Abstract

- RUNE is well-integrated into the THORchain ecosystem, and the token economics design reasonably ensures that the value of RUNE increases with the growth of the ecosystem

- Considering that base-case, bullish, and bearish scenarios are equally likely, we arrive at RUNE’s expected fair value of USD 4.1

Introduction

In the November Digital Investor, we introduced blockchain interoperability or blockchains’ ability to exchange information between different ecosystems. We concluded that interoperability facilitates secure and trustless value exchange, and we expect interoperability solutions to capture value in future. Therefore, we think that interoperability solutions demand investor attention.

Interoperability may take many forms. In this edition of the Digital Investor, we focus on interoperability that allows investors to increase their asset utilisation. We analyse THORchain, a decentralised cross-chain liquidity protocol with no pegged or wrapped tokens, and how it facilitates liquidity mining across different blockchains. We briefly present the project and its functioning, analyse the economics of THORchains and value accrual mechanism before proposing valuation scenarios.

Increasing asset utilisation

Bitcoin represents close to two-thirds of the cryptoasset market and therefore, is potentially the most critical source of liquidity for DeFi applications. Bitcoin obviously serves as a store of value and as the most secure decentralised payment settlement network globally. However, in just six months, over 120,000 BTC were minted on Ethereum. It suggests that market participants want to put their bitcoins to more use and earn yield while maintaining bitcoin exposure. Ethereum has been the bedrock of DeFi innovation. Various projects such as Compound, Aave, Maker, Yearn Finance allowed investors to earn a yield on their blockchain assets. Given this backdrop, we think applications that enable and incentivise utilisation of assets such as bitcoin on other blockchains will be essential ingredients of the future ecosystem.

There are two ways to transfer assets from one chain to the other: either to port (asset portability) those assets on desired chains or to use some mechanism to source liquidity across different chains to facilitate swaps and incentivise liquidity providers in the process. Wrapped bitcoin and tBTC are examples of the former approach, while THORchain takes the latter course.

Wrapped Bitcoin and tBTC

Wrapped bitcoin, an initiative by Kyber, Ren, and BitGo, is an ERC-20 token backed by bitcoin in a 1:1 ratio. It involves merchants and custodians to port BTC on the Ethereum blockchain. Users need to send their bitcoins to various merchants who mint equivalent wrapped bitcoin on Ethereum. BitGo acts as the custodian for bitcoins sent to different merchants. tBTC is an initiative by Keep, Summa, and the Cross-chain group. It allows users to exchange BTC for TBTC; an ERC-20 token backed 1:1 by BTC. The team had to pause the network after finding a bug two days after the mainnet was launched. The team relaunched the mainnet in September.

The difference between tBTC and Wrapped bitcoin is the non-custodial nature of tBTC. tBTC uses random signers to ensure the safety of users’ bitcoins. Interested readers can learn more about the process here.

