Abstract

This Digital Investor builds on concepts explained in The Bridge and analyses the landscape of decentralised exchanges (DEXes) for investors, from market making to different players. The first section examines market-making in Automated Market Makers (AMM) and how liquidity providers (LPs) can use these properties to their advantage. The second section describes different players and their value accrual mechanisms in the space. And the final section analyses valuations in the DEX space.

Introduction

2020 has been a remarkable year for Decentralised Finance (DeFi) applications. The liquidity mining kicked off by Compound quickly morphed into a stack of DeFi applications working homogenously. Lending/borrowing, exchanges, derivatives, asset management, and payment infrastructure are the broad categories of current DeFi applications. Decentralised exchanges play a pivotal role in facilitating everything else. In this article, we analyse market-making in DEXes and their valuations.

The alchemy of AMMs

Automated Market Makers (AMMs) are revolutionary. They democratised market making as anybody can be a market maker through AMMs. All one needs to do is provide liquidity to earn fees from trading. AMM apparatus has three critical players – liquidity providers (LPs) who provide liquidity, traders who swap assets, often creating arbitrage opportunity for the third player – the arbitrageurs. In this section, we shed light on the benefits of being an LP, ways to mitigate impermanent loss (IL), and desirable market conditions for the three players.

As stated in the Bridge, LPs run the risk of IL. Before getting into how LPs can mitigate the IL, it’s important to note why LPs should even consider providing liquidity to pools. There are two reasons for doing so – the first is, of course, to earn trading fees. On March 13, DEXes did approximately USD 2 bn in volume. If we take a standard 0.25% fee, LPs have earned USD 5 m on March 13. The second reason to be an LP is portfolio rebalancing. LPs can choose custom weights or use existing weights across pools to outsource their portfolio rebalancing to the market and earn some fee while the market rebalances their portfolio.

IL could also be thought of as the cost LPs pay to get their portfolios rebalanced by the market. Therefore, LPs must consider different parameters before providing liquidity to a pool. First and foremost is the curvature of the AMM. The impact of a particular trade on an asset’s relative price in a pool depends on the AMM’s curvature. The more pronounced the curvature, the more significant the impact on price. When the curvature is flatter, the slippage will be lesser, resulting in lower IL. The lower the curvature’s slope, the better it is for highly correlated assets such as stablecoins or different wrapped versions of the same underlying (sBTC, wBTC). When the curvature is more pronounced, the slippage is higher, which invites arbitrageurs creating higher income for LPs.

