On 18th June 2019, Facebook released documents describing its blockchain project, Libra. We believe Libra to be the most significant blockchain project initiated by a publicly listed multinational corporation since JP Morgan announced JPM coin. However, unlike JPM coin, which will be limited to a private and centralized ecosystem, Libra coin will be more retail focused and relatively more decentralised. Should the project overcome regulatory hurdles, the network impact of Facebook and other large companies such as Uber, Spotify and Vodafone who are already a part of the Libra ecosystem could result in fast adoption of the network.

In essence, Libra is very different from bitcoin. Libra is first of all a medium of exchange, while bitcoin is a store of value. They are both positioned to potentially become a global unit of account.

In this month’s report, we look into the details of this project. Our key takeaways regarding the Libra project are:

- The Libra coin is an attempt to provide a simple global currency to everyone, including the unbanked population.

- The Libra project is designed to facilitate the trade of goods and services via the internet and is aimed at increasing the profitability of the members within the network.

- Due to its global reach, Libra challenges incumbent global payment networks and potentially even the FX market in the long run.

- As the Libra coin is backed by an undisclosed basket of fiat currencies, the umbrella Libra Association1 acts as a currency board. Under certain circumstances, especially where active management of the underlying basket becomes necessary, the Libra coin could have destabilizing effects on the underlying currencies.

- Libra is likely to face various regulatory hurdles as policy makers seek to provide a framework that balances the advantages to end-users versus the macro risks such a project could potentially generate.

- The Libra Network2 is not implemented in a conventional blockchain structure, but in principle strives to achieve the same effect as a conventional one. The security of Libra network depends on a new consensus mechanism called LibraBFT which requires 2/3rd of the validators to arrive at a consensus to validate a transaction.

- Access to the blockchain as a validator is restricted (in the beginning) to the Libra association members only.

- Libra issued two coins, Libra coin and Libra Investment Token3. Libra Investment Tokens, which are only available to the association of nodes4 (“Founding Members”), will be replaced with Libra coins over time, which could result in a situation where the holders of the Libra coin become the validators on the network.

- The Libra Network is likely to develop into a self-sustaining ecosystem from a financial point of view as it hinges on fiat investments to generate cash-flows (interest) to cover operating costs.

This analysis starts at the macro level and goes down to the details of how the project works. We start by describing the goal of the project, its potential impact on the FX market as well as the global payment system and the regulatory hurdles faced by the project. We then look at the protocol, tokenomics and financial sustainability.

Project goal

The Libra project intends to offer “a simple global currency” named Libra coin, or Libra in short. Even though the Libra network uses cryptographic techniques and is marketed as blockchain technology, the Libra coin is not a cryptocurrency in its purest form but rather a digital currency backed by an unspecified basket of fiat currencies. The concept itself is not novel (there are several fiat backed tokens in the crypto currency space for example Tether, USD Coin etc), but the scale at which it will be implemented makes it by far the most ambitious project backed by traditional players.

Between 1973 and 1985, the Singaporean dollar (SGD) was a currency backed by an unknown basket of other fiat currencies. The value of the SGD was as good as the constituents of the basket and the approach the Monetary Authority of Singapore (MAS) took to manage it. In the same way, the value of Libra is as good as the constituents of its underlying basket and the way the Libra Association will be able to manage the currencies that back the Libra.

Contrary to bitcoin, which has a pre-defined monetary policy that is firmly embedded within the bitcoin protocol, the monetary policy that supports Libra is flexible in order to adjust to the fluctuations in the value of the underlying currency basket as well as the changes in the demand for Libra. This monetary policy aims to offer a stable currency with low volatility.

By offering a global, digital and “stable” currency, Libra offers the unbanked population the possibility to transfer value (e.g. remittances) instantaneously and at minimal cost. Libra also provides a currency designed to facilitate exchange on multiple platforms, such as those of the founding members (listed in exhibit 2) and several others seeking to integrate with it.

To fully grasp the scope of the Libra project from a business perspective, it is essential to understand its value-add to the existing business of the founding members.

- First, it will create one of the largest ecosystems by leveraging networks of companies like Facebook, Uber, Vodafone and more giving its members access to a vast user base. As the network grows, value-added will also increase.

