Abstract

The term ‘token’ is very commonly used in the digital assets space, but few people fully understand it. In this edition of The Bridge, we provide an understanding of what tokens are and how they can be categorised based on their characteristics. We also dive into the concept of tokenisation of assets in order to understand its benefits and use cases before looking at how tokens are issued. Finally, we discuss the hurdles that tokenisation is facing at its current stage of development.

What is a token?

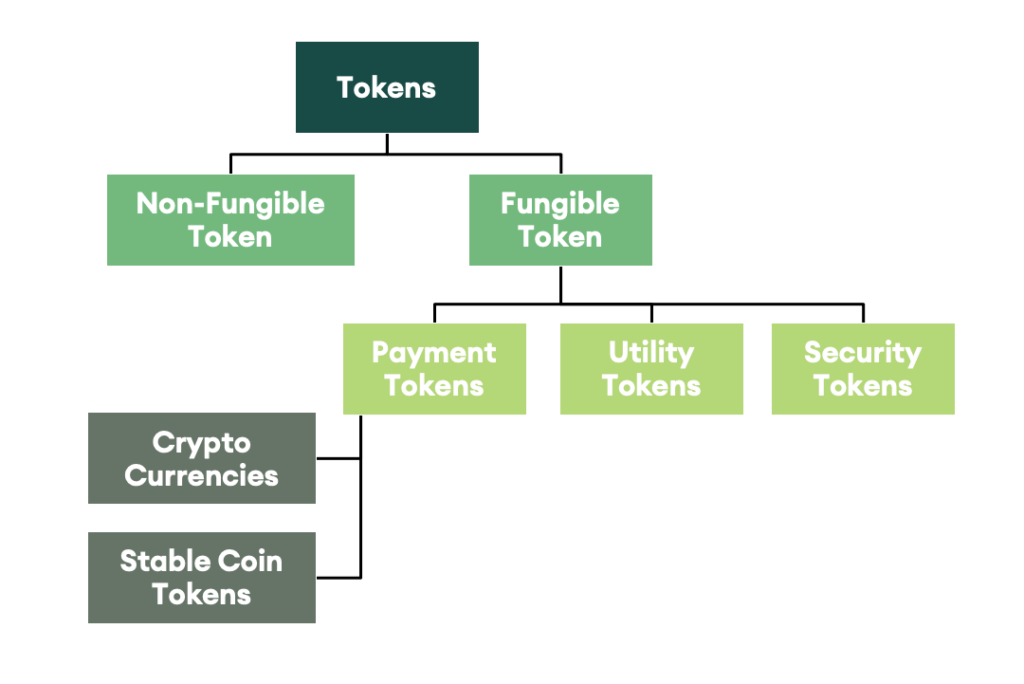

The concept of tokens is not very clearly defined in the digital assets space. We describe tokens as a digital representation of any kind of value or valuable underlying. Therefore, cryptocurrencies such as bitcoin and Litecoin can also be considered as tokens. Besides cryptocurrencies, which represent the value of human economic trust, tokens can also represent the ownership of any valuable underlying assets such as gold, equity, land and more. In figure 1, we categorise tokens based on their characteristics.

Figure 1: Categories of tokens

Non-fungible tokens

Tokens can primarily be categorised on the basis of fungibility. Non-fungible tokens are non-interchangeable as they are unique and usually non-divisible in nature. This makes non-fungible tokens ideal for use cases such as digital tickets, digital identity, digital certifications, etc.

Fungible tokens

Fungible tokens are interchangeable and divisible by nature. Based on their use case, they can be further divided into payment tokens, utility tokens and security tokens.

- Payment tokens: These tokens are used as digital money. Payment tokens can be pegged to a fiat currency, as Tether is pegged to the US dollar, making them stable coin tokens. Another type of payment tokens is known as cryptocurrencies, they independently derive their value from demand and supply, such as bitcoin.

- Utility tokens: These tokens are generally issued on a platform with the aim to facilitate various activities within that ecosystem. In the case of exchange tokens, such as Binance token (BNB), these activities may include obtaining a trading fee discount and buying certain assets that are denominated only in terms of BNB. Whereas in the case of platform tokens such as Ether, they might be used for running a smart contract or using the network’s bandwidth.

- Security tokens: The definition of security can vary across different jurisdictions and thus lead to differences in the definition of the security token itself. Usually, tokens that are backed by or represent a unit of real-world assets, such as company shares, real estate, commodities, etc. can be classified as security tokens.

What is tokenisation?