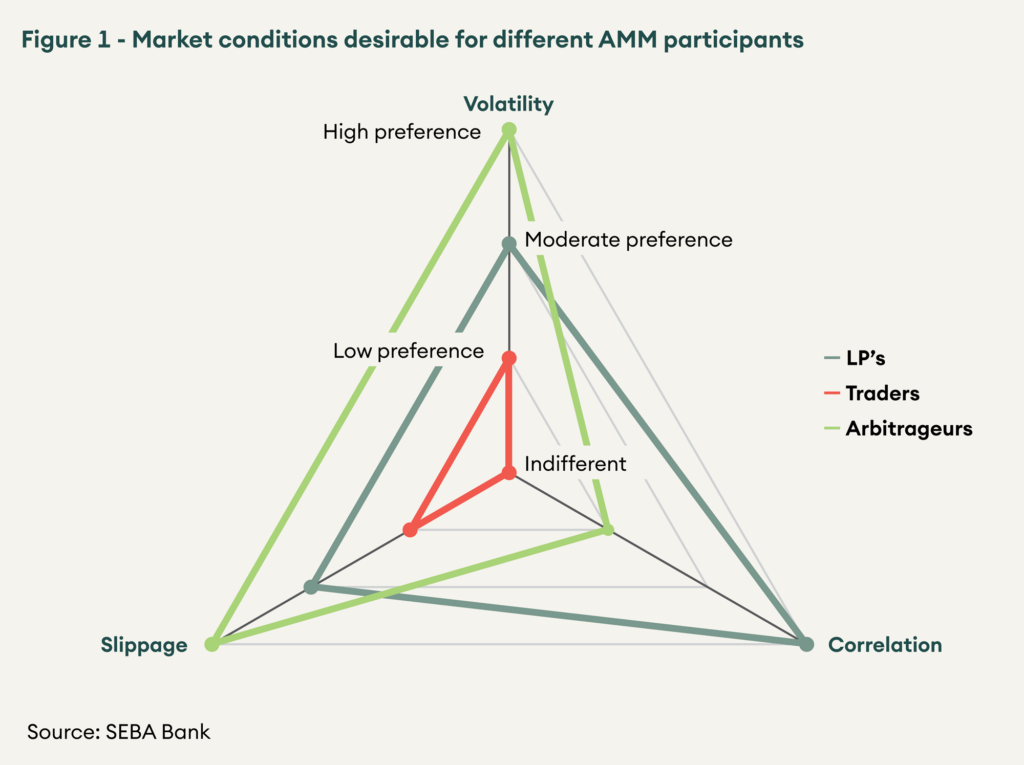

As stated earlier, three DEX market participants benefit from different market regimes. The three market parameters affecting market participants’ profitability are – correlation of assets, volatility, and slippage. Figure 1 shows the favourable market conditions for the three players.

As an LP, one wants a slight relative movement of the two assets. Therefore high correlation is desired. Also, LPs want moderate volatility. If the volatility is too high, the correlation between the two assets may break and LPs risk higher IL. If the volatility is too low, LPs do not earn enough fees. Higher slippage may lead to higher relative price movements. And lower slippage means lower volume as arbitrageurs are not incentivised enough. Therefore, moderate slippage is ideal for LPs.

High slippage means asset prices in the pool change more than prices outside; this is ideal for arbitrageurs. High volatility and low correlation help arbitrageurs maximise their gains.

Traders who swap assets from a pool prefer lower slippage and lower volatility. Figure 1 summarises ideal market conditions for the different players.

Figure 1 – Market conditions desirable for different AMM participants

Though it is impossible to eliminate IL in the current setting, LPs can hedge IL in two ways – synthetically hedge the IL using various options strategies and choose pools based on protocol incentives that mitigate IL. However, the second alternative may not exist in perpetuity as protocol incentives will end at some time.

DEXes and their value accrual

We touch upon different DEXes, their USPs, and their value accrual mechanism in this section.

Uniswap

Uniswap championed the x*y = k model, also known as the constant product model. It allows a user to swap any two Ethereum based tokens. These swaps are facilitated by LPs who provide liquidity to pools. LPs currently earn 0.3% of every trade.

Uniswap borrowed the idea from Bancor, a protocol that pioneered AMM, and removed the token from design to make it more gas effective. Bancor did an ICO worth USD 150 m as opposed to Uniswap’s modest USD 100,000 through an Ethereum grant.

Uniswap is the most successful DEX and leads the space in terms of volume and daily active users. It has the backing of one of the most successful research-driven VC firms, Paradigm. Uniswap, like other DEXes, is often criticised for IL. However, it has been working with researchers, and there are indications that Uniswap may provide some sort of protection from IL in the much anticipated V3 launch.

Value accrual

Liquidity providers earn (LPs) 0.3% trading fee right now.

Uniswap has a governance token called UNI. As of now, UNI token holders do not have a claim on platform revenues. However, this is anticipated to change with V3.

Sushiswap

Sushiswap, initially just a vampire attack on Uniswap, later started differentiating itself on standout features. A couple of Sushiswap products that stand out are Miso and Bentobox. Miso is a whole suite of contracts that allows project teams to launch their token. Different projects need tokens for different needs, and the launch methods will vary accordingly. Miso tries to cover these different methods. Bentobox is a lending solution that allows users to lend tokens in pairs (one to lend and the other as collateral). It also acts as a placeholder for tokens reducing the need to approve all the tokens, saving on gas fees.