- Second, the underlying blockchain technology will provide additional metadata to the validators, i.e. the members of Libra association could find additional ways to monetize this information.

- Thirdly, the network will also pay out interest to Libra investment token holders. The details of how such cash flows will be split among token holders are not clear from publicly available documentation. However, there is some indication that the economic benefits of the network would be somewhat skewed in favour of early investors.

Impact on global payments and FX market

With its global reach, the Libra project is likely to impact both the global payment system and the FX market, two elements of our modern financial system in which central banks play a key role. Given Libra’s stated stance to offer low transaction fees, the most direct and visible consequence of the Libra project is for incumbent credit card companies, payments providers and gateways who may witness a drain in transaction flows towards the Libra network. This seems inevitable because of the sheer combined network effect that Libra is likely to create. A simple strategy for incumbents would be to integrate with the Libra project; however, this approach could potentially result in Libra becoming the price setter for global retail payments.

From a central banking point of view, Libra does not wait for a regulatory framework to exist; it is likely to define a framework going forward. At a high level, the emergence of a private global digital currency such as Libra essentially offers an easily accessible alternative to traditional money, just like bitcoin does within public digital currencies. By doing so, it exerts new disciplinary pressures on central banks. As central bank discipline creates trust, and trust is the reason money is broadly accepted, policy makers have essentially two possibilities: either they accept the situation as it is and thus restrict the use of some policy tools, or, they design regulation to provide them with more room to manoeuvre. As an example, a Negative Interest Rate Policy (NIRP) is a policy tool that exists only as long as there is no alternative. At full scale, Libra could potentially be this alternative threatening the freedom central banks currently enjoy.

Further, when viewed through an economist’s lens, the Libra Association acts similarly to a currency board, i.e. a monetary authority which is required to maintain a fixed exchange rate with a basket of foreign currencies. Libra could become a new type of fiat currency that is virtually accessible at any time and from anywhere. This may have two important effects on the FX market in our view – one on soft currencies and another on hard currencies.

Soft currencies have the reputation of trending lower and losing purchasing power. Often, the reasons behind their chronic devaluations are political uncertainty and economic mismanagement, as seen in the recent extreme case of the Venezuelan bolivar. To manage the depreciation, governments implement capital controls to limit citizens from selling the domestic currency against the hard currency, usually the US dollar. With Libra however, users will access an alternative to their local currency devoid of any capital controls. This could add further pressure on the domestic currency of an economically weak country and may have a destabilising effect on its monetary system and its government as well. The flipside to this is that Libra could provide citizens of such countries with a way out to preserve their wealth.

Hard currencies, on the other hand, are the currencies that have a good reputation for being well managed and liquid (e.g. the euro, the US dollar, the British pound, the Japanese yen and the Swiss franc). They are the most liquid currencies and are also the most likely candidates to populate the underlying currency basket of Libra. As Libra derives its value from multiple currencies, it will be prone to speculative trading in a scenario where a crisis hits one or more of the constituent currencies. Keep in mind that even hard currencies are subject to significant price movements. Within the past decade alone, the euro was materially threatened, the Swiss franc appreciated up to a point that the Swiss National Bank had to intervene, and more recently the British pound depreciated significantly in the wake of the Brexit vote.

The direct consequence of these sharp price movements would be a higher volatility of the Libra, contradicting its original purpose to maintain stable medium of exchange. This can make other stable coins (which are backed by a single fiat currency) and even individual fiat currencies look more attractive. This is because it is much easier to peg one currency to another as opposed to pegging versus a basket.

None of the documents provided by Libra Association have specified how the composition of the underlying assets will be decided and managed, leaving us with many unanswered questions. However, The Libra Reserve paper makes clear that “the association may occasionally change the composition of the basket in response to significant changes in market conditions (e.g., to respond to an economic crisis in one of the represented regions), but the goal will always be value preservation.”

