Abstract

In this edition of The Bridge, we first cover what drives the need for NFTs and the technology behind them. We discuss the nature of NFTs and how they are not the asset itself but a deed to it. Then we cover some of their use cases beyond digital art. We also give an investment framework to value collectible NFTs. Finally, we discuss some of the criticism that NFTs have faced and how they might be mitigated.

Introduction

Non-Fungible Tokens (NFTs) have picked up steam during this crypto market bull run when the importance of digital experiences has become ever more important, especially, with people being restricted to their homes due to Covid-19 lockdowns. However, most people think of NFTs as just digital art; let’s dive deeper into that statement and uncover what NFTs are and what they have to offer.

What are NFTs or Non-Fungible Tokens

To understand them, we must first discuss why there is a need for non-fungible tokens. Fungibility or interchangeability is the desired quality for money as it must serve as a unit of account, or standardised commodities for ease of trade, or assets representing a part of a larger whole like shares of a company for broad representation and distribution. However, for unique, different, and whole assets with different properties like a plot of land, a piece of art, fungibility does not work as each asset is unique with different properties and consequently values. With blockchain ecosystems having broadened to include more use cases than just medium of exchange or store of value, non-fungible tokens or NFTs bring scarce and unique assets on-chain to serve this growing need.

As bitcoin solved the problem of double-spending of money without a centralised authority, NFTs solve this problem for unique assets. NFTs are provable “deeds” of ownership, that ensure verifiable authenticity of an asset. NFTs store the entire holding and transaction history of an asset from the original author to the current holder ensuring a trustless verification of ownership and authenticity. Further, NFTs having standardised formats allow interoperability and composability between projects. For example, a CryptoKitty NFT created on the Ethereum blockchain can be used to fight other CryptoKitties in another Ethereum application, Kotowars. Another example for interoperability, could be that by owning a wrestler’s card, unlocks a special move in a wrestling game. NFTs being on platform chains can also have revenue sharing conditions so that the original artist is rewarded every time the NFT is sold in the secondary market. Through this, artists can have a steady revenue stream and are incentivised to continue to support their NFT products.

The standard for NFTs on Ethereum is given by ERC-721, and there are other implementations like ERC-1155 which allows for both fungible and non-fungible tokens within a single token contract. Dapper Labs, the founder of CryptoKitties, have developed their own blockchain for NFTs and gaming called Flow. Forks of Ethereum like Binance Smart Chain (BSC) and Tron have token standards similar to those of Ethereum.

NFTs are deeds or proof-of-ownership and authenticity

A common mistake is to confuse NFTs for the asset it represents. In fact, NFTs are closer to the deed or proof-of-ownership and authenticity for an asset than the asset itself. When Jack Dorsey sold his tweet on the platform “Valuables by Cent” for USD 2.9m, he did not sell the tweet itself as that remains on Twitter, nor did he sell a screenshot nor the words. He sold a provably authentic collectible item – the first-ever tweet from the founder of Twitter himself, with proceeds going directly to him and the transaction forever printed on the blockchain. Cent platform calls it a “digital certificate”, which is something it most closely resembles.

For a piece of digital art, the NFT is not the jpeg file; it is the ownership title to the art. Some of the subjects in popular memes like Bad Luck Brian, Overly Attached Girlfriend or Scumbag Steve sold the original photo of the meme as NFTs for 20, 200 and ~30 ETH, respectively. In this case, it is obvious that since everyone can use the picture to make the meme, the NFT is not the picture nor the exclusive right to use it. The buyer has bought a collectible item that is verifiably limited and authenticated by the person in the meme picture itself.

