Abstract

As a response to the coronavirus pandemic, central banks worldwide have taken dramatic steps to ease the blow to the global economy. On the contrary, Bitcoin is set to become scarcer after the halving. With more efficient mining equipment, bitcoin miners become more competitive as their breakeven improves. We then estimate how price may behave, given a no-arbitrage condition.

Introduction

It is the time of resilience; it is the time of vulnerability. It is the time of restrictions; it is the time of freedom. It is the time of abundance; it is the time of scarcity. The world is currently pervaded with contrast, reminiscent of what Charles Dickens describes in the A Tale of Two Cities.

What makes Bitcoin, Bitcoin? Is it the block size, its technical development approach, or its supply schedule? Bitcoin is a summation of all these characteristics. For us and many others, however, the limit of 21 million coins is what is so sacred about Bitcoin. Everything else is flexible; the social contract around the circulating supply ceiling, however, is set in stone.

At this time of unprecedented expansionary monetary policy, the forthcoming halving event in the supply of Bitcoin is unorthodox! When countries are exerting all their effort in increasing money supply, Bitcoin is set to become scarcer. According to the supply schedule, the Bitcoin supply halves every 210,000 blocks circa every four years. On 12 May 2020, Bitcoin’s block reward is scheduled to be halved; that is, miners will receive 6.25 Bitcoins per block instead of the prevailing rate of 12.5 today.

Ceteris paribus, Bitcoin’s monetary policy forces miners to improve their efficiency by at least 100% or find cheaper electricity resources in four years to remain profitable. Those who comply, stay afloat. Those who do not comply cease to exist. While the positive impact of conventional austerity measures is debatable, the impact of Bitcoin’s monetary policy can only be measured in a few years.

This article has two objectives. It draws parallels with historical halvings of Bitcoin and other related cryptocurrencies and dives deep into the expected miner economics and how price may impact miners (Interested readers may want to consider previous editions of the Digital Investor on the subject: Bitcoin halving: buy in May and go away? (January 2020) and Implications of Litecoin’s reward halving (August 2019).