Sushiswap’s beginning was a bit distasteful; the founder was forced to hand over the project to others. From just a fork of Uniswap with nothing more to offer to one of the top three DEXes based on differentiated product offerings, Sushiswap has turned itself around with a lot of community involvement.

Value accrual

LPs earn 0.25% of the trading fee.

Sushiswap’s governance token, SUSHI, can also be staked into the protocol, and the stakers earn 0.05% of the trading volume. SUSHI stakers earn approximately USD 75 m on an annualised basis.

0x

0x is different from other DEXes. Instead of using liquidity pools to match orders, 0x takes the order book off-chain. It works on request for a quote model. Once an order is generated, relayers find the counterparty to execute the trade. After finding the counterparty, the order is executed on-chain.

Two crucial pieces of 0x infrastructure are Mesh and Matcha. Mesh is an off-chain peer to peer order sharing network that adheres to 0x order message format. Matcha is a consumer-facing DEX that utilises 0X API and Mesh to aggregate liquidity and price information from different DEX venues.

Value accrual

ZRX is the governance token of 0x, and for a long time, there was no precise value accrual mechanism for ZRX. In January 2020, 0x v3 went live with staking. Users can now stake ZRX in pools set up by different market makers (relayers). Relayers facilitate trades, and each trade has a fee associated with it. Staking pools accumulate the fee over a seven-day epoch. The fees are then distributed to individual stakers based on their stake proportional to the pool.

There are currently nine pools for staking, out of which only two have generated meaningful rewards for stakers (based on average rewards shared). As per staking rewards, ZRX stakers receive approximately 2% in staking rewards which may not be enough for users; this is evident from the observation as only 5.4% of the circulating supply is staked. Ceteris paribus, if more users decide to stake, the APY will drop further, making things worse.

Curve

Curve improvised upon the constant product market function to offer a constant sum market function for pricing trades. It facilitates swaps of stablecoins (USDC, USDT, DAI, sUSD, etc.) and highly correlated assets (WBTC and sBTC, sETH and ETH, and so on). The constant sum function allows Curve to support large trades with limited slippage.

Curve is one of the most used DeFi products. It leads the DEX space in terms of Total Value Locked (TVL), with over $4 billion locked in the protocol.

Value accrual

CRV is the governance token of Curve. All the Curve pools charge a 0.04% fee currently. 50% of the fee goes to LPs, and the rest goes to veCRV holders who are DAO (Decentralised Autonomous Organisation) members. veCRV stands for vote-escrowed CRV; it is CRV locked for a time period.

1inch

1inch is an exchange aggregator that can split a single trade and bring liquidity from different exchanges. It gets liquidity and the best price from various exchanges, thereby making trades more straightforward. As 1inch sources liquidity from multiple DEXes, users don’t have to spend gas numerous times to approve the same token. 1inch also has a gas token called Chi which allows users to tokenise gas and manage the gas price volatility better.

1inch was one of the first protocols to have an integration with the Binance Smart Chain, indicating that the team are nimble to deploy on non-Ethereum chains in case there is traction.

Value accrual

1INCH is the governance token of 1inch DEX aggregator.

1inch team has also launched a DEX called Mooniswap that uses virtual balances to take care of the slippage issue. It charges a 0.3% swap fee, of which 5% goes as a referral fee (to incentivise integrations with wallets and other services that increase trading volume and additional income for liquidity providers), and the rest goes to LPs.

The 1inch Pathfinder works such that users get the latest and best prices for a swap. The swap price may change by the time a transaction is mined, resulting in a spread surplus. As of now, the entire surplus goes to referrers. In future, this can be changed, and part of the surplus could go to the governance participants.

