Executive Summary

- The macro-environment for the next year is consistent with ease in global liquidity conditions. We expect risky assets like cryptocurrencies to recover

- Since the blockchain technology is battle tested and is solid, we are confident the technology will continue developing, and cryptocurrencies will strengthen again

- We expect Bitcoin to retain its throne. The key metric to track would be miner profitability, which, if economically unsustainable, could lead to a less decentralized bitcoin network

- Ethereum rollups are pipped to bring in the next wave of adoption with the chain’s upcoming upgrades after The Merge that was successfully completed in 2022. ZK-based rollups are expected to provide stiff competition to optimistic rollups soon

- The “Modular vs Monolithic Blockchains” conversation is one to follow closely. Modular chains would observe increasing adoption once they go mainstream

- Web 3 identity and decentralized social network protocols are two narratives that could uncover potential on-chain DeFi markets that make access to credit easier

- We do not see the need for new layer one protocols, as many exist already. The case of Solana is particularly interesting in this context

- With institutions continuing to double down on their involvement in the digital assets space, there is now increased demand for better regulations to protect customers and investors

- 2023 is expected to provide a conducive environment for developers to build and experiment on different ecosystems before letting any major narratives take over

Introduction

2022 was a rough year for crypto. Events like the Terra (LUNA) crash, the losses on Celsius, the Three Arrows Capital implosion, and of course, the FTX-Alameda collapse, each took the market to where it is now.

These crashes have left many scarred and have undermined the general confidence in blockchains and cryptocurrencies. However, in this crypto winter, development and innovation have continued, and a few trends are emerging. In this special edition of the Digital Investor, resolutely forward-looking, we present our outlook for 2023.

We see no threat to Bitcoin and confidently say it would remain the leading crypto asset. Ethereum will continue implementing the roadmap it started last year with “The Merge”. We expect increasing rollup adoption on the network. Institutional participation has increased this year and with it, the need for transparency and regulation. Compared to this year where we have seen a few layer one (L1) protocols propping up, we expect modular blockchains to play an essential role in 2023 and beyond. Decentralized social networks and web 3 identity are two topics we would follow closely.

We expect higher regulation and institutional adoption to go hand in hand. As a result, Centralized Finance (CeFi) actors like Centralised Exchanges will offer better consumer and investor protection. There will be less unregulated CeFi in the future as they do not provide safety, as this crisis shows.

At the same time, we also expect higher off-chain and on-chain transparency. For instance, some CEX have taken the first step by voluntarily showing a Proof of Reserves (PoR) of assets held by users on their platform. Transparency is a cardinal value of blockchains and can be used to enhance the quality of DeFi applications. The security will be enhanced by providing a transparent and accurate real-time state of any DeFi balance sheet.

Macroeconomic outlook

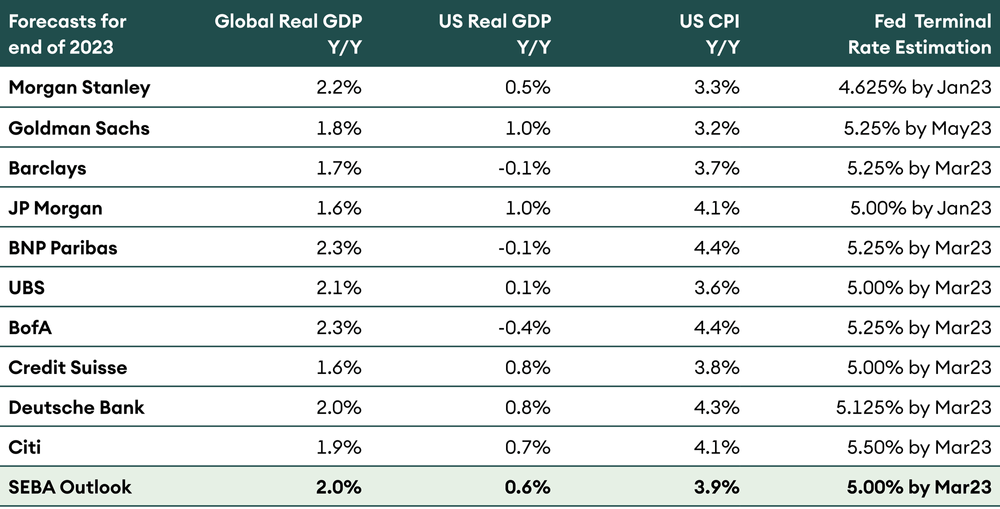

There is no clear consensus for the macroeconomic outlook. An overview of a few big investment bank forecasts illustrates the divergence in views.