A retrospective look at halving events

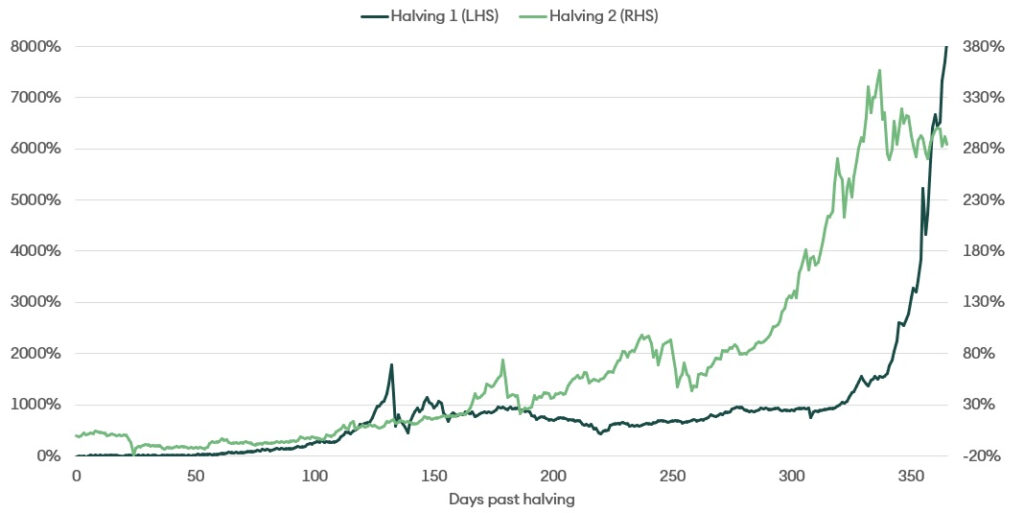

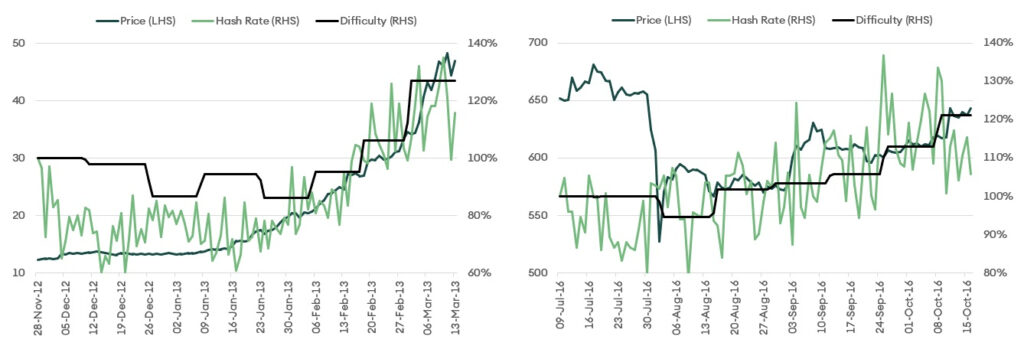

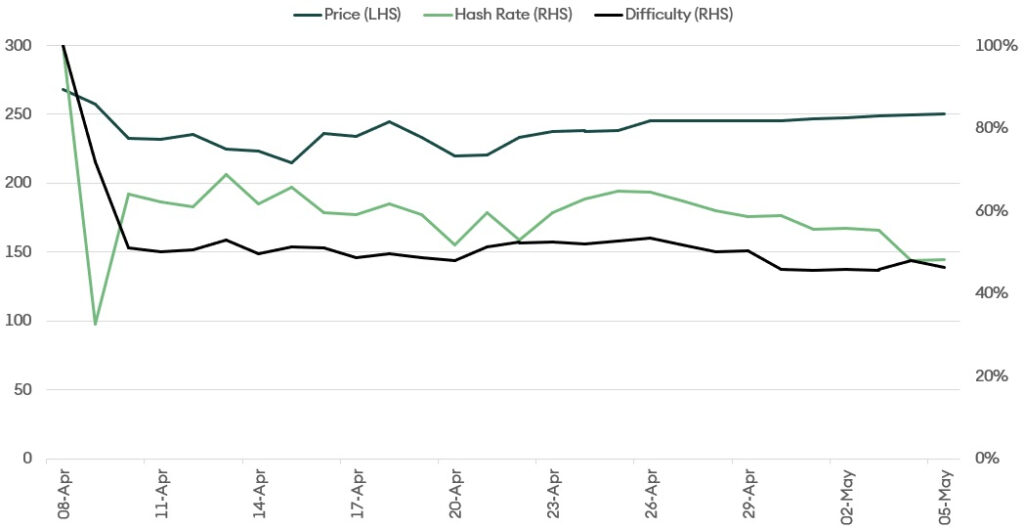

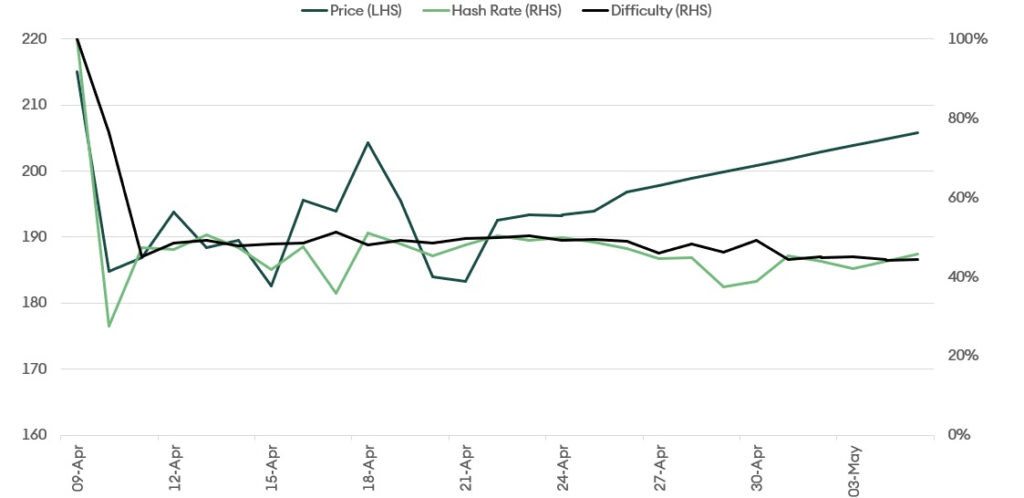

The Bitcoin price remained subdued immediately after both previous halvings1 (figure 1). As expected, the hashrate decreased immediately after both halvings, before gradually improving, as the difficulty adjusted (Figure 2).

