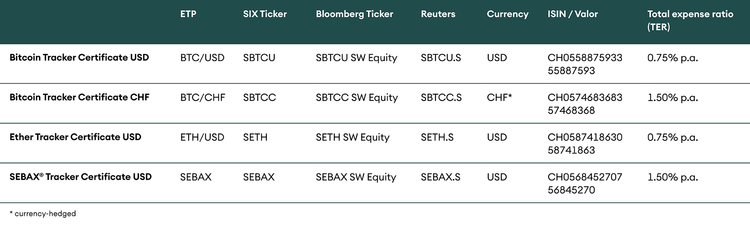

- Product suite consists of Bitcoin and Ether Tracker Certificates in USD, Tracker Certificate on the SEBAX® Crypto Asset Select Index and the first CHF currency-hedged Bitcoin Tracker

- SEBAX® – the market leading Digital Asset Index – is now available as ETP

- GHCO and SEBA Bank announce strategic partnership to bring multiple digital assets ETPs to market

Zug, 08 April 2021 – SEBA Bank, a FINMA-licenced Swiss Bank providing a seamless, secure and easy-to-use bridge between digital and traditional assets, today announced it is listing a suite of digital-assets-based exchange traded products (“ETPs”) on the SIX Swiss Exchange in partnership with GHCO, a leading liquidity provider specialising in exchange traded funds, from tomorrow, 09 April 2021.

The ETPs have been designed to provide investors with secure and cost-effective access to digital assets without the typically associated custody and security challenges.

The product suite consists of Bitcoin and Ether Tracker Certificates in USD, as well as the first CHF currency-hedged Bitcoin Tracker in the market. The Tracker Certificate on the SEBAX® Crypto Asset Select Index, a leading digital assets market index, is also being listed. SEBAX® is a unique combination of professional index methodology and bottom-up research. SEBA Bank´s Research unit applies the highest standards and complies with the Swiss Bankers Association research guidelines. Digital assets are selected according to a rigorous process combining quantitative metrics and in-depth qualitative analysis.

GHCO will act as the liquidity provider and market maker for the newly listed ETPs. The partnership between SEBA Bank and GHCO will leverage the firms’ respective expertise in asset management and market making as investor appetite for digital assets continues to grow.

Stefan Schwitter, Head Investment Solutions at SEBA Bank, said: “We believe our products stand out based on the institutional-grade quality and the highly competitive price points. We are providing a secure and cost-effective alternative to holding coins directly at exchanges.”

Guido Bühler, CEO SEBA Bank, added: “We set out to build a bridge from traditional banking to the digital world. Our product philosophy and the exceptional performance track record of the SEBAX® Index are a reflection of this ambition.”

Stefan Kaba-Ferreiro, Head of Trading and Managing Partner at GHCO said: “ETPs are a key development for investing in crypto assets as it matures as an asset class and we see more demand for reliable, easily-accessible infrastructure with deep pools of liquidity.”

Benefits of the listed products include:

- Fully backed by coins

- Low management fees

- Institutional-grade custody

- Highest quality processes of a licensed Swiss bank

- Excellent performance track record of the SEBAX® Crypto Asset Select Index

- Custodian bank is SEBA Bank AG

About GHCO

GHCO is one of the fastest-growing liquidity providers specialising in exchange traded funds. It strives to make ETFs accessible in every market worldwide with a focus on intelligent algorithmic trading, tight spreads, reliable presence and the expertise to price a wide range of products.

With offices in the UK and US, GHCO is a market maker on and off all major European exchanges. Throughout a single trading day, GHCO quotes thousands of products and helps asset managers to bring even the most niche and esoteric products to market.

For more information, please visit: www.ghco.co.uk

Media contact

SEBA Bank AG