Abstract

In this edition of The Digital Investor, we look at the reasons that make crypto assets an attractive addition to an investor’s portfolio. Our analysis shows that a small exposure to crypto assets can enhance portfolio performance for a given level of risk as the low correlation of crypto assets with traditional asset classes allows them to act as an effective portfolio diversifier. The diversification argument favouring crypto assets is further supported by historical scenario analysis where we find that bitcoin was not as impacted as other asset classes during periods of heightened macroeconomic uncertainty. Finally, we note that rapid infrastructure improvements within the industry, along with increasing global regulatory acceptance are now acting as tail-winds for faster and wider adoption of crypto assets.

Why invest in crypto?

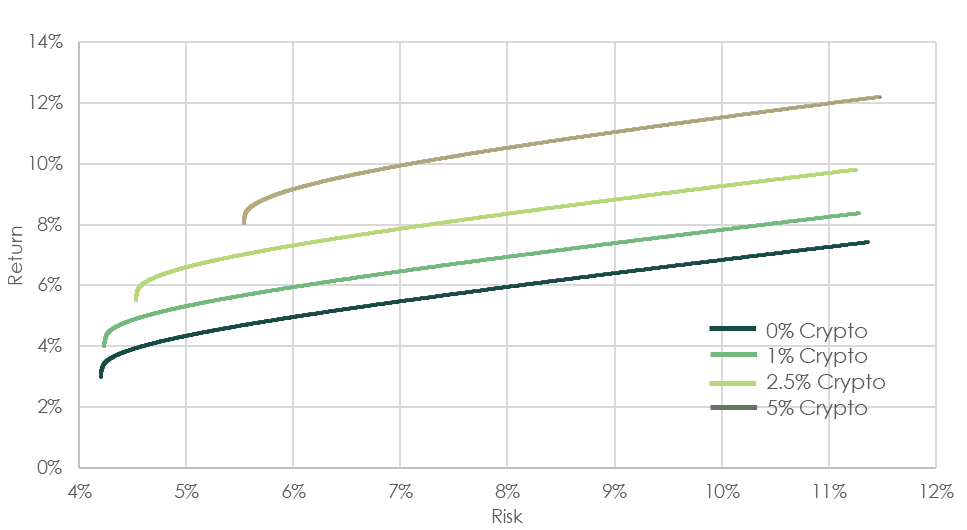

Modern portfolio theory looks at an investment within a portfolio context, i.e. the impact of the investment on expected portfolio risk and return. Our analysis shows that the addition of crypto assets to a portfolio consisting of traditional asset classes such as global equities, global bonds and commodities improves the risk-adjusted portfolio return. In Exhibit 1, we show the “efficient frontiers” for USD denominated traditional portfolios with varying amounts of fixed exposure to bitcoin (1%, 2.5% and 5% respectively). Any point on the efficient frontier represents a portfolio with the highest expected return for a given risk level1 .

For example, without including crypto assets the expected return of a traditional portfolio with a volatility of 5.0% is approximately 4.3%. Allocating 1.0% of this portfolio to bitcoin has the potential to raise the expected return to 5.3%. This implies that including bitcoin into the portfolio results in an upward shift of the efficient frontier, resulting in a higher expected portfolio return for the same level of risk.

So what drives this improvement in risk-adjusted return? We look at some of these factors in the following sections.