For the sake of argument, imagine that you are a European citizen holding a diversified portfolio of hard currencies in addition to Libra. Further assume that the euro is part of the Libra basket and that a euro crisis resurfaces. What would you in this scenario do to protect your financial wealth? Would you buy Libra? Or would you buy Swiss franc, US dollar, gold or bitcoin? You may speculate that due to the significant changes in market conditions, the euro will see a drop in value and the Libra coin, may also suffer a price correction (since euro is a part of its underlying basket). You may find it easier to buy the Swiss franc, the US dollar or even the Japanese yen – all of which benefit from safe-haven features during crises. To go one step further, you may even find it safer to access non-fiat currencies such as gold and bitcoin. A rational decision in this situation would be to sell your euro and potentially your Libra for other alternatives. The consequence of this action would exacerbate downward pressure on euro and Libra.

The conclusion of this section is that the emergence of Libra could impact the functioning of the FX market and the global payment system. As a result, policy makers will design rules to maintain controls on these markets. As usual, there are risks and opportunities associated with any new financial technology and the question is how policy makers will balance the advantage a global, digital coin offers to end-users versus the macroeconomic risks it poses to the existing financial ecosystem.

Regulatory Headwinds

Regulators and central banks across the globe, have so far taken a negative stance towards the Libra coin. The vagueness of the whitepaper is clearly worrying regulators. We expect heightened regulatory scrutiny for Facebook and the Libra Association. It will be essential for Libra’s project management team to clearly state the methods through which they will comply with regulation, especially in those countries whose currencies will act as an underlying to the Libra coin. Exhibit 1 shows the key developments in various jurisdictions since the launch of the project.

Exhibit 1: Global govt. debt outstanding with negative yielding

| Countries | Regulatory Stance |

|---|---|

| US | House of Representatives recently wrote a letter to Facebook management asking them to halt development of the project until Congress and regulators have investigated possible risks; Senate hearing on 16th July |

| UK | Multiple regulatory bodies collaborating toward analysing the project |

| Russia | Will not allow Libra to be used as a medium of exchange for goods and services |

| Japan | No official stance taken yet |

| Switzerland | Regulators in contact with Facebook but declined to comment on the subject |

Source – Bloomberg

Project Overview

This section of the Digital Investor focusses on the Libra project setup and target operating model: i.e. the underlying blockchain protocol, a comparative analysis of the Libra network, the tokenomics, and its financial sustainability.

Libra Association published multiple documents explaining the network and its functioning. Below, we list some important takeaways that will help readers to understand the key features of the Libra and make comparisons it with other existing projects.

The Protocol

- Libra Association is a not-for-profit organisation registered in Switzerland. As of now, there are 28 founding members in Libra Association (Exhibit 2), which will increase to 100 members over time. These members will be responsible for governing and managing the Libra Reserve.

- Although marketed as a blockchain, the project does not store transactions in a block format but instead in a single data structure that records the history of transactions over time.

The network is currently not entirely decentralized as only entities approved by Libra Association (founding members that run a node) can verify transactions and govern the system. This will change over time as the Libra Network moves from a permissioned one to a permission-less one.

A new language called Move has been introduced to develop smart contracts on the Libra Network. While it is expected to be very user friendly, initial reviews do suggest that it loses out on flexibility when compared to Solidity (Ethereum’s development language).

- Facebook is expected to lead the project through 2019, although the final decision-making authority rests with the Libra Association.

Exhibit 2: Current Founding Members of Libra Association

Tokenomics

- There are two tokens issued on the network:

a. Libra Investment Token (LIT), which is issued to the initial investors in the Libra Network representing the voting rights of the nodes.

b. Libra Coin, which is the native currency that is designed to be a stable coin backed by a collection of low volatility assets, such as bank deposits and short-term government securities. - The network will have a flexible monetary policy, i.e. it will mint and burn coins only in response to demand for the currency in order to achieve a low volatility and preserve value.

- A geographically distributed network of custodians (selected by Libra Association) will hold the Libra Reserve, i.e. underlying assets.

- Libra coin holders will not be eligible to receive the interest generated on the underlying assets, but instead, the interest will be used to cover the cost of the system and pay out dividends to the initial investors, the holders of LIT, while supporting growth and adoption.

