Executive Summary

- July 2022 has been the best performing month for Bitcoin and the overall crypto markets this year. Ethereum led the rally with 58% positive returns, followed by smart contract platforms Avalanche, Solana, and Polkadot, all of which outperformed Bitcoin

- Ethereum is in the final stages of its transition to proof of stake and continues to build momentum within the ecosystem. The last testnet will merge in August, followed by mainnet merge in September 2022

- On-chain activity for alternative platform blockchains is growing with Avalanche having the highest number of new addresses, Solana with the highest numbers of daily transaction count, and one of the Polkadot parachains, Acala doubled its TVL with the help of native stablecoin called AUSD

- Decentralised finance sector tokens from the AMINA coin universe have outperformed last month. Yearn Finance generated the most positive returns, followed by Aave, Uniswap, and Synthetix

Outlook

After the prolonged downward trend of cryptocurrency prices for almost all months this year, July 2022 has been the time of recovery for the crypto markets. The total market cap increased by 24%, and it is now once again more than USD 1 trillion. The upward rally was led by the smart contract platform, Ethereum (ETH), gaining 58% in one month, followed by Bitcoin (BTC) at 21%. All assets in the AMINA coin universe have generated a positive return in the last 30 days, with DeFi as a sector outperforming others.

The macroeconomic scenario remains uncertain given Covid-19 outbreaks and lockdowns in China, and the unstable geopolitical situation of war in Ukraine, which continue to result in higher-than-expected inflation worldwide, especially in the United States and major European economies. The forecast for growth has slowed down compared to the last year, given the high energy and food prices, reduced household purchasing power, tighter monetary policy, and disturbed supply chains worldwide. Policymakers are trying to control rising inflation that can potentially enable a positive outlook and growth soon.