Balancer

Balancer is a generalised implementation of Uniswap, which allows LPs to create pools with more than two assets, i.e. Balancer is a multi-token automated market-making protocol. It generalises Uniswap’s x*y = k model for multiple tokens, and a pool could have up to eight tokens in Balancer’s first version. Liquidity providers can use these pools as portfolio rebalancing tool whereby they also earn a fee on trading instead of paying a fee for rebalancing.

Balancer does not charge a fee for trading. The liquidity pools are funded by investors. However, pool creators can set a swap fee. This fee currently ranges from 0.01% to 10% for different pools.

Theoretically, Balancer does everything that Uniswap and Sushiswap do, plus a bit more. However, in terms of volume and number of active users, Balancer lags both the DEXes by a wide margin. This gap likely exists because of Balancer’s fragmented user experience, as different pools charge an inconsistent fee.

However, with their v2, Balancer plans to bring new efficiencies. Notable changes are new protocol vault that holds and manages all the assets added by all Balancer pools. V2 separates token management and accounting. AMM logic is individual to each pool, while the vault does token management.

Value accrual

LPs earn a fee set for the pool (by whoever deploys the pool). BAL is the governance token of Balancer. It is used to incentivise LPs via liquidity mining. The protocol does not charge anything to the traders; therefore, there is no direct value accrual mechanism for BAL.

The protocol did not charge anything to the traders until now, but with the upcoming v2, this may change. A protocol-wide fee may be charged, and all the fees will be kept in the vault.

Bancor

Bancor launched the first-ever AMM in 2017. In the 2.1 version, Bancor allows LPs to provide liquidity in one token and Bancor mints equivalent amount of BNT for the same pool, and when LPs take the token out, Bancor burns equivalent BNT. However, LPs can add liquidity with BNT also. Bancor uses BNT to cover for impermanent loss of LPs. The IL protection works in the following manner –

- 0% up to 30 days

- 30% on day 30%

- Increases 1% per day after that until 100%

Despite raising approximately USD 150 m in ICO, Bancor took time to figure out the product-market fit. BNT token added a lot of friction at the beginning and was deemed unnecessary by the Ethereum community. However, the team seems to be addressing these concerns in the latest v2.1

Value accrual

LPs earn a default 0.2% on Bancor pools along with incentives or liquidity mining rewards. The LPs can also set the fee. 30% of the liquidity mining incentives are for the non-BNT side of the liquidity, and 70% are for the BNT side of liquidity.

BNT tokens holders can stake BNT in vBNT/BNT pool. vBNT is the governance token of the Bancor protocol. Users can stake vBNT and earn swap fees. vBNT can also be used as collateral to borrow other assets. Bancor plans to introduce a small protocol wide fee, with which it will buy vBNT and burn it, effectively charging the non-BNT LPs for IL.

Kyber Network

Kyber Network has a hybrid market-making approach – constant product function (x*y=k style) plus traditional market-making approach for on-chain liquidity focusing on the latter. Kyber Network used to be among the highest trading volume venues throughout 2019. However, as they were focused more on bringing traditional market-making on-chain, they missed out on capturing mind share through the DeFi summer. Kyber currently does less than 10% of Uniswap’s daily volume.

The Kyber team seems to have realised the limitations of their approach and have released upgrade plans in January 2021. In a nutshell, Kyber will launch DMM (Dynamic Market Maker) protocol to allow anyone to launch Kyber pools and be LPs. The DMM approach borrows two ideas – introducing virtual balances to tweak the curvature of the market-making function as Mooniswap (DEX by 1inch) and adding a dynamic fee to reduce IL’s impact as in the case of Thorichain’s slip based fee.

Value accrual

KNC is the governance token of Kyber Network. Users can stake it in the DAO to participate in governance. The upcoming upgrade will also decide how much fees are charged to different liquidity protocols. These fees are distributed to KyberDAO and, thereby, users who have staked KNC in the DAO.