Figure 1 – Price-performance post-halving events

Immediately after both halvings, the hashrate dropped before climbing after the difficulty adjusted downward.

Figure 2– Hashrate performance post-halving events

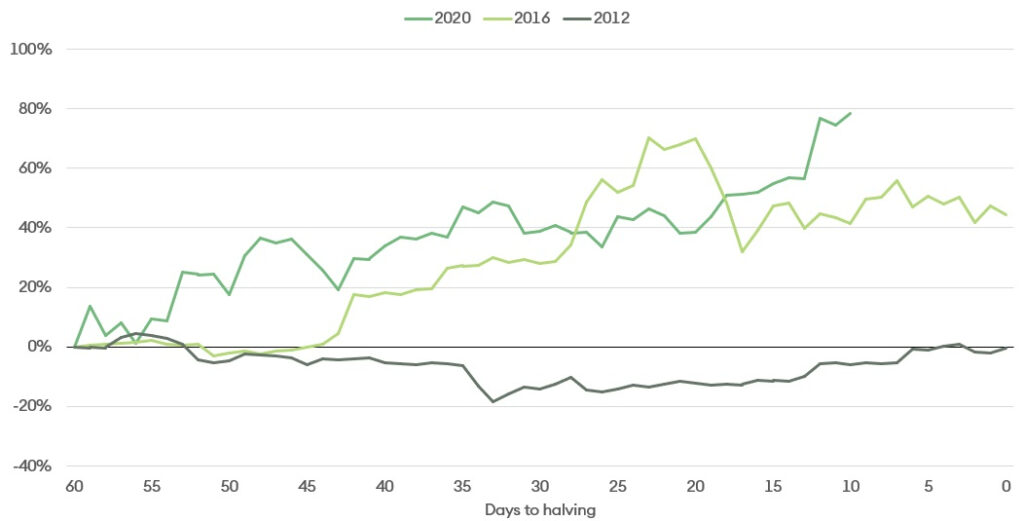

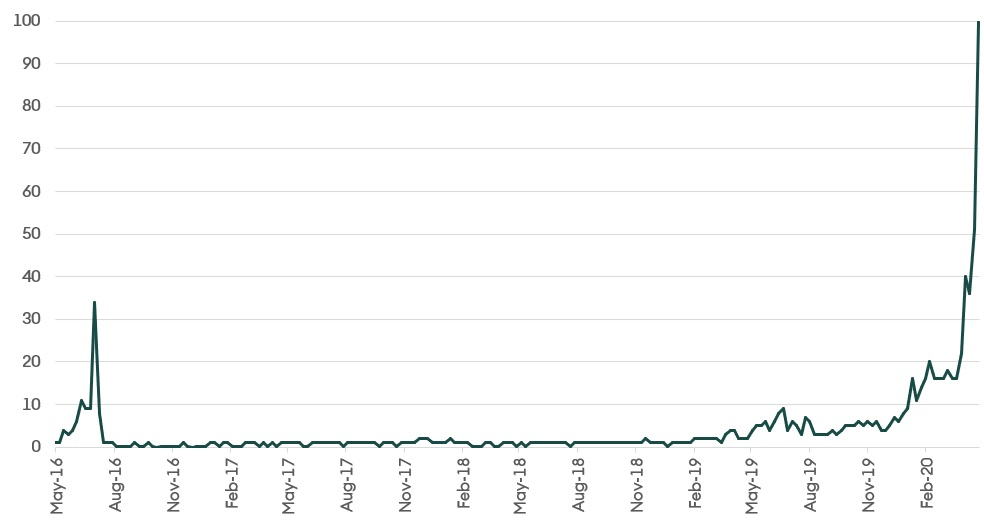

Bitcoin’s price action before the second halving was more bullish than the first halving. Moreover, the price actions leading to the third halving seems to be more bullish than the second one (Figure 3). The increasing awareness of Bitcoin may explain this situation. Thus, as the halving events draw near, anticipation increasingly grew each cycle, as Figure 4 illustrates.

