Executive Summary

- The Bitcoin network activity increased after Ordinals Inscriptions NFTs popped off. There are over 262,000 Ordinals as of the time of writing.

- Ethereum’s Shapella upgrade is set to launch in April after being tested on the Goerli network on 14 March.

- According to our analysis, if all validators opt for partial withdrawals of ether after the upgrade, daily liquidity will increase by 2%. If 50% of validators opt for partial withdrawals and the other 50% apply for exiting the network, daily liquidity would increase by 0.7%.

- We expect this additional liquidity to have little impact on ether price.

Introduction

In this edition of the Digital Investor, we focus on the forthcoming Ethereum upgrade that will combine the Shanghai and the Capella upgrades, the so-called Shapella upgrade. It is set to go live on mainnet in the first two weeks of April.

This upgrade is significant for stakers as it allows them to withdraw their staked ether (ETH) after over two years. This is not an automatic process, and we describe how to do it in this article. We also explain the logic behind the withdrawals as it affects how quickly these ETH can be unstaked. Finally, we estimate the price impact of this upgrade as it will essentially increase the number of ETH in circulation.

Before our deep dive into the Shapella upgrade, we provide a short overview of the Bitcoin network and the recent uptick in activity on the network, thanks to the Ordinals Inscriptions NFTs. Towards the end of this article, we have also reviewed a few important updates for some coins that have had significant updates over the past month. Notice that, as our macroeconomic outlook and general view on coins have remained broadly unchanged since the last Digital Investor, we do not delve into it again. Interested readers are invited to read the February Digital Investor: From Bear to Bull: Crypto’s Resurgence.

Bitcoin

Bitcoin activity increased in February 2023 as NFTs gained traction on the proof-of-work network. Previously, Bitcoin was primarily considered a store of value, unlike Ethereum, which also serves as a utility token for building decentralized finance and economies on the proof-of-stake network. The introduction of the Ordinals collection on Bitcoin sparked the rise of NFTs on the network.

Previous attempts to bring NFTs to Bitcoin, such as Rare Pepe NFTs in 2014 and Stacks in 2017, were not as technologically advanced as the Ordinals. The Taproot upgrade on 14 November 2021, enabled inscriptions on satoshis, the smallest denomination of Bitcoin named after its founder, Satoshi Nakamoto. The inscription process writes the data of the content stored into the witness (signature) of the Bitcoin transaction.

Taproot allows all parties in a transaction to collaborate and make complex transactions look like standard, person-to-person transactions by combining their public keys and signatures. To acquire an Ordinal, a complete guide is available here.

It is fundamental to understand that the main difference between these Bitcoin inscriptions and NFTs on Ethereum (and other networks) is that Ordinals are considered “complete” by some Bitcoin developers because all the data is inscribed directly on-chain. In contrast, NFTs on Ethereum often point to off-chain data on the Interplanetary File System (IPFS) that can be changed using dynamic metadata.

