Executive Summary

- Macro headwinds dominate cryptocurrencies as central banks tighten monetary conditions

- Bitcoin is closely correlated with USD liquidity. As the Fed started quantitative tightening on 1 September, pressure on cryptocurrencies is likely to remain

- The Ethereum Merge is set to take place mid-September. It is a watershed event with positive medium to long term implications for the Ethereum ecosystem

- Innovation and technical improvements are happening on almost all smart contract blockchains as they gear for the next bull run

- Decentralised Finance has performed better than BTC in the last 90 days. Last summer was an altcoin Season. We expect a reversal as monetary conditions become more restrictive

Outlook

August started on a strong foot, with Bitcoin (BTC) rallying from USD 20,800 to USD 25,000, a 20% increase. In the month’s second half, Bitcoin’s price reversed its course to below USD 20,000, mimicking equity markets. The hawkish stance of Jerome Powel, President of the Fed, at the Jackson Hole Symposium in late August dashed investors’ hope that the Fed would pivot.

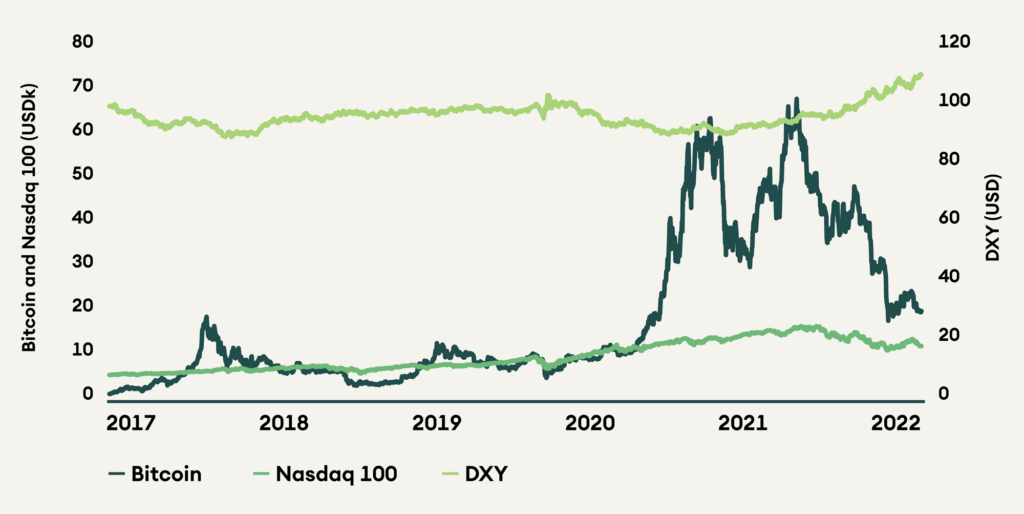

The correlation between BTC and the Nasdaq 100 (a tech-heavy index) retracted to yearly low levels of 0.5-0.6. Most major cryptocurrencies by market cap followed BTC. Market outperformers for the month include Yearn Finance, up by 23%.

Last month’s crypto market talk was dominated by “The Merge”, the Ethereum blockchain transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanism planned for mid-September. While this narrative has supported ether (ETH) price earlier, investors took profit in advance of the event.