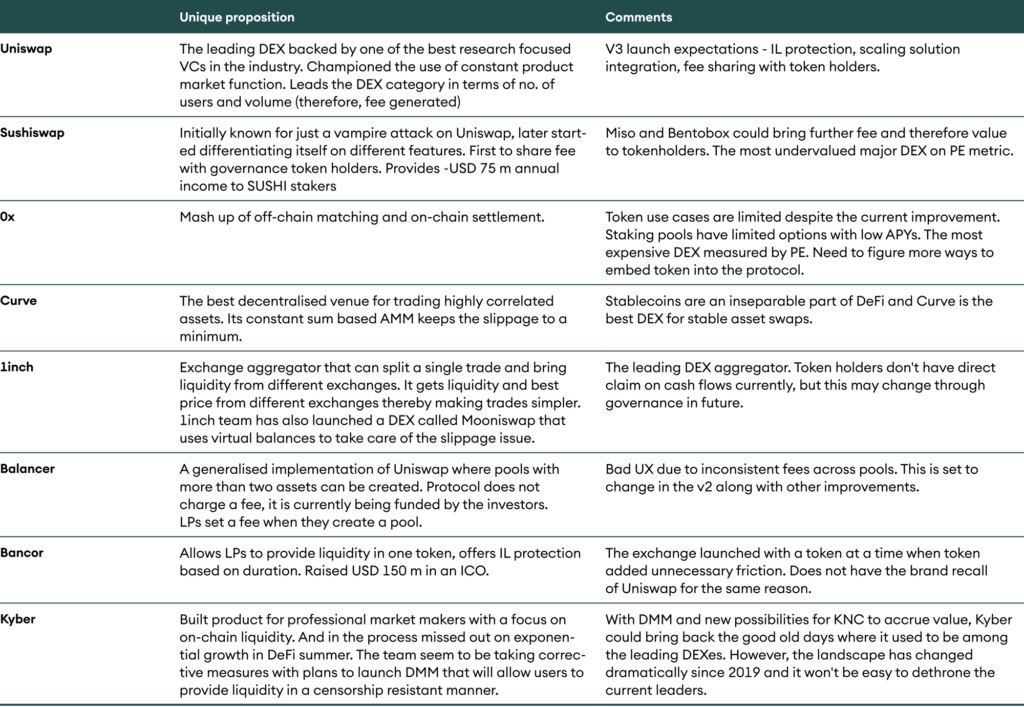

Table 1 – Summary of DEXes

Valuation

In this section, we perform the discounted cash flow-based valuation for Uniswap and Sushiswap and then perform the relative valuation of DEXes. Coinbase’s IPO has given a reference point for valuations of the entire exchange space, and we will use this to understand how other exchanges stack up.