Comparative Analysis of the Libra network with other networks

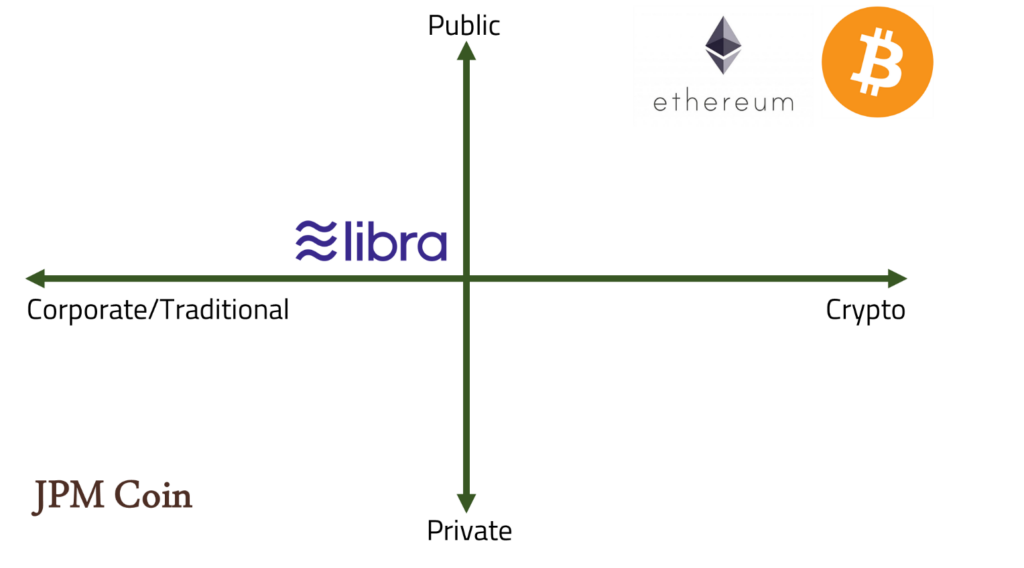

For a clearer visualization, we divide projects based on network type, i.e. private or public and organisation type, i.e. corporate or crypto. JPM Coin is an example of a traditional corporate organisation that operates in a private network as the participation in the network is fully controlled by JP Morgan. Whereas, Bitcoin and Ethereum are two examples of crypto based projects that operate in a permission-less public environment. Meanwhile, Libra Network takes a new approach for creating its ecosystem by starting as a permissioned public network with an intention to evolve into a permission-less public network. Exhibit 3 showcases the main differences between Libra and other major networks.

Exhibit 3: Libra Coin Vs. Other Networks

Libra Network certainly shares similarities with Ethereum, as it intends to offer its users the ability to develop applications on its platform. Looking at the current status we see Ethereum as the dominant Distributed Application (Dapp) platform with more than 2500 Dapps. In other words, Ethereum has a significant head start over Libra which is yet to launch. Nevertheless, the vast network of users that Libra brings can provide enough incentives for Dapps to move to this new network. We believe that over a longer timeframe Libra has the potential to compete with Ethereum.

Financial Sustainability

The financially viability of the Libra project stands on solid ground. A consortium of 28 entities has already joined the network as validator nodes to govern and increase adoption of Libra coins as a medium of exchange via their platforms.

Each member of the Libra Association contributes USD 10 mn to be a founding member and the number of founding members are expected to increase from 28 to 100, representing a USD 1 bn corpus. This reserve could grow substantially over time as more revenue is driven through the network. Over the medium term we expect the reserve to provide a stream of cash flows that could potentially cover the cost of running and sustaining the project. Taking the average policy rate of the five largest central banks as a simple proxy to estimate a conservative return on reserves (assuming an equal-weighted basket) results in an expected return of approx. 50 bps for the Libra Reserve (Exhibit 4). This figure is comparable to the expense ratio of very large exchange traded funds focussed on traditional asset classes.

