Abstract

The Bitcoin supply schedule has been known from day one, as it is written into the code that every 210,000 blocks, approximately once every four years, the block reward is halved. The next halving is expected to take place in May 2020, when the miner’s reward will decline from 12.5 to 6.25 Bitcoins.

The question currently concerning every crypto-investor is whether this event will lead to a doubling (or more) of the price of Bitcoins.

In this edition, we investigate how the upcoming halving could impact Bitcoin’s price. In the course of this article, we will look at the history of Bitcoin, Litecoin and Ether to understand the likely price effect of the forthcoming Bitcoin halving.

Empirical evidence shows that halving events have been broadly supportive (either neutrally or positively) for prices when confidence in the network is high.

Why is halving important?

Every 210,000 blocks, the Bitcoin miner’s reward or coinbase reward is halved. In May 2020, it will be halved again from 12.5 to 6.25 Bitcoins (BTC) for every block added to the blockchain. For an introduction to mining, we invite readers to have a look at our latest educational piece on Mining: the essence of proof of work.

As a consequence of this, miner revenue1 earned from block rewards drops by virtually 50% after every halving. As block rewards represent almost 97% of mining revenue, if the dollar price per Bitcoin does not rise to compensate for the halving, miners are adversely impacted.

Miners play a central role in the proof-of-work blockchain as they “perform two critical functions for the network: they clear and settle the transactions and supply new Bitcoins to the network2.” Therefore, how mining dynamics shape up after the halving is important for the Bitcoin ecosystem and hence the price.

What happened in the previous halvings?

Bitcoin has experienced two halvings since its inception, in November 2012 and June 2016. Before we jump into arguments around the upcoming halving, let’s see how previous halvings have affected Bitcoin prices.

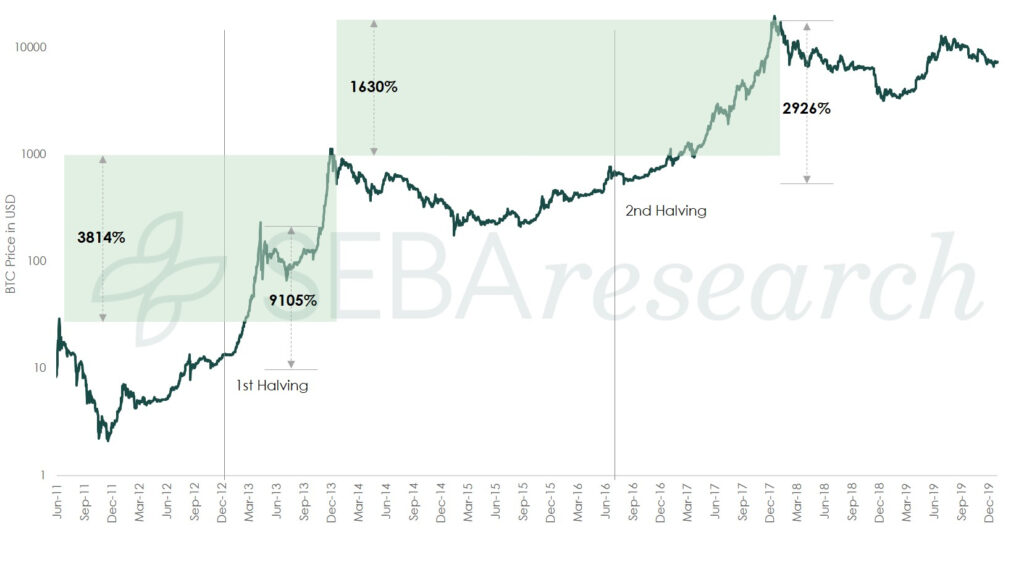

Exhibit 1 shows that after halving, gains are significant with respect not only to the price at the time of halving, but also to the pre-halving peak.

