TL;DR

- The market cap of cryptocurrencies has reached USD 1.2 trillion, with Bitcoin and Ethereum having market dominance of 48% and 18%, respectively.

- Despite concerns in the traditional banking sector, equity and crypto markets have remained resilient.

- US Fed’s Bank Term Funding Program will inject further liquidity into the market, which is generally good for risk assets.

- We anticipate the release of data such as US employment figures and retail sales in April, and any deviation from expectations will likely impact prices.

- The market will likely continue moving upward, barring any shocks.

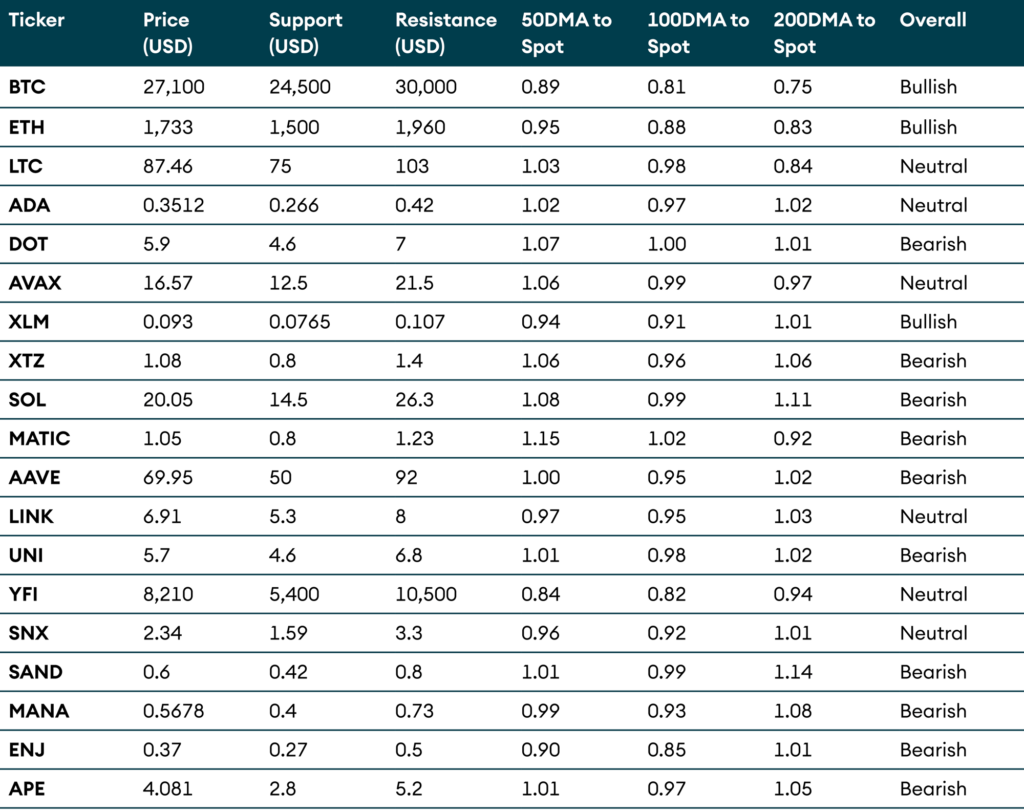

- Technical indicators suggest a bullish trend for Bitcoin, Ethereum, and Stellar in the upcoming month.

• Bitcoin has seen a surge in price and hashrate, with demand returning after the collapse of some banks. - Ethereum’s Shanghai upgrade is expected to enhance its attractiveness for institutions, while the upcoming Cancun upgrade may reduce gas fees by 100x.

- Polkadot has seen elevated developer activity but may be impacted by the impending shared security solution by Cosmos Hub.

- Bitcoin has the highest number of daily active addresses (DAAs) and new addresses, while Solana has the highest number of daily transactions.

- DeFi’s TVL increased by over 37% YTD to reach USD 49.75 billion, but daily wallets interacting with DeFi apps dropped by nearly 15%.

- Aave demonstrated resilience by covering bad debt resulting from the USDC depegging event, while Chainlink integrated with two Ethereum layer two solutions and TrueUSD to provide real-world data.

- Uniswap consistently ranked as the second-highest earning protocol/blockchain after Ethereum and launched its self-custody wallet in early March.

- Synthetix received a USD 20 million investment from DWF Labs, and perp volume on the platform is increasing, reaching USD 100 million daily.

