Abstract

This digital investor explores the Synthetix protocol, its upcoming changes, and how it stacks up against other DeFi protocols in terms of valuation. The article dives into the mechanics of the protocol to understand its challenges and how the protocol can tackle them.

Introduction

Synthetix is a decentralised platform on Ethereum for issuing and trading synthetic assets or synths that track the value of real-world assets. Born as stablecoin project Havven, Synthetix rebranded and expanded its scope in February 2019. Though Synthetix has its own trading platform, synths can be traded on other venues as well. Synthetix offers a broad range of synths – BTC, ETH, BNB, other digital assets, and their inverse tokens as well (1x short), commodities such as gold, a few equities, and so on. The synth offerings are expected to cover considerable width and depth of asset classes.

A natural question is why not hold the underlying asset itself instead of a synth. There are multiple reasons – ability to hold assets in fractional denominations, 24/7 access, liquidity, and so on. Platform’s token SNX (Synthetix Network Token) is used to collateralise and issue synthetic assets, with sUSD or synthetic dollar as the flagship asset. SNX holders are incentivised to stake as all the synth trading fee, and inflation rewards are shared with them on a pro-rata basis. SNX stakers act as a counterparty for the trading of all the synths. If holders don’t stake, they get diluted via inflation.

How Synthetix works

Synthetix allows holders to mint synths using SNX. While doing so, they have to maintain a 600% C-ratio (Collateral Ratio). When they mint synths, they incur debt. They must actively manage this debt, or they run the risk of liquidation (we describe how debt position changes later). When the C-ratio drops below the desired level, the wallet is flagged, and the synth issuer has one day to act before their position is liquidated. The issuer can either add more SNX as collateral or burn some synths to bring the C-ratio up. If a user mints USD 1000 worth sUSD by staking SNX worth USD 6000. Assuming that this is 10% of the total debt, they have to pay 10% debt back to unlock their collateral. We can now get into the mechanics of how the debt pool and debt positions work.

Debt positions and protocol subsidy

Imagine Alice and Bob, the only SNX stakers, mint 2500 sUSD each by staking SNX worth USD 15,000. Alice converts her sUSD to sETH when ETH is at USD 2500, and Bob keeps sUSD. At this time, both have similar debt and collateral ratio. As the debt of all the SNX stakers is ‘pooled’, the total debt of the system is USD 5,000. This debt is split on a pro-rata basis among the minters. Later, say ETH doubles to USD 5,000. The total debt of the system now increases to USD 7,500, and both Alice and Bob have a debt of USD 3,750 (as each of them minted 50% debt). Alice has gained USD 1,250 (USD 5,000 – USD 3,750) while Bob has lost USD 1,250 (USD 2,500 – USD 3,750). As Bob’s debt was denominated in sUSD, he has an additional burden of USD 1250. Assuming SNX is trading at the same price, his collateral ratio has fallen from 600% to 250%. Now he may provide USD 7,500 worth SNX as more collateral or burn 1250 sUSD to avoid getting liquidated.

This example establishes that staking SNX is a zero-sum game and needs to be actively managed1. But it also begs the question whether it is worth the effort. There are two types of incentives for stakers – fee from synths and protocol rewards from the inflationary monetary policy.

