Abstract

In last month’s publication, Crypto-assets: An emerging asset class, we looked at how a small exposure to crypto-assets improves portfolio performance. This month, The Digital Investor examines whether crypto-assets are suitable for institutional investors. We investigate the factors required to create a market environment in which institutional investors can navigate. Looking at the existing mature markets where institutional investors are active, such as commodities, equities and fixed income, we observe that they share common foundational factors: regulation, infrastructure, and awareness and interest.

On the regulatory front, countries and international bodies across the globe are actively working towards building their regulatory framework around digital assets. Among these countries, we see Switzerland as one of the leaders working towards building an inclusive framework for blockchain technologies and digital assets.

In the past five years, infrastructure, as measured by the number of services offered and their quality, has improved considerably. As investor interest has increased, traditional institutions have started to offer financial products related to crypto-assets. Growth analysis of these products by traditional financial institutions shows that customer demand is on the rise, with more than 40 exchange-listed financial products now available.

In parallel to regulation and infrastructure, awareness and interest have also increased, signalling growing interest among institutional investors in this new technology.

Has this development tide reached a level sufficient for institutional investors to navigate in new waters? According to our analysis, in countries like Switzerland, the answer is yes. However, other countries need to develop further in some areas in order to initiate institutional entry.

An institutional playing field

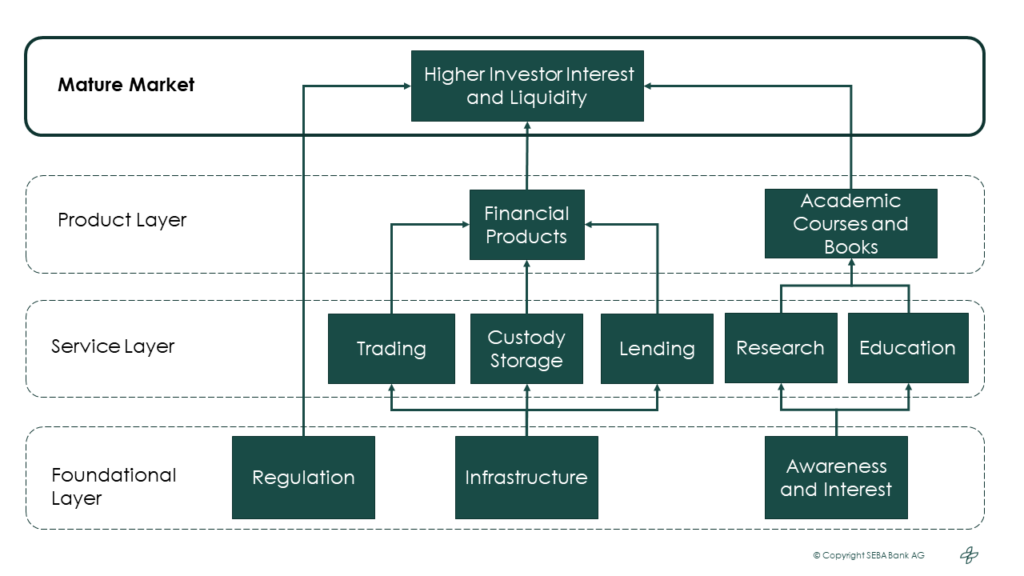

To guide us in our assessment, we have defined a so-called “minimum viable institutional investment environment” as illustrated in Exhibit 1 and in which we describe the steps needed for an asset class to become part of the asset allocation of institutional investors.

At the bottom of the construct, the foundational layer consists of three blocks. Infrastructure is the collection of market players that offer services (supply) deemed adequate to sophisticated regulated and institutional investors. The regulation sets the navigation rules, and awareness and interest measures potential demand.

The foundational layer supports the service layer where market players provide investment services such as trading, custody storage and lending. Research and education are also gaining momentum.

The conjunction of services helps build the product layer in which sophisticated financial products and educational courses are created. Overall, a solid regulatory framework along with infrastructural development and investor awareness are vital for attracting institutional players to a new asset class. When they jump in, liquidity increases and the market matures.