- Yearn Finance’s codebase received a high level of security from Chain Security, and with the Shanghai upgrade, it is expected Yearn will launch its LSD vault.

- Similar to layer one blockchains, one can evaluate the financials of DeFi protocols, and Uniswap is the only protocol with a positive score.

- DeFi’s resilience during macro hardships will likely improve the adoption of remaining protocols.

Introduction

March has been a tumultuous month for traditional finance, while the cryptocurrency industry has remained steadfast. Despite several chaotic and watershed moments, the overall trend of the crypto market has been upward. In this month’s edition of the Digital Investor, we provide a comprehensive overview of the key events in crypto during March, including the collapse of several traditional banks and their impact on the crypto market. We also explore how decentralized finance (DeFi) has remained resilient and how DeFi lending platforms managed risk during USDC deviation from peg. Our coverage includes popular blockchains such as Bitcoin, Ethereum, and Polkadot and their recent progress and upcoming key events. Additionally, we provide an overview of DeFi coins such as Aave, Chainlink, and Uniswap. Finally, we delve into cryptocurrencies’ real-world adoption and valuation with simplified methods, and sources for everyone’s understanding.

Macro and Fundamental Outlook

The market cap of cryptocurrencies has reached an impressive USD 1.224 trillion, experiencing a 14% increase in March 2023 with a 24-hour volume of USD 45 billion.

Among the leading digital assets, Bitcoin has a current price of USD 28,280 and a market dominance of 48%. In contrast, Ethereum, the second largest digital asset, has a price of USD 1805 and a market dominance of 18%. Interestingly, Bitcoin has been the best performing asset in March, gaining an impressive 19%.

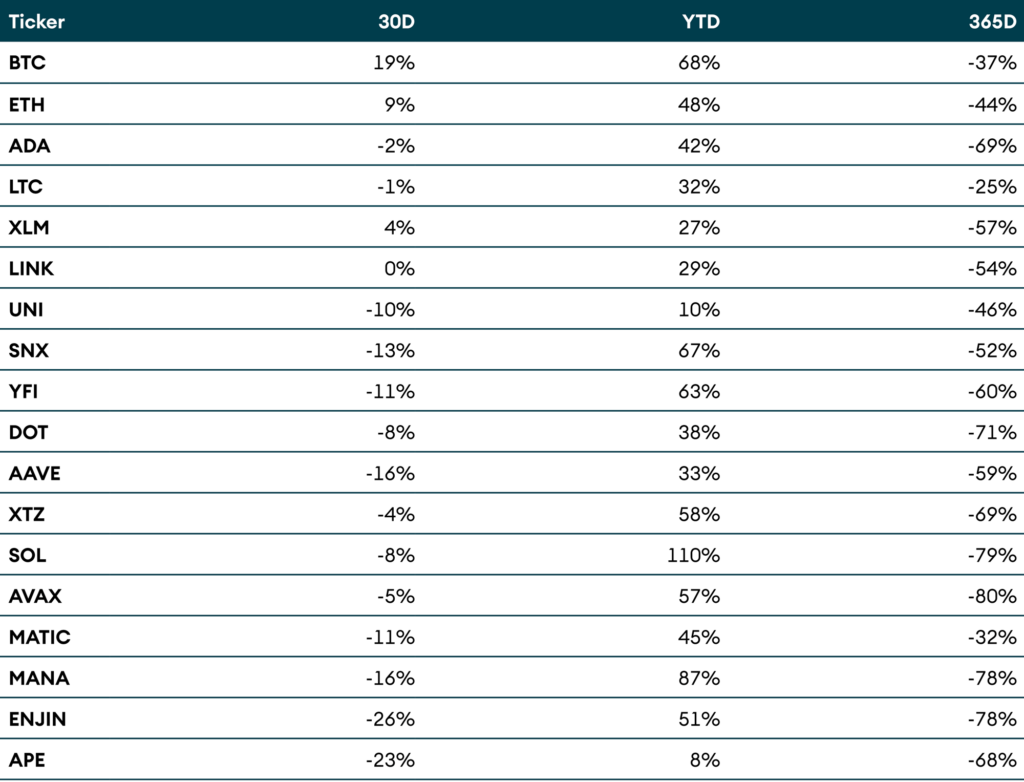

Table 1: Coins Performance

Despite banking sector concerns, the equity and crypto markets have remained resilient. US equities and the Dollar index have bounced back from their mid-March lows, despite US Fed Chair Powell’s announcement that the Fed will likely raise interest rates again in May 2023 before pausing this hiking cycle. The markets have priced in 100 bp of rate cuts in 2023 alone.