THORchain

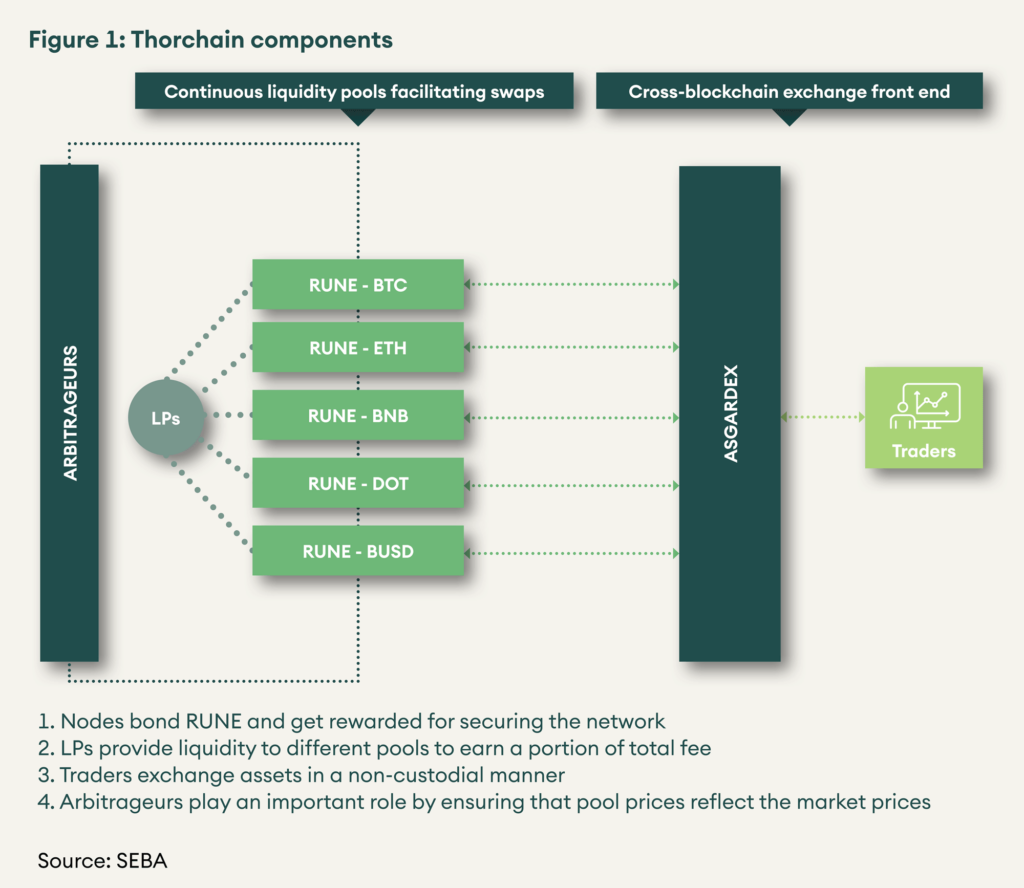

THORchain is a cross-chain non-custodial liquidity protocol. One can imagine THORchain as the Uniswap equivalent for different blockchains. Currently, asset swaps are facilitated by BEPSwap (current web client limited to Binance chain assets) which will be replaced by ASGARDEX (a desktop client that manages the full life cycle of a transaction related to THORchain).

THORchain’s innovation lies in creating a continuous liquidity pool (CLP) as illustrated in figure 1. It uses RUNE, THORchain’s native currency, as a means to link all the pools together. For example, if a user wants to swap BTC for ETH, RUNE is internally transferred from RUNE-BTC pool to RUNE-ETH pool. And then ETH is transferred to the user’s wallet. Users only have to make one transaction; the internal transactions are abstracted away from them. Liquidity providers (LPs) facilitate all the transactions by providing liquidity to different pools. In other words, liquidity providers are market makers. Decentralised exchanges empower everyone to be a market-maker. Traditional exchange businesses do not offer this opportunity to their users.

How does THORchain Work?

THORchain has four major components – node operators, liquidity providers (LPs), traders, and arbitrageurs (figure 1). Nodes secure the network by bonding RUNE to ensure that bad behaviour gets punished. LPs provide liquidity to different pools which follow X*Y = K logic1. Protocol mandates node operators to bond at least two times more RUNE than LPs stakes. Traders or swappers are users who exchange assets in a non-custodial manner. Arbitrageurs are integral to the functioning of the protocol as they keep pools in balance. The following section explains the role of arbitrageurs further.