- JP Morgan expects the Federal Open Market Committee (FOMC) to tighten monetary policy by another 100 basis points, taking the fed funds range to 4.75-5%

- Goldman Sachs thinks the US will avoid a recession due to a strong labour market and the normalization of supply chains

- In contrast, Bank of America’s Ethan Harris predicts a recession in the US, Europe and the UK in 2023

Our analysis suggests that US inflation has peaked, and the Fed will hike interest rate further but with less impetus. In case of marked growth slowdown negatively impacting the labour market, we think the Fed will accommodate monetary conditions to absorb part of the slowdown as it has done repeatedly in the past. If this scenario materializes, most of the tightening is already priced in and global liquidity conditions should not weigh much on cryptocurrencies.

Table 1: 2023 Forecasts

The Crypto Winter and the 4th wave

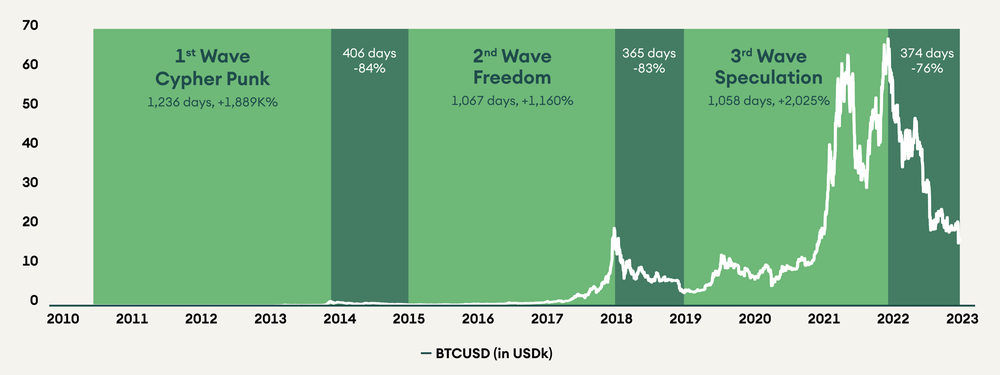

The decline in BTC price started in November 2021 when US inflation passed the 6% mark. It led to a change in global monetary conditions, from low rates and ample liquidity to a world of higher rate and lower liquidity. This change in global liquidity conditions has changed the macro landscape and impacted crypto, equities, and fixed income. This episode showed that bitcoin is a liquidity asset.

However, what happened in 2022 is not only about macro; it is mainly about crypto. Terra’s collapse was the first big shock, and FTX the latest. Many things went wrong. First was the financial engineering of the unbacked algorithmic stablecoin (in this case, UST) – a category of stablecoin we have always been skeptical of. The collapse of UST, the Terra stablecoin, showed the interconnectivity of crypto finance and the absence of lender and buyer of last resort. Soon, the shock hit Celsius, an unregulated Centralized Finance (CeFi) platform, shedding light on poor risk management and paving the way for better risk controls via regulation. More recently, the FTX debacle sadly confirmed what Celsius’ brought attention to.

It is worth noting that Decentralised Finance (DeFi) applications did well for two reasons. First, smart contracts make rules clear to every participant and the rules (e.g. margin calls) are applied automatically, without exception and delay. Second, DeFi lending applications master over-collateralized loans, mitigating the risks of bank runs.

While 2022 is a crisis year for the cryptoverse, the root of the crisis is financial, not technological. This is a financial crisis because poorly designed cryptocurrencies collapsed and badly managed CeFi went under. This is not a technological crisis as blockchains continue to work smoothly. In the case of bitcoin, a block is added on average every 600 seconds, independently from price level and market stress.

This crypto winter is the third since the invention of Bitcoin. The technology is battle tested and is solid. There is no reason to believe that this time is different and that bitcoin & co will not strengthen again.