Exhibit 1: Efficient frontiers for traditional portfolios including cryptos

Portfolio diversification

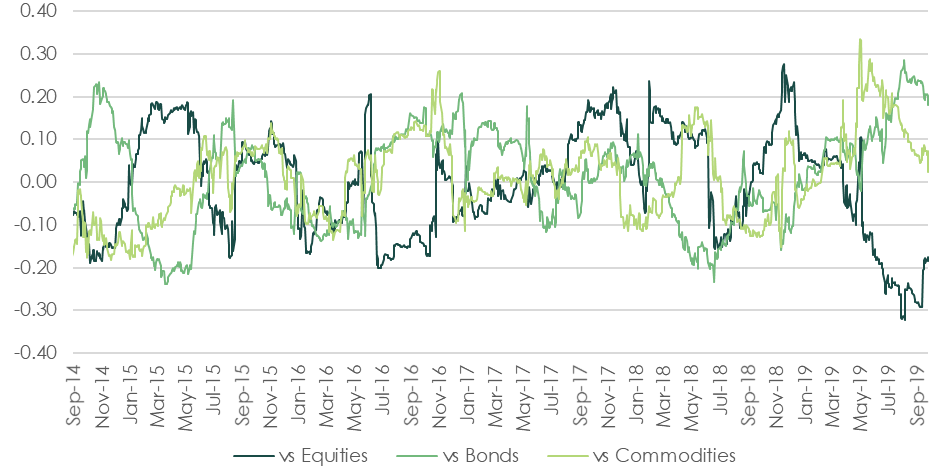

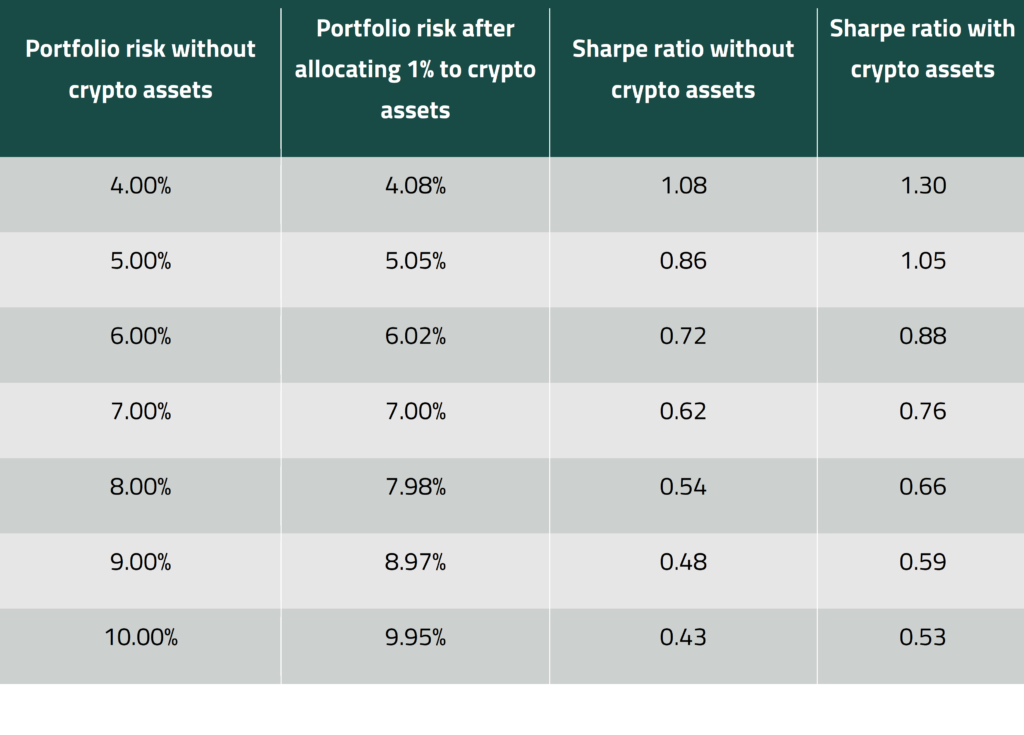

To build robust portfolios, investors should hold assets that have a low correlation with each other. This makes crypto assets attractive as their correlation with traditional asset classes is very low. Exhibit 2 shows the 90-day rolling correlations of bitcoin with global equities, global bonds and commodities. The data indicates that these correlations have ranged mostly between -0.3 and 0.3 over the past years, which is almost negligible. While crypto assets have a reputation of being volatile, their low correlation with other asset classes also makes them effective diversifiers. A small allocation to crypto assets is therefore unlikely to increase portfolio risk materially. For example, if we assume that crypto assets have a volatility of 100% and an average correlation with traditional assets of 0.0, then allocating 1.0% of the traditional portfolio to crypto assets has an insignificant impact on portfolio risk (Exhibit 3).