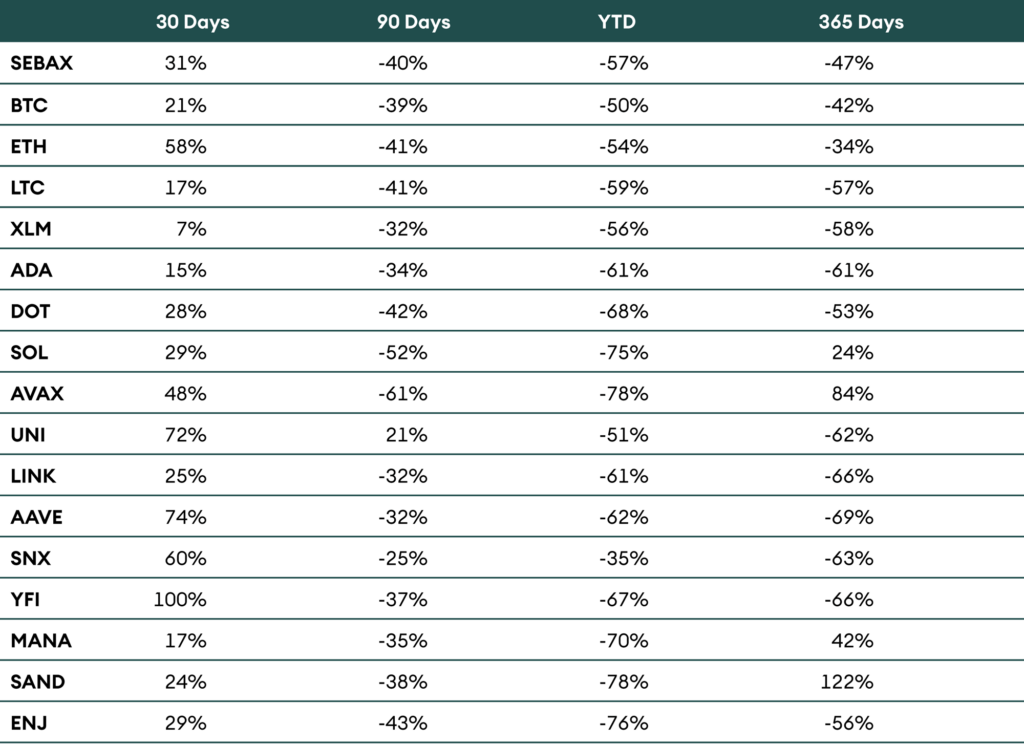

Table 1: Performance of AMINAX and AMINA universe coins as of 1 August 2022

The AMINAX® Index, a selection of blue-chip cryptocurrencies, has also recovered in the last month by 31%. During the same time, alternative smart contract platforms such as Avalanche (AVAX), Solana (SOL), and Polkadot (DOT) have recovered more than Bitcoin but less than DeFi tokens, Uniswap (UNI), Aave (AAVE), Synthetix (SNX), and Yearn Finance (YFI). It is essential to note the year-to-date (YTD) performance of all assets in the AMINA coin universe are still negative, with Synthetix losing the least by 35% and Avalanche losing the highest at 78%.

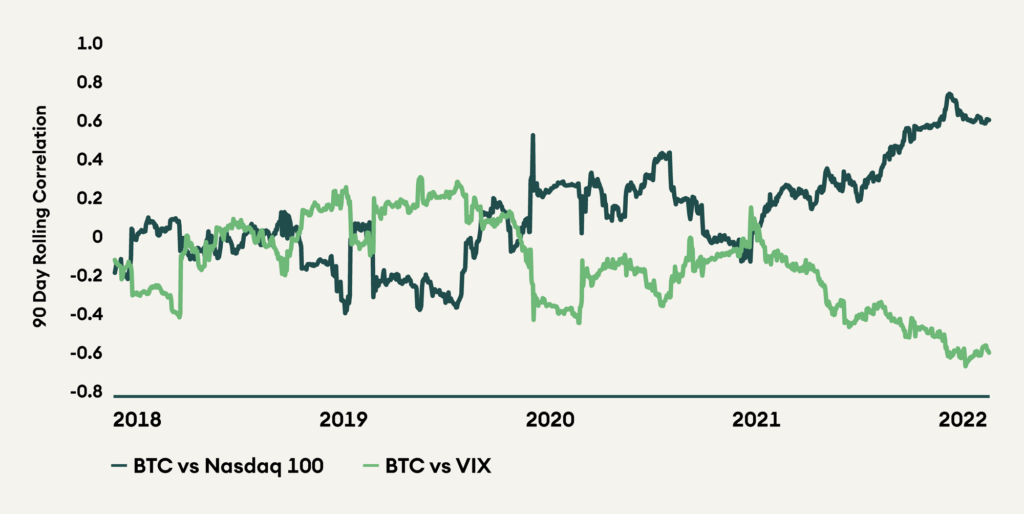

Figure 1: 90-Day Rolling Correlation of Bitcoin with NASDAQ and VIX

Cboe volatility Index (VIX), commonly referred to as the ‘fear gauge’ of the US (United States) stock market, shows the future 30 days of expected volatility in the market. It is low when the stocks are in the uptrend and would rise only when the fear in the market is growing. BTC still has a long way to go to be termed as an uncorrelated asset. The chart below shows that BTC has been increasingly correlated with Nasdaq and inversely correlated with VIX. This goes to show that Bitcoin does not perform well when the overall sentiment in the US stock market is risk-off, a far cry from a safe haven asset.

Bitcoin

After three consecutive months of negative returns for the apex digital asset – Bitcoin, July 2022 has been the best performing month of the year, with gains of 21%. Unlike previous positive performance months that were led by Bitcoin and followed by Ethereum and alternative cryptocurrencies, several smart contract blockchain assets and decentralised application tokens have performed better than Bitcoin in the last one month.

The price increase can primarily be attributed to the increased macro-optimism that caused an overall rally in risk-on assets like equities. Investors anticipate the slowing economic environment limiting the Fed from aggressively tightening the monetary policy, enabling positive momentum in the stock market, and thus cryptocurrencies, given the consistent correlation for more than a year.