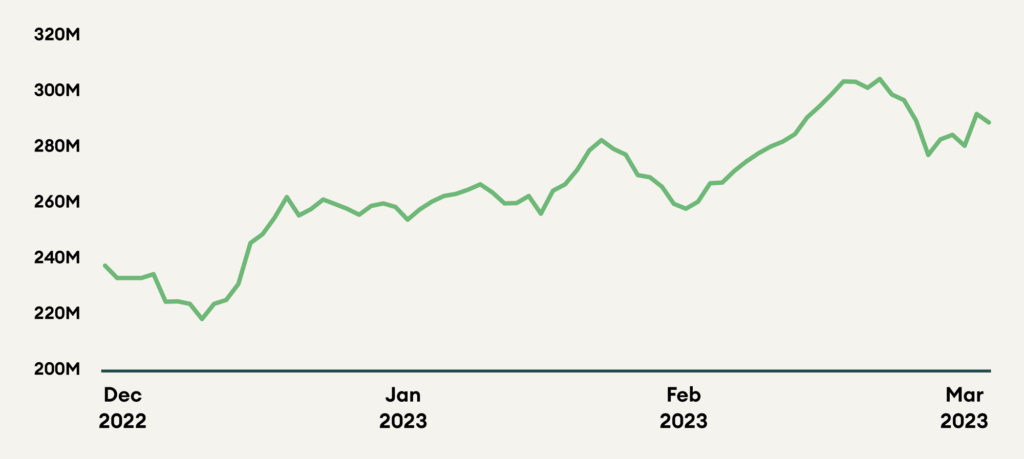

Within a month, the Bitcoin network achieved a significant milestone by successfully inscribing over 200K Ordinal Inscriptions. This NFT activity led to an all-time high in BTC’s Taproot utilization, according to Glassnode. At the time of writing, Dune reported that a total of over 262K Ordinals had been inscribed, with image-type Ordinals accounting for the majority, followed by text. Additionally, Bitcoin’s mining industry experienced growth as its hash rate hit a new all-time high on 21 February 2023, indicating an increase in the number of new miners joining the network.

Fig 1: The Bitcoin network’s mean hash rate steadily increased throughout February 2023

Recently, the company behind the Bored Apes Yacht Club (BAYC) NFT collection Yuga Labs announced that they would soon launch an NFT collection similar to the Ordinals Inscriptions on the Bitcoin network. Called TwelveFold, the collection will feature 300 generative art NFTs.

Ethereum

The main discussion in the market has been around the Shanghai upgrade for the Ethereum network. According to the most recent Ethereum core developers’ call, the upgrade is planned on the Goerli test network for 14 March. If everything goes as planned, the mainnet upgrade will be launched within the first two weeks of April. Now would be the right time to discuss it in detail, especially after developers started referring to it as the Shapella upgrade. The upgrade will have several implications for stakers, the ecosystem, and Decentralised Finance (DeFi) applications in general. Having said that, let us now look at what the upgrade is, how it will affect the ecosystem, and the potential impact on ETH market price after the upgrade.

What is the Shapella Upgrade?

Shanghai and Capella are the names of the upcoming Ethereum hard fork. Together, they are collectively referred to as the Shapella upgrade.

Shanghai and Capella are two upgrades affecting the execution and the consensus layers, respectively. They will lead to several improvements, including some technical novelties concerning the Ethereum Virtual Machine (EVM). However, since staked ETH withdrawals are the key feature of this upgrade, this article will mainly focus on this feature. It will first describe the mechanics behind the withdrawal process and then estimate the price impact. Much has been speculated in the market about the potential price impact of this upgrade and how it could trigger a capitulation event for ETH. The calculations and the analysis below justify why we do not expect significant sell pressure on the asset post the upgrade.

What are withdrawals?

To run a validator node, the Ethereum network currently requires a 32 ETH staking batch. Since the Merge in September 2020, validators staked ETH on the beacon chain and have locked them up for over two years. Enabling withdrawals will allow validators to unstake (unlock) staked ETH and for investors to get liquidity back.

There are two types of withdrawals:

- Partial withdrawals: Anything staked above 32 ETH (earned rewards) can be withdrawn and spent immediately. In this process, the validator continues to validate the blocks on the beacon chain.

- Full withdrawals: As the name suggests, the entire staked balance, i.e., 32 ETH and all the validators’ earned rewards, are unlocked. Once the entire withdrawal process is complete, all the ETH retrieved can be spent. When a validator chooses full withdrawal, it no longer secures the network and stops being part of the beacon chain.

The beacon chain validators have a field called withdrawal credentials. The first two bytes of this credential are known as the withdrawal prefix. Currently, the network offers two prefixes – 0x00 and 0x01. These prefixes are assigned initially when validators stake their Ether via a deposit tool. Validators with a 0x00 prefix will not be able to withdraw immediately. Validators must move to the 0x01 credential to enter the withdrawal queue. This is a one-time process and they can use the Ethdo tool to migrate their credentials. Migration can be done to both externally owned accounts and contract accounts. If the migration proved difficult, validators could also use the step by step guide provided by the Ethereum foundation.

Partial withdrawals will start automatically (automatic sweep) if the validator withdrawal credentials are set to 0x01. For full withdrawals, validators must manually initiate the exit process after migrating to the new credentials.

