Abstract

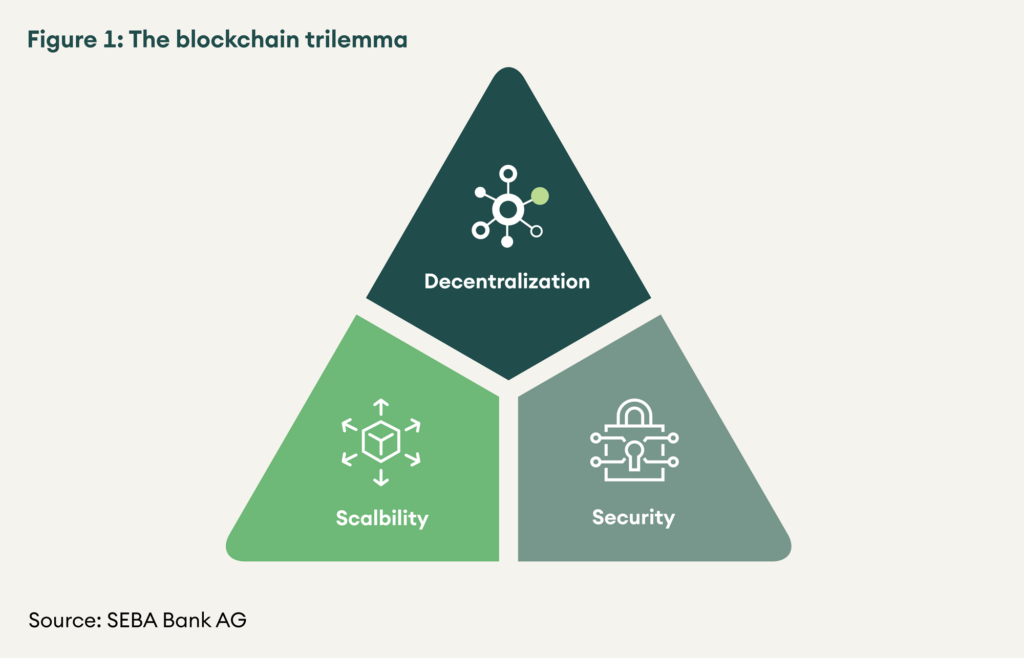

In this edition of the Bridge, we present an idea central to the design of any public blockchain: the blockchain trilemma. Trilemma refers to the fact that no blockchain has been able to optimise three qualities simultaneously, decentralisation, security, and scalability.

We discuss the advantages of each of the qualities, why they are desirable and their trade-offs. We illustrate the trilemma with live blockchain examples.

Introduction

Before diving into the dynamics of the trilemma, we broadly define what scalability, security, and decentralisation mean:

- Scalability is the ability of the blockchain to accommodate a higher volume of transactions

- Security is the ability to protect the data held on the blockchain from different attacks or blockchain’s defence against double-spending

- Decentralisation is the redundancy in the network that makes sure fewer entities do not control the network

Blockchain trilemma or scalability trilemma is often just stated as a rule, which is not the case. It is not necessary that blockchain may never achieve optimum levels of decentralisation, security, and scalability. Before diving any further, we need to understand why or how this gets introduced in current public blockchains. We explain the tussle among the three qualities with the example of Bitcoin blockchain.

Bitcoin’s breakthrough was that it solved the double-spending problem without a central entity. ‘Without central entity’ is a key here as double-spending is a trivial problem in centralised settings. The goal, always, was to facilitate the exchange of value between two parties with trust minimisation. Trust minimisation takes place when there are no centralised entities which meant that bitcoin relies on multiple miners (instead of one clearing house). Bitcoin introduces a delay in the form of blocks to ensure that the majority of the miners had sufficient time to verify transactions. It means that sacrificing speed was a conscious choice to ensure trust minimisation or decentralisation. The simplest way to increase speed or scalability is to reverse the decision of introducing time lag to ensure decentralisation. All other blockchains are built with bitcoin in their DNA in some shape or form.

The interplay among Scalability, Security, and Decentralisation

The network first needs to agree on the validity of the transaction to settle it. If the system has a large number of participants, the agreement may take time.

Therefore, given similar security parameters, we see that scalability is inversely proportional to decentralisation.

Now, assumes that two proof of work blockchains have the same degree of decentralisation and we can think of security as the hashrate of the blockchain. If the hashrate is higher, the confirmation time is lower, and scalability increases with security. Therefore, at constant decentralisation, scalability and security are proportional.