Exhibit 4: Policy Rate of Major Economies

| Currencies | Policy rates in % p.a. |

|---|---|

| US (USD) | 2.50 |

| UK (GBP) | 0.75 |

| Euro (EUR) | 0 |

| Japan (JPY) | -0.10 |

| Switzerland (CHF) | -0.75 |

| Average Interest | 0.48 |

Source – Bloomberg

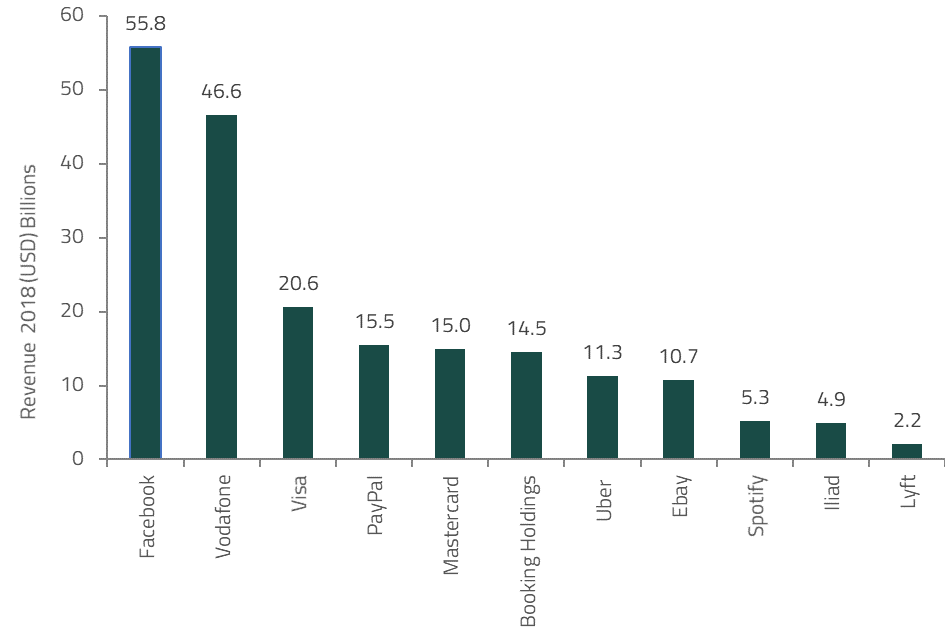

Any organic growth, which in our view will be an important component of total revenue generated by the network and also does not consider and any interest proceeds from a larger Libra Reserve. Exhibit 5 shows the 10 largest listed founding members by annual revenue, with a clear dominance of Facebook and Vodafone, that count for more than half of the total revenue (estimated at USD 200 bn).

Exhibit 5: Top 10 Libra Listed Founding Members by Annual Revenue

Our opinion

Based on available information, the Libra project demonstrates several positives and negatives. It has received much pushback from the crypto community for being centralised and the central banks of the world as they see it as a threat to their existing position. Public sentiment, as evidenced by news reports in general, also remains somewhat muted as concerns around data privacy in the aftermath of the recent Facebook scandal are yet to be fully addressed.

No one can deny that the project offers the ability to connect world finance in a more inclusive manner and at a scale never experienced before, but at this stage, many questions are unanswered. However, we believe that the Libra project will help popularize the use of blockchain based currencies. It is, in our view, a catalyst for mass adoption.

We do not see Libra as a competitor to bitcoin as we believe both the currencies are fundamentally different on multiple aspects. The Libra coin is designed as a medium of exchange to facilitate economic activity on the internet, while bitcoin showcases protocol design (similar to gold) that will make it a good store of value in the future. We believe both bitcoin and Libra will be working towards becoming a global unit of account.

The macroeconomic implications of this project are several. To facilitate the transfer of values globally, at virtually no cost, and with low volatility are some of Libra’s attractive features that will benefit people across the world. By providing such a new technology, incumbent financial infrastructure will be challenged – this includes existing global payment networks as well as the FX market. There is no doubt that a regulatory framework has to be put in place in order for the Libra project to mitigate the risk of creating economic and political instability at the global level.

1The Libra Association is an independent, not-for-profit membership organization, headquartered in Geneva, Switzerland. There are 28 founding members in Libra Association (Exhibit 2) ↵

2 Libra Network refers to the “blockchain” layer that Libra Association is currently building ↵

3Libra Investment Token are given to the founding members. These will earn them dividends from the interest earned by the Libra Reserve and allow them to vote. ↵

4Nodes refers to the 100 founding members who will be responsible for validating the transactions on the network. ↵