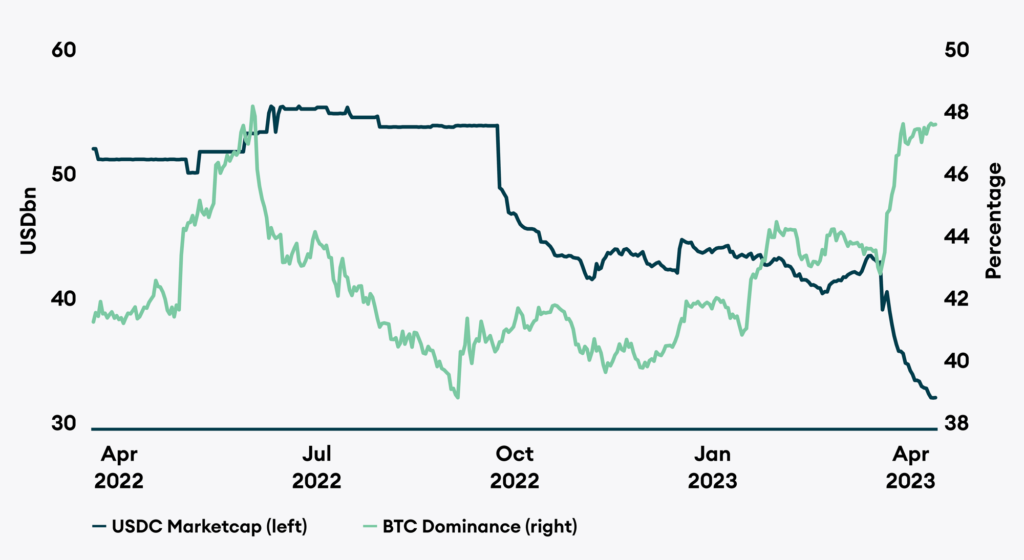

March was an eventful month for cryptocurrencies, marked by significant events such as the collapse of Silicon Valley Bank, Silvergate Bank, and Signature Bank, as well as concerns surrounding USDC. As a result, investors have flocked to safer assets, increasing Bitcoin spot demand (see figure 1 below).

Figure 1: BTC Dominance and USDC Marketcap

The fear in traditional banking has triggered stints from influencers like Coinbase’s ex-CTO Balaji Srinivasan, that bet BTC will reach a million dollars by June 2023. Many believe that it is a strategy to bring attention to the issue of traditional banking and inflation.

The Fed recently announced the Bank Term Funding Program (BTFP), which will help US banks cope with massive withdrawals by allowing them to borrow against their UST and MBS at maturity prices at a 1-year interest rate. BTFP will inject further liquidity into the market, which is generally good for risk assets. Unless there are any shocks, the market should continue moving upward.

Bitcoin led the crypto rally in March, and in the past, this rally has often trickled down to the altcoins.

In this month’s Digital Investor, we cover the adoption and development of blockchains despite macroeconomic and regulatory uncertainties. In global economics, we anticipate upcoming releases of important data such as the US employment figures on April 6th-7th, retail sales data on April 14, advance GDP growth figures on April 27, and core PCE figures on April 28. Any deviations from the market’s expectations in these releases are likely to have an impact on prices.

Technical Outlook

Technical indicators suggest a bullish trend for Bitcoin, Ethereum, and Stellar over the upcoming month. However, it’s important to note that these indicators rely solely on price and volume data and do not consider any fundamental or news-related events.

