Abstract

DeFi has been the centrepiece of conversations revolving around Ethereum’s future. DeFi protocols aim to bank the unbanked with intuitive applications. However, along with promises, DeFi protocols are also riddled with challenges. In this document, we explore how investors can make use of DeFi protocols while being mindful of the risks embedded into these protocols.

Introduction to DeFi

DeFi or decentralised finance aims to democratise finance by removing participation barriers existing in the traditional finance world. DeFi aims to increase financial inclusion by offering financial services to the unbanked in a censorship-resistant manner. It allows anyone with an internet connection to gain access to global finance. One of the biggest advantages of DeFi is that users control the custody of their wealth and information while accessing financial services.

Is it DeFi or open finance?

In our view, the term DeFi is misleading and not as salubrious as it sounds. The majority of protocols are not even close to being decentralised. Most of the DeFi platform teams have admin keys, which are used to make changes to the platform. Though some of the platforms have talked about how they will become decentralised, it is not clear what incentives they have to achieve it and there is currently little evidence of them moving forward in that direction. How different platforms plan to treat admin keys can be found here. In this light, we prefer the term ‘open finance’ over ‘decentralised finance’.

Though the existing lexicon is confined to services built on Ethereum, we believe that it encompasses services outside the Ethereum ecosystem as well. Second layer solutions such as Lightning Network and EOSrex built on top of bitcoin and EOS respectively can also be considered as a part of open finance.

Why open finance?

Finance has been a prerogative of the selected few. With permissionless and borderless applications, people in geographical locations where there is a lack of financial services can attempt to build their capital.

Traditional banking services vs open finance

The impact of open finance on traditional finance is similar to Netflix’s impact on legacy movie studios. Netflix was a disruption in distribution. It provided an impetus to the number of screens by allowing more access points to new movies. Does it mean Disney and Warner Brothers were sent packing? No. But they did acknowledge Netflix as a threat to their business and have produced movies suitable to watch on Netflix along with big-budget films.

Similarly, open finance applications are a disruption in distribution. Do they threaten to make the legacy old financial institutions obsolete in future? Probably so for some bank businesses. But currently, open finance applications are fragile and need further development to be available for everyone. There is room for new open finance applications and legacy banks to co-exist. Just as people still want to go to theatres to watch movies, some still prefer to trust banks over upcoming but vulnerable platforms.

A recent example is where the Ethereum blockchain was used by Paxos to settle equity trades in the US. It shows how open finance can be integrated with existing systems. DTCC (Depository Trust Clearing Corporation) has been acting as the counterparty for more than 30 years. Paxos settlement uses Ethereum’s private blockchain to settle equity trades. It uses ‘atomic swaps’ where digitised cash and securities held at the custodian account are swapped instantaneously. In this way, settlements occur in a few hours. Though the service is in a pilot testing phase, it is a major event, as it marks the beginning of open finance protocols replacing intermediaries, and we should expect such tweaks in business models going forward.

Intermediaries run the risk of being abstracted away by software. Therefore, banks need to adjust their business models where there is no need for intermediation.

Different components of open finance

Open finance is a broad term as it covers services such as lending and borrowing, trading, derivatives and so on. In this article, we’ll explain how MakerDAO works to some extent and briefly touch upon other major protocols.

MakerDAO, a borrowing platform, has two tokens: DAI (the stablecoin pegged to the US dollar) and MKR (the governance token). Borrowers must collateralise at least 1.5 times the collateral to borrow DAI. Currently, ether (ETH) is used as collateral. The interest rate, called the stability fee, is decided by the MKR holders. It increases when there is a shortage of DAI and vice-versa. The stability fee has been volatile, ranging from 0.5% to 20.5%. The stability fee is decided in a similar manner as to how central banks manage interest rates.