Bitcoin (BTC)

Bitcoin is the leading cryptocurrency. It has held onto its throne since the inception of the industry, and will continue to do so next year, even though its market share is on a downward trajectory.

Mining profitability will play a crucial role in maintaining the sanctity of the Bitcoin network. Currently, miners are under significant pressure as the combination of elevated mining difficulty and low BTC prices makes this activity unprofitable. The direct consequence of it is for miners to sell more BTC to cover their running cost, adding selling pressure.

Earlier this quarter, Core Scientific, the largest Bitcoin miner by hash power, stated that they were not sure if they would be able to continue operating in twelve months if this trend continues.

According to JPMorgan Chase & Co. analysts, the current cycle’s bottom for Bitcoin is around the USD 13K mark as they expect the bitcoin production cost to revisit the USD 13K low. Furthermore, if contagion continues to reverberate from FTX’s bankruptcy, Bitcoin may have more room to fall.

The recently introduced Bitcoin Core 24 upgrade has been controversial, but it has also been a blessing in disguise for the network since it indirectly increases miner revenues. In the current bear market, it is essential for the network to remain sufficiently decentralized to remain attractive to investors. Decentralization is one of the key value bitcoin offers.

Therefore, miner revenue is a key metric to watch over the next few quarters. If mining stays unprofitable for a long time, it could force many miners to capitulate, purging out smaller miners and leading to a relatively more centralized Bitcoin network.

If macro conditions improve, we may see an increase in investments into Bitcoin next year. Institutions have started offering crypto exposure to clients, particularly in Bitcoin and Ethereum. If this trend continues, we can expect a significant inflow of institutional money into the space once global liquidity conditions stabilize.

Monolithic vs Modular Blockchains

The Cosmos ecosystem attracted a lot of attention in 2022. What set it apart from others like Ethereum, Solana and Avalanche is its architecture, scaling and economic model. It is a modular blockchain, not a monolithic one like Ethereum. The one that comes close in comparison is Polkadot. This has sparked a conversation in the market – “Monolithic blockchains vs Modular blockchains”. Let us see what this is all about and why we can expect this conversation to continue well into 2023.

Blockchains can be divided into two main categories: monolithic and modular. In monolithic blockchains, all key functionalities are handled internally within a single base layer. This means that data availability, settlement, and execution are all handled within a single, limited space. Examples of monolithic blockchains include Bitcoin and Ethereum. In contrast, modular blockchains handle only a few key functionalities within the base layer, outsourcing the rest to other layers. This allows for more flexibility and scalability but can also introduce additional complexity.

The argument for monolithic chains has been made and the model has also been proven through its poster kid Ethereum. On the other hand, the modular blockchain concept is newer and is yet to be proven in the market to be equally good, if not superior, to the monolithic one. Polkadot is built on this concept, but its economic and scalability model is not the same as that of the Cosmos ecosystem. The Cosmos ecosystem has a mesh-like network with individual app chains connected to one another with the Cosmos Hub at the center. From all the activity on the ecosystem, the value for monetary premium is supposed to be accruing primarily to the ATOM coin, similar to Ether on Ethereum. The case for the sustainability of app-chains has been made multiple times this year with dYdX being the one of the first few major decentralised applications (dapps) to fork off into chains of its own. Other popular chains within Cosmos include Osmosis (the primary DEX on the network) and the Binance Smart Chain. In fact, Terra was connected to the Cosmos ecosystem. What made the case for modular chains stronger was the fact that Terra’s collapse did minimal if not zero damage to the other Cosmos chains.

The case for modular blockchain architecture is made stronger by innovative projects like Celestia. Formerly known as LazyLedger, Celestia aims to become the plug-and-play data availability and consensus layer that enables developers to launch new chains without the need to bootstrap a new consensus network. One can consider it to be aimed at becoming a sort of decentralized cloud computing company. What Amazon Web Services has been to web 2 companies, Celestia aims to be for web 3. The project aims to provide consensus and data availability on-demand. It does this by separating consensus and execution into separate layers. Using its Celestia-node component, validators can participate in consensus while its Optmint component enables any Cosmos zone to deploy as a rollup directly on top of Celestia. Currently, Celestia is in test net phase with mainnet launch slated for 2023.