Table 2: Technical Outlook

Bitcoin

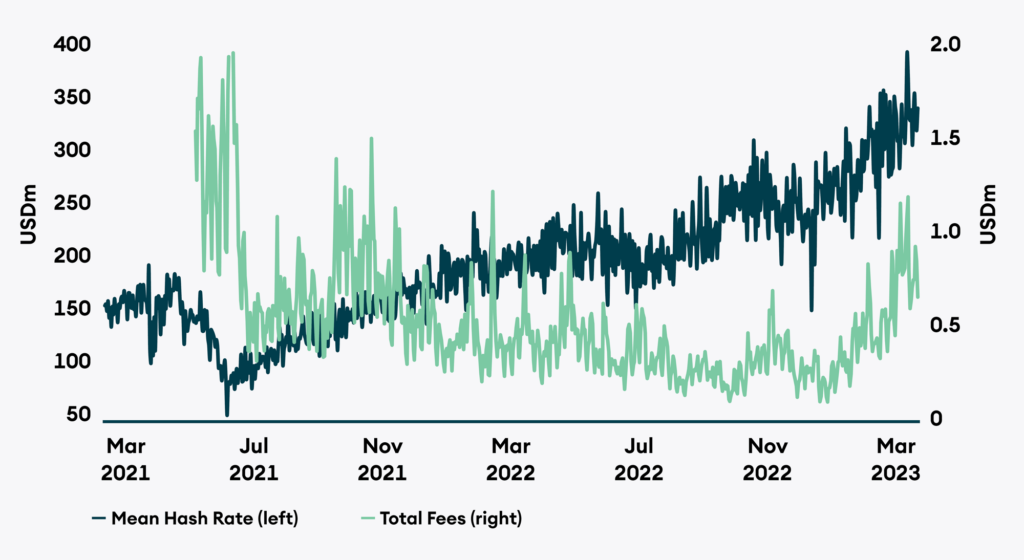

Bitcoin’s price surge, driven by banking uncertainty and its function as a hedge, continues to make headlines. As a result, a significant increase in hashrate has led to accelerated block times and an increase in the overall value generated for the mining industry, both in terms of BTC and USD (see Table 3 below). The first quarter of the year saw a remarkable performance by Bitcoin, with a rise of over 70%, leaving the network much healthier than when the year began.

The exchange balance is now flat YTD, with roughly 2.28 million Bitcoin on exchanges, and demand has started to return after the SVB collapse. Futures’ open interest is now at a one-year low, with approximately 300K Bitcoin liquidated from the 2022 peak in October 2022. Meanwhile, options open interest saw a record-breaking amount of USD 4 billion worth of options expiring on March 31, with roughly 130,000 Bitcoin unwound in contracts from the exchange Deribit.

Spot demand has primarily driven the rally in Bitcoin’s price in recent weeks. Furthermore, Bitcoin’s Fourth Halving is approaching in April 2024, which has prompted a manifold price increase in the past. A tailwind for miners has been the return of a robust fee market, particularly aided by ordinals and inscriptions. The total number of inscriptions on the Bitcoin network has surpassed 600K, with 144 BTC in cumulative fees paid by the inscription market.

Although the total amount in fees paid is still relatively small, the effect of a full mempool for transaction fees has helped fee revenue and incentivized extra hash rate to come online at the margin.

Figure 2: Mean Hash rate EH/s and Total fees paid by transactors (not including new issuance)

Ethereum

The Shanghai upgrade scheduled for April 12, 2023, will enhance the attractiveness of Ethereum staking for institutions. Despite the initial withdrawal, prices are unlikely to be affected significantly. You can read about the Shanghai upgrade in our previous Digital InvestorDigital Investorlink1.

In early March, Gary Gensler, Chairman of the SEC, reiterated that the SEC might regard Ethereum as a security. Coinbase notified SEC in writing this month that staking services will fail the Howey test.

The next Ethereum upgrade, dubbed Cancun, is presently in development and is expected to include EIP 4844 or Proto-Danksharding, which may reduce gas fees by 100x. We expect the upgrade to be available in Q4 2023.

Polkadot

Polkadot, a prominent player in modular blockchain’s shared security system, has elevated developer activity. However, the impending shared security solution by Cosmos could have a profound impact on Polkadot.

In a significant development, Lido, the liquid staking protocol, has announced its decision to discontinue staking on Polkadot and Kusama from August. According to one of Lido’s developers, the move was prompted by “challenged macroeconomic factors and adjacent lack of liquidity in Polkadot’s DeFi ecosystem,” which undermined the value proposition of liquid staking.

Decentralized Finance

DeFi’s TVL experienced a significant surge of over 37% year-to-date basis, reaching USD 49.75 billion. However, during the same period, the number of unique daily wallets interacting with DeFi applications dropped by nearly 15%, compared to a 10% overall drop in web3 dApp users.

On March 11, the FDIC announced its takeover of Silicon Valley Bank, causing USDC stablecoin to deviate from its USD 1 peg. Circle’s announcement of USD 3.3 billion locked up at SVB caused a further decline, with USDC bottoming out at USD 0.87 and redemptions suspended. USDC’s on-chain price acted as a proxy recovery rate for SVB depositors over the weekend. The FDIC’s announcement on Sunday that all SVB deposits would be available at market opening on Monday ended the crisis. Dai mirrored USDC’s price, while USDT traded above USD 1, showing investors’ willingness to pay a premium for stability.