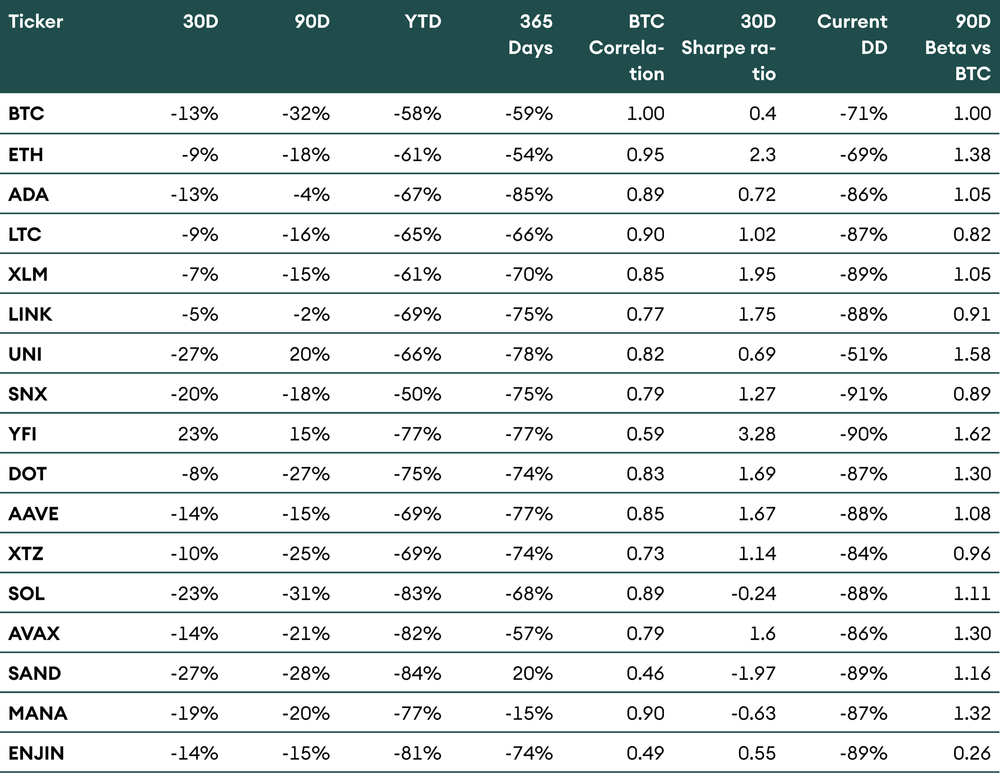

Table 1: Performance of AMINA Bank universe coins as of 1 September 2022

Macroeconomics

The economic landscape has deteriorated continuously since the beginning of the year. Inflation, war, supply bottlenecks, rising interest rates, and quantitative tightening have compounded and created the challenging market environment we face today.

Investors expected the Fed to pivot, but this is not the bottom line of Jerome Powel Jackson Hole’s speech. Interest rates are set to increase further, and the Fed balance sheet will shrink by USD 95 billion a month starting on 1 September.

The US labour market remains tight, and wages are increasing at double-digit rates. This is the reason inflation started to accelerate even before energy prices went through the roof.

For about a year, cryptocurrencies have responded to economic data the same way as risky assets. They have reacted inversely to global monetary conditions, i.e. to the dollar, to interest rates and to the declining quantity of money.

Cryptocurrency value drivers are different from all other asset classes, but they have not yet decorrelated, a sign this asset class is still in its infancy.

Against this background, we keep a cautious stance on cryptocurrencies in general. We prefer the blue-chip BTC and ETH over the other coins of our universe.

Figure 1: Price performance of Bitcoin, Nasdaq 100 and DXY

Bitcoin

The macro-environment heavily weighs on Bitcoin price. High inflation data has led to a hawkish Fed since November 2021. Higher interest rates pull down all asset classes, including Bitcoin.

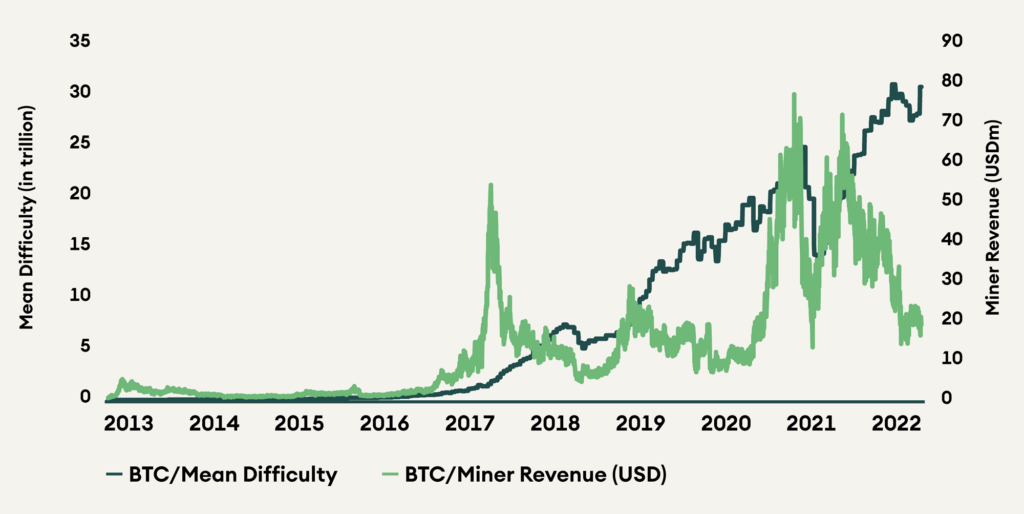

Notwithstanding the increased energy cost, it is a difficult period for BTC miners as the revenue per hash has declined. A recent report showed that miner holdings have declined by 27% since April 2022, adding additional selling pressure on Bitcoin. Miners have been forced to sell BTC to cover their running costs.

