Executive Summary

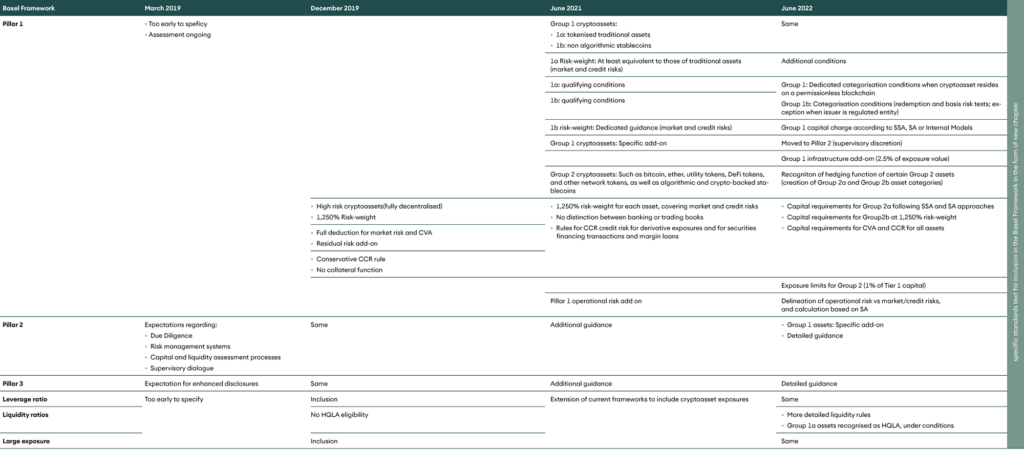

By issuing its second consultative document on the prudential treatment of cryptoasset exposures, and proposing standard text for inclusion in the Basel Framework, the Basel Committee on Banking Supervision (BCBS) has approached the finishing line of its effort started in 2019 to include cryptoasset exposures in the global prudential regulatory framework applicable to banks.

The thinking of the BCBS has evolved over time, from (1) the early identification of a high-risk category of unbacked cryptoassets to be charged with the highest possible capital charge, to (2) a comprehensive framework characterised by

(i) the distinction between four groups of cryptoassets

A. tokenised traditional assets;

B. non-algorithmic stablecoins; other cryptoassets;

C. meeting hedging criteria;

D. not meeting hedging criteria),

(ii) qualifying conditions for each category,

(iii) dedicated methodologies for calculating regulatory capital charges for market and credit risks for each category,

(iv) the application of the harshest possible capital charge for exposures to cryptoassets C and D,

(v) an approach to calculate the operational risk charge,

(vi) the introduction of an infrastructure add-on for cryptoassets A and B,

(vii) the introduction of an exposure limit for cryptoassets C and D,

(viii) the possibility for supervisors to implement specific add-ons,

(ix) the inclusion of cryptoasset exposures in the leverage ratio, liquidity ratios, and large exposure frameworks,

(x) the limited recognition of cryptoasset A as high-quality liquid assets, and

(xi) detailed disclosure guidance.

On balance, over time, the complexity of the regulatory framework has increased and has become more conservative. Some of the infrastructural/operational conservatism (see vi–viii above) may be gradually relaxed after enhanced confidence is gained over the distributed ledger technology. The attribution of the harshest possible capital charge to cryptoassets C and D needs further work, as it mixes different cryptoassets such as, unbacked layer 1/layer 2 cryptoassets and algorithmic stablecoins.

First, the BCBS should appreciate that the value of cryptoassets comes from the value of the protocol they carry – evidenced by its usage. Currently, the BCBS attributes the highest risk to ‘unbacked’ cryptoassets such as bitcoin and ether because it cannot identify an underlying traditional asset from which to derive a risk profile (let alone a (central) counterparty or intermediary). Second, and consequently, the BCBS should distinguish between unbacked cryptoassets and algorithmic stablecoins.

