Executive Summary

- The global economy continues to be a source of concern for investors, with the potential for a recession still at the forefront of many people’s minds

- In the cryptocurrency market, Bitcoin continues to see miners’ capitulation and low volatility, while Ethereum is facing the aftermath of the FTX issue and is preparing for the Shanghai upgrade. Liquid staking derivatives have been in the spotlight as the upgrade approaches

- Cardano has seen an increase in whale holdings and is now home to over 8,000 NFT projects while the Polkadot ecosystem has grown to include 74 parachains and over 300 Dapps

- Avalanche announced partnership with International Chess Foundation and Polygon launched the second testnet for its zkEVM

- In 2022, Chainlink provided its oracle services to a record number of developers and projects, enabling over USD 6.9 trillion in transaction value and Uniswap Labs raised USD 165 million at a USD 1.6 billion valuation and made several strategic moves

Outlook

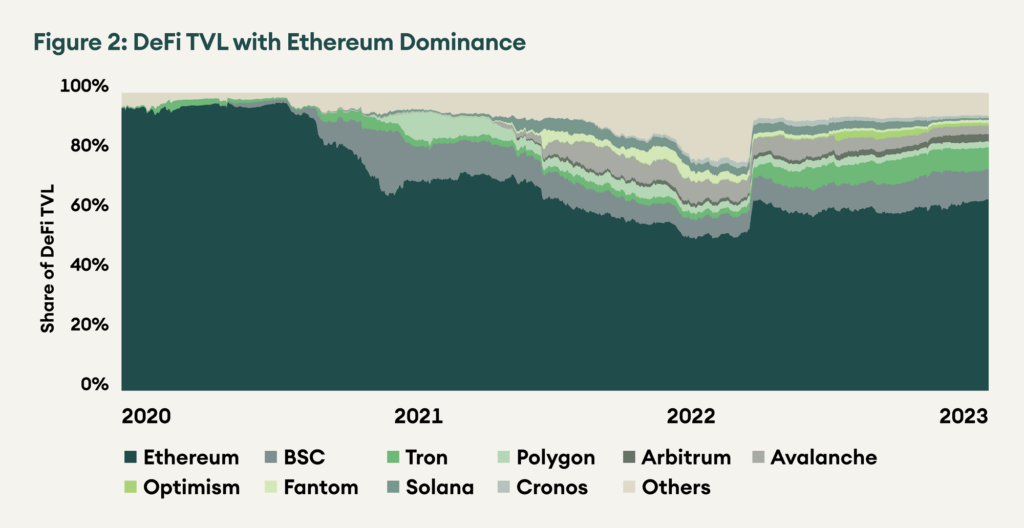

Some analysts are predicting further declines in the S&P 500 in the first half of 2023, followed by a potential buying opportunity before the Federal Reserve starts cutting rates in 2024 to support the economy in a potential recession. According to VanEck, the low point of the current crypto winter may come in Q1 2023 as Bitcoin tests the USD 10-12K range. Ethereum network is making progress with Visa recently proposing account abstraction for recurring auto payments and testing an autopayment application using StarkNet, a layer 2 solution on top of Ethereum, with Argent wallet. DeGods and Y00ts, two Solana-based NFT projects, will be migrating to Ethereum and Polygon, respectively, by the end of Q1 2023. Tezos aims to process 1 million transactions per second in 2023 with the Mumbai upgrade. The Stellar network saw significant growth in 2022 and will be able to support smart contracts in mid-2023. Aave’s $GHO stablecoin launch is expected to be one of the most anticipated developments in the DeFi space in 2023.

Macroeconomic Environment

Our thesis for this month is consistent with last month, as we had previously believed that recessionary concerns would again top the agenda, underpinned by high inflation and rising interest rates. This potential for a recession has been reflected in recent economic data from the US, including softer than expected wage growth and moderating non-farm payroll additions. However, the US economy is still creating jobs at a pace that is higher than what the markets had anticipated. This has led some to believe that the Federal Reserve’s tightening policies have been effective in containing inflation and maintaining economic growth without tipping the US into a recession.

Looking ahead, global banks have mixed predictions for the S&P 500 in 2023. JPMorgan expects market volatility to remain elevated with another round of declines in equities and the S&P 500 re-testing this year’s lows as the Fed overtightens into weaker fundamentals in the first half of the year. Bank of America anticipates a bearish outlook for risk assets in the first half of the year, potentially turning bullish in the second half as the market narrative shifts from inflation and rate “shocks” in 2022 to recession and credit “shocks” in the first half of 2023. Morgan Stanley believes that consensus projections for S&P 500 earnings per share (USD 220 in 2022 and USD 230 in 2023) fail to consider the possibility of declining volumes and loss of pricing power for companies. Citi sees the risk of a recession in the coming year as a key focus, with the potential for it to be the most widely anticipated recession in decades. Jefferies notes conflicting signals for US equities, with a softening dollar, a deep curve inversion, and moderating inflation expectations all contributing to uncertainty.