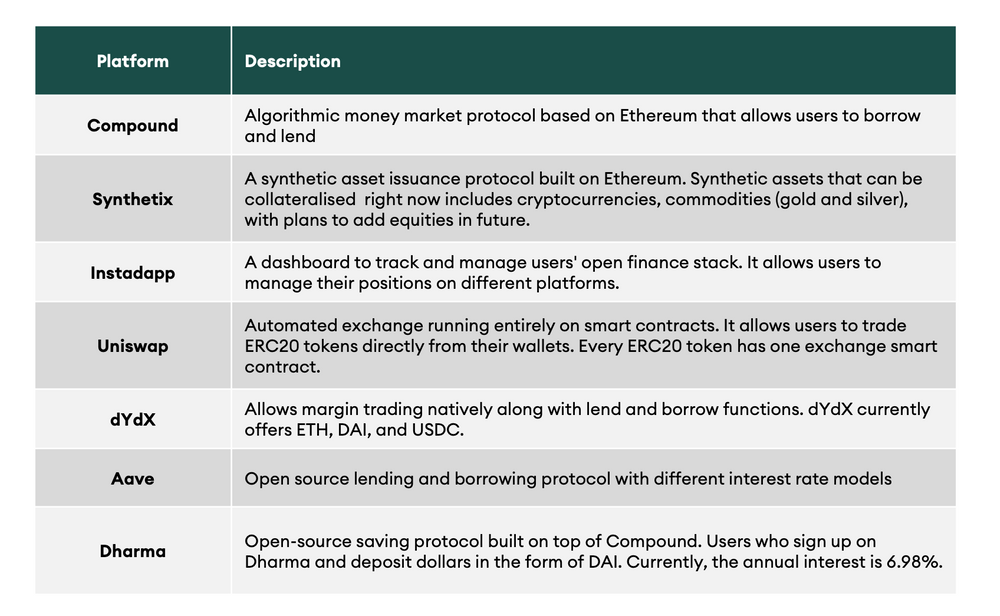

Other major open finance platforms are shown in the following table.

Table 1: Open finance protocols

Overview of the current open finance landscape

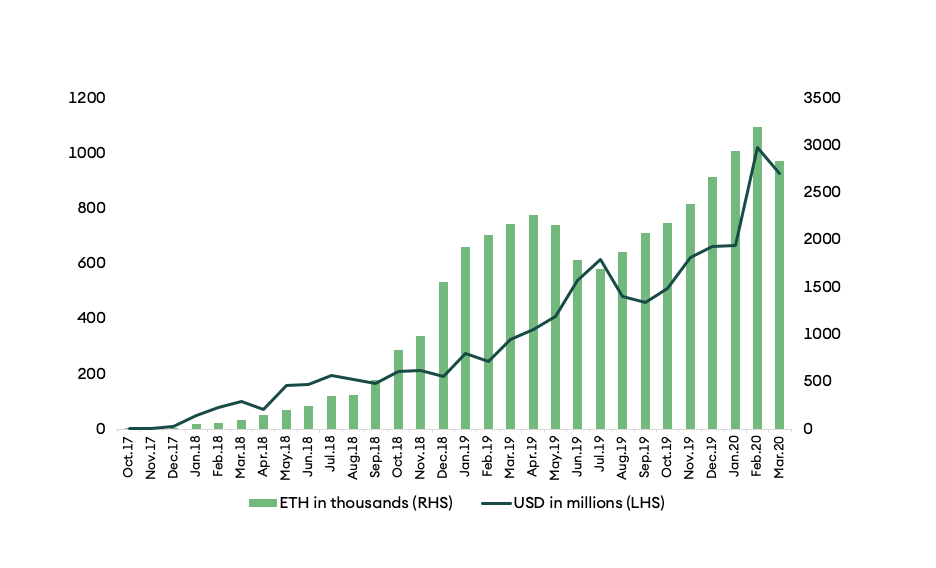

From a few million dollars at the beginning of 2017 to over a billion dollars of value locked at the time of writing, the growth of open finance protocols is phenomenal (figure 1).

