Abstract

In this edition of Digital Investor, we cover the largest decentralised asset management protocol, Yearn Finance. We cover its fair launch, the value drivers for the token, its moat and significant protocol updates. Finally, we attempt to find a fair value for the token using DCF.

Introduction

Yearn Finance is a decentralised finance (DeFi) protocol that pioneered Asset Management for passively earning yield on stable and risky assets. One can think of it as an automated asset manager allocating depositors’ funds into the best yield generating strategies for the highest returns.

What started as a simple yield generating product called iEarn by Andre Cronje has morphed into a financial edifice built on the bedrock of smart contracts. iEarn was a simple product that would lend assets via the highest interest generating protocol among Compound, Aave, and dYdX. However, Yearn Finance does much more than just allocating funds to different stablecoins savings accounts.

Yearn Finance offers a wide range of products, the most relevant being vaults. Vaults are dynamic strategy aggregators that allocate funds to various strategies providing the best yield for the depositors in their asset of choice (instead of just stablecoin), allowing users to earn a yield while maintaining exposure to their preferred asset.

Background

Yearn launched its governance token YFI in mid-July 2020 and is touted as one of the fairest token distributions in the space. YFI tokens were awarded to liquidity providers of specific Curve and Balancer pools who had staked their liquidity in the protocol. In the beginning, only 30,000 YFI were minted and fully distributed to all the stakers. The community approved Proposal 0, which allowed minting more YFI to create ongoing incentives for liquidity providers, developers and contributors.

With limited supply and high usage, YFI price skyrocketed from USD 32 to a high of approximately USD 43,000 within a couple of months of launch despite the founder’s assertion that it has zero financial value. However, we believe that the governance token, YFI, must have significant value for the platform to function well as the token holders decide the outcome for the depositors. At the time of writing, Yearn Finance has USD 3.8 billion of value locked, of which approximately 78% is locked in the vaults.

Why should YFI have a non-zero value?

Not all governance tokens are the same. YFI allows holders to vote on strategies for different vaults, change the fee structure, mint new coins and distribute rewards to contributors. Token holders also control the protocol treasury of about USD 0.6 bn. A non-zero price means that those who take governance decisions have something to lose in case a bad decision is taken. Consequently, token holders are incentivised to take good decisions that increase the attractiveness of strategies and increase AuM and protocol revenue.

Yearn’s defensibility

Open source projects can be forked. What is Yearn’s defensibility in this case? One of the primary moats for Yearn is that it shares the spoils with the strategy writers. As per the YIP-52 (Yearn Improvement Proposal), Yearn made vault strategists equal partners in the strategy. Yearn vaults charge a 2% annual maintenance fee and a 20% performance fee from the depositors. Before YIP-52, the strategist earned only 0.5% from the performance fee, 19.5% went to the protocol treasury. After YIP-52 got approved, the profit is split equally between strategist and treasury. If the vault is sizeable, a good strategy can fetch substantial gains for its writer. Yearn has the highest AuM of any decentralised asset manager and, there- fore, provides the highest incentive for the best strategy writers to share their strategy with it alone. This creates a virtuous cycle of better returns, higher AuM and better strategists.

Secondly, though ironic, trust is an essential aspect of increasing network effects. As has been seen in some Binance Smart Chain forks of Ethereum projects, hacks and exploits are more likely if the team has forked the project and does not understand it deeply. Yearn’s team is a pioneer in the space and has shown that they can adapt to a changing environment. When yields fell, they changed vaults’ strategies to increase it. When new strategies were not being developed, the governance took a call to increase strategists’ rewards. Adaptability points towards the team’s ability to deliver over the long-term while forks may have a shorter life.

But is yield a constant feature of Yearn?

An obvious question is whether yields within cryptoassets are constant. Thankfully, traditional finance has not set the bar too high, with close to 0 per cent interest rates in the developed world. We think that yields within the cryptoasset ecosystem will follow cycles. Higher yield attracts more users, which then increases the fees. Higher fees discourage small investors, and thus, the yield falls1. As smaller investors stop interacting with the blockchain, the fees drop. The next cycle of price rise combined with lower fees again encourages smaller investors to participate, and the cycle repeats. Our previous Digital Investor explains this hypothesis.

Though the prices of DeFi tokens took a hit in the recent crypto crash, the number of tokens locked in various DeFi protocols was almost constant. More and more bitcoins and stable- coins want to be on the Ethereum blockchain in search of yield. We believe DeFi has a long way to go still.