Incentive Structure

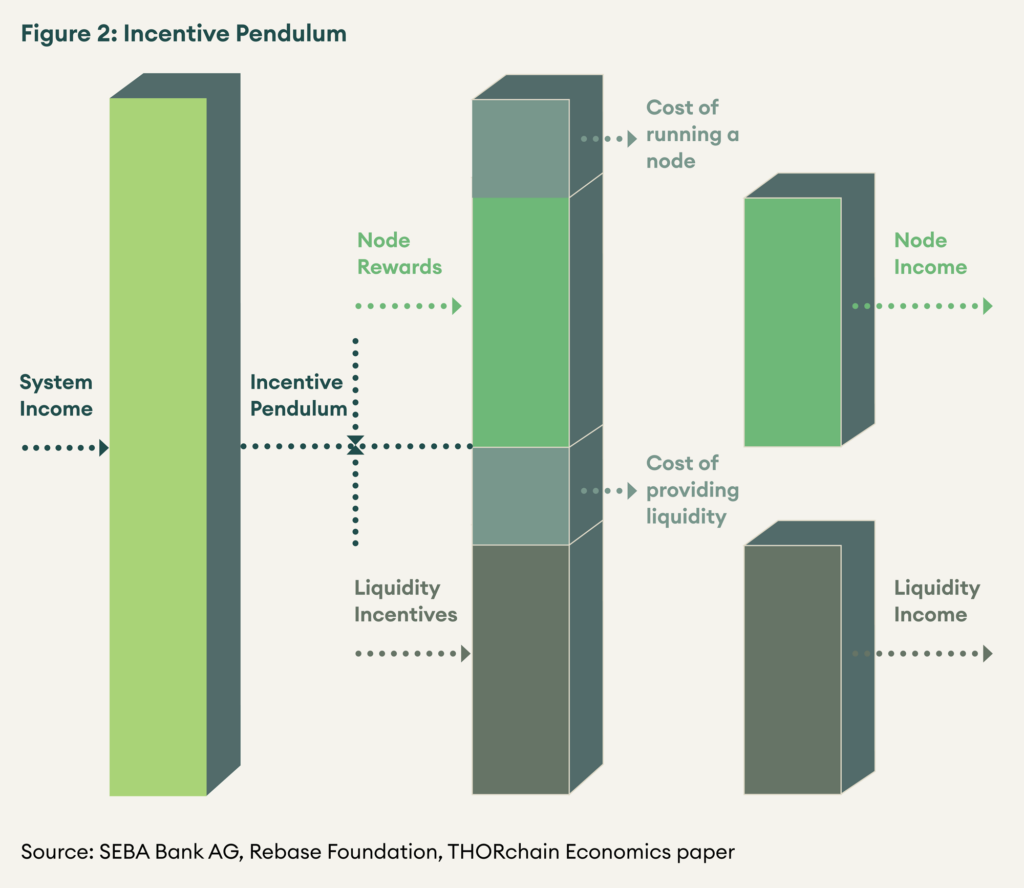

RUNE is used to incentivise Node operators and LPs. Node operators and LPs get two types of rewards, protocol emissions and fee generated from the exchange activity. As mentioned earlier, nodes need to stake at least twice the amount of RUNE staked by the LPs. Therefore, two-thirds of the block emission rewards go to node operators and the remaining one-third to LPs. Fee earned from trades is divided between LPs and node operators using an incentive pendulum mechanism. When bonded RUNE is too high, the system is inefficient; which means LPs need more incentive to pool RUNE. This incentive pendulum shifts towards LPs. When there is too much RUNE in the pools, the system tends to be insecure; which means node operators need to be rewarded more to stake more RUNE. In such a case, the node operators are further rewarded.

Traders are incentivised to use THORchain to swap cross-chain assets for two reasons: getting assets from one chain to another is cumbersome and time-consuming. THORchain does that in less than 20 seconds, in a non-custodial manner and for a low fee.

RUNE circulation is divided into three distinct groups2 – staked by nodes, staked by LPs, and non-participating RUNE circulating in secondary markets (either in wallets or exchanges).