On-chain DEX volume soared, setting a new all-time daily high of USD 25 billion, with Uniswap and Curve ending at USD 12 billion and USD 8 billion, respectively. MEV-Boost also reached an all-time high.

While a depeg or any volatility is advantageous for a DEX, it could be detrimental to a DeFi lending protocol if risk and volatility are not appropriately managed.

AAVE

Aave has demonstrated its resilience by covering all the bad debt that resulted from the USDC depegging event. Aave v3 is soon to be deployed on Metis Andromeda. However, slow governance during the recent USDC depeg led to the protocol incurring bad debt on chains with a smaller presence, like Avalanche.

Chainlink

Chainlink has integrated with Starknet and Base, two Ethereum layer two solutions, and TrueUSD to provide real-world data. With 86 node operators and 2045 blockchain integrations, there is an anticipated increase in demand for staking LINK in the future, with a current APY of 4.75%.

Uniswap

Since January 2023, Uniswap has seen a trading volume of 1.2-2.1 times that of Coinbase, consistently ranking as the second-highest earning protocol/blockchain after Ethereum. Daily active users have doubled in the past year. Uniswap launched its self-custody wallet in early March, receiving mixed reviews.

Synthetix

Synthetix received USD 20 million in investment from DWF Labs. Perp volume on the platform is increasing, reaching USD 100 million daily, indicating an increase in the number of investors on the platform.

Yearn Finance

Chain Security recently completed an audit on Yearn Finance, concluding that the codebase provides a sufficiently high level of security. With the Shanghai upgrade in two weeks, Yearn’s LSD vault is expected to launch soon.

Layer 1 Blockchain networks

Adoption

Bitcoin and Ethereum, two of the most prominent blockchain ecosystems, have experienced various growth cycles, exuberance, and turmoil in their relatively short lifetimes of 14 and 8 years, respectively. While some may argue that the market cap of crypto, which currently stands at USD 1.2 trillion, does not justify the lack of adoption of cryptocurrencies, others point out that blockchain has remained resilient, especially in light of the breakdown of centralized entities such as banks this year. Regardless of which side of the debate one finds oneself on, it is important to periodically examine blockchain adoption metrics since all activities are visible to everyone due to the open ledger nature of the blockchain.

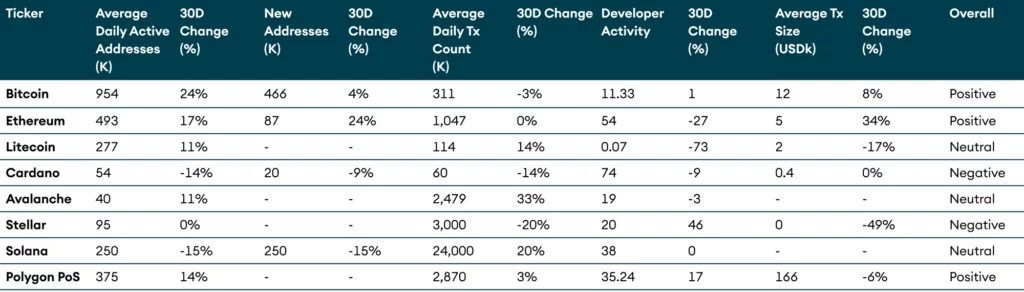

Looking at adoption metrics such as daily active addresses (DAA), new addresses, and the number of daily transactions helps to understand the level of crypto adoption. Bitcoin, for example, boasts the highest number of DAAs, which are the unique addresses that interacted with the network in the past 30 days. Additionally, it had the highest number of new addresses joining the network in March, followed by Solana and Ethereum. On the other hand, Solana had the highest number of daily transactions, a testament to its status as the blockchain with the highest transactions per second (tps). The overall scores are based on changes observed over 30 days.

For instance, although Solana’s transaction counts increased by 20% in March, its decline in new and daily active addresses earned it a neutral rating. In contrast, Polygon received a positive score despite a reduction in transaction size, which may occur if users engage in small-value transactions that are not necessarily detrimental to the network. These metrics also demonstrate that Bitcoin is not a “ghost network,” as some had speculated last year.