Overall, it seems that many analysts expect further selloff in the S&P 500 in the first half of 2023, with a buying opportunity potentially arising before the Fed is eventually forced to start cutting rates in 2024 to support the economy in a potential recession. It will be important to closely monitor economic data and the outlook of central banks in the coming months to get a better understanding of the direction the global economy is heading.

Bitcoin

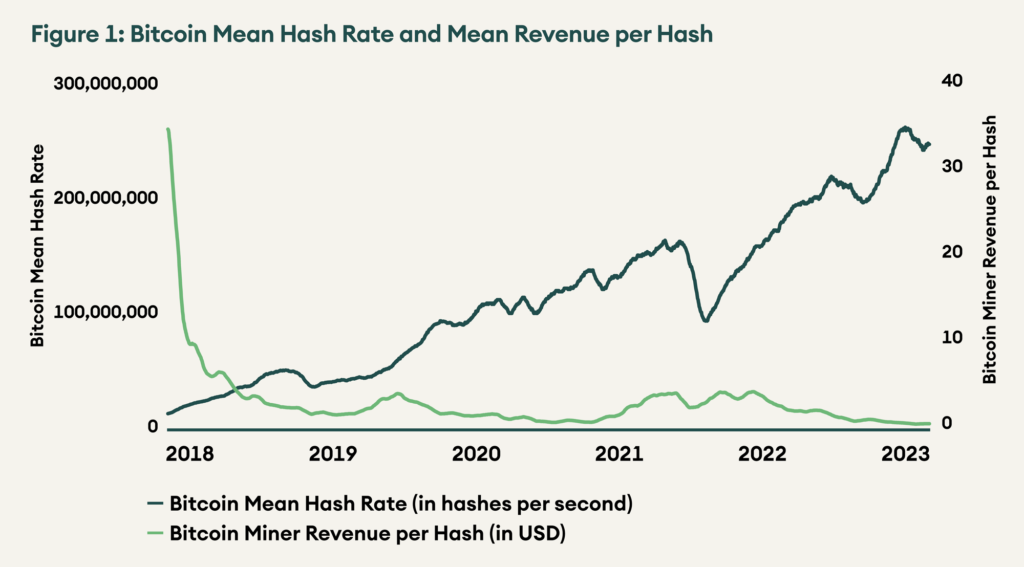

Amidst all the recent Gemini-Genesis-DCG drama in the market, Valkyrie Investments recently put out a blog proposing to become the sponsor and manager of the Grayscale Bitcoin Trust. MicroStrategy, another major institutional Bitcoin adopter, recently purchased 2,395 BTC for USD 42.8 million and said that it will release software applications and solutions powered by the Bitcoin Lightning Network in 2023. Meanwhile, Bitcoin miner capitulations continue and force unprofitable miners to shut down. According to VanEck, the low point of the current crypto winter may come in Q1 2023 as Bitcoin tests the USD 10-12K range amid a wave of miner bankruptcies. BTC dominance is currently at 38% and BTC’s volatility is at an all-time low.

The current price of Bitcoin is significantly lower than the average network cost basis (as evidenced by the MVRV Ratio being below 1) and is also lower than its production cost. This has led to the exit of inefficient miners from the network and the rewarding of the most efficient capital allocators. While this may be detrimental to Bitcoin’s price in the short term, as BTC reserves are often sold and bankruptcies declared, it ultimately increases the network’s efficiency and resilience in the long run.

Figure 1 – Bitcoin Mean Hash Rate and Mean Revenue per Hash

Ethereum

The effects of the FTX collapse are still being felt and have not yet fully dissipated. Recently, on-chain data revealed that about USD 1.7 million worth of tokens from Alameda-linked wallets were sold in the open market over several hours last week, with Ethereum-based tokens such as ETH, USDC, DAI, CRV, and CVX consolidated into two wallets and later sold for USDT. ETH’s dominance is currently at 17.5%. Despite this, there are exciting developments to look forward to. Visa recently proposed account abstraction for recurring autopayments, testing an autopayment application using StarkNet, a layer two solution on top of Ethereum, with Argent wallet. This application could allow for programmable payment instructions to push funds between self-custodial wallets at recurring intervals without active user participation, which could have significant implications for crypto adoption and user friendliness. In addition, the upcoming Shanghai upgrade has brought liquid staking derivatives into the spotlight. Lido has become the defi application with the highest total value locked (TVL), surpassing Maker with a TVL of USD 5.95 billion compared to Maker’s USD 5.93 billion.

