Executive Summary

- Risk-on sentiment has pushed the cryptocurrency market cap above USD 1 trillion for the first time since the November 2022 FTX collapse

- BTC sentiment indicator Fear and Greed Index recently turned to ‘Greed.’ This means token holders are in profit

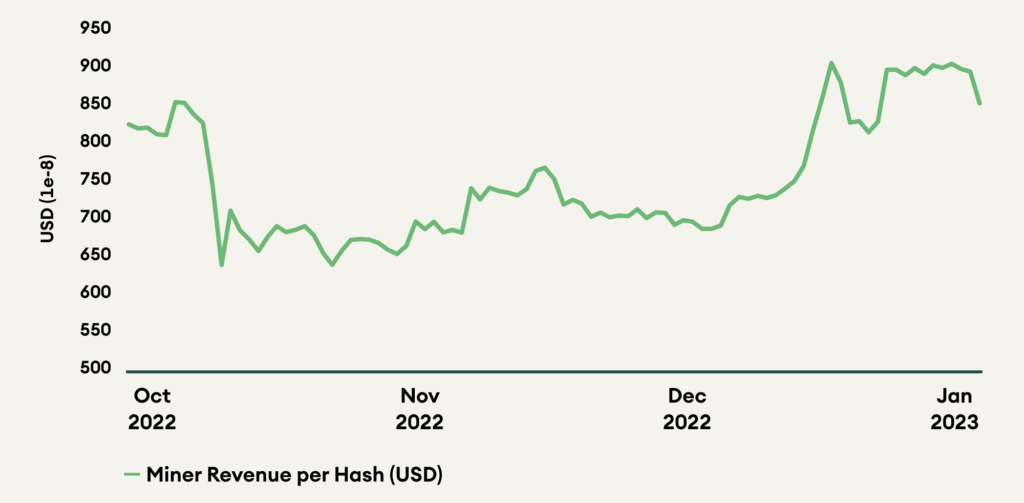

- Bitcoins hash rate is at an all-time high, while miner revenues have increased by 50%

- Ethereum shanghai upgrade that unlocks the staked Ethereum in Beacon chain worth 26 billion dollars is on the horizon. This unlock will be via a waiting queue, and all Ether will not be unlocked at once

- Cardano recently launched EVM sidechain toolkit on its testnet and will soon launch on the mainnet

- Polkadot launched its cross-chain communication V3. Web3 foundation recently reiterated that Polkadot is a software and not a security. We suspect regulation may be around the corner

- Aave recently launched V3 on Ethereum. The community waits in anticipation for the

launch of its stablecoin that might share real yield with Aave stakers - Ava Labs, the company behind the development of Avalanche, has partnered with AWS to promote blockchain adoption and Shopify to facilitate NFT trades on the network