Table 3: Layer 1 on-chain data

Financials

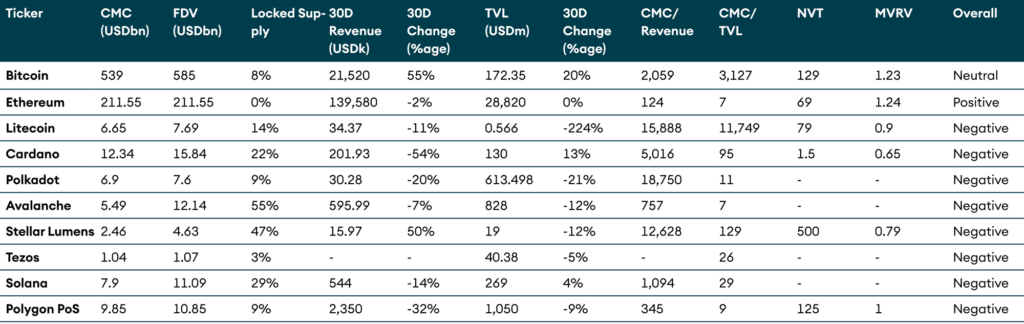

Blockchain ecosystems’ native assets have multiple uses, including transaction fees, block rewards, and coordination tools. Balancing fees and rewards ensure the sustainability of the network’s participants. While some ecosystems like Stellar Lumens do not offer block rewards, securing and decentralizing the network still carries a cost, whether in electricity or opportunity costs of capital. Thus, it is possible to assess blockchains from an investment-only perspective.

The table below displays the revenue token holders earn through a token burn or block issuance. Ethereum is the only network with a positive rating, thanks to its low CMC/Revenue ratio. Its CMC/TVL ratio is also the lowest, with Avalanche, Tezos, and Solana following closely but experiencing monthly revenue declines. However, this model is a simplification, and other networks like Bitcoin have seen revenue growth despite very high CMC/Revenue ratios in the past. In short, assessing blockchains’ profitability is complex and nuanced, but considering revenue, market cap, and total value locked can offer insights into an ecosystem’s health.

Table 4: Blockchain Financials

Speed and Latency

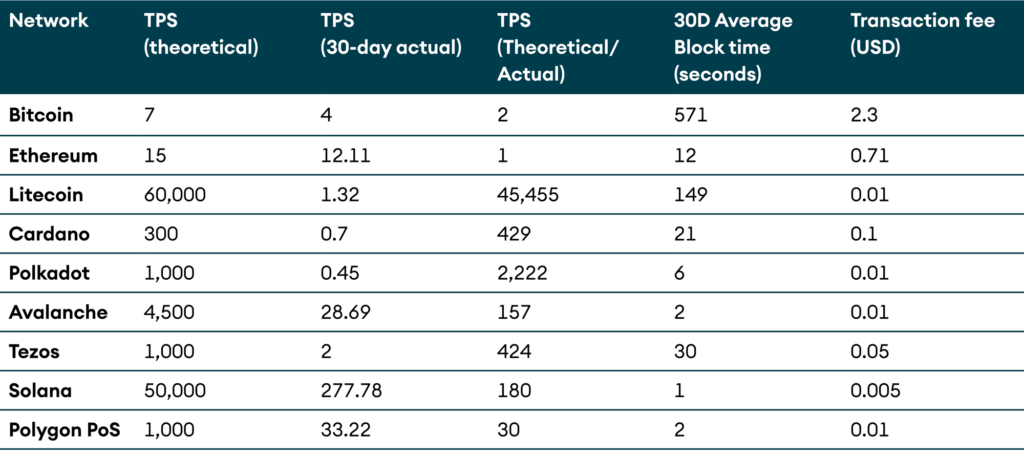

Blockchain speed is determined by the network’s capacity to process transactions, typically measured in transactions per second (TPS). A higher TPS indicates a faster network speed, allowing for quicker transaction processing times. However, increasing TPS can also increase the risk of network congestion and reduce decentralization.

Latency, however, refers to the time it takes for a transaction to be confirmed and added to the blockchain. Latency can vary depending on the specific blockchain and its consensus mechanism. For example, proof-of-work (PoW) blockchains like Bitcoin typically have higher latency due to longer block confirmation times. In comparison, proof-of-stake (PoS) blockchains like Ethereum have lower latency due to shorter block confirmation times.

