is also creating bullish pressure in the medium-term, assuming EIP 1559 will also be implemented. Therefore, ETH may show a price increase in the short- to medium-run. Table 1 shows estimates of the price impact on ETH given that the circulating supply decreases with the number of ETH converted and staked in Ethereum 2.0 and assuming that the total market capitalisation and demand remain constant.

Table 1: Possible price impact of Ethereum 2.0 staking on ETH

In the longer run (i.e., after Phase 2) the price impact of Ethereum 2.0 may be bearish on ETH, as PoW network’s utility will decrease, when transactions, smart contracts, and Dapps are initiated on the PoS network. Note that migrating the Ethereum network to PoS will be time-consuming and difficult and result in the locking up of capital. Therefore, one should avoid staking all Ethereum holdings on Ethereum 2.0. For long-term investors, it would be prudent to stake some of their ETH in Ethereum 2.0 to benefit from the high initial returns while also keeping some ETH on the PoW chain. These investors should also consider that this transition is one of the most ambitious projects in the digital assets space. A failure to deliver or any delays can negatively impact ETH’s price and lead to the locking up of capital on Ethereum 2.0 for an indefinite time period. Investors and traders can also consider the option of holding Ethereum and benefiting from the likely short to medium-term price increase up until the Beacon Chain release on June 30, 2020.

To become a validator

The barrier to entry to becoming a validator on Ethereum 2.0 is relatively low. To become a validator, one must fulfil certain financial and hardware conditions. The entire process will be clarified by release of the Beacon chain. However, the following are basic requirements for becoming a validator on the Beacon chain.

- The validator must convert 32 ETH into ETH2 using this deposit contract.

- Each validator must stake 32 ETH2. More than 32 ETH will not result in added returns, and therefore staking should be performed in multiples of 32.

- Validators can use cloud computing or personal hardware to stake. The following personal hardware specifications are recommended6:a. Processor: Intel Core i7–4770 or AMD FX-8310 or better

b. Memory: 8 GB RAM

c. Storage: 100 GB available space on SSD

d. Internet: Broadband connection

Conclusion

Now that the Bitcoin reward halving is completed, many investors are eyeing Ethereum as the next trade and investment opportunity. A smooth release of the Beacon Chain will be a positive step towards the migration of Ethereum from PoW to PoS. In the medium- to short-term, we expect ETH’s price to increase, as the PoS-based Ethereum 2.0 will not be fully functional until Phase 2 is implemented. During this time, Ether’s reduced supply and increased demand should increase its price. In contrast, in the long-term, the launch of Ethereum 2.0 may lead to a price decrease as users migrate from the PoW to the PoS chain. However, predicting these changes is difficult, because of the many factors affecting coin swap and interoperability functions.

1ETH refers to the currency used in Ethereum 1.0 network and ETH2 refers to the currency used in Ethereum 2.0 network ↵

2Blockchain Bloat is a condition under which the size of stored data becomes very large because of increasing numbers of users and transactions. When blockchain bloat is severe, transaction speed suffers. ↵

3In a database management system, sharding is a type of database partitioning that divides or partitions information into smaller data, also known as shards. These shards are not only smaller, but also can be processed faster and hence are more easily manageable ↵

4Here, we show 100 shard chains but the actual number may vary, as the Phase 1 details have not been finalised. ↵

5Network Variables Assumptions- ETH Price (auto update): $238, Validator Deposit (ETH): 32, Average network % online (only >2/3 supported): 95%, Network Fees/Day (ETH) Proposer Surplus: 0, Network Fees/Day (ETH) Burned: 0, ETH Circulating Supply: 110,000,000, Shards: 64, Slot Time (sec): 12, Epoch Length (slots): 32, Base Reward Factor: 64 Validator Assumptions- Validator Uptime: 98%, Validators Run: 1, Cost of Computer Hardware: $225, Useful Life (years): 2.5, Cost Per kwh (Global Average): $0.20, Watts (Per Shard Validated): 10, Watts Per Machine: 40, ISP Per Month (Global Average): $51.42, Cost of Router Hardware (Global Estimate): $90, VPS Cost (Per Machine Per Month): $20, Unknown Cost (Per Machine): $25, Number of Machines (16 Validators Per): 1, Total Watts: 50, ETH Cost: $7, 629, Initial Investment (USD): $7, 969 ↵

6Based on Beacon chain’s testnet requirements ↵