The process to initiate a full withdrawal is different for each client. The process for each client can be found in the respective sections below:

Withdrawals are considered as a balance increase and not as a transaction. Consequently, no gas fees are charged by the Ethereum network, and the withdrawn ETH will show up on the validator’s execution layer address.

When will validators receive their withdrawn ETH?

The speed at which credentials can be updated to 0x01 or automatic sweep will take place will be 16 partial operations per slot, i.e., every 12 seconds, starting with index 0. Since the queue for partial and full withdrawals is the same, balances over 32 ETH will be a part of the automatic sweep, and full withdrawal will be processed much slower.

Let us now separate the partial and full withdrawal process to make understanding the duration and complexities involved easier.

Partial withdrawals

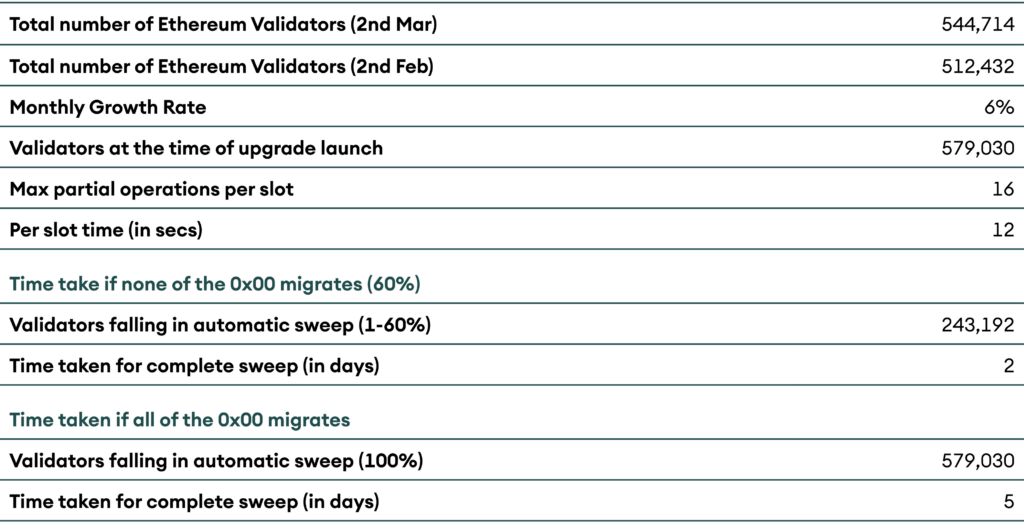

Validators with 0x01 credentials can expect their balance to be partially withdrawn every two to five days following the upgrade. This is the expected time based on the number of total active validators and the time for the automatic sweep to go through. The range is provided from two to five days because it takes around two days if no validators apply for migration to 0x01 credential and around five days if all of them apply for withdrawals with migration. The math can be found below:

At most: [(active validator count)/16) * 12]/60/60/24 days

Table 1: Partial Withdrawal time range

Full withdrawals

Execution of full withdrawal is a combination of the two processes, each with a different duration – the validator exit process and the full withdrawal process. Firstly, the validator must exit from the consensus layer and then goes through the same process again to enable partial withdrawals but with an added period. It takes a minimum of 28 hours for their staked ETH to become fully withdrawable. These additional 27.3 hours are taken for the status to change from “exited” to “fully withdrawable”.

Total time taken = Exit Epoch (5 Epochs or 32 minutes) + Withdrawable Epoch (256 Epochs or 27.3 hours)

After this, a few more days are required for the next validator sweep to execute full withdrawals. These additional days for the next sweep depend on factors like the validator index, sweep position, and the number of validators.