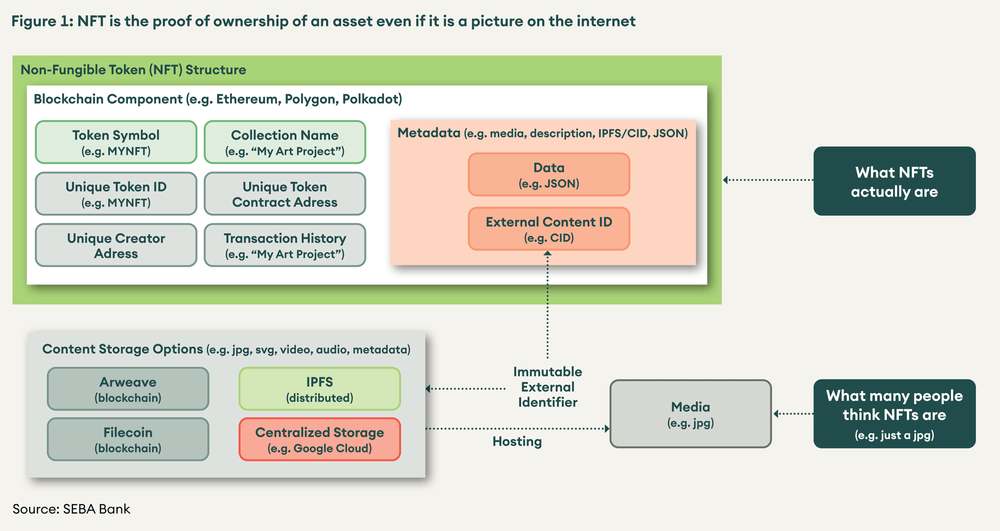

Storage on a blockchain like Ethereum is extremely costly as all nodes have to store it independently, and the blockchain can get very bloated extremely fast. As per an estimate, storing 1 GB of data on Ethereum might cost more than 60,000 ETH in transaction cost for a gas price of 100 gwei. Therefore, instead of being stored on-chain, NFTs contain an off-chain link to the art, and it can be loaded by the platform being used to browse the NFT.

Use Cases

NFTs necessarily need not be digital nor art. As discussed earlier, they can have varied use-cases like gaming, physical art, music, ticketing and more.

Art / Collectibles

The most popular use case for NFTs is digital art on the blockchain. But even in art, it should be noted that there are differences – it can be randomly generated content like CryptoKitties or a tokenised piece of unique art like artist Beeple’s “Everydays: The First 5,000 Days”. Further, the art can have a physical component as well, Banksy’s “Morons” was burnt and tokenised, and some NFTs can come with a physical copy. As discussed earlier, NFTs following the same standard allow for composability and interoperability. The owner of any digital art can display it on other platforms like the virtual worlds of CryptoVoxels and Decentraland.

Gaming

Games already have a thriving in-game economy with cosmetic items like knives in Counter- Strike or usable items like player cards in FIFA Ultimate team. Having these items on the blockchain gives users verifiable data about supply and supports trade where the developer can continue to earn fees. Axie Infinity, a blockchain game similar to Pokémon, has more than 19,000+ monthly active users where players can raise and battle creatures called Axies. Similar to CryptoKitties, Axies can be bred and pass on their “genes” and traded with other players. With gaming on the blockchain, players can be assured of the uniqueness of their assets and are not subject to the whims of a company supporting the game. They can participate in the governance and their assets can become part of a multi-game universe, with other projects building off a game’s established assets.

Domain Names

Ethereum Name Service (ENS) uses ERC-721 to register blockchain domain on the Ethereum blockchain. ENS allows users to register their wallet with a .eth domain, bringing personalisation and intuitiveness in transactions. Instead of copy-pasting a large string for a wallet address, a yourname.eth domain can point to an individual’s wallet.

Music / Streaming

NFTs can be programmed to share a percentage of the revenue with the original artist. This is important in the music industry, where there may be a lot of red tape and distance between the consumer paying for the art and the artist receiving it. Kings of Leon were the first band to release their album as an NFT. Along with the album, they sold some art and auctioned six “golden tickets” that gave buyers the right to four front-row tickets for each tour for life.

Streaming services generate content in real-time, and to increase viewer participation and involvement, World Poker Tour and Theta Labs are pioneering live auctions of NFTs capturing exciting moments and random “drops” to incentivise viewers.

Ticketing

NFTs have a use case for ticketing, where the number of tickets sold and used can be capped, eliminating counterfeits. To control scalping, the contract can also include instructions so that if they are sold above a certain price, the surplus is transferred to the original artist or a charity. A pilot program for FIFA World Cup 2018 sold NFT VIP tickets. These can also serve as proof-of-attendance or ownership of an exclusive event similar to ticket stubs.

Interoperability

There is overlap between use cases. An art piece may be displayed in a game, or trading cards can be collected as well as used in a game to battle. A ticket might become a collectible and a collectible may work as a ticket. This interoperability across various applications on the blockchain make NFTs an exciting space with a broad and developing use case.