Figure 1: Evolution of value locked in open finance protocols

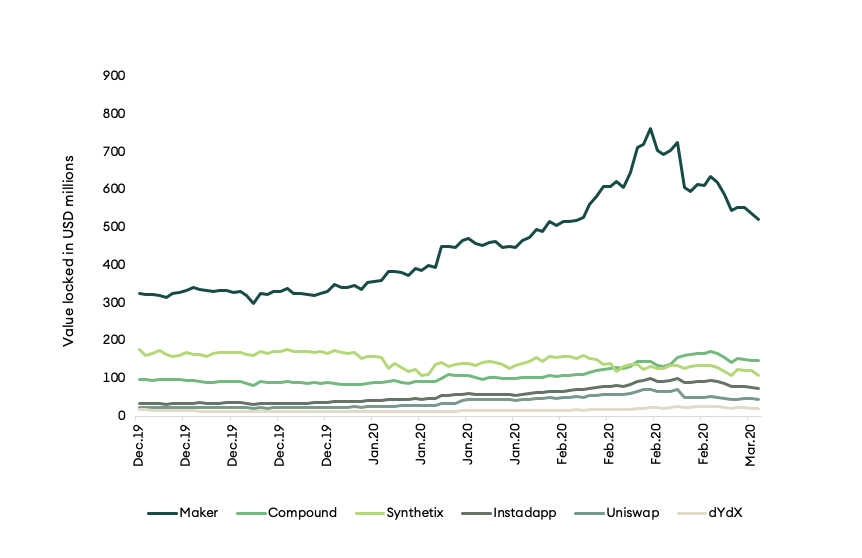

Figure 2 shows how the value locked in the top few protocols has changed over time. It also shows the dominance of Maker.

Figure 2: Value locked in top six protocols

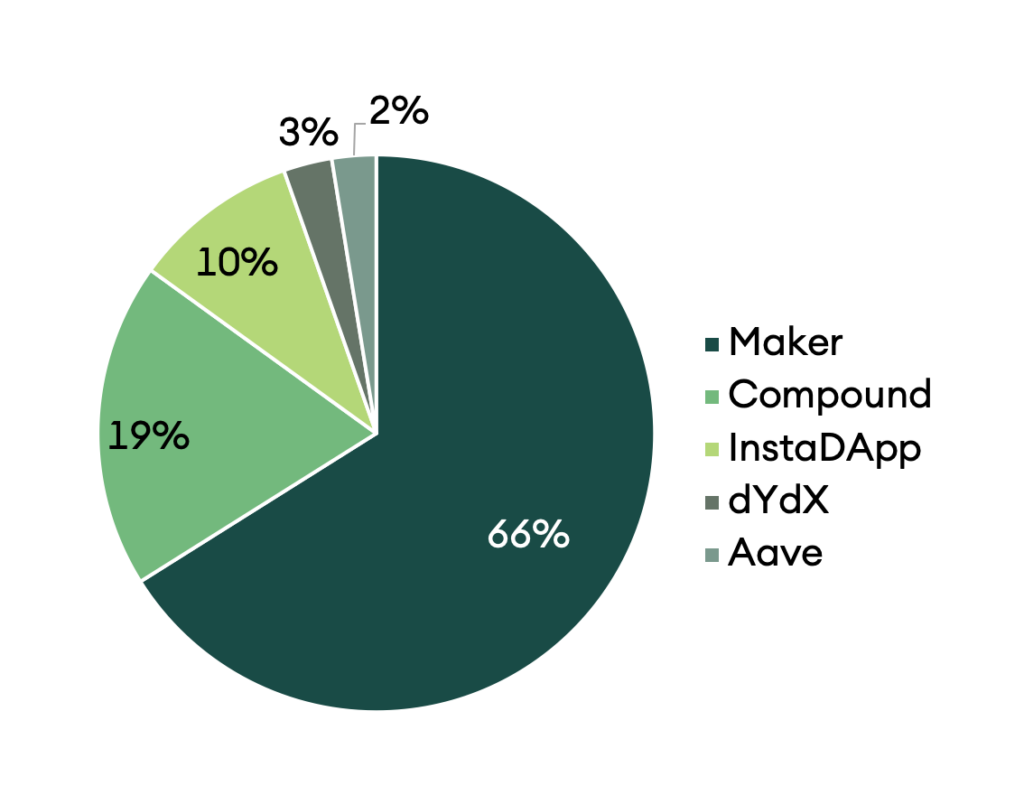

Among the top five lending protocols, Maker dominates the lending space with more than 65% of the market share1.