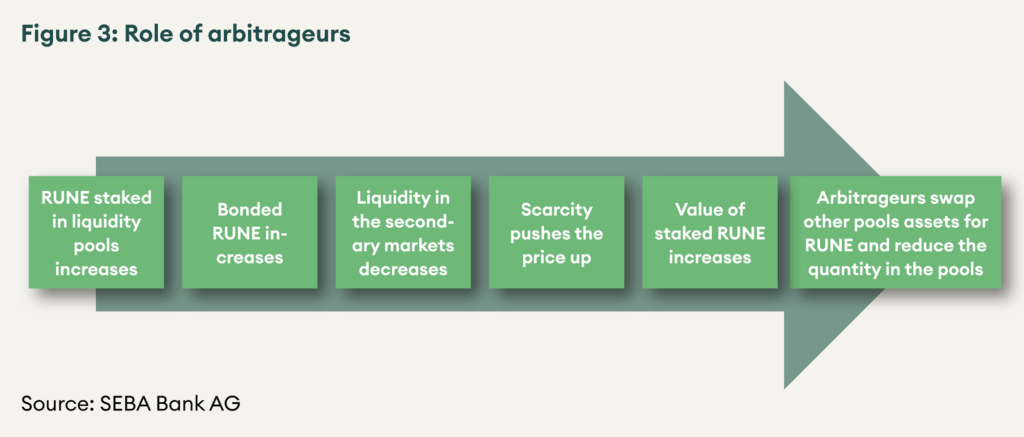

Given X*Y=K pools, the value of RUNE in pools is equal to the value of the other assets in the pool. Keep in mind that boded RUNE needs to be at least twice the staked RUNE in pools. As RUNE staked in pools increases, bonded RUNE also increases. As a result, RUNE in circulation decreases (see figure 3). The scarcity pushes the price in the secondary markets up. Assuming the value of non-RUNE assets in the pools remains the same, RUNE in pools is now worth more than other assets. Arbitrageurs spot this opportunity and provide other assets in the pool for RUNE. Thus, increasing the value of non-RUNE assets in the pools relative to RUNE and increasing RUNE supply in secondary markets. Similarly, arbitrageurs also play an essential role by providing other assets in exchange for RUNE when the value of RUNE relative to other assets drops. As arbitrage opportunities are short-lived, arbitrageurs end up paying a high fee to pools to execute their trades quickly.

Different Fee structure

Contrary to Uniswap’s flat fee structure (0.3% on every trade), THORchain implements a slip-based fee. A slip-based fee model charges commensurate fee based on the available liquidity; meaning that the transaction size relative to the pool’s depth is considered. If a trader must execute a large order, they will have to pay a higher fee.

From LPs perspective, the slip-based fee is more rewarding. When prices of the pool’s assets move suddenly, a large arbitrage trade can inflict higher impermanent loss3 for LPs. Though slip-based fee mechanism cannot avoid impermanent loss, it can fetch more revenues for the LPs by charging a higher fee. Thus, the slip-based fee is a better value accrual mechanism for LPs. Interested readers can read this and this to dive deeper into the slip-based fee structure.

Valuation

Value accrual takes two forms in THORchain ecosystem. Firstly, RUNE is pegged to other assets in the pool. As the value of other assets increases in the pools, it is matched either by adding more RUNE to the pools or price per RUNE going up. Another way the value accrues is through fee earned from trades. This fee is distributed as per incentive pendulum between node operators and LPs. It means RUNE holders who neither bond as nodes nor stake as LPs get diluted continuously.

As the pooled RUNE value is equal to other pooled capital, non-staked RUNE acts as a multiplier for the total market capitalisation. If 20% of the RUNE is staked in pools, assuming 20% of the value is equivalent to the value of the other non-pool assets, the total market cap is five times the pooled asset value.