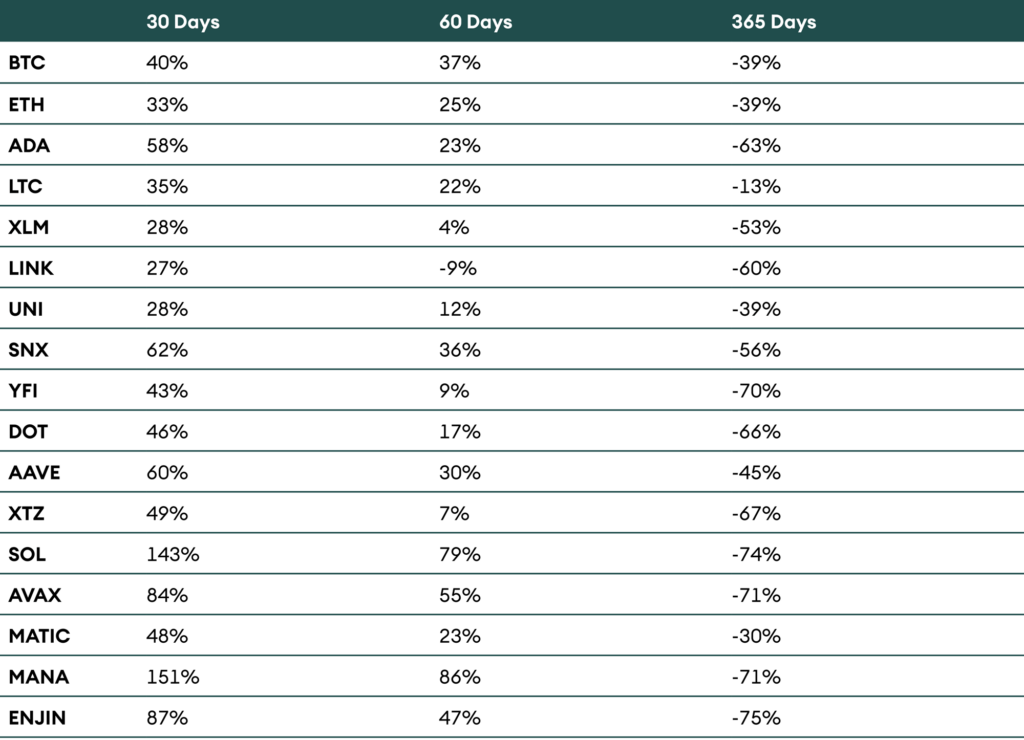

Coin Performance

Table 1: Coin Performance

The beginning of 2023 has been positive for risk assets, including stocks and cryptocurrencies. This is due to a convergence of factors, such as decelerating inflation and oversold conditions in these markets. Additionally, many investors had taken short positions in these assets, leading to a short squeeze that further fueled the upward momentum.

In the realm of cryptocurrencies, the best performers since the beginning of the year have been Decentraland (MANA), Solana (SOL), and Enjin (ENJ). This trend is particularly noteworthy because it demonstrates that the recent rally in the crypto market has gone beyond just Bitcoin and has encompassed a wider range of digital assets.

One possible explanation for this surge in cryptocurrency prices is the anticipation surrounding the upcoming meeting of the Federal Reserve. Traders may be cautiously waiting on the sidelines, hoping to see which way the winds will blow after the meeting. The expected minutes from the Federal Open Market Committee (FOMC) could provide a boost to the market, but any surprises could potentially cause it to give up its recent gains.

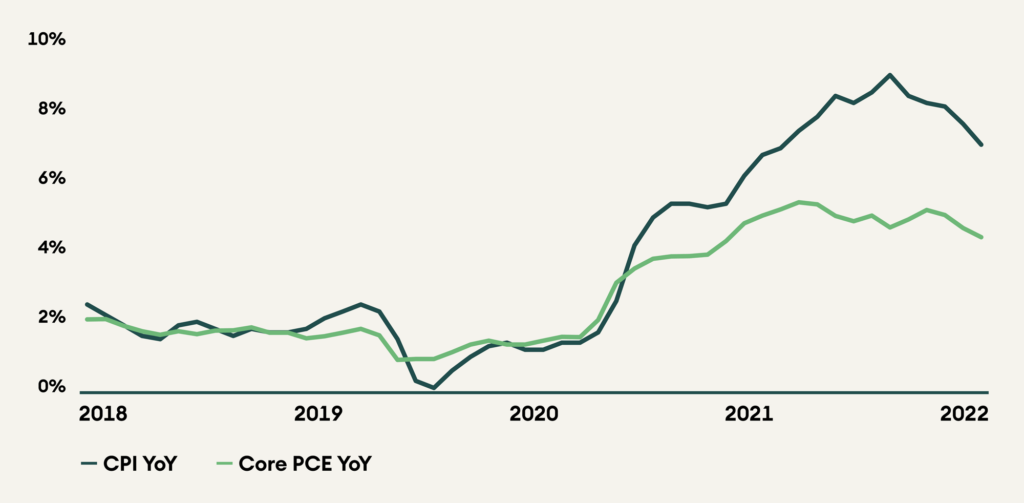

Macro

The cryptocurrency market capitalization has risen by over 25% this year, growing from USD 800 billion to USD 1.04 trillion. This upward trend can be attributed to several macroeconomic factors, including slowing inflation and a weakening dollar, as well as a slow decline in liquidity conditions. Our analysis concludes that bitcoin was in an oversold territory and the macro incentives led to a short squeeze, which further led to the recent price rise.

Looking into the details, the December Conumer Price Index (CPI) data, which was published on 12 January 2023, indicates a disinflationary trend. Year-over-year CPI slowed from 7.1% to 6.5%. This deceleration is mainly due to the broader energy category, which saw a 4.5% seasonally adjusted drop from the prior month. Furthermore, the stabilization of the unemployment rate combined with a softening of inflation, comfort investors’ view that the Fed may be close to the end of this hiking cycle. Notice that China’s bandonment of the zero-covid policy early last month also helped spur economic growth in 2023 and beyond.

Fig 1: US Inflation Data

The Consumer Price Index (CPI) fell 0.1% from the previous month and reached its lowest level since October 2021, despite still being near a multi-decade high. The core measure of CPI and PCE inflation, excluding volatile food and energy prices, is considered a more accurate indicator of inflation’s trajectory. This measure also decreased by 0.3% from the previous month, at an annual pace of 4.4%. Many believe that the peak of inflation is behind, and the Federal Reserve has effectively controlled it.