Figure 3: Market share of top five lending protocols

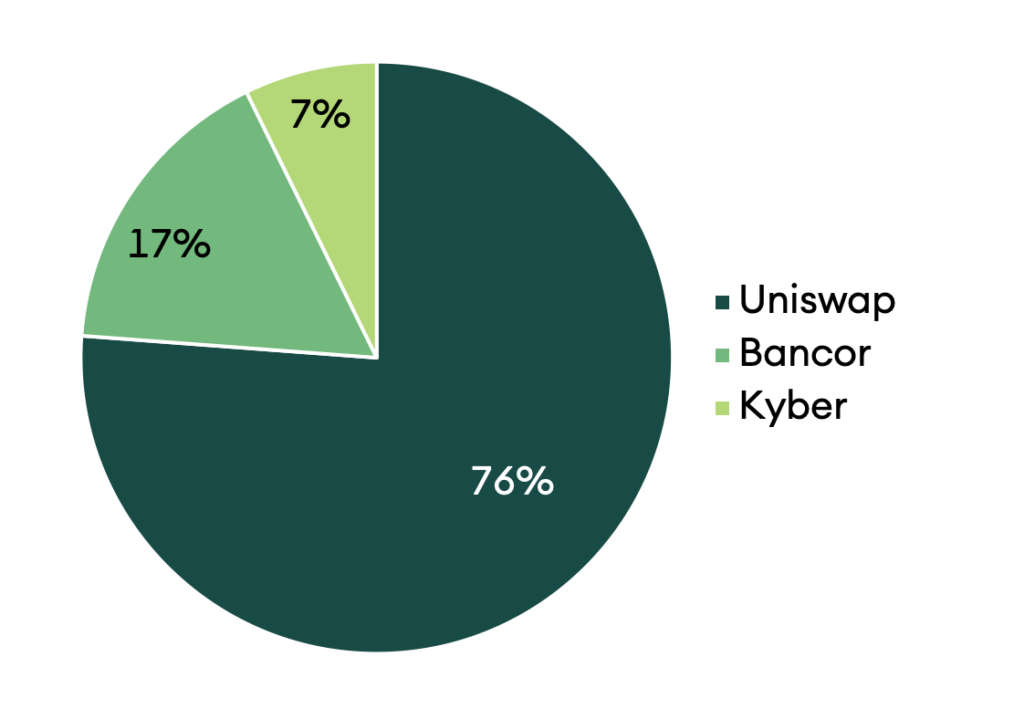

Among the top three DEX (decentralised exchange), Uniswap has the lion’s share with more than 75%2 of the market.

Figure 4: arket share of top three decentralised exchanges

Investment opportunities using open finance

We list a few opportunities that have been historically present. By means of these examples, investors can understand where and how they can leverage open finance opportunities.

- Borrow ETH from dYdX (currently at 0.03%) or Compound (0.02%) and lend on Blockfi (3.6%-2%) or Celsius (2.33%) and capture the spread.