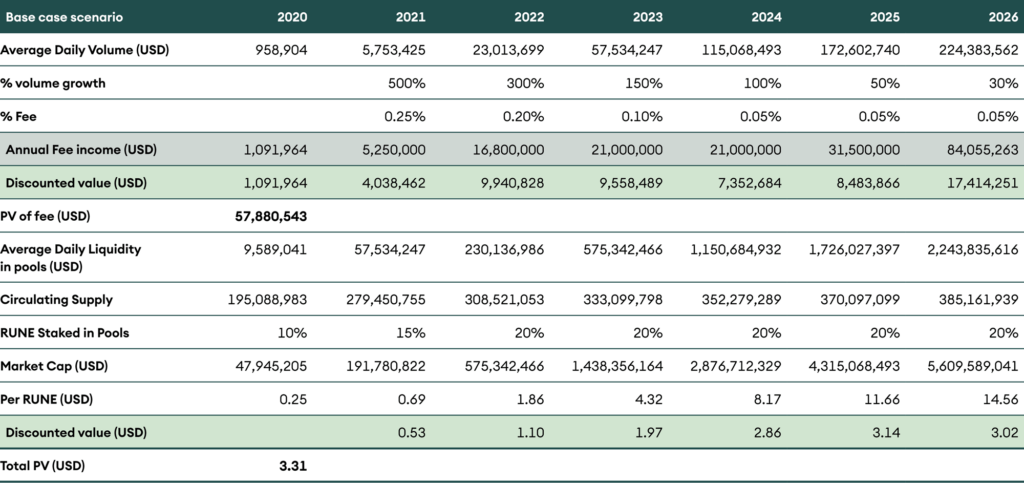

Liquidity is driven by the incentives, which in turn, are guided by the volume of trades. Uniswap approximately has USD 170 mn volume for the last 24 hours and has USD 1.7 bn worth liquidity. As there is no rule of thumb relationship between volume and liquidity, for modelling purposes, we assume a similar 10X multiple for liquidity.

We divide the valuation exercise in three scenarios – base case, bullish, and conservative. We assume a 30% discount rate and a 5% terminal growth rate. The total fee decreases as the liquidity increases, which is in line with the slip based fee design. We begin with a 0.25% fee, slightly less than Uniswap’s current model to be more conservative. At a steady-state, we assume a five basis point fee on every trade.

Base case scenario

Base case scenario assumes that the average liquidity in THORchain pools reaches the same level as Uniswap’s today’s liquidity in the next five years. We arrive at a fair value of RUNE around USD 3.40 in this scenario.

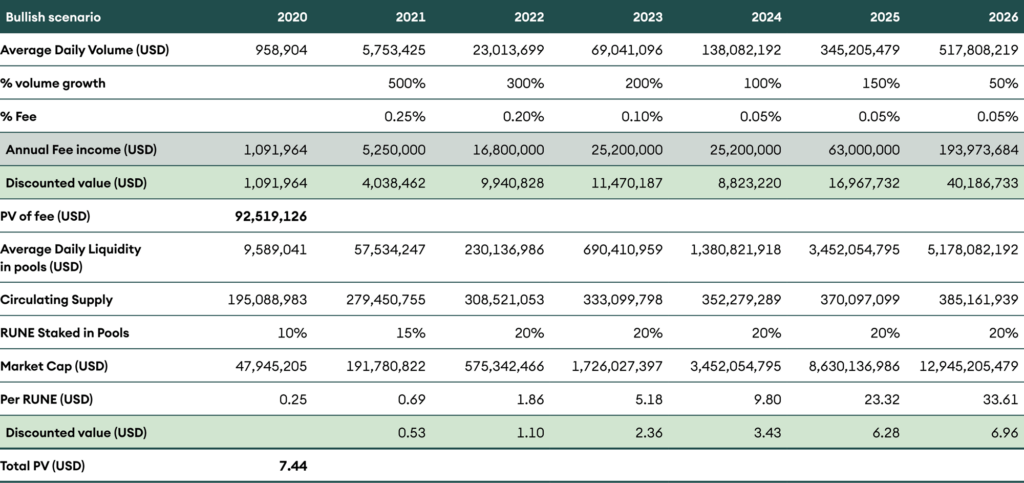

Bullish Scenario

Under this scenario, we assume that THORchain reaches Uniswap’s current volume within the next four years. We arrive at a fair value of RUNE around USD 7.63 in this scenario.