Exhibit 1: The impact of halvings on Bitcoin

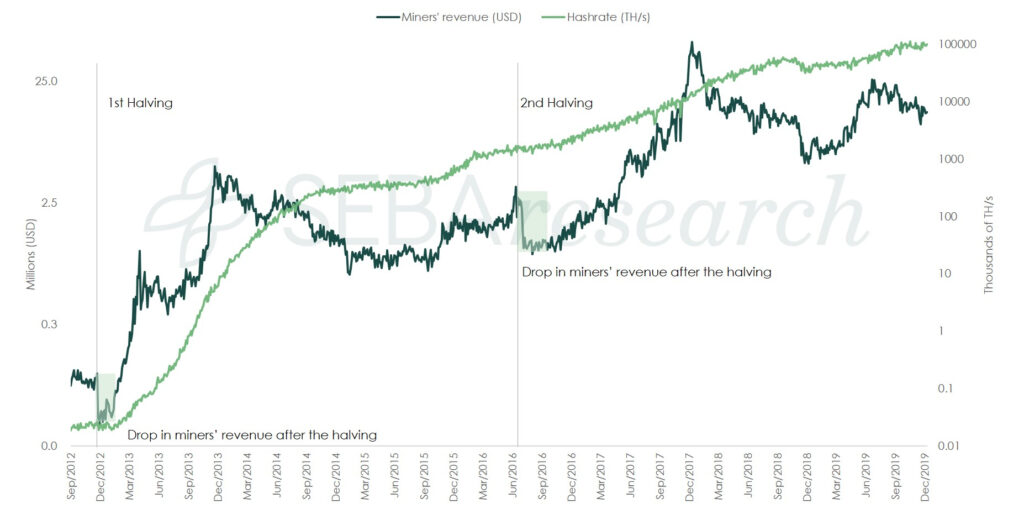

Immediately after the first two halvings, miner revenue dropped (Exhibit 2). However, we did not see any impact on the hash rate, a measure of mining activity. This is an indication of the faith that miners place in the Bitcoin ecosystem.

Exhibit 2: The impact of halvings on miner revenue and hash rate

Although both halvings seem to have had a significant impact on the price of Bitcoin, the price did not react as vigorously to the second halving. Indeed, after the second halving, the upward trend did not steepened contrary to the previous one (Exhibit 1).

The first halving episode had a positive effect on price development as the upward price trend became even more vigorous, while in the second episode, the effect was neutral in the sense that the upward trend was unaffected.

This can be explained by multiple factors. One of them is that market capitalization was much higher given that more market players had entered the market the second time, and more investors were aware of the Bitcoin halving phenomenon. If this is true, future halvings will have a lesser impact on the price as information percolates through to the wider diaspora.

How have other crypto-assets reacted to reward changes?

Apart from Bitcoin, we looked at two other major crypto-assets, Litecoin and Ether. Although Ether (Exhibit 3) has reacted to reward changes in a similar way to Bitcoin, there is no evidence of consistency in the way Litecoin has reacted to halvings, as shown in Exhibit 4 (Interested readers are invited to have a look at the August 2019 Digital Investor, Implications of Litecoin’s reward halving).

Exhibit 3: Impacts of changes in block rewards on Ether

Exhibit 4: Impacts of Litecoin halvings on Litecoin

In our view, there is an explanation for this behaviour by Litecoin. Price and hash rate have a recursive relationship. A growing hash rate means that miners appreciate the fundamentals and expect the asset to perform well enough to keep a steady stream of revenue. As miners are mid- to long-term investors in the network, the hash rate indicates their confidence level in the network. If the hash rate dwindles after the reward halving, it can be concluded that the miners do not expect the price to compensate for the reduction in revenue in native asset terms.