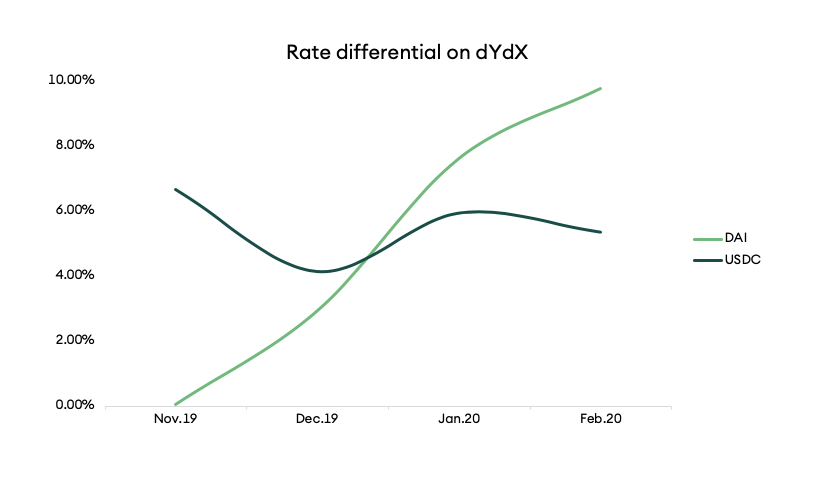

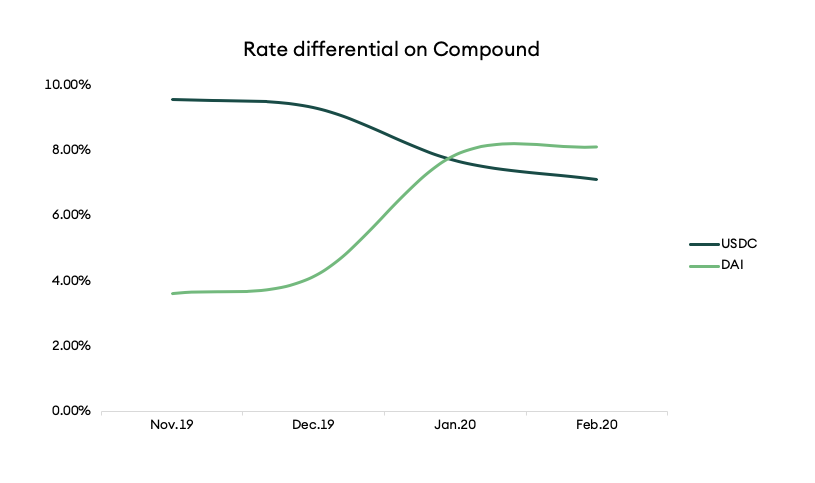

- Interest rate differentials on stablecoins can be exploited. For example, one could borrow USDC on dYdX, buy DAI, and lend it on dYdX or Compound

Figure 5a: Interest rate differential within and across protocols

Figure 5b: Interest rate differential within and across protocols

- Borrow DAI on Maker and lend it on Compound or dYdX. This works when the interest on DAI is more than the stability fee to be paid on MakerDAO. Investors must be cognisant of risks while trading on open finance platforms:

- In the case where ETH is used as collateral to borrow stablecoins and the price of ETH drops significantly, there might be a margin call as collateral ratio drops below the minimum requirement;

- Centralised lending rates on platforms such as Blockfi and Celsius are subject to change;

- Interest rates on open finance platforms are volatile.

Challenges

- Unknown attack vectors: Open finance protocols are labyrinthine and vulnerable to a number of attack vectors when there are weaknesses in the code. The recent bZx exploit3 is a good case study to help us understand the complexity of these protocols. What this means for investors is that at this point, we belive open finance protocols are too risky to allocate a significant chunk of the investor portfolio.

- Low liquidity: Open finance protocols are in their infancy. There is little liquidity on the platforms. For example, at the time of writing this article, Fulcrum offers 42% annual interest on ETH, but the liquidity is non-existent.

- Capital inefficiency: Most of the open finance protocols use crypto assets as collateral, and crypto-assets are volatile in nature. Thus, these protocols require collateral ratios of around 150%. On the one hand, lenders are secured as assets are over-collateralised, but on the other hand, capital is not used efficiently.

- Sub-par user experience: Though we understand the ethos of decentralised applications, most users simply don’t care about what happens in the background. If the user experience is not as smooth as centralised counterparts, we believe that there won’t be a meaningful adoption. Dharma is the only product that scores well on the user experience. However, only US investors can currently leverage the full potential of Dharma.

- Limited product-market fit: Open finance applications are being built under the motto of ‘banking the unbanked’. However, the brutal reality is that this utopian dream is currently a niche at best. These products are not aimed at the world’s ‘unbanked’, and it is not easy for non-tech savvy people to use them. The products need to be a lot simpler to attract the masses. A good example of product-market fit is India’s UPI (Unified Payment Interface) system, which allows people to send and receive money using just their phone numbers. Through UPI, 1.3 billion transactions worth more than USD 30 billion were made in January 2020.

Conclusion

ETH locked in open finance has increased drastically in the past couple of years. This is not an achievement to be ignored by investors. Banks in the developed world also need to be cognisant of the fact that products like Dharma may compete with them for a share of investors’ deposits by offering higher interest rates than traditional depository financial institutions. However, it is currently riddled with problems. Developers themselves are wary of using open finance to manage their treasuries. Bankers have time to figure out a strategy as to how they can pivot their businesses to allow integration of these platforms and enjoy synergies. Keeping in mind the pace at which the industry is evolving, we think this should happen sooner rather than later.

1Based on the value locked ↵

2Based on the value locked ↵

3bZx exploit: A case study of attack surfaces of open finance protocols. While there are multiple theories going around in the market related to the exploit, we think this (https://www.palkeo.com/en/projets/ethereum/bzx.html#b-the-compound-borrow) is the most compelling one. In short, the attacker spotted a bug in bZx contract logic and exploited it by manipulating the price by playing the low liquidity. ↵