The bitcoin mining difficulty has decreased for the past two months and is now 11% less than the all-time high made in May 2022. Bitcoin mining difficulty measures how difficult it is to mine a block or find a hash below a given target. It is adjusted every 2016 blocks, approximately two weeks, to maintain the average time of 10 minutes between each block.

Higher difficulty means more computing power is required to mine the same number of blocks, making the network more secure against attacks. It also means that the same mining hardware must run for a more extended period to find a block and thus consume more energy.

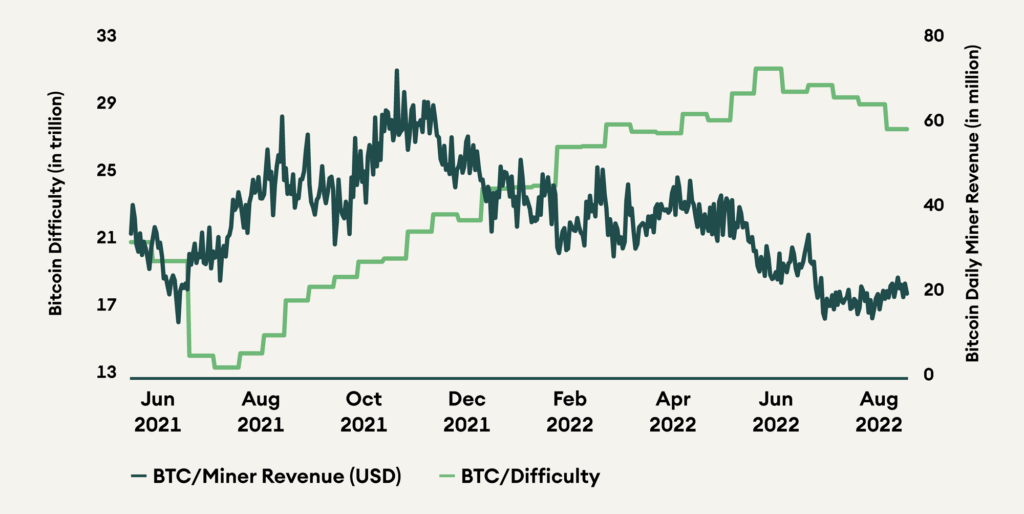

Figure 2: Bitcoin network mining difficulty and daily miner revenue in USD

The difficulty adjustment directly correlates with the estimated mining power required to run the network. The total hash rate was on a downtrend since the all-time high in June of 2022, given the falling price of bitcoin and the increased electricity cost, resulting in reduced miner revenues.

The downward trend of the total hash rate led to one of the most significant difficulty adjustments on the bitcoin blockchain in more than a year of 5%. This led to reduced energy consumption and coupled with the good price performance of the asset, 7-day average mining revenue saw a jump of more than 20% in the last two weeks, providing much-needed relief for struggling miners.

Ethereum

Ethereum has been building momentum in July towards its much-anticipated move to proof-of-stake after years of discussions and hard work. Ethereum has outperformed Bitcoin and other leading smart contract platforms in the AMINA coin universe with 58% returns in the last month. The Ethereum merge is in the final stages of testing, with only one more testnet, Goerli, to be executed by the second week of August 2022. After testing this last testnet merge, there will be a mainnet merge with a tentative timeline of September third week.

The co-founder of Ethereum, Vitalik Buterin, was at EthCC last month, where he laid out the long-term future of Ethereum. It is important to note that The Merge is a change of consensus mechanism from the current proof-of-work to the proof-of-stake, and it is not an expansion of the network capacity. For example, this upgrade will not have much effect on the transaction fees paid by the users as it is a function of blockspace demand and has nothing to do with the consensus algorithm. This is instead the beginning of ETH 2.0, and multiple solutions to pressing problems of high gas fees, transaction speed, and scalability are being addressed through rollups and other upgrades that are already happening in parallel.