Out of Bitcoin, Ether, and Litecoin, the former two have a healthy developer commitment towards respective projects. When it comes to Litecoin, the number of developers, as well as the frequency of upgrades, are tiny in relation to the other two. As a result, miners are not confident about the fundamental drivers of Litecoin compared to those of the other two. Which essentially means that miners are doubtful about the upside potential to Litecoin’s price. As a result, after the recent halving in August 2019, Litecoin’s hash rate dropped by more than 70% from the all-time high that had occurred just before the halving.

Empirical evidence based on past halvings for Bitcoin, Ether3 and Litecoin shows that there have been significant gains after halving when the hash rate remained stable, as miners were confident about the network fundamentals which led them to believe in price appreciation. As Bitcoin’s hash rate is trending upwards, we have good reason to believe that market reaction to the forthcoming Bitcoin halving will be positive, as in the past.

However, there are two arguments to contradict this conclusion:

- According to the efficient market hypothesis (EMH), the price already reflects existing information. As the Bitcoin supply schedule has been known since the start, it is already factored in.

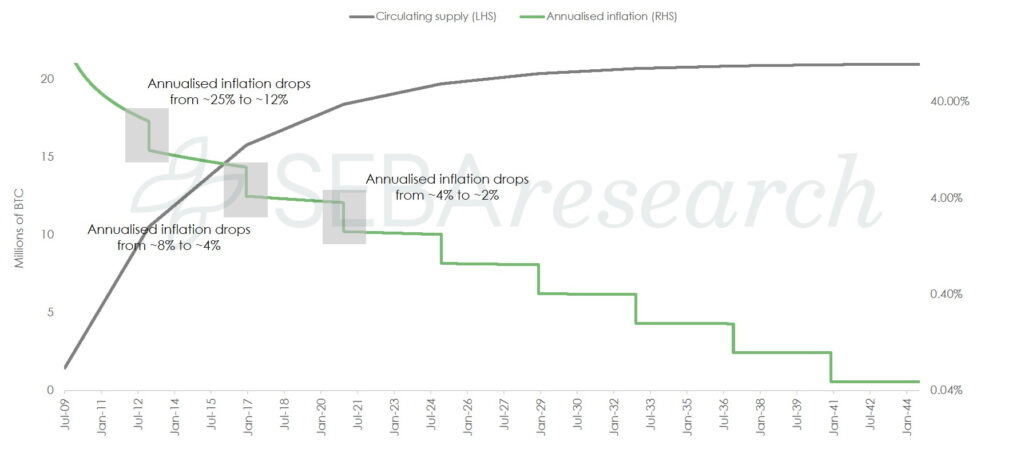

- At the time of the forthcoming halving, about 90% of supply will already be in circulation, and the annualized inflation rate will drop from 3.6% to 1.8%. Therefore, the supply shock will not be as great as during previous halvings (Exhibit 5).

Exhibit 5: The impact of halvings on Bitcoin’s annualized inflation

The role of demand

Although these are compelling arguments, there is one missing piece of information. The price exists only when demand and supply meet. Without analysing demand, any verdict on the impact of supply on the price is incomplete. Even if we assume that the Bitcoin market is efficient, market participation has a lot of room for growth. We acknowledge that there is no way to accurately predict demand. However, we can find a few useful proxies to analyse demand.