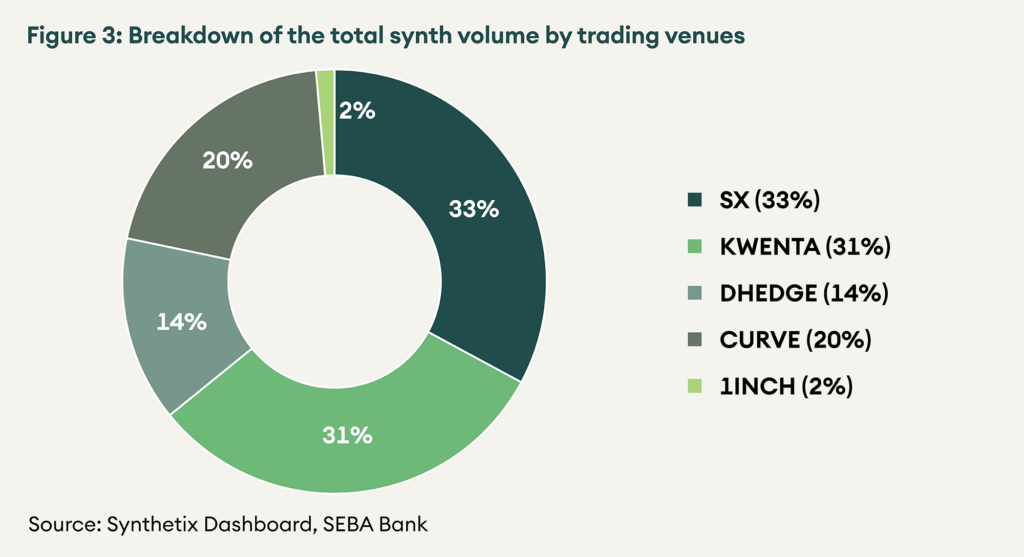

Every synth trade attracts a fee between 1 and 100 basis points (typically 30 bps). This fee is distributed among stakers. Synths can be traded on various trading venues such as Synthetix. Exchange, Kwenta, dHedge, Curve, 1inch, and other decentralised exchanges.

Synthetix changed its monetary policy in 2019, moving from fixed cap to perpetual inflation. From March 2019, the supply started increasing from the initial fixed cap of 100 million SNX as per this model. These new tokens are distributed to SNX stakers weekly on a pro-rata basis, provided their collateralisation ratio remains above the target threshold.

Table 1 – Synthetix inflation schedule

Team and Governance

What started as a business to build synthetic stablecoin using a balance sheet has now transformed into a protocol that monetises its balance sheet by facilitating minting and trading synths. The team has shown the ability to pivot when the market presented with an opportunity. Synthetix is also one of the few projects that have managed to decentralise themselves meaningfully as they grew.

Synthetix’s governance used to take place off-chain (on its Discord), and the foundation was in charge. Anyone could make proposals; these proposals were then discussed on an open call. In July 2020, the foundation was decommissioned, and three DAOs were set up – protocolDAO, grantsDAO, synthetixDAO.

The protocolDAO is the owner of all Synthetix contracts and uses a 4/8 multisig to modify and upgrade the protocol. It means the protocolDAO is responsible for implementing SIPs (Synthetix Improvement Proposals) and SCCPs (Synthetix Configuration Change Proposals)2 approved by the community through a rough consensus process. It is also responsible for the operational security of the protocol.

The grantsDAO is responsible for funding public goods such as SNX.tools, SNX.link, and so on. The synthetixDAO has committed to funding the grantsDAO with 1m SNX per year for three years since the beginning to ensure continued funding for public goods and initiatives.

The synthetixDAO was a multisig contract created at the time of token sale to ensure the safety of the funds and oversaw the deployment of funds to align with the protocol growth. It provided operational funding to Synthetix Foundation in Australia and other entities that contributed to the development of Synthetix.

Value accrual

When a user wants to stake SNX to earn inflationary rewards and fees from trading, they essentially have to mint some sUSD and contribute to the debt pool. Unlike most of the projects, SNX staking is not just rent-seeking. Users have to take some risks if they wish to earn rewards. The protocol works when users stake SNX and mint something against it, which becomes a part of the debt pool. There is no way to stake and not mint. SNX stakers accrue all the value generated from a trading fee of different synths. As the volume grows, the value accrued by SNX grows in proportion. The value accrual depends on the trading fee, which depends on liquidity, which depends on Synthetix’s balance sheet. SNX market capitalisation poses barriers to total synth liquidity. For example, at USD 1bn market capitalisation, SNX only allows USD 166 mn worth of Synth liquidity to ensure 600% collateralisation. Thus, the SNX token itself acted as a hindrance to value capture.