Solana stands out as the blockchain with the fastest speed of transaction finality, at just 1 second, and the highest tps, averaging 300 transactions per second in March. On the other hand, Bitcoin and Ethereum are currently operating at near-maximum capacity. Additionally, transaction fees across most blockchain networks have significantly decreased to just a few cents, providing incentives for new user adoption. Developers usually consider these factors when deciding on a blockchain ecosystem to join.

Table 5: Speed and Latency

Staking Comparison

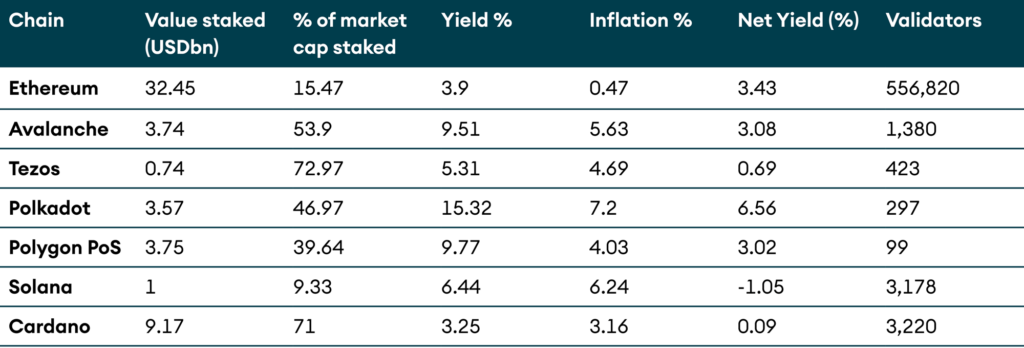

In Proof-of-stake blockchains, the value staked provides economic security to the entire network. Any participant needs a 51% majority to attack a network, and higher the value staked, higher is the network security. Below, we have a simplified version of the staking comparison of PoS blockchains. Ethereum has the highest value staked and number of validators, while Polkadot has the highest yield. This is predominantly because Polkadot has a fixed net inflation rate of 10%. Polygon PoS and Polkadot have also fixed their number of validators. Solana is the only blockchain with a negative net yield. The thing to remember is that the yields and inflation are variable in most cases.

Table 6: Staking Yield

DeFi Financials

The financials of Defi protocols can be evaluated similarly to layer one blockchains. In fact, the revenue model is more applicable to protocols than blockchains. This is because coins are needed for validating transactions in blockchains, whereas tokens are used for governance and often receive a share of the revenue generated by protocol growth.

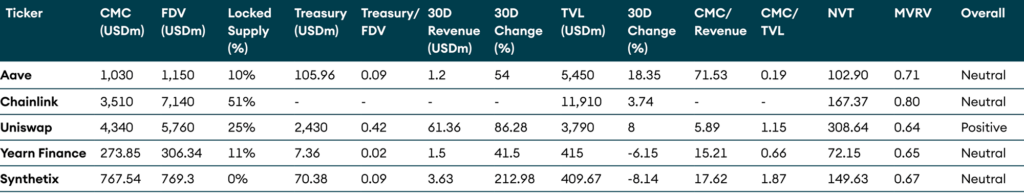

There has been a debate for over two years about the Uniswap fee switch, which could potentially direct a portion of platform fees to UNI stakers instead of solely to liquidity providers as it is currently done. Below are the financials and overall scores of the aforementioned defi projects. Uniswap is the only protocol with a positive score. For the remaining protocols, the narrative that DeFi remained resilient even during macro hardships will likely improve adoption.

Table 7: DeFi Financials

Conclusion

Regardless of whether a minor alt season occurs, the persistent tailwinds are poised to propel crypto asset class forward, irrespective of any pessimistic macroeconomic forecasts. While some correlation-driven downward movements may occur due to macroeconomic factors, the future of crypto appears promising.

The main arguments for Bitcoin outperformance lie in investor concerns regarding the regulatory status of non-BTC cryptos, fundamental arguments favouring digital assets as an alternative to the existing financial system, the approaching end of the Fed’s tightening cycle, and relatively supportive technical factors.

As for Ethereum, the upcoming Shanghai or Shapella upgrade on April 12th is expected to have a positive effect on the network’s adoption. We anticipate that this positive trend will extend to altcoins, and as an industry, we remain confident in the upward trajectory of this rapidly evolving space, with continued growth and success.

To summarize, despite any possible downward movements, we believe the crypto industry will continue to grow and flourish, driven by a number of compelling factors that make it an attractive investment opportunity.