The preparation for this transition started several years ago, and one of the most significant changes that is already implemented was about new ways to set gas prices that are intended to help users avoid overpaying for their transactions and quickly include low-cost transactions. During the first week of August 2021, about one year ago, Ethereum Improvement Proposal (EIP) EIP-1559 was activated via the London hard fork.

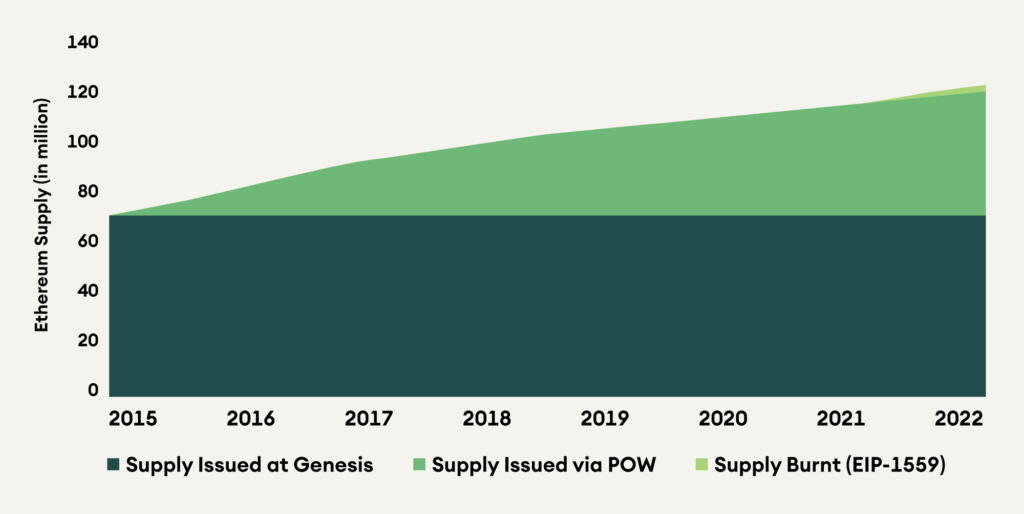

As per this upgrade, users paid the price per unit of gas which is at least as high as the current protocol-determined base fee, which is burned, in addition to the priority fee, which is paid to miners for timely inclusion of transactions in a block. This limits Ethereum as only an inflationary asset as now it is subject to deflationary bursts in proportion to excess fees burnt. Since the implementation of EIP-1559, more than 2.5 million ETH have been burnt. The following chart shows the issuance of Ethereum supply over time, along with recent changes.