Exhibit 2 – Bitcoin correlations (90 day rolling windows)

Exhibit 3: Change in portfolio risk after adding 1% crypto exposure, assuming 100% volatility and 0.0 correlation with traditional assets

Hedge during macroeconomic uncertainty

In this analysis, we look at how bitcoin has behaved over the past five years2 during four distinct macroeconomic events that triggered market corrections (Grexit, China currency devaluation, Brexit and Trade War). We observed that bitcoin was not affected by macroeconomic uncertainty and has consistently out-performed traditional assets in all four events.

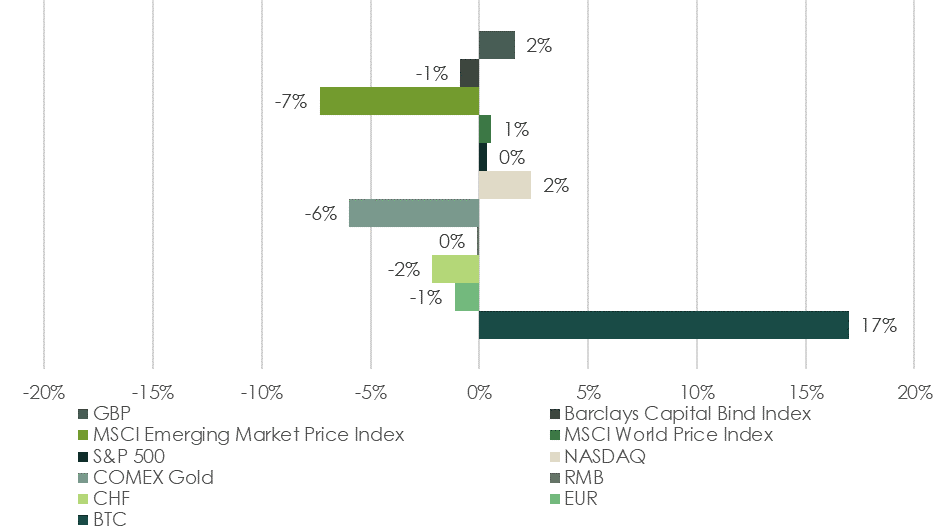

1. Grexit (28th June 2015 – 20th July 2015)

On June 28th, 2015, the Greek government announced the closure of state-owned banks with strict capital controls on transactions. This ban continued for three weeks. The ban was lifted only after an agreement was reached and Grexit was avoided. During this period bitcoin posted a return of 17% versus an average of -1.3% for the other assets mentioned below3.