Web 3 Identity

Among the various narratives that had their run in 2022, one seemed to not quite go the distance – Web 3 Identity. There are multiple teams building protocols for decentralised social networking but none of them gained enough traction to make headlines.

The idea is simple – unlike web 2 social media platforms where data generated by the user is harvested for monetary reasons by the company, the user owns all their data on web 3 social networks. With teams still working on their respective projects, it has been an unfinished story for this cycle and will most likely make a comeback in the next.

Arguably the most popular in the space is Lens Protocol. It is being built by the team behind the DeFi protocol Aave. The team has a great track record with Aave currently being the third biggest defi protocol after MakerDAO and Lido. Lens is built on Polygon, and it uses NFTs to represent user profiles. To login, users need to hold the NFT minted by Lens (specific to the user’s profile) in their wallet. There are several apps being built to be compatible with Lens. These include (and are not limited to) Lenster, Lenstube, Huddle01, Lensport, Phaver and StemsDAO. Each app serves its own purpose which could be video sharing, video calling, open-source bounties, music streaming, etc. Users can log into these apps using their Lens profile. Farcaster, Steemit and Mastodon are a few others building something like Lens.

While this by itself is a big leap in the social networking space, it could be the stepping stone to something much bigger. Since each user’s activity on these platforms is recorded on chain, one possibility is that this data can be used to arrive at individual users’ credit history. If a mechanism can be established in order to arrive at these credit history metrics according to wallet activity, it can enable easy access to under-collateralized (and possibly even unsecured) debt and credit facilities for non-KYC’ed users on chain. A protocol with an in-built mechanism like this one would increase DeFi participation since it offers advantages when it comes to user privacy while also helping them build an on-chain credit score for doing so.

The Future for Solana:

There are events hurting Solana’s sustainability and some developments are pushing for growth. As of writing, there is no right or wrong call one can make with respect to its future. It would therefore be wise for investors to keep an eye on the developments on the ecosystem to gauge the direction it is moving in.

Solana is the most impacted cryptocurrency in the FTX-Alameda contagion (after FTT) but it remains a leading L1 blockchain with a strong community.

As a result of the sharp fall in Solana price, security concerns persist since the cost of an attack has diminished. In addition, the network went down due to the fall in number of nodes over the past few months. Also, it is to be seen how the newer so-called “Solana Killers” Aptos and Sui (another upcoming L1 project) compete with Solana’s market share.

USDC issuer Circle recently announced that they would be expanding into five new chains next year and are going to be launching their own cross-chain interoperability protocol. While this is good news for USDC, it is not for Solana which has been the primary chain for USDC thus far. It is premature rule Solana out of contention for a top-ten spot for the next cycle.

Concerns surrounding validator centralisation risk of Solana have alleviated after the FTX bankruptcy announcement. Discussions regarding network downtime have reduced after such events have significantly reduced. Serum, which was the liquidity backbone on the chain that went down during the FTX collapse, has been forked by the community into OpenBook. OpenBook is a community-driven fork of Serum’s V3 program. This fork of the Serum program essentially allows the community to have a shared custody of Serum’s infrastructure and governance. Whether the Solana community coming together at this time of difficulty is what it takes to take it back to its glory days, or the chain is a slowly sinking ship is to be seen.

Layer One Saturation

We expect Ethereum being the leading layer 1 (L1) like it is right now. We expect it to face competition from modular blockchains which will attempt to break the pattern of monolithic supremacy.

This cycle has seen many attempts at (L1) disruption. While Ethereum gained prominence back in 2017 last cycle, newer ones like Solana, Avalanche, Fantom, Cardano and Terra (LUNA) tried to dethrone it this time around. There were many more but these have arguably been the most popular. However, as of writing, none of them even come close to Ethereum in TVL, daily active users or revenue. While Terra was knocked out of competitions after the collapse of UST, Solana has been deeply affected by the FTX-Alameda implosion and has lost most of its TVL. Avalanche, Fantom and Cardano remain stronger than they were before but still find difficult to compete with what Ethereum has to offer.