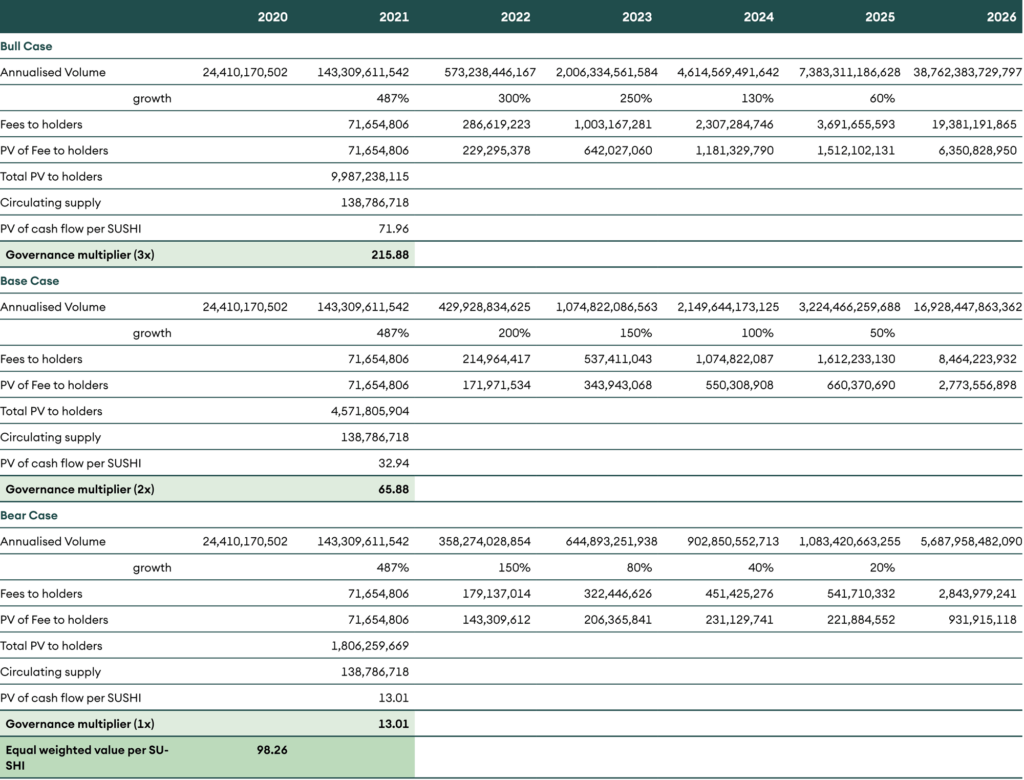

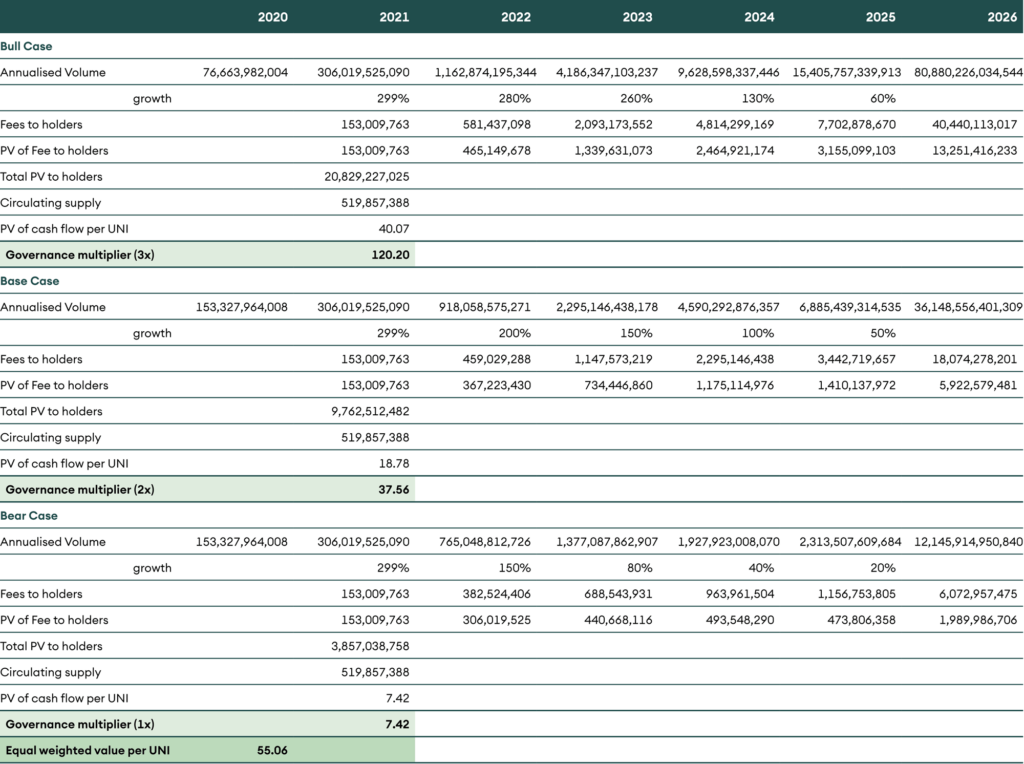

Many DeFi application tokens have cash flows linked to them. Therefore, they can be valued using discounted cash flows. We value UNI and SUSHI, the top two DEXes by market capitalisation, using the same methodology as valuing RUNE. For the rest, we carry out a relative valuation with a P/E ratio. The model takes three scenarios into account – bullish, base case, and bearish or conservative. In the bullish scenario, we gradually taper the current growth trajectory, and the bearish one assumes the growth receding quickly. The base case scenario takes a moderate stance between the other two.