Figure 3– Price action gets more bullish before every halving event

Figure 4– Search interest growing more for each cycle

At this point, we have gained some appreciation of Bitcoin performance regarding the previous halvings. Let us now consider three other crypto assets that recently experienced halvings. On 5 August 2019, Litecoin (LTC) halved, followed more recently by Bitcoin Cash (BCH) and Bitcoin SV (BSV) on 8 April and 10 April 2020, respectively.

Figure 5(a)– The Litecoin hashrate did not recover after the halving

Figure 5(b)- The BCH hashrate hovered at around 60% of the pre-halving rate

Figure 5(c) – The BSV hashrate hovered at around 50% of the pre halving rate

Even though there was not enough time for the hashrate to pick up after the Bitcoin Cash and Bitcoin SV halvings, we can still compare it to Bitcoin’s post-halving hashrate because Bitcoin’s difficulty adjusts approximately every two weeks (2016 blocks), whereas that of Bitcoin Cash and Bitcoin SV occurs after every block.

Although it is challenging to quantitatively argue why the Bitcoin hashrate behaves more favourably than its proof-of-work counterparts (at an order of magnitude of approximately 80 to 100 times), there are a few qualitative arguments. Other than the network effects, an important factor is that Bitcoin has one of the most robust development practices. The development is not dictated by one or two individuals. Therefore, it is easier for the wider community to set their expectations regarding development. As miners’ bets are relatively long term, visibility into the future from the development standpoint is crucial, and, historically, visibility is offered by the Bitcoin development ecosystem. Predictable development activities act as anchors for miners.

Miner Economics

Four major economic participants exist in the Bitcoin economy: Miners, Merchants, Speculators, and Holders (colloquially known as hodlers). Reward-halving affects miners the most in the short term. Thus, it is no surprise that miners have been preparing for the halving event since, at least, the last two quarters. Miners have to compensate for the reduction in rewards by increasing the efficiency of their mining equipment. In 2016, the standard chip size of the ASIC miner was about 16nm; currently, it is 7nm. The efficiency of mining equipment has more than doubled since the previous halving. Despite the impact on supply chains due to the coronavirus pandemic, many miners have upgraded their equipment. Canaan, a mining equipment manufacturer, has recorded about 87% year-over-year growth in its sale of computing power for the fourth quarter of 2019. Moreover, the share of old miners, the S9 generation of the Antminer, is roughly about 25% to 30%, currently.

Mining equipment upgrade is crucial because it compensates for falling revenue with increased efficiency. We conducted a sensitivity analysis2 on how the old and new generation3 mining equipment fare based on electricity costs and Bitcoin price. The following charts show the expected monthly profit earned by one mining equipment in US dollars (USD). Losses are in shown in red; marginal profit, light green; and higher profit, dark green.

Figure 6- Sensitivity analysis of old- generation mining equipment: pre-halving

Figure 7 –Sensitivity analysis of old- generation mining equipment: post-halving

Figure 8 – Sensitivity analysis of new- generation mining equipment: pre-halving

Figure 9 – Sensitivity analysis of new-generation mining equipment: post-halving

These tables show that halving will encourage miners to switch to the latest technology as old-generation miners may find themselves in an unprofitable position. Ultimately, the dominance of the new technology will lead to higher, albeit short term, hashrates. The hashrate is likely to decline after the halving.

To further appreciate the impact of halving, we show how the hashrate is expected to change post-halving in the short term. Contrary to popular assumptions, not all miners can turn off their mining equipment when the mining reward dramatically falls because they are obligated to purchase a stipulated number of units of electricity within a certain period to keep their per-unit costs in check. Some miners leave the system due to losses, while others mine at a marginal loss. When miners leave the system, a lower hashrate than before pursues the same number of Bitcoins. Thus, the revenue of the remaining miners increases.