The inexorable inclusion of cryptoasset exposures in the Basel Framework

The Basel Framework is the global prudential regulatory framework applicable to banks that the Basel Committee on Banking Supervision (BCBS) has been developing since 1975. The BCBS has begun the work to include in the Basel Framework banks’ cryptoasset exposures in 2019, when it issued a newsletter and a discussion paper. The triggers were the relative growth of cryptomarkets and the emergence of jurisdictions, such as Switzerland, characterised by initial exposures of banks to cryptoassets and related service providers. The BCBS issued a first consultative document on the prudential treatment of banks’ cryptoasset exposures in 2021, and a second one on 30 June 2022, which is in consultation until 30 September 2022. In what follows, we review the work done so far by the BCBS to include cryptoasset exposures in the Basel Framework. We point out innovations and continuities (see also Figure 1), and propose an assessment.

The Basel Framework

As a way of introduction, the Basel Framework consists of:

Three Pillars

- Formulaic, risk-based minimum capital requirements for market, credit, and operational risks (according to a menu of approaches), and a leverage ratio (as a backstop to risk-based capital requirements);

- Supervisory review process, covering risk management and supervision, driving supplemental (capital) requirements and expectations regarding the management of interest rate risk in the banking book; and

- Disclosure requirement, meant to foster market discipline.

Other elements

such as the definition of capital, formulaic liquidity standards (liquidity coverage ratio [LCR] and a longer-term net stable funding ratio [NSFR]), large exposure limits, and core principles for banking supervision.

2019 Newsletter

On 13 March 2019, the BCBS issued a newsletter in which it anticipated the continued growth of cryptoassets and the possibility that this development could increase the risks faced by banks, including those related to liquidity, credit, market, operational, money laundering, terrorist financing, legal, and reputation. The Committee formulated the expectation that banks authorised to acquire cryptoasset exposures, or provide related services, should, at a minimum:

- Perform proper due diligence of exposures to cryptoassets related to the mentioned risks;

- Adapt their governance, risk management, capital, and liquidity adequacy systems to ensure their robustness in view of the enhanced risks;

- Enhance transparency and disclosure; and

- Foster an appropriate supervisory dialogue about these new exposures.

From the perspective of the Basel Framework, the expectations laid out in the newsletter relate to Pillars 2 and 3. The Committee refrained from formulating Pillar 1 capital and liquidity charges for cryptoasset exposures, and from commenting on other elements such as leverage ratio, large exposures, and liquidity provisions.

2019 Discussion paper

Building on the analyses and concepts proposed in the newsletter, on 12 December 2019 the BCBS issued a Discussion paper on Designing a prudential treatment for crypto-assets, with the goal to engage with the industry in including banks’ cryptoasset exposures in the Basel Framework. The view taken by the Committee was that the lack of standardisation, rapid growth, and high volatility of cryptoassets justify a conservative global prudential standard. The key innovation was the formulation of a Pillar 1 capital charge for exposures to cryptoassets considered high risk, and setting it at the most possible conservative level.

- High-risk cryptoassets – The BCBS defined a category of ‘high-risk’ cryptoassets in terms of assets recorded on a distributed ledger technology (DLT), secured cryptographically, not issued by a jurisdictional authority of another identified issuer, having no intrinsic value, nor linked to or backed by assets with intrinsic value, and the holding of such assets not giving rise to contractual obligations between the holder and an identified issuer. The BCBS identified bitcoin and ether as such assets, which constituted over 80% of the market capitalisation of cryptoassets in 2019. The committee recognised the emergence of other types of cryptoassets such as tokenised assets or stablecoins, but took the view that these other cryptoassets warrant further assessment before specifying a prudential treatment.

- Harshest Pillar 1 charge – The Committee proposed to apply the harshest possible Pillar 1 minimum capital requirement to banks’ exposures to such high risk cryptoassets. This is done by applying a 1.250% risk-weight factor to the standard 8% of the original exposure. Holding USD 100 equivalent of bitcoin on the banking book would attract (100*8)/100)*(1,250/100), that is, USD 100 of core capital. This is the highest possible capital charge in traditional finance, and applied only to the worst externally rated securitisations. The holding of such exposure on the trading book would equally be most conservatively subject to the equivalent of full deduction treatment for market risk and credit valuation adjustment (CVA) risk, whilst exposures bearing residual risks would be subject to a relevant add-on.

- Other provisions – Banks would not be permitted to use internally modelled approaches for any cryptoasset exposures. Cryptoassets would not be eligible to serve as financial collateral for the purpose of the credit risk mitigation framework, or as high-quality liquid assets (HQLA) for the purpose of the LCR and NSFR. Exposures to cryptoassets would be included in the leverage ratio calculation, and subject to the large exposure limits. The Committee referred to the expectations formulated in the March 2019 newsletter as far as the provisions of Pillars 2 and 3 are concerned.