As per the DCF approach and taking three scenarios with equal probabilities, the fair values for UNI and SUHI are USD 55 and USD 98, respectively. Currently, both UNI and SUSHI are undervalued based on their fair values.

Figure 2 – DCF for UNI

Figure 3 – DCF for SUSHI

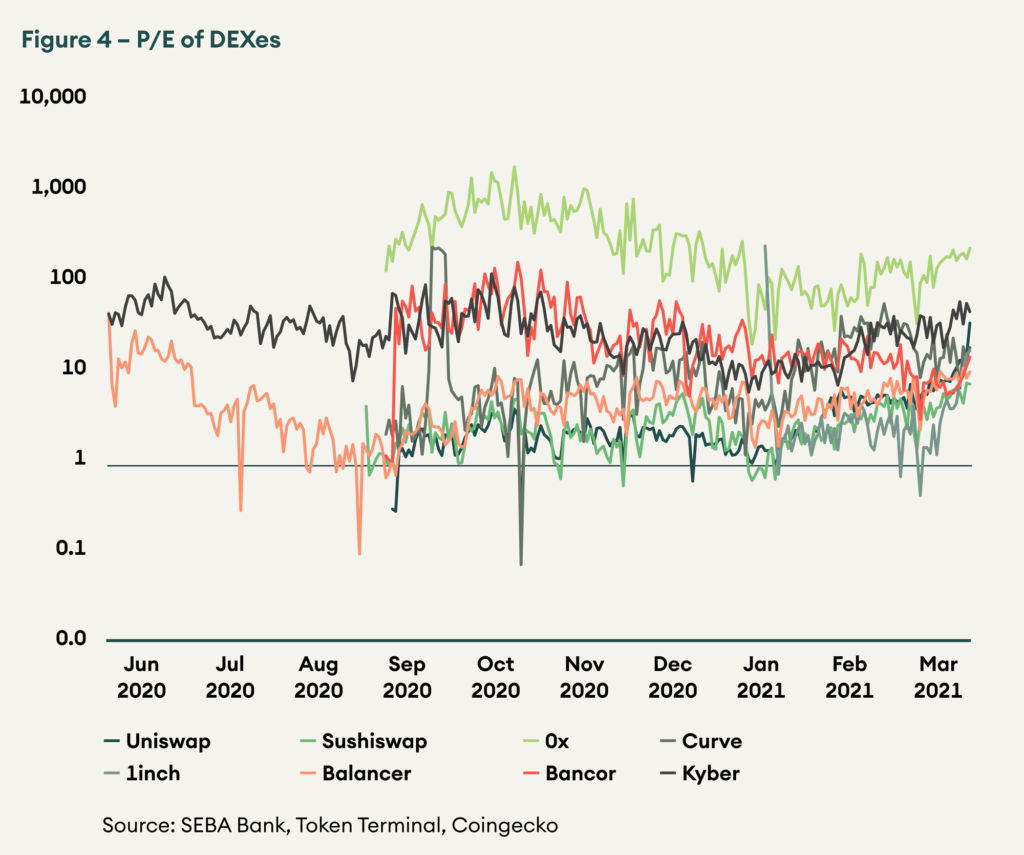

We now compare valuations among the DEXes. In figure 4, we look at the time series of P/E of different DEXes. P/S and P/E are the same as treasury takes care of the expenses and fee go directly to LPs or token holders.