Figure 3: Ethereum supply issuance over time

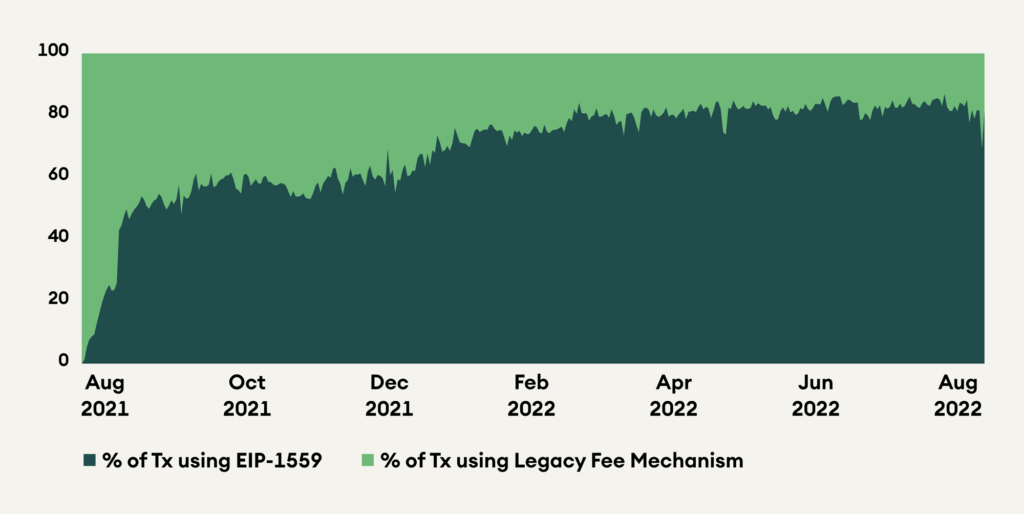

Ethereum proof-of-work mining will become absolute after The Merge is executed. Ethereum miner revenue on an annual basis has been higher than Bitcoin in the year 2021, which is still the case this year. But soon, the miners will be replaced by staking validators, which will drop the mining revenue from double-digit USD billion to extremely low numbers or zero. The following chart shows the increasing share of the new fee mechanism of the network.

Figure 4: Ethereum transaction type adoption after the implementation of EIP-1559

Alternative Blockchains

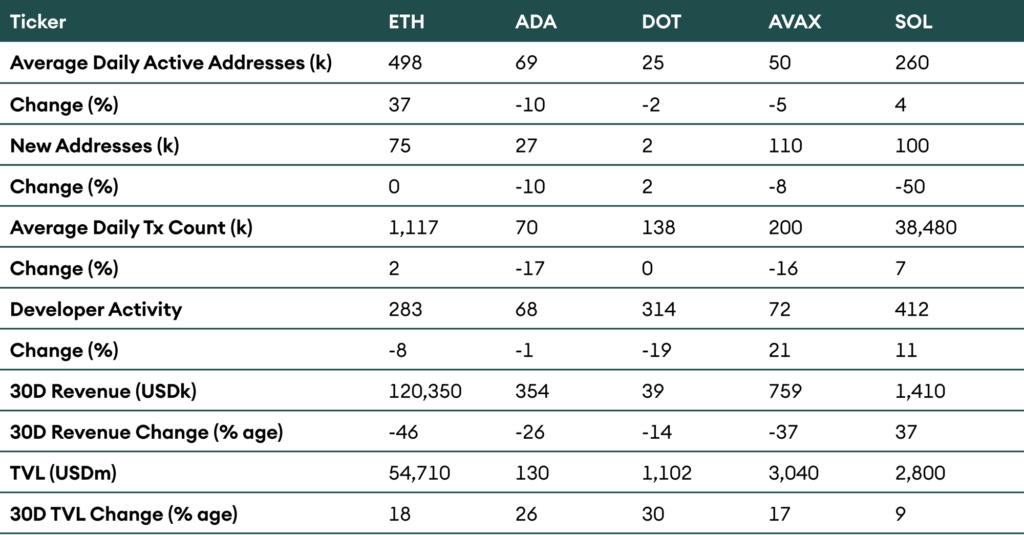

Among the alternative platform blockchains, Avalanche (AVAX) has outperformed in the last month with 48% returns, followed by Solana (SOL) at 29% and Polkadot (DOT) at 28%. Layer 1 blockchain ecosystem is a highly competitive space. Blockchains like Avalanche, Polkadot, Solana, Tezos, Near, and others are competing for developers, users, innovative new apps, partnerships, and even funds in some cases. One way to compare these ecosystems is to compare their current usage.

Daily active addresses are the number of addresses that have transacted on a blockchain at least once a day irrespective of the on-chain activity, whether it was sending funds, buying NFTs (Non-Fungible Tokens), or trying new Dapps. Among smart contract chains, Ethereum has the highest number of daily active addresses at 500K, followed by Solana at 260K.

An increasing number of new addresses on a blockchain is indicative of interest generation among new users. Avalanche had the highest number of new addresses at 110K in July alone. This can be attributed to quick finality, low transaction fees, and fast throughput on Avalanche. Moreover, the launch of Crabada on the Swimmer Network of Avalanche has opened doors for on-chain gaming apps that can be deployed on Avalanche easily.