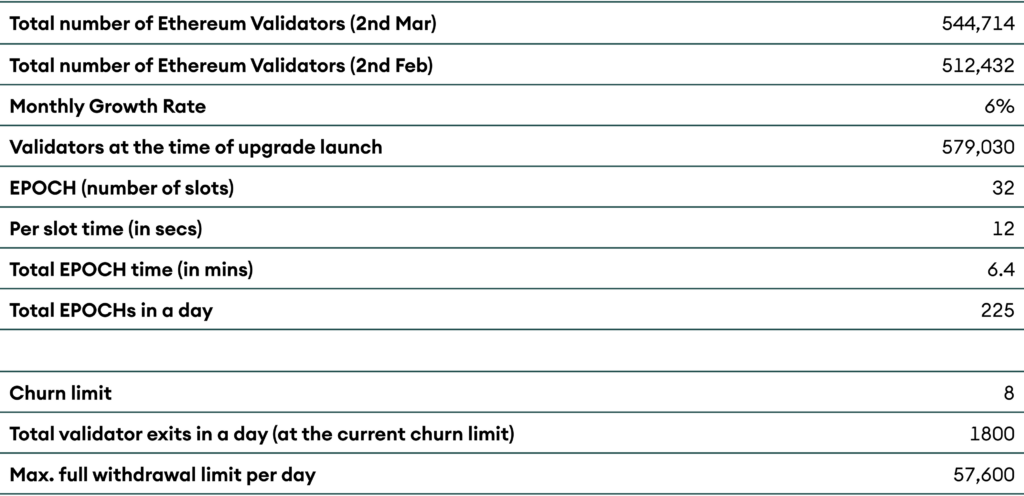

Keep in mind that validators secure the network. Therefore, a churn limit needs to be set so that the number of validators does not change too quickly. The churn limit is defined as the maximum number of validators exited per epoch.

Churn Limit = max[4, total active validators/(2^16)]

In the table below, we present the total number of validators exit possible per day and the rate at which the maximum amount of ETH can be withdrawn per day.

Table 2: Full Withdrawal

Impact of the Shapella upgrade on Ether’s price

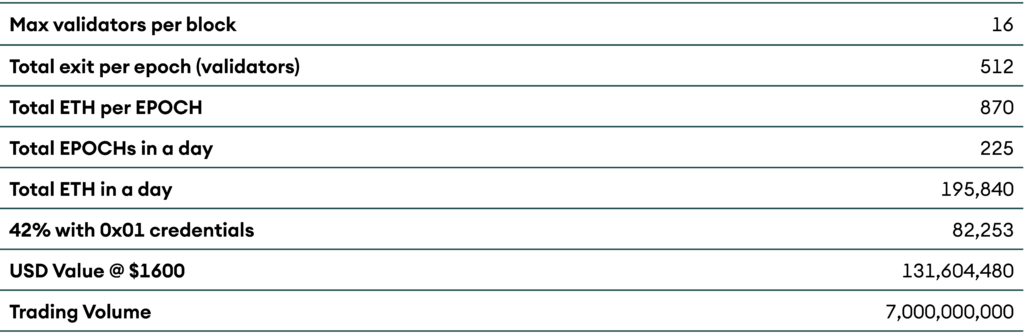

At the time of writing, 14.88% of the total ETH supply is staked, i.e., approximately 18.2 million coins. This staked ETH is deposited to over 540K validators, and the average balance surpasses 32 ETH. This suggests that the average Ethereum validator has accrued about 1.7 ETH in consensus layer rewards to date. Approximately 900K ETH could become liquid through partial withdrawals post Shapella. It is important to note that according to an analysis presented by Tripoli, 58% of validators have the 0x00-type withdrawal credentials. Considering this, let us look at two extreme scenarios to estimate the price impact of the Shapella upgrade, post-withdrawal.

We decided to focus on two extreme scenarios as we want to estimate whether this upgrade has the potential weigh significantly on ETH price. We assume that the upgrade will run smoothly.

In the table below, we assume that no validator entirely withdraws their ETH, but all choose partial withdrawals. In this scenario, the market encounters an additional liquidity of USD 131 million worth of ETH per day, approximately 2% of its 24-hour trading volume, standing at about USD 7 billion.

Table 3: 100% partial withdrawals

Therefore, according to our calculation, if all validators go for partial withdrawal, it will result in a 2% increase in ETH liquidity in the market. A 2% increase in liquidity is relatively small and is no cause for concern about the price impact.