Hash rate measures the computing power in the network. The Higher the hash rate, the more secure the network is.

BTC hash rate declined in July but increased again to reach a level similar to May. The recovery in the hash rate is a strong signal that the miners continue to do their job even though the profitability of their activity has dropped. It confirms that the Bitcoin network is solid and secure.

Figure 2: Bitcoin network mining difficulty and daily miner revenue in USD

Ethereum

The Ethereum Foundation has confirmed the date for the long-awaited Merge upgrade between 14-15 September 2022. At the time of the Merge, the network will migrate to PoS from the current PoW network.

The Merge is the result of the hard labour of Ethereum core developers. After about six years of preparation, this moment finally takes place.

Notice that the transition to PoS was in the original Ethereum Roadmap. According to Vitalik Buterin, one of the Ethereum founders, Ethereum will be 55% complete after the Merge.

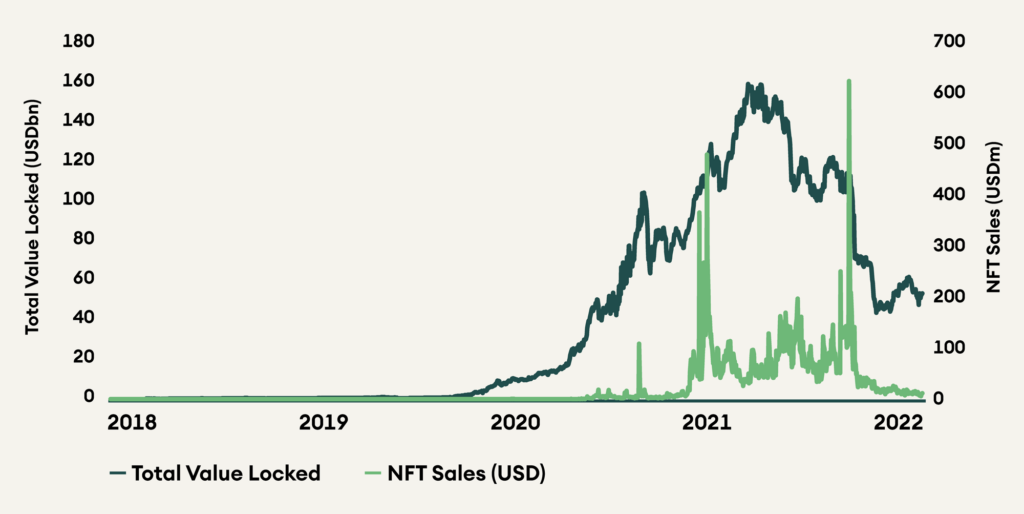

Technically, The Merge is the only fundamental growth factor for Ether (ETH) today as the two driving revenue markets- DeFi and NFTs are stalemates. Ethereum remains central in DeFi despite losing USD 2.9 billion in Total Value Locked or TVL ahead of the Merge. The NFT volumes have also plunged from the highs of USD 1.1 billion in April to USD 100 million in August.

Figure 3: Total Value Locked and NFT Sales Volume on Ethereum

In its current PoW form, the Ethereum ecosystem suffered from low throughput. This led to alternative blockchains like Polygon, Avalanche, Solana, and Binance Smart Chain, offering a faster and cheaper environment to develop DeFi applications.

While several projects have failed due to a lack of infrastructure that prevents them from competing, Ethereum dApps may see an increase in liquidity due to the switch to the proof-of-stake network.

The next step in Ethereum’s roadmap is Sharding. Sharding is a multi-phase upgrade expected sometime in 2023 or even 2024 and will improve scalability.