The main driver for increasing Ethereum activity has been rollup adoption. Arbitrum and Optimism have reduced gas fees on Ethereum to a fraction of what they used to be on main net. In addition to these, zkSync, Loopring, Boba and Metis continue to bring in users. The Polygon PoS chain has helped numerous web 2 companies enter web 3. Starbucks, Reddit, Adidas, Stripe and Meta are only a few notable ones on the list. While these companies use Polygon for transacting on-chain, settlement happens on Ethereum. This is because of Polygon’s ultra-low fees and the market’s association of credibility with Ethereum.

Innovations mostly include the opportunities offered by the dapps being built on rollups. These opportunities can now be unlocked, thanks to these rollups’ near-zero gas costs. In addition to this, other breakthroughs have been in the form of different blockchain models such as modular blockchains. Therefore, it is starting to look like the L1 blockchain market may be saturated. Users may have stopped looking for better L1 experiences. They are instead more likely to scan for rollups that offer the least transaction fees or dapps that offer good user experience paired with utility.

Institutional Participation

Institutional adoption of web 3 is not coming, it is already here! A plethora of web 2 companies including Meta, Adidas and Starbucks have entered the space through NFTs and participation in the metaverse segment. The big banks like Goldman Sachs, JP Morgan Chase and Morgan Stanley are here as well. While such companies are approaching web 3 participation from a business development point of view, some are taking an investment-first route.

The adoption of bitcoin by institutions is accelerating, with the world’s largest asset manager, Blackrock, launching a bitcoin private trust and the largest 401(k) provider in the US, Fidelity, allowing investors to add cryptocurrencies to their retirement schemes. A report by Boston Consulting Group, Bitget and Foresight Ventures predicted there will be 1 billion crypto holders by 2030. While this may seem like a long shot now, we most likely will see it happening much sooner.

Brokerage firm Bernstein recently said that institutional investors remain committed to cryptocurrency despite the recent fall in prices, with some planning to increase capital allocation to the sector. They added that many investors who were ambivalent about digital assets in late 2021 had delayed their plans, but those who were already active in the sector continued to look for opportunities.

However, security and illegally acquired cryptocurrencies remain a concern for institutions since they cannot afford to risk unknowingly being party to fraudulent transactions. Banks are therefore looking to implement on-chain analytics to help identify money laundering patterns in the growing cryptocurrency and digital assets space. A Chainalysis report found that over USD 14 billion of illicit transactions took place in 2021, meaning that it is critical to build the infrastructure to support the growing institutional appetite for digital assets. On-chain analytics query public blockchains to help identify trends in transactions, enabling institutions to detect patterns of money laundering and other illicit activities. These solutions must align with existing anti-money laundering controls that banks already have in place. Another reason as to why AML and transaction monitoring must be in place is due to the trends, we are seeing in the technology growth. In the last two years, we have seen new models like cross-chain bridges, and transaction mixers like Tornado Cash increasingly being used. Keeping security systems updated and more efficient with the speed of technology growth is important to attract the institutional capital into digital assets.

Regulation and transparency as trust mechanisms

Another major topic of discussion, in the traditional finance space and in the digital asset ecosystem is who to trust with investments. This directly leads to two important schools of thought. One of them says that trust will be improved with more regulations but at the cost of more centralization. The other one sees value in being 100% transparent with the users which would lead to a more decentralized industry.

After the collapse of FTX, it seems clear that regulation will come as 100% transparency is more a wish than a real possibility, however we will see that there are ways to improve transparency. IOSCO, the world securities regulator, considers it necessary to start the discussion and mentions the possibility of taking available frameworks and financial principles to be used as reference for crypto regulations at a global level. In this respect, 2023 will be a crucial year for the crypto market to see which new rules will be written, leading to more supervision and centralization, and to better consumer and investor protection.

We see the acceptance of digital assets growing at a global level but with more regulated activities in play. For example, the new UK prime minister has shown interest in making the UK a hub for crypto. Also, FCA recently changed the limit for crypto in a diversified portfolio to 10% instead of zero earlier. Similarly, in the USA, there are on-going discussions on how to consider crypto as an asset class in order to provide regulatory measures. For example, whether akin to equities or commodities etc., since different entities (in this case, the SEC and the CFTC, respectively) handle each of them and may have different ideas for regulations for the crypto market. Once this dilemma is cleared up, retail investors may feel safer with regulatory protections and an influx of capital in the digital asset ecosystem can be expected.