Exhibit 1: Path towards a mature market

Regulation

The first key factor needed to attract institutional investors is a well-articulated regulatory framework. Clear regulation helps them better understand their scope of involvement in an asset class, which further increases investor confidence.

Switzerland is one of the top countries in terms of the regulation of digital assets as it offers a high degree of regulatory certainty and allows for a regulated infrastructure. Some other countries such as Singapore, Liechtenstein, the United Kingdom, Germany, France, Hong Kong and Japan also provide a regulatory framework. Overall, Switzerland’s political attitude towards digital assets and blockchain technologies has been positive. This strong political support has helped create a favourable breeding ground for digital assets. In particular, the technological neutrality stance adopted by the Swiss authorities is very pragmatic and allows the inclusion of crypto-assets in the current regulatory framework.

Some of the major developments in Switzerland include:

- The famous statement by Swiss Federal Councillor Schneider-Amman in January 2018 in which he envisaged Switzerland as a crypto-nation, indicating a clear political will at the highest level of politics.

- The Swiss Financial Market Supervisory Authority (FINMA) guidelines on initial coin offerings (ICO) in 2018

- The FINMA guidelines on stable coins in 2019

- The Crypto Valley Association (CVA) code of conduct for ICOs in 2018.

- The Swiss Banking Association (SBA) guidelines on opening corporate accounts for blockchain companies in 2018.

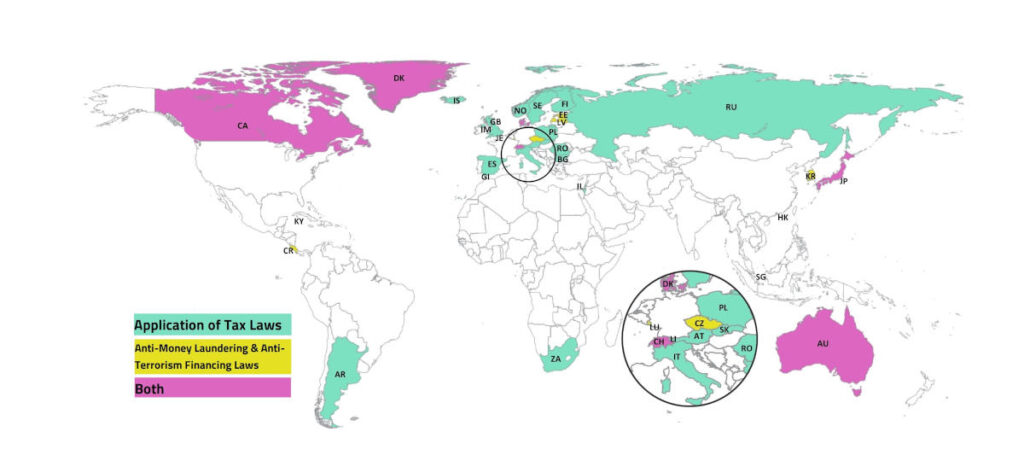

At a global level, we can see that most major economies are working towards establishing clear regulatory guidelines (Exhibit 2).

Exhibit 2: Regulatory framework for crypto-assets

Infrastructure

Infrastructural development is another foundational factor in the path toward a mature market. In the past five years, digital assets and blockchain space have seen some significant infrastructural developments. However, we believe that there is still a long way to go until the emergence of a globally standardised infrastructure. The current status of the service layer is discussed below:

- Trading: There are currently more than 300 cryptocurrency exchanges globally, but not all exchanges are institutional-grade platforms. However, top exchanges such as Coinbase, Binance, Kraken and others have actively developed their platforms to cater for institutional requirements. These exchanges have worked towards setting up structures compliant with KYC (Know Your Client) and AML (Anti-Money Laundering) and offer derivative products, fund insurance, cold storage and Over-The-Counter (OTC) trade functionalities to attract more institutional investors. We are also witnessing traditional exchanges like the Intercontinental Exchange (ICE) entering the crypto exchange space with its subsidiary, Bakkt.