We divide the daily market cap by annualised daily revenue to arrive at time series of P/S (which is the same as P/E). As shown in figure 4, Sushiswap is undervalued relative to the pack followed by Balancer, and 0x is most overvalued, followed by Kyber.

Figure 4 – P/E of DEXes

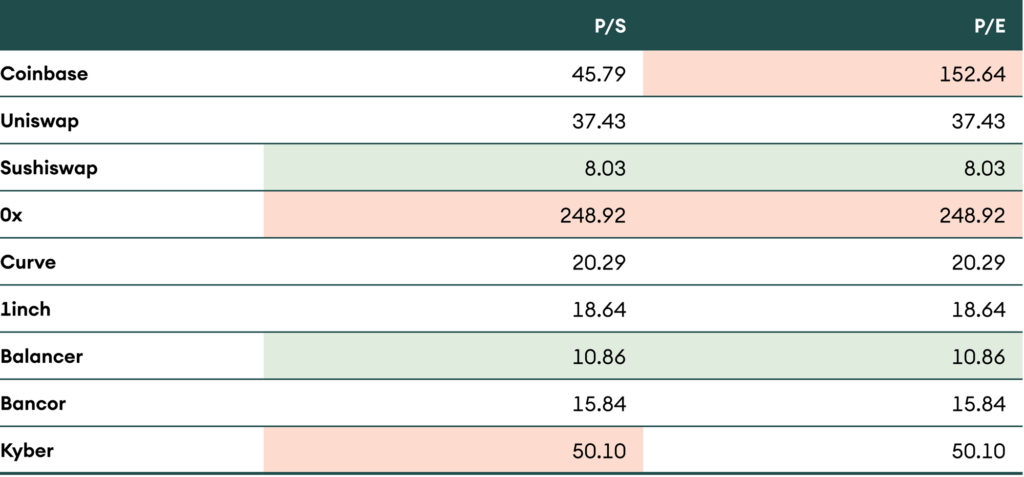

Coinbase may command a valuation of approximately USD 100 bn on the listing and is trading at an implied valuation of $117 bn on FTX. It brought in revenue of USD 1.3 bn in 2020 and net income of USD 322 m. Assuming a 100% revenue growth and 30% net income margin, Coinbase commands a forward (FY21) P/S of about 45.79 and P/E of 152.64. Except for 0x, almost every DEX is undervalued compared to Coinbase. As shown in figure 5, Sushiswap is the most attractive exchange among the selected universe, and 0x is the most expensive.

Figure 5 – Comparison of DEXes with Coinbase

Conclusion

Exchanges have been a thriving business in the digital assets landscape. Centralised exchanges such as Coinbase, Binance, and FTX have flourished over the few years. 2020 witnessed the Cambrian explosion of DeFi powered by DEXes. Given that DeFi users accrue actual cash flows, we think that DeFi and DEXes will find higher representation in the digital assets market. We expect DEXes to grow at a high rate during the next couple of years.

We explored multiple facets of the DEX landscape in this article, from market making to individual players’ valuations. As per DCF valuation, values for UNI and SUHI are USD 55 and USD 98, respectively. Among the DEXes we evaluated, SUSHI is relatively undervalued based on the PE ratio.

Appendix

Assumptions for valuation –

- Discount rate – 25% and terminal growth rate – 5%

- The governance multiplier is higher for the bull case with no value for governance in the bear case. The reason is governance decides what happens with the treasury of the protocol along with other important decisions. The higher the treasury, the more important the governance function

- For Uniswap, though the users don’t have any claims on cash flows, we have assumed a 0.05% fee going to UNI holders as we anticipate this to take place with the V3 launch

- For 2021 revenue, we have annualised the revenue accrued in the first two and a half months of the year.