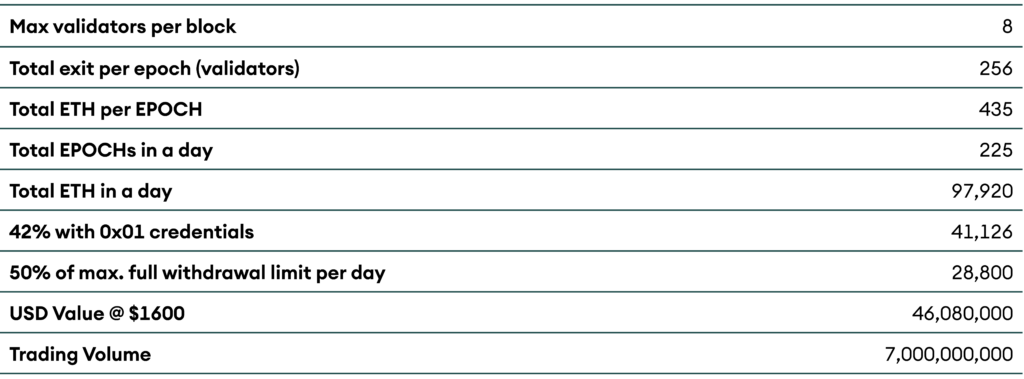

Next, let us look at another possible scenario where 50% of validators opt for partial withdrawals, and the other 50% apply for exiting the network, i.e., full withdrawals. If everything goes as planned, the market will experience a selling pressure of roughly USD 46 million daily, which is approximately 0.7% of the one-day trading volume at the time of writing. This is not significant in terms of selling pressure and, we believe, is no cause for concern. The calculations for this case are outlined below.

Table 4: 50%-50% Partial and Full

Summing up the discussions above, we highlight that the selling pressure on ETH after this upgrade might not be as significant as the market currently anticipates. The selling pressure is minimal as the effect on daily trading volumes is limited, so a smooth transition can be expected without any significant price impact.

Other updates

Let us have a look at some of the more significant ecosystem updates for coins in the AMINA universe.

Let us have a look at some of the more significant ecosystem updates for coins in the AMINA universe.

- Synthetix: Earlier this month, Synthetix launched its v3 on the Ethereum Mainnet. This new version enables the creation of products that provide a liquid market for any financial derivative that developers want to build. These derivatives can range from traditional financial markets to more unconventional ones such as no-loss lotteries or separate protocols. V3 also offers simplified staking and differentiated debt pools, which allows network stakers to supply collateral to and receive fees from specific asset pools.

- Aave: In early February, Aave deployed its GHO stablecoin on the Goerli testnet. Developers and potential adopters of GHO can access the stablecoin’s codebase and test how it works before being released to the wider public on the Ethereum blockchain.

- Yearn Finance: The dapp’s developers said they would soon introduce a product that allows users to gain exposure to a basket of liquid staking derivatives through one token. The token rallied 39% and trading volumes soared almost fivefold on the announcement. The forthcoming token – yETH – will give users exposure to a basket of ether liquid staking derivatives. (LSD)

- Solana: On 25 February, the Solana network went down for almost 20 hours following a network upgrade. There was performance degradation of the Solana Mainnet and the validator community decided to restart the network. The Solana Foundation wrote in a blog post that the reason for this is still unknown and that the matter was under investigation.

- Polygon: Polygon’s zero knowledge-based scaling solution for Ethereum will launch its Mainnet Beta on 27 March 2023. Its testnet went live last year where it gained over 84K wallets, produced over 300K blocks and over 5K smart contracts were deployed. Over the next few weeks, Polygon Labs will be releasing more details about Mainnet Beta.

Conclusion

Bitcoin activity increased in February due to the large Ordinals interest. As outlined earlier, NFTs on the network gained momentum and resulted in an uptick in activity.

The crypto space is also gearing up for the Ethereum network’s Shapella upgrade. While it is clear from the analysis above that we do not expect to see any significant sell-side pressure on ETH’s price after the upgrade, it allows change in how, when and with whom the stakers decided to stake.

Post-withdrawals, the flexibility to stake could trigger the reallocation of ETH enough to change the market share distribution across the Ethereum staking ecosystem. This could boost competition in the market and drive innovation in technology and business models, especially amongst liquid staking protocols. This could be a pivotal point in time for Ethereum and also for DeFi.