Solana fares the highest in daily transaction count, with 38 million transactions processed on average every day. Ethereum falls behind at 1.1 million transactions processed a day. It is also worth noting that although Ethereum processes only 2.5% of the number of transactions on Solana, Ethereum miners earn almost 85 times more than Solana validators. Ethereum miners’ profitability is expected to decrease once Ethereum moves to PoS (Proof of Stake), and miner/validator rewards are reduced by 90%.

Table 2: On-chain activity of leading smart contract blockchains

A perfect blockchain has users’ and miners’/validators’ interests perfectly aligned. Blockchain revenue fuels validator interests and incentivizes innovation through public goods funding and the onboarding of talented developers. In July, Solana and Ethereum had the highest number of developer commits. Albeit this metric is only quantitative and not qualitative in nature.

Acala, the DeFi hub parachain on Polkadot, has increased its TVL by almost 2x owing to the native stablecoin AUSD on Polkadot. The launch of XCM (cross-chain messaging) has also aided in interoperability with Polkadot parachains.

Decentralised Finance (DeFi)

The decentralised finance (DeFi) sector has outperformed layer one blockchain protocols in terms of one-month price performance. It was led by Yearn Finance (YFI), which is up 100% in the last 30 days in anticipation of their V3 launch within the next two months that will have improved tokenomics and optimised yield generating strategies. This is followed by lending and borrowing protocol, Aave (AAVE) generating 74% returns, the most prominent decentralised exchange, Uniswap (UNI) generating 72%, and Synthetix (SNX) making 60% for the month.

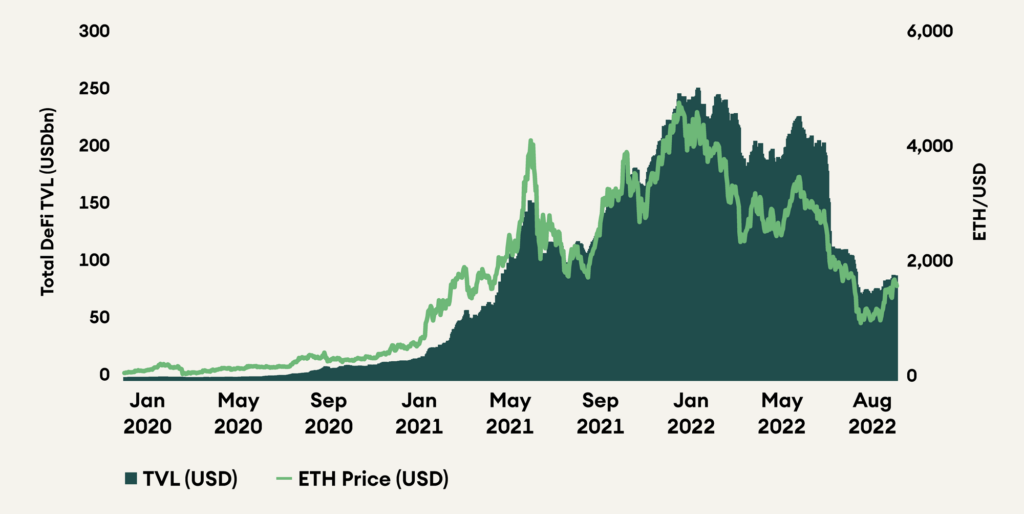

The increase in prices of DeFi tokens and Ethereum, the most extensive DApps ecosystem, can be seen in the total value locked (TVL) chart below. The TVL that consists of all decentralised applications across multiple blockchains was more than USD 250 billion in November 2021, and it had fallen to a low of USD 69 billion in June 2022. It has since recovered and is now closing in at USD 90 billion.

Figure 5: Total value locked (TVL) across decentralised applications on multiple blockchains

The on-chain activity for DeFi tokens has been positive on monthly basis in terms of daily active addresses and new addresses for all assets in the AMINA universe. The daily count of transactions has been up for Uniswap and Aave over the last month, but Aave token saw negative growth in transaction size measured in US dollars.