Investment thesis

Bottom-up

The rise of DeFi allows holders to benefit not only from price increases but also from earning passive income on various assets. Yearn facilitates the latter. Though holders can independently earn this yield without Yearn, the protocol offers a few benefits. Firstly, it is safer than the average holder moving their own funds around. DeFi is a wild west, even those who understand technical aspects have been victims of hacks and exploits. An average user cannot possibly audit smart contracts and deploy funds in a dynamic environment. Yearn’s team is vastly experienced and understands the pitfalls better than its users, and therefore is in a position to provide better risk-adjusted returns. Secondly, we know gas prices can be very high. Small investors (<USD 10,000) are priced out and cannot keep up with the yield farming activity. Yearn provides the option to pool the funds and thus subsidise gas costs.

YFI benefits directly from the platform’s earnings. The protocol charges 2% management fees and 20% performance fee. The entire management fees and 50% of the performance fees accrues to the treasury that is controlled by the token holders. Net of expenses, protocol earnings are used to buy back YFI from the open market (see YIP-56 below). With a limited number of YFI, growing TVL, and constant buy pressure from the treasury, the tokenomics are likely to act as a strong driver for the price.

Top-down – the macro-environment craves for a product like Yearn Finance

Most of the developed world is ageing. Baby boomers2 will retire in the next few years, and pensions will become an essential aspect of their lives. Unlike the generation before baby boomers, the current conditions for retirement are different. Firstly, as life expectancy has increased, retirees at 60 will likely live for 25 more years, relying heavily on their pensions. Secondly, when the previous generation retired, the interest rates were around 18%, favouring savers. Currently, the interest rates are near 0, which does not incentivise saving. The combination of a large population hitting the retirement and near-zero interest rates is a poor combination. Most of the developed world is facing (or will face) this problem.

Bitcoin has been the flag bearer of the cryptoasset industry. However, 2020 has proven that stablecoins are also one of the exciting aspects of the digital asset revolution. With stablecoins comes the opportunity of earning a yield on dollars. It is an exciting opportunity not only for crypto natives but also for sophisticated funds where the mandate would be to make about 6-8% annual returns on some part of their portfolio. Pension funds currently hold about USD 32 trillion (the US alone holds about USD 18.8 trillion) in assets. We live in a world where the total negative-yielding debt has surpassed USD 17 trillion, and public companies such as Microstrategy and Tesla are choosing bitcoin as a reserve asset.

While it may be too early for pension funds, more adventurous funds and individuals might be tempted to test platforms built on Ethereum to escape from their negative yield environments. As traditional finance and decentralised finance integrate more, Yearn Finance will be well-positioned to claim a significant share of the capital as the leader in the decentralised asset management space.

Governance and significant protocol changes

Yearn Finance is one of the most active protocols as far as governance is concerned. In general, proposals are first discussed on the governance forum, and then they go for on-chain voting in the form of YIP (Yearn Improvement Proposal). Yearn is also the first DeFi protocol to provide quarterly earning’s report regularly. We think this should become the norm in the DeFi space.

Change in YFI supply (Proposal 0 and YIP-57)

The first-ever proposal was to change the YFI supply. YFI had started with one of the fairest launches, and the community decided to mint more tokens later. Recently, as per YIP-57, 6,666 new YFI tokens were minted to support protocol development. It allowed Yearn to extend vesting packages (2,222 YFI) to developers to align incentives. The rest of the tokens are with the treasury to use for protocol growth.

Change vault fee structure (YIP-51)

Yearn V1 vaults had a different fee structure where every withdrawal was charged. YIP-51 changed the fee structure to a 2/20 model, where the protocol charges a 2% maintenance fee and a 20% performance fee.

Make strategist skin in the game partner (YIP-52)

Out of the 20% performance fee, 19.5% went to the treasury, while 0.5% was allocated to the vault strategist. Governance approval of YIP-52 made strategist an equal partner in performance. The rationale for this change was simple, yearn’s defensibility relies on strategists exploiting best of yield opportunities. And the protocol needs to incentivise the best of the strategists to do the same.