Fundamentally, there are two ways Synthetix can improve its value capture – add other collateral options and onboard more traders via partnering with different trading venues. Adding collateral and sharing fee with non-SNX token stakers is a counterproductive approach as it reduces the need to hold SNX. Instead, allowing staking other assets with lower collateral ratio and not pooling this debt along with SNX stakers positions improves liquidity for synth traders without diluting SNX’s importance and, thus, earning potential for SNX stakers.

Adding ETH as collateral

In 2020 Synthetix allowed users to put ETH as collateral to mint sETH. ETH stakers’ debt is not pooled with SNX stakers’ positions. The collateral requirement is 150%, with a minting fee of 50bps and an interest rate of 5% APR.

Let us say Alice puts up 150 ETH as collateral; she gets 100 sETH against her collateral. If she manages to make a series of trades using sETH to earn a profit, regardless of how much profit she makes, she only needs to pay back 100 sETH to unlock her original collateral. The rest of sETH is her profit and SNX stakers’ loss. Because Alice is not taking any risk on her collateral, she will not be eligible for any trading fee generated by synths or inflation rewards. Thus, ETH as collateral increases the earning potential of SNX stakers and risks as well.

Integration with Curve

Curve is arguably the best venue for trading pairs that track the same price (sBTC and WBTC, USDT and DAI, and so on). Due to its peculiar AMM function, unlike Uniswap, Curve does not have pools with assets that track different prices. Curve partnered with Synthetix to facilitate cross-asset swaps. Say trader wants to convert WBTC to DAI using Curve, it works as follows –

- Curve converts WBTC to sBTC

- Swap sBTC to sUSD using Synthetix. SNX stakers are the counterparty here. This is the step where Synthetix captures fee from trades originating on Curve.

- Swap sUSD to DAI on Curve

The second step occurs at ~0 slippage, as Synthetix works on a price oracle instead of an AMM curve like many DEXes. To see the impact Synthetix has on this, we tried to see the effect of selling 100 WBTC for DAI across three different DEXes – Sushiswap, Uniswap, and Curve. When we attempted this trade (May 1, 2021), the impact seen on Curve was the least. While bitcoin was trading around USD 56,700 on centralised exchanges, the offer on Curve for selling 100 WBTC was USD 55,928 versus USD 53,870 on Sushiswap and USD 50,910 on Uniswap. The price offered on Curve is only possible because of Synthetix. Since its launch in January 2021, Curve cross-asset swaps already suggest that high volume swaps already go through synthetix. The biggest single trade was a USD 20mn swap so far.

Figure 2: Price impact of selling 100 BTC on different DEXes

Sources of trading fee

Apart from Curve, the other sources of the trading fee are Synthetix Exchange, Kwenta, dHedge, 1inch, etc. We expect Synthetix will expand its integrations further and onboard more traders to drive the volume.

So far, the distribution of total synth volume looks as follows.