Aave recently proposed to issue an algorithmic stablecoin called GHO that can be minted against the collateral provided on the Aave protocol. Chainlink (LINK) continues to partner with nodes, data providers, and different blockchains to enable interoperability and thus enhance demand for LINK token. Uniswap has received yet another proposal to turn on fees for UNI holders, which has received early support but has a long way to go. Synthetix DAO (Decentralised Autonomous Organisation) has announced a renewed partnership with Jump Crypto that will provide liquidity for SNX to be a backbone for on-chain derivatives.

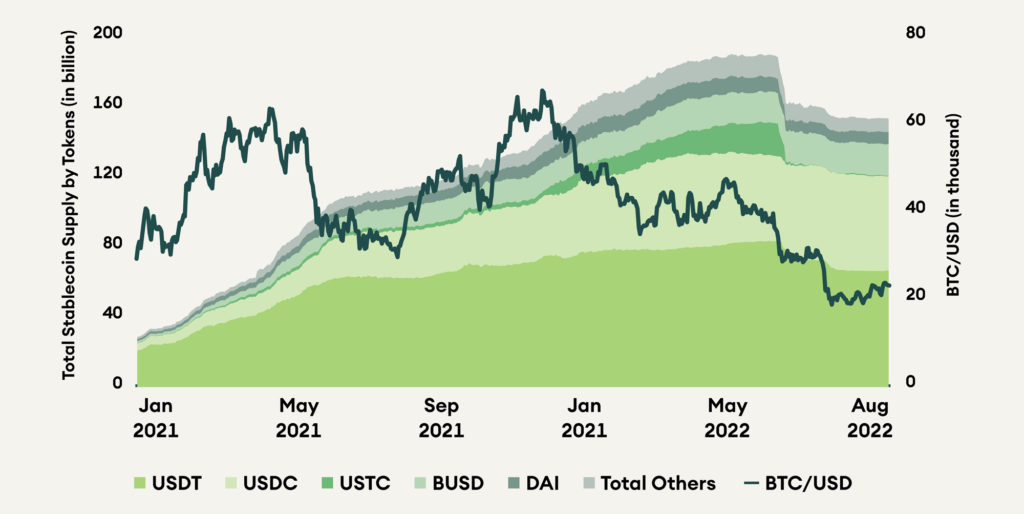

Figure 6: Stablecoin supply of multiple tokens on different blockchains

Stablecoins gained immense popularity in the last two years as DeFi summer began in 2020. Stablecoins are essential for adoption of DeFi and provide a base for swap or interaction between different coins. 2020 saw an influx of experimentation in the form of algorithemic stablecoins but that experiment failed to a wider market contagion. Investor confidence was shaken and trust in centralised audited stablecoins was reinforced. As a result, the leading stablecoin USDT circulating supply has been reduced by almost 20%, and USDC has gained 10%. The total supply of stablecoins in the market continued to increase, although bitcoin and other crypto asset prices have decreased since November 2021. It is only after the fall of Terra Luna; that the overall supply has been reduced.

Conclusion

The much-needed recovery in the crypto market was seen in the month of July 2022. It has been the best performing month for Bitcoin since October 2021, and Ethereum has led the rally with alternative platform blockchains also generating higher returns than bitcoin in the last 1 month. Decentralised Finance (DeFi) sector has outperformed layer one blockchains based on double-digit growth in key on-chain activity indicators as well as positive news around the development of these projects.

Ethereum is now in the final stages of The Merge with the last testnet upgrade to PoS in August, followed by the mainnet merge in September 2022. A continued momentum can bring more users to decentralised applications and increase user activity across blockchains.

The macro uncertainties of the Covid-19 outbreak and lockdowns in China, unsettling war in Ukraine, and rising inflation numbers for the US and European countries still dominate the market sentiment. However, the overall market rally has provided some relief for investors, which can potentially convert into a growth outlook in the near term. The market expects the Fed not to be as hawkish if inflation numbers come down, considering GDP is negative for the second quarter of the US. So, if the inflation has peaked, it would be bullish for the market, something to keep track of.