Due to the recent collapse of FTX and Alameda Research entities, there is a possibility of regulations focusing specially on the areas where conflict of interests exists such as trading, brokerage, custody etc. We may see new regulated entities emerging in these segments, making crypto banking a more lucrative business.

Having spoken about the first school of thought (regulation to protect customer), let us get familiar with another set of equally, if not more, compelling, ways to address the problem of trust – increasing transparency/decentralization as a means to protect customers. This advocates for complete transparency while maintaining anonymity (if required).

To achieve this, Proof of Reserves (PoR) has emerged as a favored way to be transparent. PoR is an independent audit conducted by a third party to confirm the assets held by custodians on behalf of its clients. This reconciliation of asset holdings can be done off-chain or on-chain. In case of off-chain reconciliation, a trusted analytics service provider can verify the holdings of the custodian/exchange independently upon receiving the data from auditor. Similarly, in on-chain verification, a PoR smart contract is implemented on one network with data injection from analytics service provider about assets held in wallets on another network.

However, PoR does not show a completely transparent nature of books published by the custodians/exchanges unless supported by proof of liabilities. The latter made more sense after Crypto.com recently transferred about 280K ETH to another address after it released its PoR audit raising more questions in the mind of investors about audit reliability. Dishonest actors can fake their audits by borrowing assets just to show to the public for the sake of transparency. Since there are no clear rules or standard operating procedure to ensure what constitutes a fool-proof audit, showing assets without liabilities has close to zero credibility.

There are no clear indications as to what the most efficient implementation could be. However, it seems that a PoR is an important step to create a robust self-regulatory commitment, though this is the bare minimum regulatory measure to be adopted by the centralized exchanges to gain investors’ trust. Till now, a few exchanges such as Binance, Kraken and Bitmex have completed their PoR audits while others have announced plans to follow suit. However, there are assumptions in PoR about the auditor, the method chosen and the credibility of assets in reserve that make verification of transparency inefficient.

FTX’s collapse came with a sliver of silver lining, paving the way for increased decentralization. This problem of asset recovery in case of bankruptcy is not related to just FTX but is inherent to all centralized exchanges, also known as custodial exchanges. Customers’ assets stored on these exchanges are prone to the risk of the exchange going bust which, if it happens, would result in a close-to-zero chance of being able to recover them as there are no laws for protection to cover these losses. This catastrophe therefore marked a step forward in the direction of adoption of decentralized exchanges (DEXes). DEXes, also known as non-custodial exchanges, are DeFi protocols that allow users to trade directly with other users via smart contracts. Unlike centralised exchanges (CEXes), a DEX does not have any control over users’ assets, giving the user complete and exclusive control over their coins/tokens. After the collapse of FTX, DEXs saw a spike in trading volume. In fact, according to DeFi Llama, the monthly DEX volume showed an 80% increase month-on-month from October to November.

Conclusion

There were a lot of emerging trends among big directional winds in the crypto ecosystem that defined the year 2022. We saw heavy funding rounds at that start of this year, traditional brands stepping their way into crypto markets, anticipating a more regulated environment and client demand in the next wave, Ethereum moving towards a more sustainable future, Terra’s “Lunar eclipse” with the year ending with the biggest jolt to the crypto market – The FTX-Alameda Collapse and the resulting contagion, turning the year into a decade.

These changes have purged the digital asset ecosystem of several bad actors. A level of transparency has started to come in where there are ways to see beyond visible metrics not just for institutional investors but also for retail players. We saw the right questions starting to be asked before the space possibly evolving into a bigger powder keg.

2023 is expected to provide a conducive environment for developers to build and experiment on different ecosystems before letting any major narratives take over. Many venture capital and other funds have already raised or are in the process of raising fresh rounds of capital for deployment in the crypto markets. We are expecting to see a rise in investments. Markets are evolving in terms of users acceptance and are expected to continue at an increasing pace.