2021 First consultation document

On 10 June 2021, the BCBS issued for consultation the document ‘Prudential treatment of cryptoasset exposures’. The key innovation was the specification of various types and categories of cryptoassets, beyond the high-risk or not-high-risk categories. The key continuity was the maintenance of the highest possible capital charge for banks’ exposures to cryptoassets others than tokenised traditional assets and non-algorithmic stablecoins.

Three groups of cryptoassets

The Committee introduced the following categories:

Group 1 cryptoassets

- Group 1a: tokenised traditional assets

- Group 1b: non-algorithmic stablecoins

Group 2 cryptoassets

Capturing (all) other cryptoassets, such as bitcoin, ether, utility tokens, DeFi (Decentralised Finance) tokens, and other network tokens, as well as algorithmic and crypto-backed stablecoins.

Dedicated Pillar 1 market and credit risk charges

The committee proposed Pillar 1 formulaic minimum capital charges against market and credit risk raised by exposures to each group, and specified qualifying conditions.

Group 1a

The capital charge should be at least equivalent to those of the underlying traditional assets. The categorisation into Group 1a would be subject to a set of specific conditions that the cryptoasset must always meet cumulatively.

Group 1b

There would be a new, dedicated Pillar 1 guidance. Non-algorithmic stablecoins would only qualify for inclusion in Group 1 cryptoassets if they are redeemable for their underlying assets.

Group 1

All cryptoassets qualifying for Group 1 may be subject to a specific capital add-on.

Group 2

The capital charge would be calculated by applying a 1.250% risk weight to the standard 8% of the original exposure (see above). The risk-weighted assets would be calculated for each Group 2 cryptoasset separately. The risk weight would apply to the greater value between the absolute value of the aggregated long positions and the absolute value of the aggregated short positions. There would be no distinction between banking and trading book positions. The proposed treatment would capture both credit and market risks, and the CVA risk. The BCBS also specified rules to calculate counterparty credit risks (CCR) for derivative exposures having Group 2 cryptoassets as underlying assets, and proposed rules for securities financing transactions and margin loans involving these cryptoassets.

Operational risk charge and other guidance

The BCBS anticipated the need to supplement the Pillar 1 minimum charge with an operational risk add-on, as well as to provide additional guidance under Pillar 2 (supervisory review process) and Pillar 3 (disclosure), and to extend the current leverage ratio, large exposures, and liquidity ratio frameworks to cryptoassets.

2022 Second consultation document

On 30 June 2022, the BCBS published the ‘Second consultation on the prudential treatment of cryptoasset exposures’. The consultation paper amends and complements the first consultation document on several scores, whilst retaining the structure in ‘Groups’, and proposes for the first time specific standards text for inclusion in the Basel Framework. On balance, the complexity of the regulatory framework increases whilst the rules become more conservative. Key amendments and complements to the June 2021 document include:

Qualifying conditions for Group 1

The Committee solicits industry feedback on any modifications to the classification conditions that would be required to permit the inclusion in Group 1 of cryptoassets that use permissionless blockchains, and on the risk and ways to mitigate it that such modifications would raise.

Qualifying conditions for Group 1b

The document proposes to refine the categorisation conditions driving the inclusion of stablecoins in Group 1b. Stablecoins would qualify for inclusion in Group 1b only if they meet a:

- redemption risk test (demonstrating that the reserve assets are sufficient to enable the cryptoassets to be always redeemable) and

- basis risk test (aimed to ensure that the holder of a cryptoasset can sell it in the market for an amount that closely tracks the peg value, specified in terms of bps differences between the peg and the stablecoin market value).

Cryptoassets that meet all the classification conditions for inclusion in Group 1b, but only narrowly pass the basis risk test, would be subject to an add-on to risk-weighted assets.

The BCBS recognises that banks’ exposures to stablecoins issued by regulated entities would generally be lower risk than those issued by unregulated entities, and should be subject to a capital treatment alternative to the one specified in terms of redemption and basis risk tests.

The Committee proposes to calculate the capital charges for Group 1 cryptoassets market risk according to three methodologies – Simplified Standardised Approach (SSA), Standard Approach (SA), and banks’ Internal Models – approaches already in use for exposures to traditional assets.