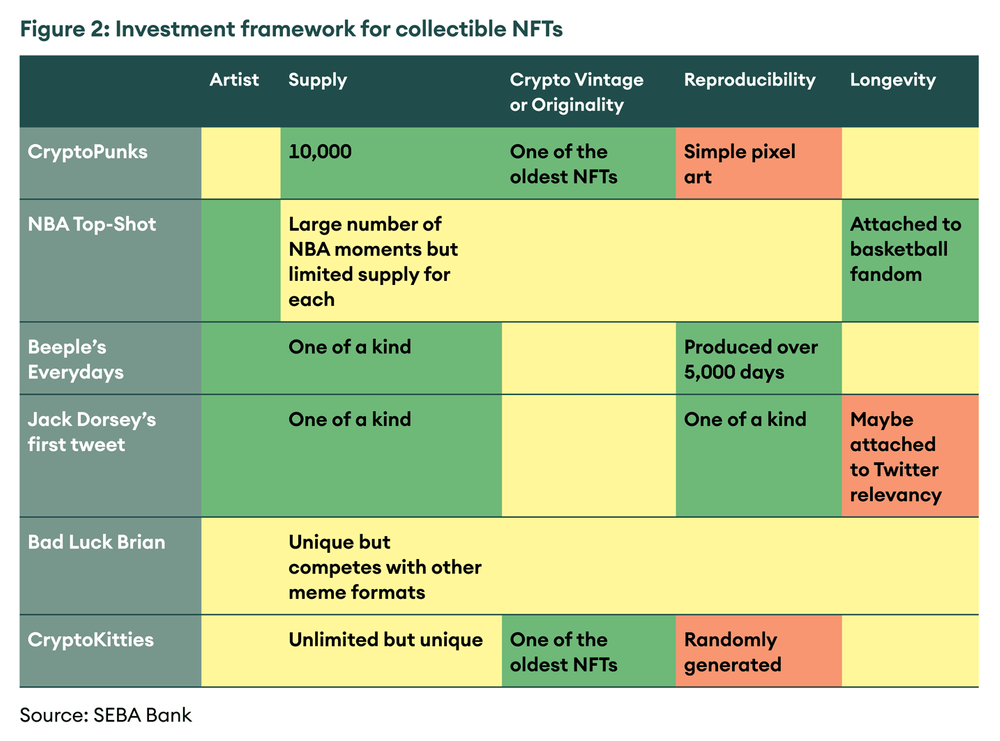

Valuing collectibles

While NFTs are unique and therefore difficult to value, we want to give potential investors a framework to use when investing in the space. The most important aspect of an NFT is its source or original author – Jack Dorsey’s first tweet has a high value because it is the firstever tweet on Twitter by its founder; another tweet may not have the same value. Another thing to consider is the total supply of the NFT and how prolific an artist is. NFTs can have multiple copies, and the higher the number of copies, the less rare and valuable it is likely to be. Similarly, if the artist is extremely prolific with many similar art pieces, the asset may not be as lucrative. Original and early products like CryptoPunks will command a higher price than derivatives like Binance Punks (the same product on the Binance Smart Chain, a modified fork of Ethereum). However, in another consideration, whether the art is easily reproducible or if it takes time, effort and expertise to create and recreate, CryptoPunks may fall short, as it is just 24×24 pixel art. The longevity of the underlying hobby is also important. An NBA Top-Shot may have a longer life as it should hold interest and demand as long as basketball remains a popular sport.

Criticism

As discussed previously, since NFTs are not the art itself and merely link to a server that hosts the file, there exists a possibility that the hosted server may go offline at a point in the future, and the NFT will forever forward to a dead link. This can be mitigated through using decentralised solutions like Filecoin, Arweave or IPFS. However, some NFTs still point to a centralised server and in case of loss of support, while it does not invalidate the proof of ownership, it would mean that the NFT would not be viewable from just the data it contains. In this case, the original author or issuing platform may need to reissue a new NFT to replace the old one. If they are not available, the owner may be able to do it themselves by destroying the old dead NFT and reissuing a new one. However, it is unclear if NFT will retain its full value after such a transaction as some part of the history of the token may be lost.

Another concern is part of the broader impact of blockchain mining on the environment. NFTs, like any other blockchain transaction, consume a certain amount of energy per transaction, and with growing interest, the amount of transaction space that it takes on Ethereum blocks has also become considerable. OpenSea, Axie Infinity smart contracts feature in the top 50 gas guzzlers for Ethereum transactions. However, with scaling solutions like ImmutableX and Polygon, these costs should come down in the future. As platform blockchains like Ethereum move away from proof-of-work, the environmental impact should be further reduced.

Conclusion

NFTs have opened the door for broad adoption of crypto assets. Sports enthusiasts, collectors, hobbyists, gamers, artists can all find a project that excites them in a world that was previously mostly consisted of finance and technology enthusiasts. The ecosystem is still in its infancy, and the leaders are yet to emerge. Even as market interest waxes and wanes, future leaders will keep building and innovating and those that can capture and maintain user attention should do well.