- Custody Storage: Storage is the most diverse segment in the digital asset space, with a plethora of options available to investors. Many companies have started offering institutional-grade custody storage as a service. Traditional financial institutions such as Fidelity have also entered the crypto custody business. This represents a sign of growth in institutional demand from the institutional client side. The crypto-asset storage business is highly scalable, as the cost of securely storing one bitcoin will be the same as the cost of storing one million bitcoins. Due to this scalable and unregulated nature, most crypto exchanges themselves act as custodians, unlike traditional exchanges. We believe that the crypto custody storage business will develop rapidly.

- Lending: Lending against crypto-assets is a relatively untapped business, mainly due to the highly volatile nature of crypto-assets. At present, there are very few options available to institutional investors. Although exchanges and new companies are actively venturing into the lending business, we believe that this segment requires much more development before institutional players can fully leverage these services.

While the traditional banking industry is actively looking to integrate blockchain technologies and digital assets into their business, we are witnessing the rise of a new type of crypto-focused bank. In Switzerland, two financial institutions that focus on crypto-assets, namely AMINA Bank AG and Sygnum Bank AG, have received fully-fledged banking licences from FINMA, while in Singapore, five digital banking licences are expected to be issued very soon. These banks focus on catering to institutional clients by offering them crypto custody storage, trading, exchange and lending services. These developments in the infrastructural service layer help investors obtain easy access to the crypto markets.

Switzerland, as the home to the first two banks worldwide to promote digital assets, is again well placed to attract institutional investors.

Financial products

Financial products are an essential aspect for gauging the maturity of a market as they provide investors with the flexibility to invest in a customised manner. An asset class that has a higher number of financial products naturally attracts more investors as there is a product to suit everyone’s requirements. Financial products like tracker certificates and ETFs can offer investors the ability to cope with exposure to digital assets without the operational aspect of holding or managing the underlying asset. We can broadly categorise the different types of products as follows:

1. Products offered on traditional exchanges

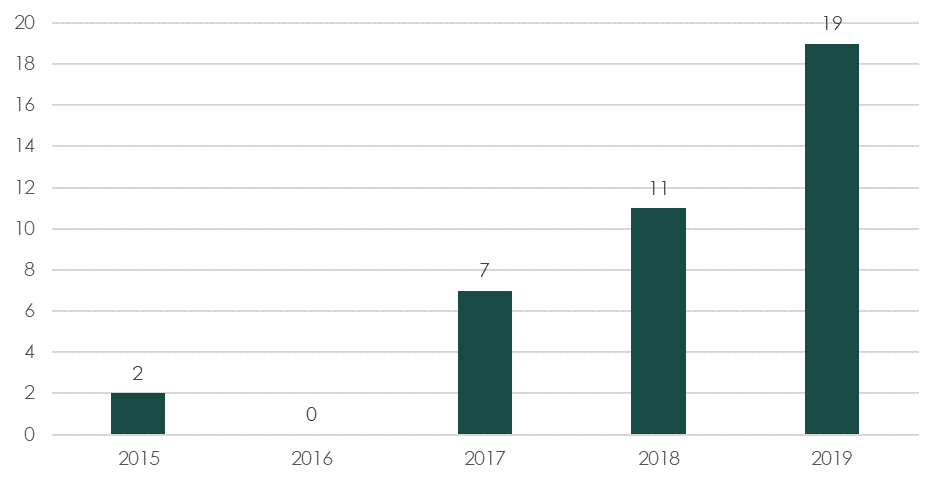

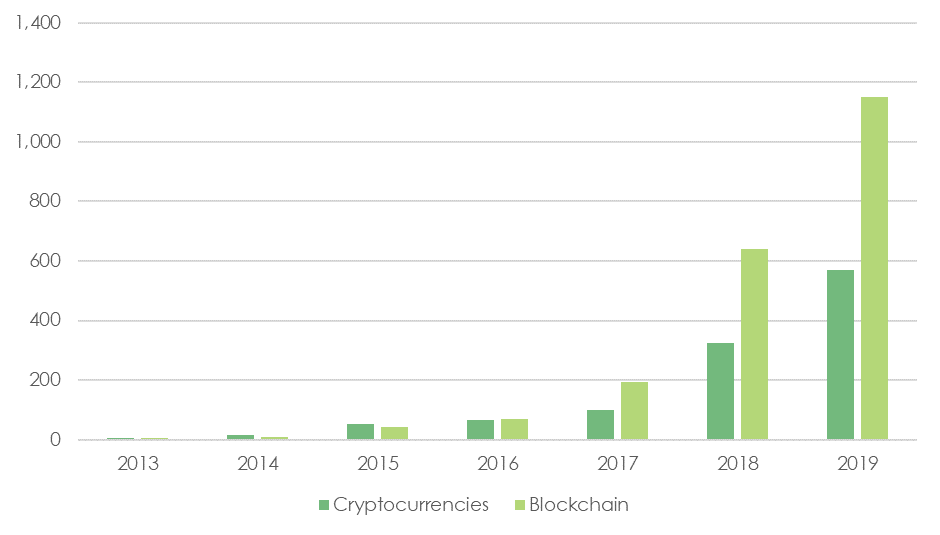

Many regulated exchanges have introduced digital assets and blockchain-focused products over the past few years. Data suggests that financial products based on digital assets saw rapid growth in 2019 (Exhibit 3). This may imply that there has been an increase in demand for such financial products. Global exchanges such as CME (Chicago Mercantile Exchange), LSE (London Stock Exchange), SIX (Swiss Exchange) and Nasdaq are among the top exchanges that offer this kind of financial product and are expected to introduce Bitcoin options as trading products in the future. There are currently more than 40 financial products based on digital assets and blockchain technologies offered by traditional exchanges that give investors direct or indirect exposure.

Exhibit 3: Number of new financial products introduced on regulated exchanges per year

2. Products offered on crypto exchanges

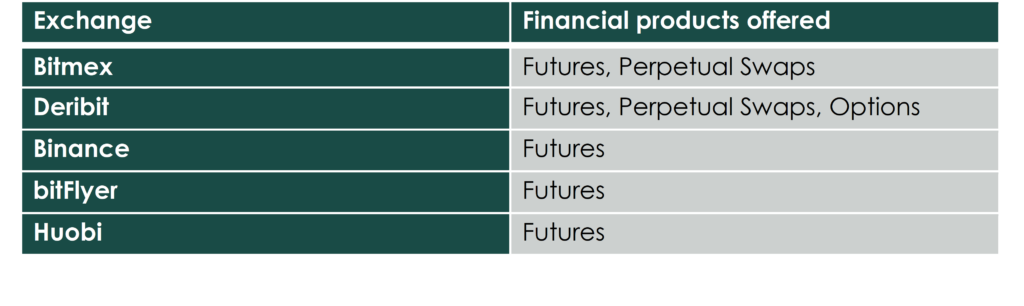

Financial products based on digital assets offered on non-traditional crypto exchanges have also experienced growth, with many new exchanges now offering derivative trading options. Although these exchanges have good liquidity, their unregulated status restricts institutional investors from entering the market. There are a large number of exchanges that provide financial products. We have listed the top five according to their trade volume in Exhibit 4.

Exhibit 4: Financial products offered by crypto exchanges

Going forward, we anticipate that growth will continue as both traditional and crypto exchanges plan to launch more financial products based on digital assets and blockchain technologies. Issuance of Bitcoin ETFs in the US is expected to be the next major milestone in the development of crypto-based financial products. When the opportunity arises, the availability of a higher number of financial products will encourage more institutional and retail investors to enter the market. In the long run, as more investors come into the market, this will result in better price discovery and a more mature market.