Buyback and build (YIP-56)

When YFI started, YFI holders had to stake YFI into the governance vault to claim a stake of protocol income. With YIP-56 in effect, the governance vault was retired, and the protocol started distributing profits by buying back YFI from the market. It simplified staking and governance and spread the rewards across token holders. The YIP also made gains more tax-efficient as capital appreciation through buybacks could be taxed less than dividend income through staking rewards. Another by-product of this improvement was making YFI more efficient as holders can vote while putting YFI to use. For example, users can put YFI as collateral to mint DAI in Maker and earn interest on DAI using other DeFi protocols.

Valuation

Cumulatively, Yearn has generated more than USD 8 million in rewards since August 2020, out of which close to USD 5 million earned until April 2021, where April alone amounted to USD 2.7 million.

Valuing Yearn Finance is a tedious task. Yearn works with several other protocols, whether in the form of tie-ups or just using them. Some noteworthy mentions are Curve, Sushiswap, Cream, and Badger. The composability makes it difficult to project how the growth may pan out.

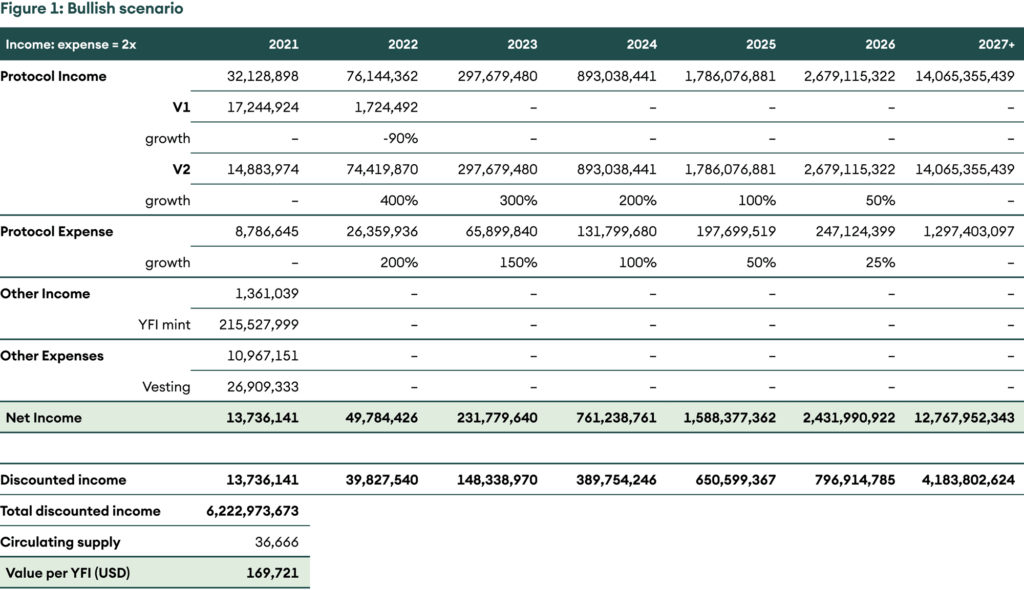

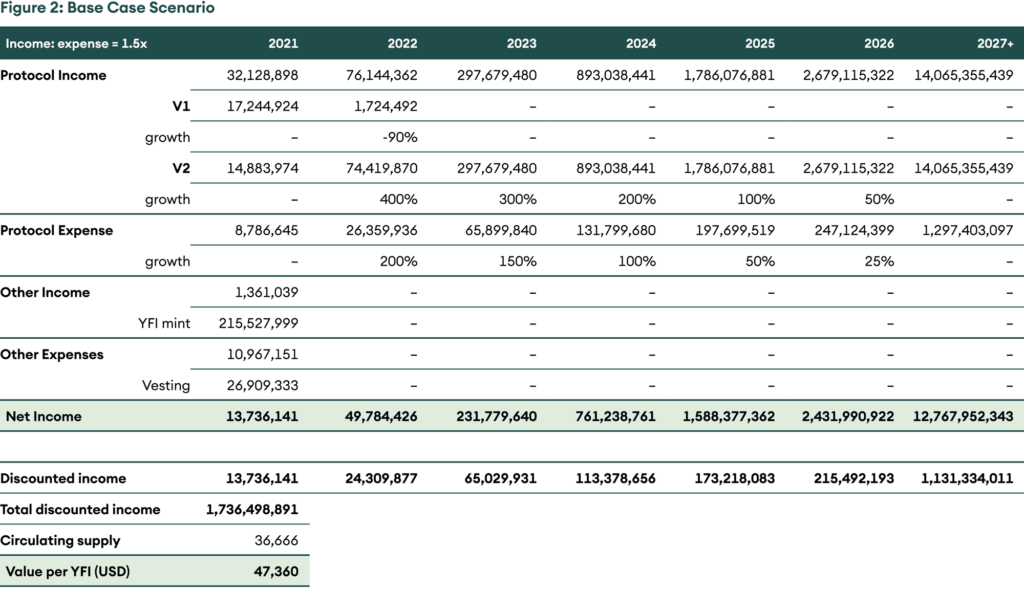

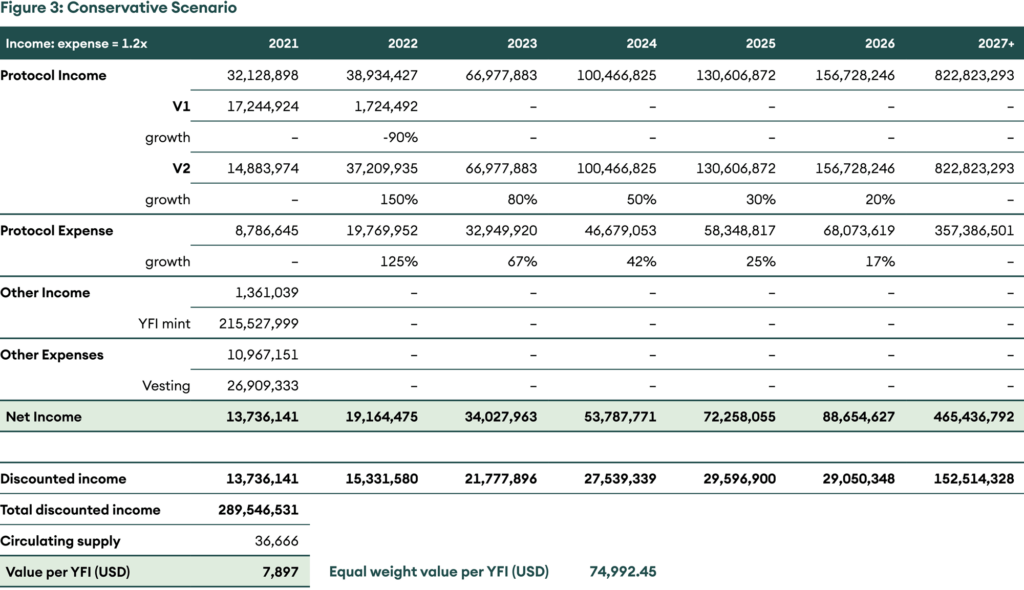

We assume three scenarios – bullish, base-case, and conservative. Scenarios use different growth and income per unit dollar spent assumptions. For the bullish scenario, income/ expense is 2x while the same for base-case and conservative scenario 1.5x and 1.2x, respectively.

Using a discounting rate of 25%, terminal growth rate of 5%, and giving equal weight to all three scenarios, we arrive at a fair value of USD ~75,000 per YFI.