Figure 2 – DeFi TVL with Ethereum Dominance

Litecoin

Grayscale’s Ethereum, Litecoin, and Bitcoin Cash Trusts are currently trading at steep discounts, with ETHE trading at nearly a 60% discount and the Litecoin Trust at a 65% discount. The entire collection of Grayscale crypto-based trusts is mostly trading at a discount, with the Ethereum Classic Trust hit hardest at a 77% discount, followed by the Litecoin Trust at 65% and the Bitcoin Cash Trust at 57%. Litecoin has had a strong start to 2023, climbing to the 12th spot on the market cap list. This year, Litecoin will undergo a halving event, which occurs once every four years and reduces the LTC block reward from 12.5 LTC to 6.25 LTC. The halving is predicted to occur on 3 August 2023, and some expect it to lead to a price rally similar to the one observed in November 2022, when Litecoin saw a pump of over 20% during its “pre-halving” period.

Stellar Lumens

Throughout 2022, the Stellar network saw significant growth, gaining over 1 million accounts to reach a total of 7.3 million accounts. The platform also saw a 176% increase in the total number of payments made on the network and a 1.9x increase in daily transaction volume. In June, the team announced that the network would be able to support smart contracts, and as of writing, Soroban is live on the Futurenet incentivized testnet, with plans to launch on the mainnet in mid-2023. In addition, MoneyGram Access, a cash-in and cash-out on/off-ramp service for digital wallets, was launched, and the Stellar Community Fund awarded a total of USD 2.3 million worth of XLM to 36 projects.

Polkadot

In the past year, the Polkadot ecosystem has grown to include 74 parachains, over 300 dapps, and 2,500 monthly active developers. The launch of the XCM (Cross-Consensus Message) has helped the network better leverage cross-chain interoperability, with over 350K XCM transfers made since its launch. In November 2022, the Web3 Foundation announced that after a three-year engagement with the SEC, the DOT token had been transformed from a security into software. In more recent news, Pendulum recently won Polkadot’s 35th parachain auction and aims to connect the fiat and DeFi ecosystems through a fiat-optimized smart contract blockchain on Polkadot. The company wants to help traditional financial services integrate with DeFi applications through their parachain on Polkadot.

Tezos

In 2022, the Tezos blockchain saw the Jakarta upgrade, which introduced enshrined transaction optimistic rollups, and the Lima upgrade, the 12th for the platform, aimed at improving the speed and smoothness of transactions on the network. Tezos has set a goal of being able to process 1 million tps in 2023, and the company believes this will be achievable with the new scalability features set to come with the Mumbai upgrade in early 2023.

Solana

NFT projects DeGods and Y00ts will be migrating to Ethereum and Polygon, respectively, by the end of Q1 2023. They were two of the top NFT projects on the Solana chain. Last week, aggressive selling of SOL led to the token reaching single-digit prices as low as USD 8 for the first time since February 2021. However, a tweet from Vitalik showing support for the Solana developer community stopped the decline, and to incentivize developers and traders to remain loyal to the platform, Solana airdropped the meme token $BONK to ecosystem participants. The airdrop has garnered attention, and $BONK has experienced significant gains.

Avalanche

The International Chess Federation recently announced a partnership with the Avalanche blockchain to bring its competitions into the web 3.0 space, potentially including the publication of tournament data and player rankings on-chain and hosting tournament prize pools on AVAX. The recent “Bankff 5” upgrade to Avalanche enables the interoperability of assets and data between subnets through the introduction of Avalanche Warp Messaging, which allows for native communication between subnets to transfer assets or data. This is intended to make it easier for developers on the Avalanche ecosystem to build and integrate subnets more seamlessly, as until now, subnets have largely remained isolated from each other unless complex bridges were used.

Polygon

Sandeep Nailwal, co-founder of Polygon, recently launched Beacon, a crypto startup accelerator program. In addition, Polygon launched the second testnet for its zkEVM, which is the final step before the mainnet goes live. This second testnet includes a new upgrade called recursion, which Polygon claims could exponentially increase scalability.

Aave

In 2022, Aave released details about its $GHO stablecoin. Once launched, it will allow users to deposit collateral in order to mint the stablecoin. Staked AAVE holders will receive a discount on the GHO borrow rate and mint price, providing additional utility for the AAVE token. The protocol expects to generate substantial fees from GHO-related activity. Its v3 upgrade boasts further capital efficiency, cross-chain liquidity through Portals, a high-efficiency mode for maximum borrowing power, and an isolation mode to reduce bad debt risks. However, in November 2022, an attack resulted in USD 1.7 million in bad debt for the protocol. In response, AAVE holders voted to deprecate several low liquidity assets due to the risk of price manipulation. While the incident had little impact on Aave’s operations, it serves as a cautionary tale for other DeFi lending protocols heading into 2023.