Awareness and Interest

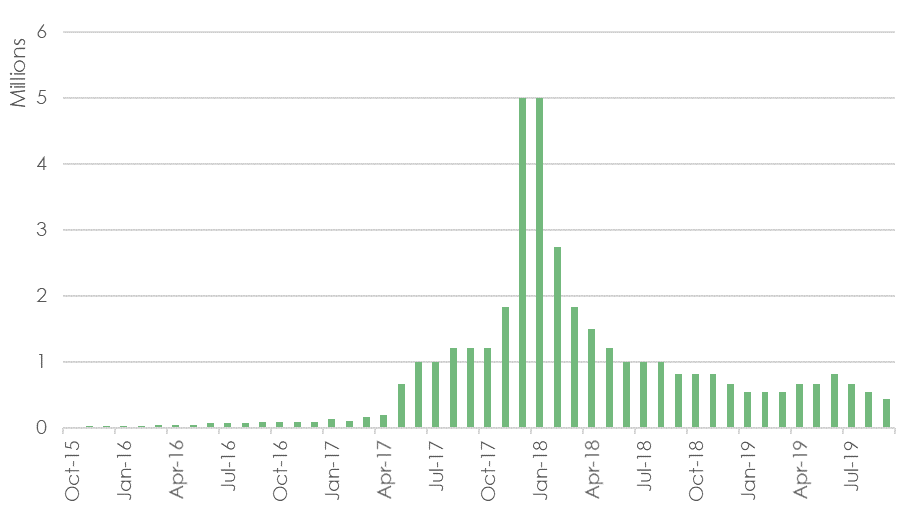

One of the most prominent outcomes of the late 2017 cryptocurrency bubble was the public attention it created. Data shows that pre-2017 worldwide Google searches (Exhibit 5) associated with blockchain technologies and digital assets were negligibly low. However, the 2017 price rally resulted in increased public interest and awareness, as shown by search volumes following the 2017 price rally. Overall, we can see that searches moved sideways throughout 2019.

Exhibit 5: Worldwide Google searches related to cryptocurrencies

An increase in awareness and interest has also succeeded in creating a more competitive research environment. We can see that the number of academic research papers on cryptocurrencies and blockchain technologies (Exhibit 6) has also increased steadily since 2017.

Exhibit 6: Research publications

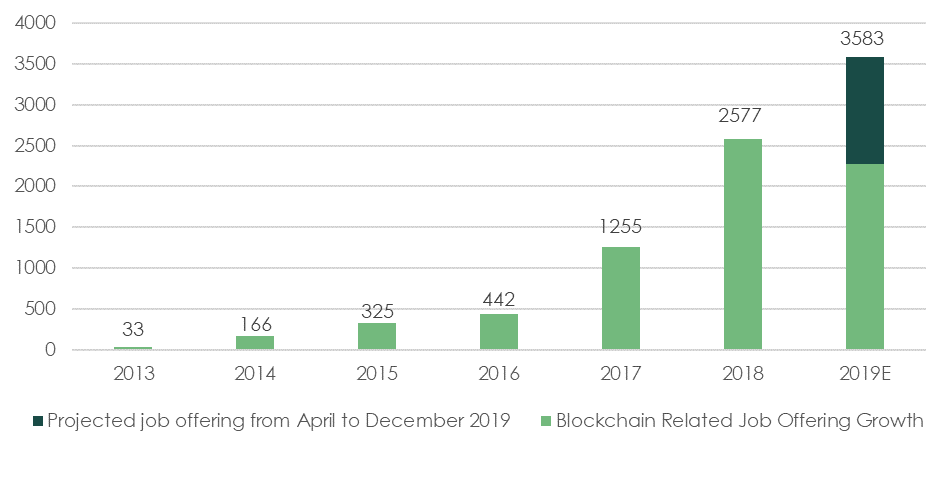

Top Ivy League Colleges such as Harvard, Colombia, Cornell and Brown are currently offering courses on blockchain technologies and digital assets. Finally, a similar growth trend can be seen in the job industries related to blockchain technologies and crypto-assets1 (Exhibit 7). All these developments suggest an increasing knowledge base in blockchain technologies and digital assets.

Exhibit 7: Growth in blockchain-related job offers

Conclusion

Regulation, infrastructure and awareness, the foundational factors, have developed rapidly in the last few years in the digital assets and blockchain space, and this is particularly true in Switzerland. In the service and product layers, we see both traditional and crypto native players now focusing on catering for institutional clients. Data shows that the number of product offerings based on crypto-assets and blockchain technologies has increased in recent years but in our view, more development is required to please all institutional investors. The momentum at this stage suggests that it is just a matter of time until the right products and right education become available. We believe that there are opportunities in sight and that institutional investors can enter this space through crypto-friendly countries such as Switzerland and Singapore. However, in other countries, more regulatory clarity and infrastructural development are required in order to attract institutional investors.

1Forecast for 2019 uses the average compound annual growth rate in jobs in the last 5 years. ↵