However, the main risk to our scenario is a severe economic downturn or a higher for longer inflation. With the Federal Open Market Committee (FOMC) meeting notes released on 1 February 2023, the market is pricing in a nearly 100% probability rate hike in February and an 89% chance of another 25 basis points in March.

Bitcoin

For the first time since last year, the BTC Fear and Greed Index’ turned to Greed’ in January 2023, as reflected by the price rally that reached the tips of USD 23k. This is due to the coping mechanism to deal with the current inflationary crisis, which may further aid the rally.

Bitcoins mean difficulty is at an all-time high, with miner revenue jumping approximately 50% in the last three months and the hash rate reaching an all-time high of 300 exahashes/second in January 2023, representing the strength of Bitcoins security as more computational power is

required to solve the hashes.

According to Goldman Sachs, BTC is the best-performing asset class this year with a Sharpe ratio of 3:1, better than all other asset classes covered in their report on 23 January. (refer to the link here).

Fig 3: Miner Revenue per Hash (USD)

Ethereum

Ethereum, the second largest cryptocurrency by market capitalization, has demonstrated its strength during the recent crypto crisis. Significant developments have taken place in the ecosystem, with the Shanghai Upgrade being the latest and most important one at the moment.

Implementation is expected in March 2023 and is a top priority according to the majority of developers according to All Core Developers Execution (ACDE) call and ACD meeting. Proposals range from basic changes, such as adjusting the unit of account in the execution layer to match the consensus layer for withdrawal harmonization, to delaying important proposals such as the Ethereum Object Format (EOF) implementation for faster execution of the Shanghai Upgrade.

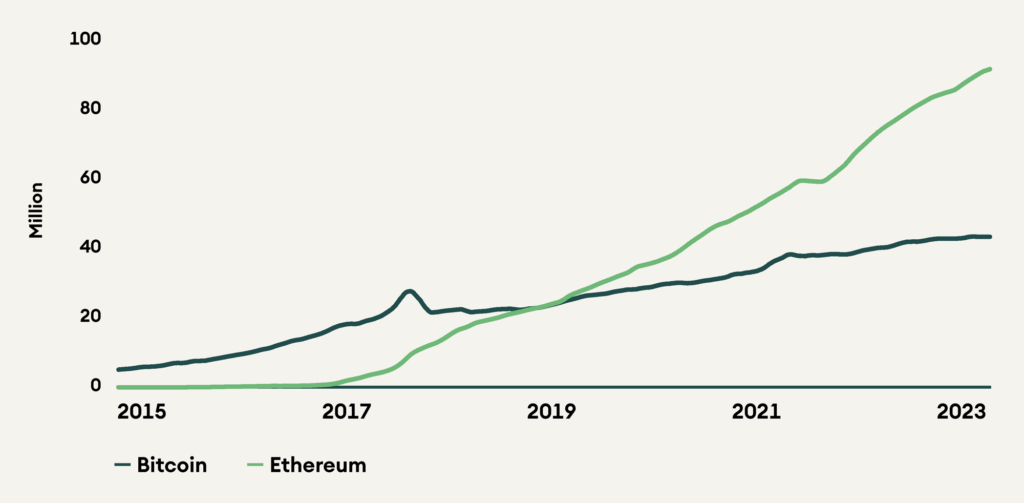

As of writing, Ethereum is on track to reach another milestone of having 100 million addresses with a non-zero balance, currently standing at approximately 92 million. In comparison, Bitcoin has over 43 million total addresses on its network.

Fig 4: Total Addresses with non-zero balance.

Litecoin

Litecoin recently surpassed Ethereum in total addresses, indicating an accelerating adoption rate. Although the price has been increasing consistently and outperforming various other cryptocurrencies in the market, the price action shows inconsistency.

After the recent and long-pending MimbleWimble upgrade, Litecoin has shown promising adoption. The higher number of addresses may be associated with the upgrade. However, due to this privacy-preserving upgrade, LTC was delisted from the two largest Korean exchanges in the past six months.

According to Bitpay, Litecoin is the second-highest payment medium after Bitcoin, capturing roughly 27% of the payments. It is the most prominent in North America, followed by EMEA. Sentiments may be bullish for the currency, as seen in the past during the time of halving, which is expected to happen in August 2023.