Infrastructure add-on for Group 1

The Committee proposes to introduce an infrastructure add-on to risk-weighted assets that would apply to all Group 1 cryptoassets to cover the risk posed by the still novel DLT underlying infrastructure. The proposed calibration of the add-on corresponds to 2.5% of the exposure value.

Hedging function/ New Group 2a category

The Committee is keen to recognise the hedging function of certain Group 2 cryptoassets, provided a set of criteria is met. Cryptoassets that meet the hedging criteria would be included in a new Group 2a category, with the remaining Group 2 cryptoassets classified as Group 2b.

The Committee would allow calculation of capital requirement for market and credit risks raised by Group 2a cryptoassets according to the SSA and SA approaches – approaches already in use for exposures to traditional assets. The use of banks’ internal models would not be allowed. These approaches would retain a conservative 100% capital charge consistent with the 1.250 risk weight.

Capital requirements for Group 2b cryptoasset would continue to be determined by applying a risk weight of 1.250% to the standard 8% of the original exposure. The risk-weighted assets would be calculated for each Group 2 cryptoasset separately. The 1.250% risk weight would apply to the greater value between the absolute value of the aggregated long positions and the absolute value of the aggregated short positions to which a bank is exposed. There is no distinction between banking and trading book positions. The proposed treatment would capture both credit and market risks.

CVA and CRR

The Committee proposes dedicated CVA and CCR minimum capital requirements for all cryptoassets.

Exposure limits for Group 2

The BCBS proposes to introduce a new exposure limit for all Group 2 cryptoassets outside of the large exposure rules. The Group 2 exposure limit is provisionally set at 1% of Tier 1 capital and applies jointly to all Group 2 cryptoassets on gross exposures with no netting or recognition of diversification benefits.

Clarification on operational risk

The capital charge for operational risk raised by cryptoasset activities is calculated by following the SA – an income-based approach already in use for exposures to traditional assets. The Committee has updated the proposal relating to operational risk and resilience to provide a clearer delineation between risks that would be covered by the operational risk framework versus those that should be captured in credit and market risk frameworks. It has also ventured into proposing how banks’ risk management processes can address operational risks relating to cryptoassets and how the supervisory review process can ensure that banks appropriately capture cryptoasset risk.

More detailed liquidity rules

The Committee has also elaborated the LCR and NSFR rules, making the approach more comprehensive and consistent, depending on whether cryptoholdings are Group 1a (tokenised claim on banks), Group 1b (stablecoins), or Group 2 (other cryptoassets). To a limited extent, Group 1a cryptoassets may be considered as HQLA.

Accounting aspects

The Committee is proposing to delink the prudential treatment of cryptoasset exposures from the intangible accounting classification.

Leverage ratio and large exposures

For the sake of leverage ratio calculations, cryptoassets are included in the exposure measure according to their value for financial reporting purposes. Regarding large exposures, the treatment of cryptoassets follows the same principles applicable to other exposures.

Pillar 2 and 3

The BCBS has developed, in great detail, the Pillar 2 language (covering risk management and supervisory review aspects) and Pillar 3 guidance (disclosure requirements).

Conclusion

The BCBS has been working since 2019 to include banks’ cryptoasset exposures in the Basel Framework, showing its belief in the ineluctability of cryptoassets and considerable pragmatism in including in the evolving framework new forms of cryptoassets such as DeFi assets and stablecoins. The result is a complex rulebook that has become more conservative over time. It is aimed to bring, to the maximum extent, cryptoassets under the paradigm, and calculating approaches applicable to traditional assets, making the riskiness of cryptoassets ultimately a function of the existence of a direct or indirect link of the cryptoasset to traditional assets and related identifiable (central) issuer or intermediary and risk profile. Once the BCBS fully appreciates that the value of the cryptoassets – certainly for those ‘unbacked’ cryptoassets – derives from the value of the functionality or protocol they carry, in turn determining their demand or usage, it may have to revisit and amend the cryptoasset exposures provision of the agreed Basel Framework, and also distinguish layer 1/layer 2 unbacked cryptoassets from algorithmic stablecoins.

Table 1: The development of the Prudential Treatment of Banksʼ Cryptoasset Exposures