Tokenisation is the process of issuing tokens that digitally represent an asset (tangible or intangible). The tokens can then be bought, sold and stored on the distributed ledger they are issued on. The tokens can be issued on various kinds of platforms but are generally seen on blockchains. Tokenisation draws many similarities from the well-known process of dematerialisation or digitisation. Although there are many forms of tokens, their use cases are unique. Last year, AnnA Villa in Paris became the first European property to be sold entirely via blockchain transaction. The tokenised deal was conducted on the Ethereum platform. The process involved first transferring ownership of the EUR 6.5 million luxury property to a joint-stock company, then dividing the company into 100 tokens to be distributed to the owners respectively. Each token can be further broken down into 100,000 units, meaning individual shares of the building can be bought and sold for as little as EUR 6.50. There have been several worldwide efforts to bring real estate sales onto blockchain technology. Last year, a USD 30 million Manhattan property was also tokenised on Ethereum. We look at some benefits of tokenising below.

Benefits of tokenisation

- Faster transactions and reduced costs: Tokenisation of assets allows the use of smart contracts to help automate processes such as settlements, compliance, distribution, reporting, etc. This reduces unnecessary paperwork, which in turn can result in a reduction of settlement time from a few days to real-time settlements. This also reduces the issuance and operational costs of managing these assets.

- More transparency and control: With the ability to programme legal obligations rights and responsibilities into these tokens, issuers and investors will see an increase in transparency and control.

- Greater accessibility: Global transferability, 24/7 markets and partial ownership of assets will increase accessibility for investors. Assets such as land, private equity and fine art might see increased liquidity as the ease of transferability increases. As issuance costs decrease, businesses which were not able to securitise their businesses earlier will also be able to tap into fundraising easily.

Observed use cases

- Securities: Tokenisation of the security market is one of the most common use cases put forward by many experts. However, issuances of tokenised equity and bonds are currently not as prevalent, but we have seen the successful implementation of tokenisation in these markets. The most recent example being the Santander bank tokenising bond worth USD 20 million that was issued on the public Ethereum blockchain.

- Illiquid assets: To date, assets such as land, art, wine, etc. were either confined to geographical boundaries or accredited investors. With the introduction of tokenisation and partial ownership, illiquid assets can overcome these drawbacks and enjoy higher liquidity. One of the most successful proofs of concept was seen when 31.5% of Warhol’s 14 Small Electric Chairs (1980) painting was sold for USD 1.7 million. However, the amount fell well short of the 49% ownership that was on offer. Nevertheless, it opened the possibility of tokenising illiquid assets with partial ownerships (fractionalisation).

- Intangible assets: With the expansion of the digital world, we are now able to monetise more types of values. By using fungible and non-fungible tokens, we can tokenize these values into new assets such as user attention and identity. The new assets can be leveraged to create new marketplaces. The Brave browser which uses Basic Attention Token (BAT) to reward ad viewers is one of the most successful examples of such new market opportunities.

Tokenisation process

At a technical level, tokenisation is the process of representing the value of a tangible or intangible asset in the form of a digital token on a database such as a blockchain. It further allows us to own, exchange, lend or alter digital tokens in various ways on these databases. One of the most used database structures for tokenisation is blockchain. It works as a ledger for these tokens and keeps a record of all the transactions, whilst its smart contract executes the token economics of the issued token. A generic process of how to tokenise an asset is shown in figure 2.

Figure 2: Tokenisation process

Current hurdles faced by tokenisation

Even though tokenisation has the potential to change financial markets for the better, at its current stage it faces a few hurdles:

- Regulations: As tokenisation of assets on blockchain is a new concept, there is no standardised legal framework for regulating its issuance and control. Many countries are currently at an early stage of developing the legal framework. If there is no standardised legal framework for tokenisation, the market might not be very keen to adopt it.

- Infrastructure: Regulatory clarity plays an important part in defining the infrastructural growth rate. Currently, tokenisation requires a huge amount of infrastructural development and standardisation for mass adoption. The current market solutions available for end-to-end tokenising processes are highly dependent on regulations and are gradually becoming user-friendly. Furthermore, distributing these tokens is yet another hurdle that only better infrastructure can solve.

- Consumer adoption: Compared to the current legacy infrastructure of dematerialising systems, tokenisation is still an unfamiliar concept for investors. Given the current highly complex infrastructure, a user might prefer not to change their existing set-up. Education also plays an important role in increasing adoption and is gradually gaining traction.

Conclusion

Tokenisation will allow us to create a more integrated financial system which will be more transparent, efficient and inclusive for illiquid assets and small investors. Market entrants are coming up with their own infrastructure whilst the traditional markets are also showing interest in tokenisation. However, a few hurdles such as the regulatory framework, infrastructure and adoption must still be dealt with if tokenisation is to have a meaningful impact on financial markets.