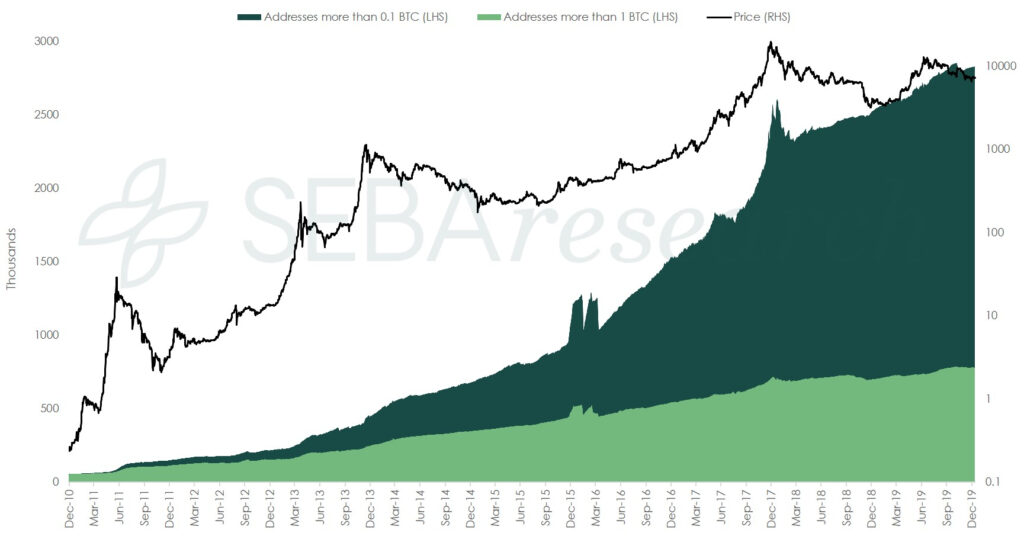

- The number of addresses holding more than 0.1 and 1 BTC has grown significantly since the previous halving in 2016. This indicates that there is a tendency among investors to increase exposure to Bitcoin, or that more investors want exposure to Bitcoin. Either way, we can conclude that demand for Bitcoin has been on the rise.

- Although custodial solutions are being built up, they are yet to gain prominence. As an illustration, Grayscale’s Bitcoin trust offers a way for institutions to gain exposure to Bitcoin without buying Bitcoins themselves4. In the last six months, the number of Bitcoins held by the Grayscale trust has increased robustly by almost 5,700 BTC per month on average to more than 261,000, which is roughly 11% of the Bitcoin supply in circulation5. One more proxy of institutional demand is Bakkt’s6 volume7. Although Bakkt’s volume was initially lacklustre, the average traded volume for December was around 2,500 BTC per day8, suggesting a modest uptick in institutions’ interest in physically-settled Bitcoin futures.

Exhibit 6: Number of addresses with more than 0.1 and 1 Bitcoins

There have also been other indications of a consistent rise in demand. Square, a payment company founded by Jack Dorsey – Twitter co-founder –, has doubled its Bitcoin revenue each quarter. TD Ameritrade – a broker offering an electronic trading platform – is testing crypto-asset trading. These two examples illustrate the rise in supply to meet the rise in demand.

Conclusion

Our analysis shows that until now, halving has been either neutral or positive for crypto-asset prices as long as mining activity has remained strong.

Looking at how crypto-asset prices have performed before and after halving when mining activity has remained solid, we can see that the price either continues the broadly increasing trend (neutral effect) or accelerates (positive effect). The first Bitcoin halving was positive while the second was neutral according to this classification.

Following the second Litecoin halving, the price declined in line with the decrease of mining activity.

Based on our findings and given that Bitcoin mining activity is solid, there is good reason to believe that the price effect will be neutral or positive.

1Miner revenue comprises two components: 1) rewards for finding blocks and 2) transaction fees. As of now transaction fees contribute only 3% towards miners’ revenue. ↵

2December 2019 AMINA research: The Bridge – Mining: the essence of proof of work. ↵

3In the case of Ethereum, the block reward is not halved. It has been reduced twice – from 5 ETH to 3 ETH and then from 3 ETH to 2 ETH. ↵

4Grayscale Investments is a company that manages cryptocurrency investment funds. ↵

5With 12.5 BTC every 10 minutes, the monthly supply of Bitcoin is 540,000 BTC. 5,962 BTC it is about 11% of the supply. ↵

6Bakkt is an exchange company specialized in crypto-assets. It belongs to Intercontinental Exchange (ICE). ↵

7Bakkt has physically settled Bitcoin futures. ↵

8Source: Bakkt Volume bot. ↵