Figure 1: Bullish scenario

Figure 2: Base Case Scenario

Figure 3: Conservative Scenario

Risks

Just as all other DeFi protocols, Yearn is vulnerable to smart contract risk. Idiosyncratic risk to Yearn is yield dying out and staying low for a long time. Low yield means no incentives for investors to lock up funds in Yearn. Low yield could typically be a bear market phenomenon. How the Yearn team tackles long periods of low yields remains to be seen. Despite the recent drawdown in prices and muted sentiment, Yearn continues to offer lucrative yields on stablecoins and curve related products.

Conclusion

Despite Yearn finance being an open-source protocol where strategies can be copied, we think Yearn has a unique proposition – passively rotate funds to earn high risk-adjusted returns through well-incentivised strategists. We think Yearn Finance’s experienced team and its strong community is its moat. It has the highest TVL among the decentralised asset managers and, with equal profit sharing, is in the best position to attract smart alpha generators. Its ability to retain strategists should give passive investors the confidence that the platform will continue to find consistent alpha for them.

1One of the most important things to understand here is the origin of the yield. Traditionally, people borrow money and create more value than the borrowed amount to pay the interest. In DeFi, yield is generated by investors believing their risky asset will outperform the interest cost of borrowing stable coins. The other source of yield is protocol issuance, where protocols distribute governance tokens to active users and contributors of the protocol. ↵

2Those born between 1946 and 1964 ↵