Around the Merge, some confusion may arise as there may be a hard fork of the PoW chain running parallel to the new PoS chain. If a fork happens, the whole ecosystem will exist on both the forked and PoS chains.

Some Ethereum miners are planning to hard fork the current state of Ethereum with its DeFi and NFT markets ahead of the Merge. While few prominent players like Circle and Tether have announced their opposition to the forked chain, some centralized players like Bitfinex and Poloniex have come in support.

Another concern that is looming over the Ethereum Network is censorship. After OFAC (Office of Foreign Assets Control) sanctioned Tornado Cash, an open-source transaction mixer, the Ethereum community has been unusually concerned about the base layer censorship. Currently, 66% of the beacon chain validators adhere to OFAC regulations, such as Coinbase, Lido Finance, Staked.us, Kraken, and Bitcoin Suisse AG. Hence, the concerns are not unfounded.

The Ethereum community has come up with solutions to mitigate these issues, such as social slashing and the growth of liquid staking protocols like Rockpool. We are hopeful that these solutions will foster further network decentralization.

As many improvements are set to happen in the coming months and years, we are constructive on ETH and welcome the Merge and the new PoS chain.

Polkadot

Polkadot’s vibrant ecosystem is abuzz with the ongoing parachain auctions. The latest parachain auctions are won by Kylin Network, BridgePort, Integritee, and Kilt, collectively raised 444K DOT (USD 31 million).

The ex-SEC Chairman Jay Clayton joined the Web3 Venture Firm, a capital firm dedicated to the development of Polkadot.

With the deployment of XCM (Cross-chain communication), Polkadot parachains will see much more interoperability among its shared security blockchains. According to some users, what Polkadot lacks in user experience makes up for in innovation.

Stellar

Stellar Development Foundation (SDF) recently announced the launch of a contract platform called “Soroban”. The idea behind Soroban is to incentivize developers to create smart contracts using the Rust language. The initiative’s goal is to present the community with new use cases and generate a new wave of adoption. Stellar (XLM) is one of the few top 50 blockchains that have not exceeded its all-time highs of 2017-2018 in the last bull run. Sustained price action is essential for cryptos to maintain traction, which is a cause of concern for Stellar.

Cardano

September is eventful for Cardano. The team is preparing for the anticipated Vasil hard fork upgrade on 22 September 2022. Vasil hard fork will enhance Plutus, Cardano’s smart contracts, and enable cheaper transactions, and increased throughput.

Cardano was also recently listed on Robinhood, a US-based retail investment platform.

As the Cardano team prefers a peer review-based approach, this slow process implies a loss of opportunity for Cardano. Considering the space’s novelty, blockchain ecosystems with quicker cycles of launch, failure, and iteration have higher chances of growing. DeFi is just beginning on Cardano, while other ecosystems like Ethereum are gearing for their third version.

Avalanche

Avalanche is an Ethereum Virtual Machine (EVM) compatible modular blockchain based on a PoS consensus mechanism. It has a throughput of 4,500 transactions per second and a median fee of USD 0.01.

The DeFi total value locked has gradually fallen since April 2022 despite the Avalanche Rush Program of USD 180 million that started last year. Therefore, Avalanche is now partnering with Metaverse and Web2 gaming companies to launch their games on Avalanche subnets. Gamestar+ and Openblox have recently integrated with Avalanche to launch their NFT and gaming platform. These new partnerships could provide the necessary boost to the network and the token price in the coming months ahead.

Solana

Solana, a smart contract blockchain dubs itself as the fastest and cheapest blockchain, made technical improvements in its infrastructure at the beginning of Q3. Unlike Q2, when Solana faced multiple technical problems and degraded performance, it maintained 99% uptime in Q3.

Solana is out of the deep waters of technical debt and now faces other systemic challenges such as insufficient decentralization, revenue compensating validator rewards, monolithic scaling sustainability, and others.

Improved network uptime results from the introduction of a fee market and QUIC. Also, EVM is coming to Solana through Neon.

The recent NFT activities, specifically the mint of the “y00ts” collection, have piqued users’ interests.

While Solana takes time to overcome the technical challenges and is out of its Beta version, the price of SOL tokens may face more volatility. The one thing working in favour of Solana is its NFT market, but it remains to be seen if NFTs survive in this bearish environment.