Stellar Lumens

Banks such as Tascombank in Ukraine and ABN Amro in the Netherlands have selected Stellar as the platform for their Central Bank Digital Currency (CBDCs). Despite this, there are several drawbacks to consider, including decreasing developer activity and on-chain transactions, and a bearish outlook according to technical analysis. Furthermore, Coinbases self-custody wallet has discontinued support for Stellar, Ripple, Ethereum Classic, and Bitcoin Cash due to low demand.

Cardano

The EVM Sidechain toolkit has recently been launched on Cardano testnet and is set to be launched on the mainnet on 14 February. This launch will improve interoperability as sidechains will be able to build Dapps using Cardanos security and decentralisation. The team said that this would be ideal for building blockchains for specific use cases.

Additionally, the upgrade from Elliptic Curve Digital Signature Algorithm (ECDSA) and Schnorr signatures will facilitate further cross-chain applications using its smart contract language Plutus. This will make it more convenient for Cardano developers to work with other blockchain networks. The other major development within the Cardano ecosystem is the upcoming launch of the Djed stablecoin. The stablecoin and its governance token Shen will soon be listed on Cardano-based DEXs after their issuance next week. The stablecoin has been jointly developed by IOG and Coti (another layer one blockchain).

Polkadot

Polkadots cross chain messaging (XCM) version 3 has been merged after 15 months of development, bringing new features like bridges, cross-chain locking, exchanges, NFTs, conditionals, and context-tracking. Web3 foundation, company behind development on Polkadot, is promoting new wallets with improved user experience (UX) and has announced the

transformation of the native token ‘DOT’ from a security to a software. This is in conjunction with U. S. Securities and Exchange Commission (SEC) guidelines. Read more here. The foundation has also released an in-depth blogin-depth blog about Decentralized Finance (DeFi), showcasing

the successful parachain auction winners.

Tezos

After the LIMA upgrade, Tezos is planning for the 13th upgrade, which is expected to go live in H1 2023. The upgrade will introduce three significant enhancements to the ecosystem, Smart rollup activation, Validity rollups on testnet and a reduction in block time to 15-30 seconds.

However, Tezos is seeing a consistent decrease in active developers for the last six months, and code commits, i.e., commits to the public GitHub repositories, have also declined since last october’22.

Solana

Solana has made significant progress in addressing its outage narrative, achieving 99% uptime since April 2022. Gaming and Decentralised Finance (GameFi), supported by funding from Solana Ventures and Magic Ventures, is bringing development to the ecosystem. Solana is also poised to roll out support for Move language developers. DeFi markets, including Solend and Mango Markets, need to be rebuilt after suffering from the USD 6.5 million bad debt resulting from a whale liquidation. With most of its competition rising back up post the FTX collapse and the bear market, Solana will need to step up their game if they are to attract liquidity into their ecosystem anytime soon.

Avalanche

Avalanche has been one of the best performing layer one blockchains year to date. This has mostly been due to developments on its business side through partnerships. Ava Labs and Amazon Web Services have partnered to increase enterprise, institutional, and government adoption of blockchain. Avalanche has also partnered with Shopify to enable NFT creation and sales on the network. However, there have been decreases in transactions and daily active developers on the network.

Polygon

Polygon made significant partnerships with Nike, Meta, and Warner Music last year and made progress on scaling solutions, including the zero knowledge technology based Ethereum Virtual Machine (zkEVM). The Polygon ecosystem is seeing rising adoption, and this is reflecting in the MATIC token price. The zkEVM testnet for Polygon has already produced 80,000 block proofs and is set for mainnet deployment in less than 3 months. The Polygon zkEVM is proving costs are low, at USD 0.0019 for a Uniswap trade. This puts Polygon in the prime position for the upcoming and significant layer two war on Ethereum.

Aave

On the ecosystem development side, Aave Grants DAO (Decentralized Autonomous Organisation) has received an additional USD 3.25 million from the ecosystems reserve fund to be used for funding projects that will benefit AAVE in the next two quarters. Usage of the Dapp on Optimism can also be expected to increase in the coming months now that the OP token has been added as a collateral asset on the rollup. Aave’s current development efforts are directed towards two key products – the Lens protocol and its GHO stablecoin. The Lens protocol has launched token-gated publications, a feature that is expected to bring new benefits to users. Aave has also acquired Sonar, a voice and text platform, to integrate with the Lens ecosystem. Aave V3 claims to do a better job at protecting Aave from attacks like the one made by Avi Eisenberg (the Mango Markets hacker) which left Aave with bad debt in CRV that amounted to USD 3.1 million. Now that, Aave V3 has been launched on Ethereum, it is to be seen if this claim holds up. While the exact details concerning the launch of the GHO stablecoin have not been disclosed, Aave founder Stani Kuchelov in a recent interview said that the market can anticipate it in a few weeks once V3 is launched on Ethereum