Thus, a blockchain cannot optimise for its three desired qualities simultaneously, and it must make trade-offs.

The most recent observation of trilemma at play was Ethereum. In the wake of the rise of Decentralised Finance (DeFi) applications this summer, the Ethereum platform usage surged. Ethereum cannot scale beyond a particular point. Therefore, increased demand pushed the transaction fees to the extent that it made prohibitive for some to interact with the blockchain. Increased fees on Ethereum is an illustration of the trilemma, where we could observe that Etehreum did not scale without giving up security or decentralisation. In the case of Ethereum, the emphasis was placed on decentralisation and security, limiting the number of transaction per second (scalability). Users paid a higher fee to incentivise miners to prioritise their transaction.

Ethereum and Bitcoin have preferred decentralisation and security over scalability. Ripple, a payment solution, prefers security and scalability over decentralisation. And EOS favours scalability at the cost of decentralisation and security.

Figure 1: the blockchain trilemma

Importance of each component in the trilemma

Decentralisation

Decentralised networks emphasise the ability of a blockchain to rely on a sufficiently large number of stakeholders. Decentralisation is observable on various levels: the number of miners, the number of full nodes, the geographical distribution, the number of active developers and so on. It is vital to note that not all blockchains are decentralised to the same extent. Decentralisation is a spectrum; it is not binary.

Advantages of decentralised networks

- Decentralisation allows maintaining consensus without mandating users to trust a single entity

- Decentralisation is desirable because it increases the robustness of the system. It makes the network resistant to censorship and thus allows anyone to use the network uplifting the property rights

Disadvantages and difficulties of decentralised networks:

- Decentralisation introduces delay and slows down the network

- It is expensive as it introduces redundancy and thus not desirable for all the applications

Scalability

The scalability refers to the capacity of a blockchain system to support the growth in size (more users, more use cases and ultimately more transactions), to deal with mass adoption without compromising performance. It essentially boils down to reducing the settlement time of a transaction to increase TPS (transactions per second) or the throughput of the chain.

How can the scalability of a blockchain increase? There are two ways (or a combination of these two ways)

- Reduce the number of entities vetting the transactions (compromise on the decentralisation)

- Reduce the block time, which demands reducing difficulty of the network (compromise on the security)

Advantages of a scalability focussed network

- Allows the network to support a high volume of transactions

- Can be useful in applications where security is not a prime focus, for example, social messaging applications

Disadvantages of a scalability focussed network

- As we mentioned above, the scalability could come at the cost of security

- As a network scales the consensus mechanism will also need to scale which could come at the cost of centralisation

Security

Security is the ability of a blockchain to maintain irrevocability of transactions. It does so by forcing network participants to expend resources to earn rewards. The more resources network participants spend, the more secure the blockchain.

In a recent Ethereum Classic (ETC) attack, the attacker re-organised over 4000 blocks1, and the attacker managed to double spend ETC worth close to USD 2 mn. Why was the attacker successful? Because the cost to acquire more than 51% of the entire network’s hashpower was insignificant compared to the stolen value. In short, the wealth in those 4000 blocks far outstripped the resources deployed by network participants.

Advantages of a security focussed blockchain

- Enables large value transfers which are quicker and cheaper than traditional value transfers

- The security of public blockchains comes from network participants. Higher security implies higher network effects which are not easy to replicate

Disadvantage with security focussed networks

- Requires more resources, i.e. more investment

Promising Solutions

It is no secret that the current scalability of blockchains such as Bitcoin and Ethereum is a limitation. Developers are approaching the problem from various angles. Bitcoin cash’s increased block size was an attempt at increasing scalability of bitcoin. However, there is no evidence of its gaining popularity. Bitcoin is attempting to solve it by adding a layer on top of the existing blockchain layer. The idea is the layer two solution will conduct bundle multiple transactions together and query the base layer blockchain only from time to time. Ethereum is taking a somewhat hybrid approach where sharding will scale base layer blockchain, and the community expects different layer two solutions to increase the throughput further. None of the scalability solutions is perfect yet. We will have to wait to find out which of the mentioned solutions works the best.

Conclusion

We have explored the blockchain trilemma that refers to the idea that a blockchain cannot reach all the three desired qualities (security, decentralisation, and scalability) all at once. Using examples, we presented diverse existing blockchains and showed how their design choice affects the other parameters in the trilemma. Finally, we introduced a few promising solutions.

1Block re-organisation means that the same block was mined again with different contents (transactions) ↵