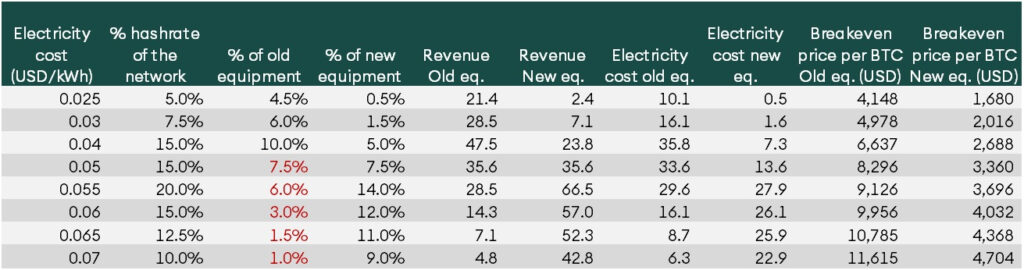

To better understand the mining dynamics, we consider a scenario where the Bitcoin (BTC) price is USD 8800 pre- and post-halving with a pre-halving hashrate of 120,000,000 Th/s. To estimate the breakeven points4 of miners at various electricity prices, we must have the distribution of miners at different electricity prices. We employ a distribution similar to the one provided here.

Figure 10– BTC at USD 8800 and a total network hashrate of 120,000,000 Th/s

After the halving, the mining revenue drops by 50%. Thus, some of the miners are forced to switch off their mining equipment.

Figure 11– Post halving: BTC at USD 8800

Some miners (the red box) are forced to switch off, and some (the green box) continue to mine at a marginal loss. Thus, the hashrate of the network drops by 19%, and the difficulty adjusts. Miners must now expend lesser energy than before to earn similar rewards. Hence, the breakeven of miners shifts lower. This situation, in turn, incentivises miners who leave the network to re-join.

Figure 12– Post halving: Some miners leave the system, while some with marginal loss start making a profit

We can observe the impact of the departure of some miners on the rest of the miners in Figure 12. The breakeven price per BTC reduces for everybody as the total hashrate of the system reduces. However, this reduction in hashrate is likely to be temporary. As breakeven drops, given the new technology, more miners join, and the hashrate eventually climbs up again.

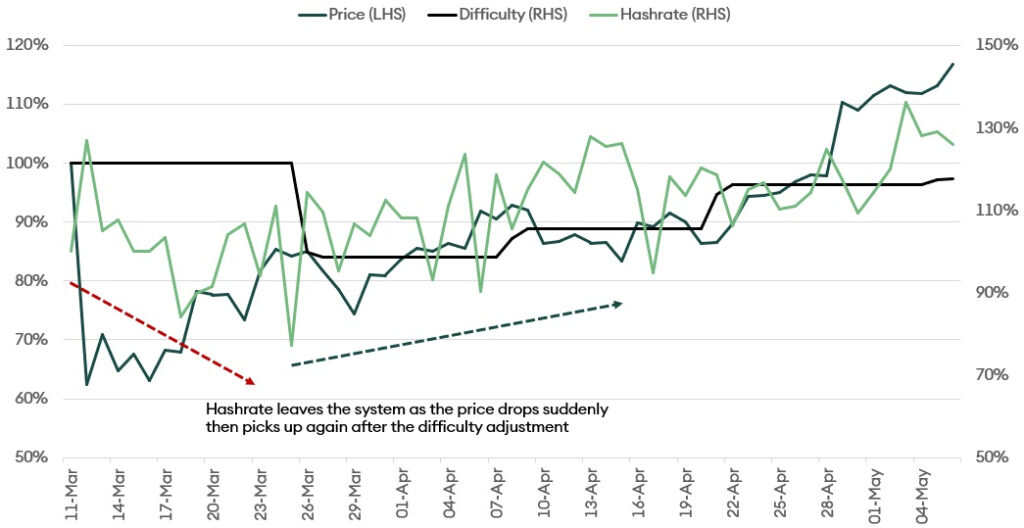

We can estimate how the hashrate may behave after the halving by observing its movement around the March crash. It lends us empirical evidence to understand how the forthcoming halving may play out. As the price suddenly dropped by about 50%, miners’ revenue was halved, and the hashrate dropped. The difficulty adjustment kicked in, and the hashrate began to improve again (see Figure 13).

Figure 13– The March crash: A simulation for the halving

New-generation equipment has the advantage of being less sensitive to electricity prices. In the post-halving scenario, miners in regions with relatively costlier electricity can continue mining even if the price per BTC falls to USD 4000. In the regions with costlier electricity, the new equipment reduces the breakeven point by 60%. Given the rise of new equipment, miners in expensive regions are poised to compete with old mining equipment in low electricity regions.