Uniswap

In 2022, Uniswap dominated DEX volume but faced competition from innovative projects such as GMX, which emerged as a blue-chip token on Arbitrum and gained significant attention from investors. Over the course of the year, Uniswap Labs raised USD 165 million at a USD 1.6 billion valuation and made several strategic moves, including launching an NFT marketplace after acquiring Genie and creating a venture arm. The company also deployed Uniswap v3 on Polygon and Celo, and passed governance proposals to deploy on Moonbeam, Gnosis, and zkSync v2. Additionally, Uniswap announced the ability to purchase crypto directly on its web app using a credit/debit card or bank transfer through a partnership with MoonPay. In response to the fee switch not yet being turned on, Uniswap governance passed a proposal to create a foundation and fund it with USD 74 million to replace the grants program. Looking ahead to 2023, Uniswap will continue to face competition and will need to stay innovative in order to maintain its leading position in the DEX market.

Synthetix

As the largest synthetic asset provider protocol, Synthetix made significant progress in development in 2022 despite SNX experiencing a fall of over 92%. The protocol’s first major development was the integration of atomic swaps directly into 1Inch, allowing users to swap assets at minimal cost with zero slippage. However, latency attack issues caused atomic swaps to be paused before an upgrade was implemented. Synthetix also expanded its presence on Optimism, with many protocols taking advantage of SNX liquidity and its synthetic assets, including Kwenta, Lyra, Overtime Markets, and Thales. In the coming year, the upcoming v3 release will rebuild the protocol’s infrastructure to allow for more modularity and customization.

Yearn Finance

Despite a decline of over 77% in its YFI token since January of last year, Yearn Finance continued to see development and innovation in 2022. The biggest announcement from the company was the release of Yearn v3 in May, which initially had the same functionality as v2 but aimed to make vaults more robust and allow for the iteration of Smart Modules with optimized debt allocation, strategy whitelisting, and dynamic fees. In November, Yearn introduced its new bribe platform, yBribe, for Curve gauge voting, which allows veCRV holders to receive compensation from buyers interested in increasing CRV emissions to their Curve pool’s gauge. Additionally, Yearn integrated with CoW Swap to assist users with complex swaps, and reduced management fees on key vaults such as ETH, USDC, and DAI as part of its long-term product vision to build innovative automated products that focus on performance.

Chainlink

In 2022, Chainlink provided its oracle services to a record number of developers and projects, enabling over USD 6.9 trillion in transaction value. The company expanded its services to new blockchains and layer 2s, and added support for the Solana chain. The introduction of proof of reserve checking using Chainlink has been adopted by leading stablecoins, wrapped tokens, and blockchain bridges to increase transparency around the reserves backing new on-chain assets. Staking was introduced as part of Chainlink Economics 2.0, which may have marked a new era for the company. The biggest development for Chainlink was the announcement that the SWIFT network would be using the company’s Cross-Chain Interoperability Protocol in an initial proof of concept to enable the transfer of on-chain tokens through SWIFT messages. It is to be seen what developments Chainlink brings in 2023 to help stay the market-leading oracle.

Decentraland

In 2022, the Decentraland desktop application saw over 161k downloads and linked wearables, which are the first step towards metaverse interoperability, were made available on the marketplace, with a total of 20k wearables and 12 collections available for purchase. The company’s VR experience is currently in beta testing through the Decentraland DAO grant program, with a total of 100 grants approved for a grand total of USD 6.2 million. Looking ahead to 2023, it will be exciting to see the continued development and growth of Decentraland as it works towards creating a fully immersive and interactive metaverse experience.

The Sandbox

The Sandbox saw significant progress in 2022 with the launch of Alpha Season 3 in August, which resulted in 17 million visits and saw over 360,000 users participate in various brand experiences, some of which had over 500,000 visits. A recent highlight for the company was the land raffle in November, which saw 14 brands and celebrities participate. Looking ahead to 2023, it will be interesting to see how The Sandbox continues to engage and attract users to its platform.

Enjin

In 2022, Enjin made several major moves to support and grow its gaming and NFT ecosystem. The company released the Enjin Wallet 2.0, a major upgrade to its mobile blockchain wallet launched in 2018, as well as the Enjin web wallet to make it easier for new users to manage their digital assets on the go. Additionally, Enjin announced a number of partnerships, including with Square Enix and Entropia Universe, to launch utility-based NFT collections.

Conclusion

The market appears to be performing well, with Ethereum showing particularly strong results compared to Bitcoin. In addition, certain liquidity staking derivative coins have experienced significant growth in recent days. The potential bankruptcy of DCG/Genesis remains unresolved and it is uncertain if it will lead to compelled selling. It is advisable to be aware of two forthcoming significant events: the release of the US December Consumer Price Index on 12 January and the Federal Open Market Committee’s interest rate increase on 31 January 2023.