Uniswap

Earlier this month, Uniswap and Circle came out with a research paper that said that DeFi and blockchain technology could reduce cross-border remittance costs by about USD 30 billion per year. According to the paper, on-chain foreign exchange can offer faster and more affordable transactions with greater liquidity and stability. Uniswap has been working to make it easier for institutions and individuals to enter DeFi. In fact, it recently announced on-ramp support through MoonPay. This would reduce the friction for users to participate in defi through the leading blue- chip DEX. However, with the myriad of hacks and attacks that happen in crypto, this will not be an easy transition. Just a few weeks ago, a vulnerability was flagged which would have allowed reentrancy attacks to happen on Uniswap. Being a major player in DeFi, such flaws in code might prove to be a serious threat to their credibility and if they continue to prop up, may in fact dissuade further adoption of DeFi.

Synthetix

Synthetix has recently launched Synthetix Perps V2, reducing fees to a level competitive with centralized perp platforms (5-10 bps) and allowing users to trade through Kwenta and Decentrex. Feedback on V3 minor code changes is expected in the coming week. However, there has been a drop in development activity (-10%) and code commits (-29.7%) which may impact the platforms progress.

Yearn Finance

The big announcement from Yearn for the month of January was its feature called the Permissionless Vault Factory. In this, users of Yearn are no longer limited to the vault strategies built by app contributors and developers. Anyone can now develop their own strategies and deploy the vault on Yearn where other interested users can deposit their tokens and earn yields On these permissionless vault deposits, Yearn charges 10% as performance fee. In the long run, this would increase Yearn’s user base and attract more liquidity. Also recently, Maker DAO voted to deploy USD 100 million in USDC from its treasury onto Yearn Finance. This will soon be executed and Maker is expected to earn a 2% yield on its stablecoin deposits. On the community side, Yearn has taken steps to build trust among its users, such as educating them on the risks of their vault strategy through case studies. Additionally, Yearn has been supported by Ledger, allowing users to interact with the platform directly through their hardware wallets. However, the one hurdle for users of Yearn is the friction associated with finding vault fees, as they are currently not easily accessible through the main website user interface. There is a proposal to improve this, however.

Chainlink

Chainlink has secured dominant chains including Ethereum, Solana, Avalanche, Polygon, and BNB chain, with 26 integrations added across its different services this month alone. The platform is the leading decentralised data oracle, with close to 60% dominance in the market. Additionally, Chainlink plans to introduce fee distribution to LINK stakers in 2023. However, there is a negative aspect to consider, as subsequent staking rounds will increase sell pressure due to token inflation.

Decentraland

The metaverse coins saw rallies and have been one of the biggest narratives entering the new year. The 2023 manifesto of the platform is specific to the platform and creators. The platform has entered the alpha phase of SDK7 (Software Development Kit), providing a wider variety of options under development. However, there is a high dependence on business development and partnerships, and a need for a quicker transition towards platform development use cases for the Dapp.

The Sandbox

The Sandbox saw significant progress in 2022 with the launch of Alpha Season 3 in August, which resulted in 17 million visits and saw over 360,000 users participate in various brand experiences, some of which had over 500,000 visits. A recent highlight for the company was the land raffle in November, which saw 14 brands and celebrities participate. Looking ahead to 2023, it will be interesting to see how The Sandbox continues to engage and attract users to its platform.

Enjin

Enjin saw an uncommon price rally in the month of January. This can be associated with recent simultaneous developments on the Enjin platform. According to the latest bi-weekly developer update, there have been some developments on NFT marketplace, Wallet, and on Enjin Tooling.

The developments are mostly related to the user experience tangent. On the tooling side, simple but required development updates are seen, such as cross-game collaboration of tokens.

Conclusion

The recent surge in cryptocurrency marketcap has surpassed multiple barriers in a short period. This upward movement can be linked to various economic elements such as slowing inflation, a declining dollar and a general risk on sentiment in the market. Our experts believe that bitcoin was undervalued, and the combination of economic factors triggered a significant short squeeze, resulting in the recent price increase. Ultimately, bitcoins growth is closely connected to central bank monetary policies and the overall global economy, especially the rise in monetary degradation and heightened liquidity. In summary, although the present cryptocurrency boom is influenced by macroeconomic variables and increasing worldwide liquidity, it is crucial to keep an eye on regulations and proceed with caution in the near future. We anticipate getting a clearer perspective on the dollars direction after future Federal Reserve meetings which will shed light on market liquidity conditions.