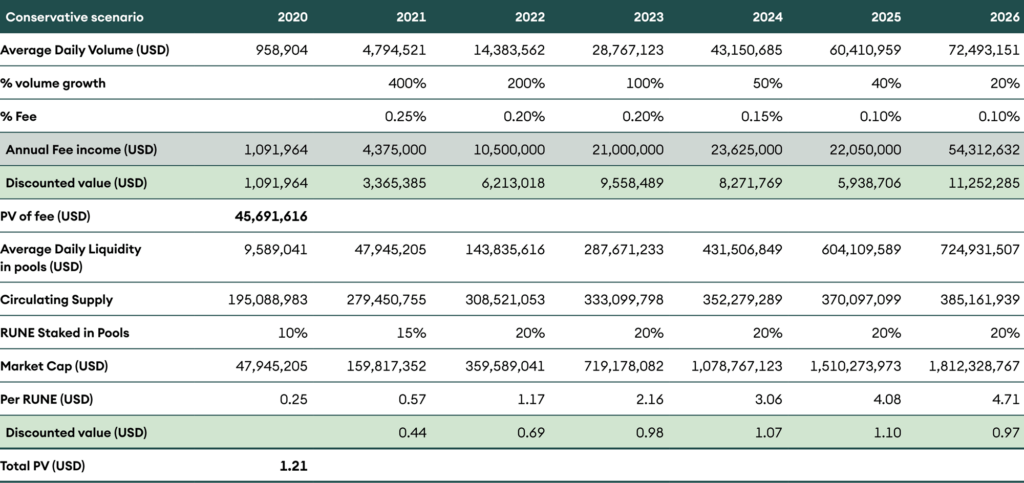

Conservative Scenario

In the conservative scenario, we assume that THORchain does not reach Uniswap’s current volume and liquidity levels in the next five years. We arrive at a fair value of USD 1.26 in this case.

Assuming that all three scenarios are equally likely, the expected fair value of RUNE is USD 4.10. As mentioned earlier, we can see the dilution effect in valuation. In case users do not supply their RUNE as liquidity, they will not benefit from the fee accrued. In that case, the expected fair value is USD 3.65.

THORchain’s defensibility/moat

THORchain’s first level of defence lied with the network effects. The team have been building technology for over two years. Over the course, they have gained good traction among the community. In a decade of cryptoassets’ history, we have seen that community and network effects, in turn, are sticky. Therefore, if a new or existing project forks THORchain’s codebase, we can reasonably assume that the network infrastructure, such as nodes, will stay with THORchain.

RUNE’s token economics are designed so that the value of RUNE follows the value of other assets in the pool. As THORchain becomes compatible with more blockchains, it is reasonable to expect the value to track the volume growth.

Risks

All the cryptoeconomic designs are based on certain assumptions. If these assumptions fall apart, the system is vulnerable to attacks. For example, if there is collusion among nodes, users may suffer economic damage. Though the distribution is deliberate and careful, one cannot be entirely sure that the network will always be collusion free.

Competition is another risk vector that always persists. If successful decentralised exchanges such as Uniswap, decide to cater to multi-chain liquidity, Thorchain will have to fight harder for its share of liquidity. However, Uniswap seems to be maintaining its focus on Ethereum. The longer this remains the case, the stronger THORchain gets in terms of its positioning.

Conclusion

THORchain’s design is very close to that bitcoin’s in spirit. Despite following proof of stake model, the platform does not have perpetual issuance, and it intends to incentivise all the stakeholders only though fee generated from trades. THORchain already generates approximately 20% of stakers’ income (equivalent to miner revenue from fee for bitcoin).

RUNE is well-integrated into the THORchain ecosystem, and the token economics design reasonably ensures that the value of RUNE increases with the growth of the ecosystem. According to our estimate, the expected fair-value is USD 4.1. We think in a multi-chain future, chain agnostic THORchain is the first mover in the multi-chain liquidity aggregation space. We imagine that in a multi-chain future, it is well-positioned to be a good product-market fit.

1Users are the market makers for decentralised exchanges. Pricing assets is a challenge in decentralised systems. Different exchanges use different formula to price assets. Uniswap and THORchain work on X*Y=K formula, where X and Y are the amounts of two tokens in the pool and K is a constant. This means that the product of liquidity of two tokens remains the same before and after a trade. ↵

2this is not the official token distribution, but only a general division based on market forces ↵

3Impermanent loss is nothing but the opportunity cost of providing the assets to a liquidity pool instead of just holding them. If you wish to further understand impermanent loss, please visit https://finematics.com/impermanent-loss-explained/ ↵