Fig 3 – Breakdown of the total synth volume by trading venues

Valuation

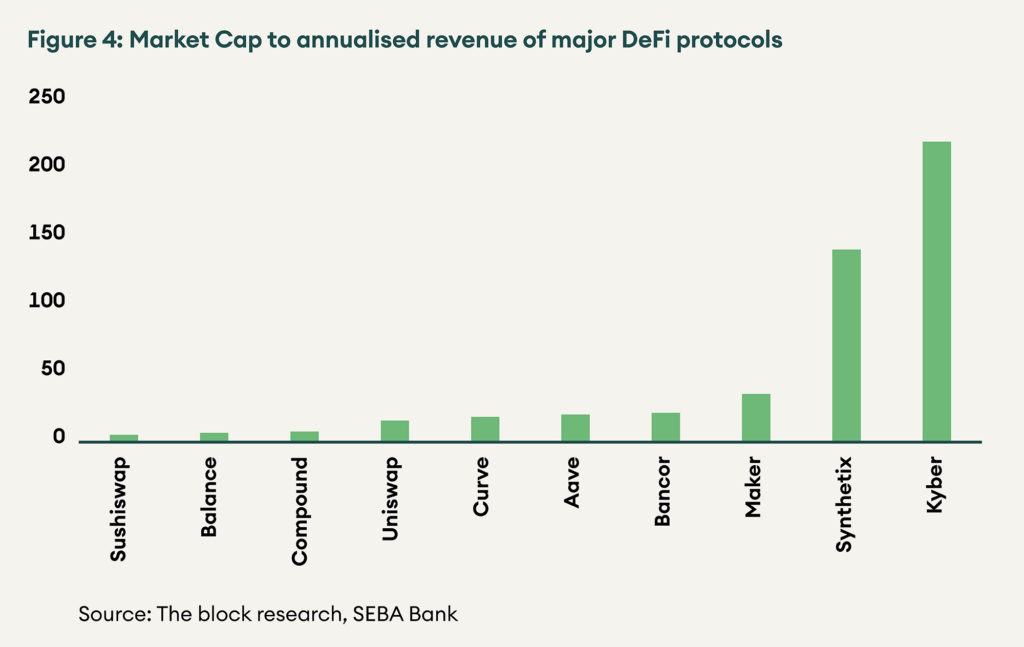

There is little to compare Synthetix with other protocols as it has a much broader scope and total addressable market compared to the rest of the decentralised exchanges.

Fig 4 – Market Cap to annualised revenue of major DeFi protocols

It is not to say that Synthetix does justice to its current valuation multiple. However, we must look beyond numbers here. The fact is Synthetix is one of the primary building blocks of DeFi on Ethereum. If an investor thinks DeFi on Ethereum is here to stay, they can be optimistic that Synthetix will be used as a facilitator by other projects, just as Curve does, in ways we probably cannot imagine today. We think this is because DeFi will likely expand to other assets (outside of digital assets), and any asset with a constant price feed via an oracle can be issued and traded using Synthetix. The team spent a lot of time getting the debt management system right before going for user/trader onboarding. Synthetix has one of the most robust communities in DeFi, and we cannot underestimate the importance of a strong community.

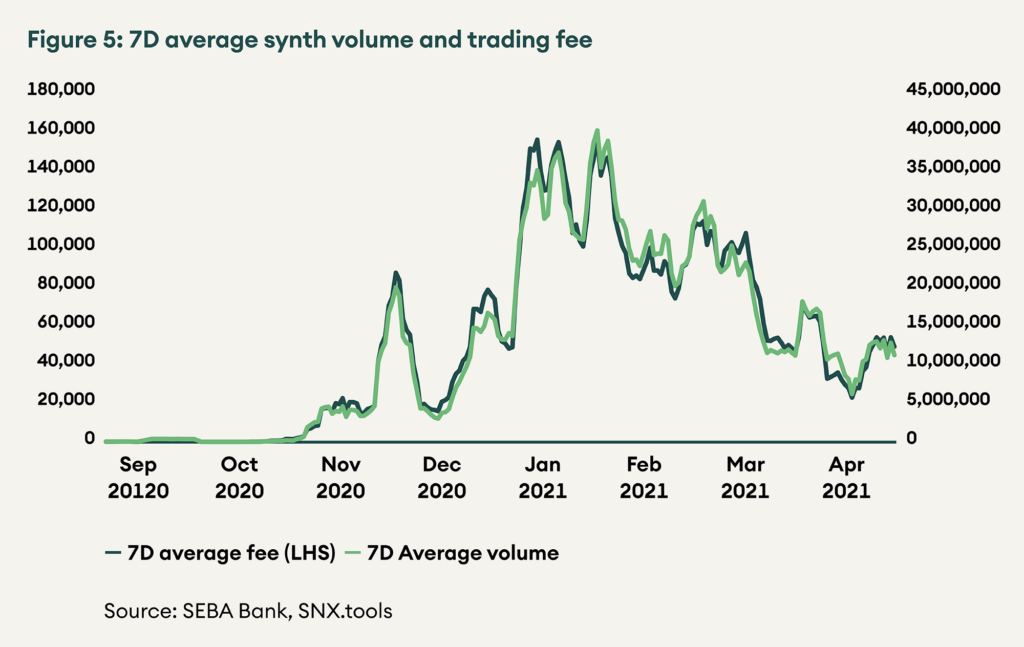

The average volume of synths traded across exchanges in Sept-Oct 2020 was approximately USD 120k, and it was USD 12.5 mn in Mar-Apr 2021. In six months, the volume increased by ten times. This type of growth makes it challenging to model SNX using the DCF method. The question is can Synthetix keep up with the same growth pattern for the foreseeable future? We are more inclined towards yes than no.