Litecoin

Litecoin is a peer-to-peer cryptocurrency based on Bitcoin consensus. It is often regarded as a legacy blockchain four times faster than Bitcoin. It currently processes around 100K transactions daily and settles almost USD 2 billion in value. The team behind Litecoin is making rigorous efforts to increase its adoption. The concern with Litecoin is its throughput of 1 transaction per second, which is insufficient to become a global payment network.

Tezos

Tezos is a liquid PoS blockchain with on-chain governance, removing the need for hard forks. Although it has seen steady growth in user accounts, the number of new accounts has declined since September 2021.

It recently deployed Jakarta upgrade that has optimistic rollup smart-contract improvement. On Tezos, NFTs account for most of the network activity, but it is still a tiny portion of its counterparts, such as Ethereum and Solana. Until EVM and WASM (WebAssembly) are available on Tezos through rollups, developer counts and activity will remain limited on Tezos Network.

Aave

Aave’s proposal to create a stablecoin called GHO is strongly supported with an initial “yes” votes from 99% of the community members. GHO will be a stablecoin that can be minted using users’ deposits. Users will continue to earn interest on their collateral, making GHO a yield-bearing stablecoin. GHO details are still unknown, but Aave hopes it can renew interest in its protocol. In addition to developing the social networking project Lens Protocol, Aave is also bringing reputation-based NFTs via Orange Protocol.

Chainlink

Chainlink, the widely used oracle network, integrated with 57 projects across six blockchains in August alone, including Moonbeam parachain on the Polkadot Network. The total Value Secured by Chainlink vs. other oracles has been declining since the advent of internal oracles like Maker and Winklink. Currently, Chainlink secures 48% of all value on DeFi across all major blockchains.

Chainlink gained some traction recently after announcing that it will provide services to the Ethereum PoS blockchain and not its PoW hard fork. However, that interest waned due to broader crypto market retracement.

Partnerships with nodes, data providers, and blockchains will create more demand for LINK tokens, which shall result in an increased market cap of the project in the future.

Uniswap

Uniswap, the largest decentralized exchange by trading volume, recorded less than USD 40 billion for the second consecutive month, reaching 39 billion in August. The lackluster on-chain activity is concurrent with the overall bear market. Albeit Uniswap continues to account for almost 90% of all trading volume on Ethereum.

A recent proposal to create the Uniswap Foundation has passed the initial vote. The proposal will streamline Uniswap’s grant program and optimize protocol governance. A proposal to turn on the Uniswap fee switch has also gathered a majority of “yes” votes, and it will run for 120 days on three stablecoin pairs. Although these fees will not be accrued to token holders, they will be added to the Protocol treasury, which the DAO will govern. These developments create additional demand for UNI tokens.

Yearn Finance

Yearn Finance recently rebranded itself with improved proposal YIP 69, enabling tweaking yield aggregator fees and optimized APY for customers. While the protocol suppressed the 2% management fees it charges on every pool, it still levies a 20% performance fee on old and 10% on new vaults.

Protocol improvements are yet to translate into more liquidity on the platform, and it cannot be said whether the recent token price resurgence can be sustained.

Synthetix

Synthetix improved notably in Q3 2022. Its revenue has increased 10-fold since Q2. This can be attributed to the launch of atomic swaps, a feature that enables users to swap tokens on two different blockchains. This eliminates the need for third-party involvement.

In the latest proposal, Synthetix’s founder has proposed capping the supply of SNX tokens to a fixed 300 million as the protocol gains revenue from newer products. Although this may benefit the value proposition of current SNX holders, it remains to be seen if Synthetix will continue to attract new users with organic yields in a space where yields are abundant.

Conclusion

The challenging macroeconomic conditions combined with global monetary tightening are set to weigh on cryptocurrencies. Bitcoin price is first impacted by monetary conditions. Despite selling pressure from miners, the network remains solid as the hash rate has increased recently. The long awaited Ethereum event, The Merge, will eventually takes place mid-September. The switch from a PoW to a PoS consensus mechanism marks the beginning of a new era. In the coming months and years, Ethereum will upgrade and become faster and cheaper. Regarding alternative chains and DeFi applications, we observe many developments. It seems this crypto winter did not prevent developers’ team to improve their protocol and to get ready for the next bull run.