Along with the quantitative reasoning above, some qualitative developments support the hypothesis that the hashrate will revive in the medium-term post-halving. Upcoming themes in this regard include firms in various parts of the world that are utilising native energy sources to mine Bitcoin. Moreover, the Chinese government is inviting miners to tap into the excess hydroelectric power generated in the Sichuan province.

Mining Parity

Previous sections of this article analysed the behaviour of miners in light of profitability. We have demonstrated the impact of halving and new technology regarding breakeven points. This section analyses mining profitability relative to other proof-of-work coins.

Three coins—BTC, BCH, and BSV—are comparable as they use the same mining algorithm. Therefore, miners can switch between them. The relative ease of switching between these coins forms the basis of analysing whether some coins are more attractive than others.

The first assumption is that miners are rationale. In a competitive market, each coin is expected to result in the same expected return. Otherwise, arbitrage is possible between the coins. This no-arbitrage condition is the mining parity5.

The expected USD profitability of mining the next block is expressed as follows:

The equation illustrates that the expected profitability in USD in time t to mine the next BTC block at time t+1 is equal to the probability of mining the block multiplied by the block reward (mining reward and fee) expressed in USD minus the cost of mining in USD (e.g., hardware and energy ). This generic equation holds for BTC, BCH, and BSV.

Mining parity states that

as miners are indifferent in mining BTC or BCH. Given that the equipment and overhead costs are the same, rearranging the terms, we get the following mining parity for BTCBCH (i.e., the price of BTC expressed in BCH).

According to the mining parity condition, the BTCBCH exchange rate should be equal to the ratio of the probability of mining the next block of each coin, multiplied by the respective rewards.