Synthetix has been extremely good at pivoting when they realised that their model was not working. It is one of the very few protocols that has meaningfully decentralised as promised at ICO. It has a strong community that intimately understands the protocol, knows how to manoeuvre their debt positions and so on. One might look at the lack of significant volume and be tempted to think that maybe the valuation is too high. However, the plan has always been to build a strong foundation before onboarding traders. As shown in the value accrual section, many DEXes will likely route their cross-asset swaps via Synthetix as it offers the most cost-effective path.

Fig 5 – 7D average synth volume and trading fee

At the current market cap of USD 2.7 bn, if Synthetix has to have a Market cap / Protocol revenue of 10, assuming 30bps average fee per trade, synths have to do an annual volume worth USD 90 bn. Based on the 7D volume of Uniswap and Sushiswap, their annualised volumes are USD 452 bn and USD 120 bn, respectively. Given that Synthetix offers the best rates for high volume trades and the foundation has now been laid for such high-volume trades, the market is signalling that USD 90 bn volume for Synthetix is not too farfetched.

How can Synthetix achieve desired growth?

Synthetix launched on Optimistic Ethereum in Dec 2020. It will help in reducing gas costs and add more throughput, which will allow Synthetix to reduce oracle latency. Reduced oracle latency will allow deploying leveraged futures contracts on Synthetix exchange. The team estimates Synthetix will offer a minimum of 10x leverage on futures.

Several features are planned for 2021 and beyond. Synthetix V3 plans to add improvements such as siloed debt pools, tokenised debt, and more. The V3 also proposes a new staking mechanism that would require users to send SNX to a contract address if they want to stake it, and the rest of the SNX in the wallet would be freely transferrable. It is an improvement over the current mechanism wherein staked SNX remains in the wallet and is non-transferrable. Currently, the SNX paid out inflation is locked for one year after claiming. V3 proposes to create eSNX, which will be sent directly to wallets (not immediately staked, as it is done currently). Users will be able to burn eSNX to get SNX one year after burning. eSNX creates more flexibility as users have the optionality of not staking it.

Challenges

The first challenge is Synthetix uses its governance token to build its balance sheet. As long as the price is in an uptrend, everything works fine. However, a downtrend may cause damage to the protocol’s balance sheet and has the potential to be reflexive. As SNX price drops, debt positions have to be burnt, reducing the balance sheet, further damaging the sentiment. Synthetix has recently added ETH as collateral to address this issue.

Secondly, Synthetix may face competition in the synths space from other protocols built on Ethereum or other cost-effective chains such as Cosmos, Solana, or Polkadot. Mirror, a protocol on Terra, has already been gaining some traction. However, we know that network effects and composability offered by Ethereum is tough to break.

Thirdly, as protocol inflation drops, SNX stakers’ incentive to take the risk reduces. The trading fee has to compensate for the loss of inflation rewards. However, if the staking ratio drops by a few percentage points, inflation rewards and fee would be sufficient for stakers to continue staking.

Finally, the collateral ratio, though dropped from 800% to 600%, is still high. The initial requirement was high because there was no liquidation mechanism. The only punishment for undercollateralised positions was the loss of rewards. Now that the liquidation engine is active and ETH as collateral is live, the collateral ratio may be reduced in future.

Conclusion

Currently, Synthetix looks overvalued compared to other DeFi protocols. However, it is a crucial piece of infrastructure within the DeFi ecosystem. It offers a strong foundation for other protocols to build on top of. Many impending upgrades will improve the user experience of Synthetix. We think that puzzle pieces are aligning for Synthetix, and the project has the potential to justify and surpass expectations.

1Users can also use tools like xSNX that automate staking ↵

2SCCPs are used to make changes to the configuration of the protocol such as C-ratio, while SIPs tend to broader changes. ↵