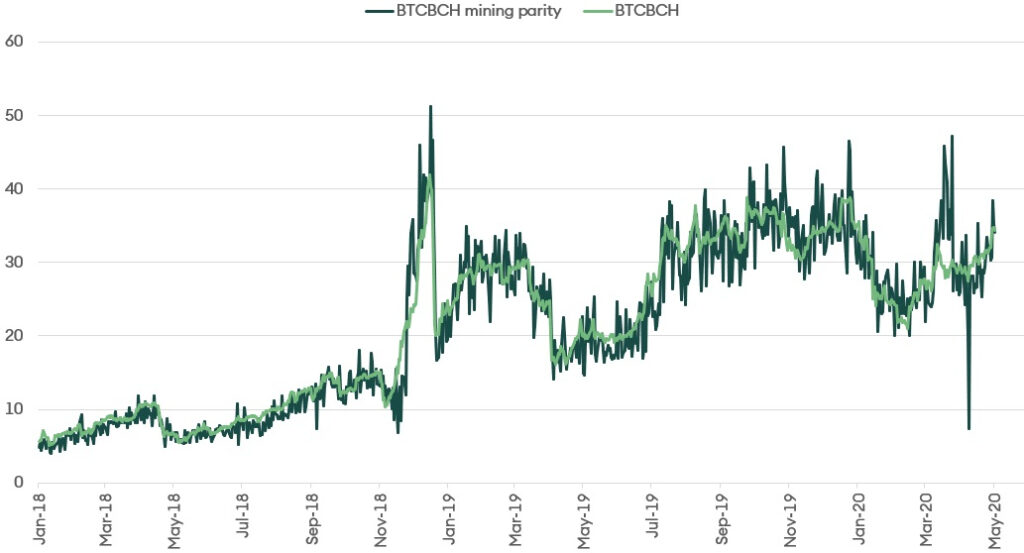

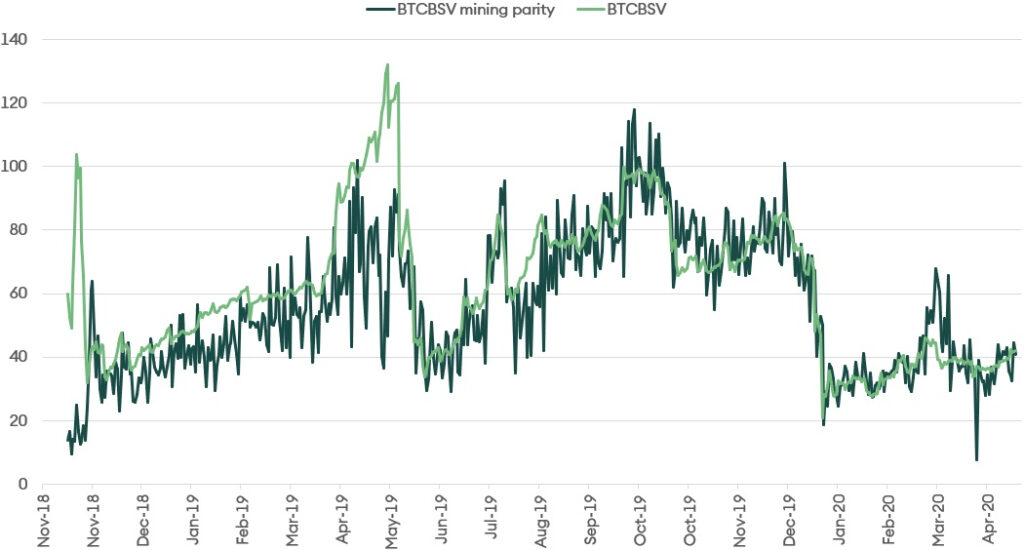

While there is no evidence of miners switching between coins to maximise their expected returns, mining parity seems to hold nonetheless, as Figures 14 and 15 suggest.

Figure 14: BTCBCH and the mining parity

Figure 15: BTCBSV and the mining parity

Given the empirical findings, we can illustrate a scenario for the future price of Bitcoin. We can simply imagine that for both BCH and BSV, the probability of mining the next block and block rewards remain constant. However, in the wake of the halving event, the BTC block reward will decline for the next 210,000 bocks. What about the probability of mining the next block once the halving takes place?

As argued earlier, we posit that the probability will first increase6 right after the shock since some miners will switch off their mining equipment. Thus, the remaining miners will have a higher chance of mining, notwithstanding the difficulty adjustment.

In the second stage, we posit that, given the lower breakeven point, new miners will join in pushing the hashrate up. Consequently, the difficulty will rise, which will mean that the probability of mining the next block will decline. A lower probability of mining combined with the halving of block rewards implies that the denominator of the mining parity condition will decrease, thereby leading to the appreciation of BTC relative to BCH and BSV.

Given our hypothesis, where everything remains the same for BCH and BSV, and the mining parity condition hold after the BTC halving event, the dollar price of Bitcoin should increase once the halving dust settles.

Conclusion

New-generation mining equipment makes electricity cost significantly lesser important for miners to keep operating post-halving. After analysing the behaviour of Bitcoin miners regarding past halving events and the recent March crash, we expect (with reasonable confidence) that the hashrate will recover after the initial dip. The recent jump in the price of Bitcoin and the fact that the Chinese government encouraged the use of its excess hydroelectric power for mining activities further bolsters the case for a healthy Bitcoin mining ecosystem post-halving. Our concern, however, is that post-coronavirus Bitcoin is still highly correlated with the broader financial markets. If equities fall, we expect downward pressure on Bitcoin price as well. Moreover, this expectation, along with reward-halving, may create problems for the mining ecosystem.

However, given the mining parity, increase in hashrate and the resultant difficulty reduces the likelihood of validating the next block and getting the block reward. Hence, to compensate for this effect, the relative crypto exchange rate adjusts accordingly. Therefore, if the prices of other cryptocurrencies remain the same, this effect should benefit BTC in the medium term.

1Bitcoin’s first two halvings took place on 28 Nov 2012 and 9 July 2016, respectively. ↵

2Profit in USD per machine per month ↵

3For this analysis, we employed Antminer S9 and S17 as a proxy for the old and new-generation mining equipment, respectively. S9 specs – hashrate: 13.5 Th/s and power consumption: 1.4 Kw. S17 specs – Hashrate: 50 Th/s, Power consumption: 2.1 kW ↵

4Only the operating costs are considered while calculating the breakeven for old and new generation equipment. Costs and revenue are in USD million per month ↵

5We based our ideas on mint parity, a no-arbitrage condition previously applied in a bi-metallist monetary system where gold and silver coexisted. ↵

6Immediately after the halving, the hashrate is expected to decrease as some miners will be forced to switch off their mining equipment. Thus, the difficulty will readjust downward, which means that the probability of finding the next block increases. ↵