Exhibit 4: Grexit (28th June 2015 – 20th July 2015), performance measured in USD

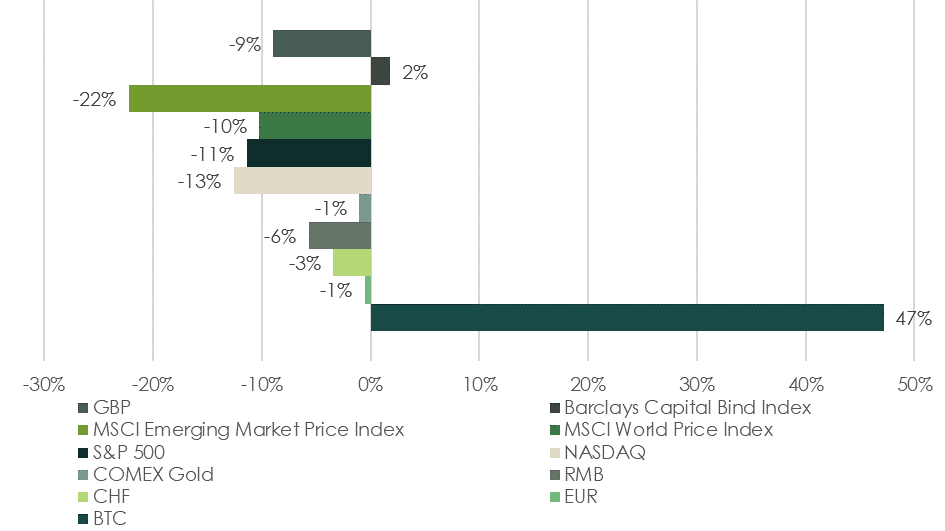

2. China currency devaluation (10th August 2015 – 20th January 2016)

On 10th August 2015, the People’s Bank of China devalued the yuan for the first time in over a decade, setting its rate to 7.0 CNY against USD. Expectations of a recession in China were growing and this fuelled fears that the Chinese debt bubble was close to bursting. Disappointing Chinese PMI data eventually triggered a global market sell-off in late December 2015. During this period bitcoin posted a return of 47% versus an average of -7.4% for the other assets4.

Exhibit 5: China Currency devaluation (10th August 2015 – 20th January 2016), performance measured in USD

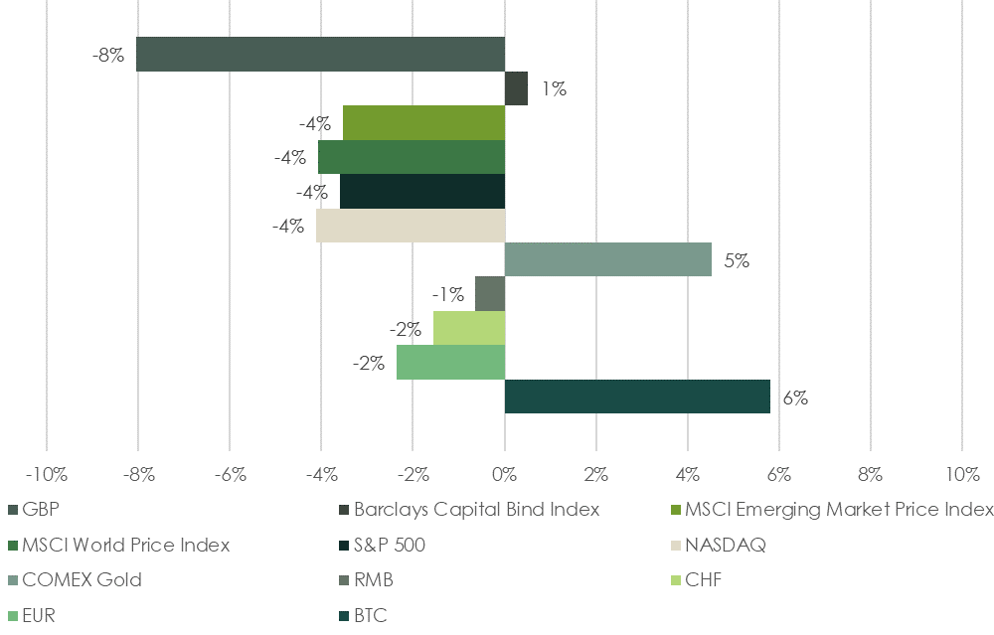

3. Brexit (23rd June 2016 – 24th June 2016)

On 24th June 2016, the United Kingdom announced the result of a referendum vote in favour of separation from the European Union (EU). This resulted in an immediate knee-jerk sell-off across multiple asset class. Bitcoin saw a price increase of 6% during this period whereas the rest of the market saw an average decline of 2.3%. However, similar to bitcoin, gold also saw an increase in value during this period.

Exhibit 6: Brexit (23rd June 2016 – 24th June 2016), performance measured in USD

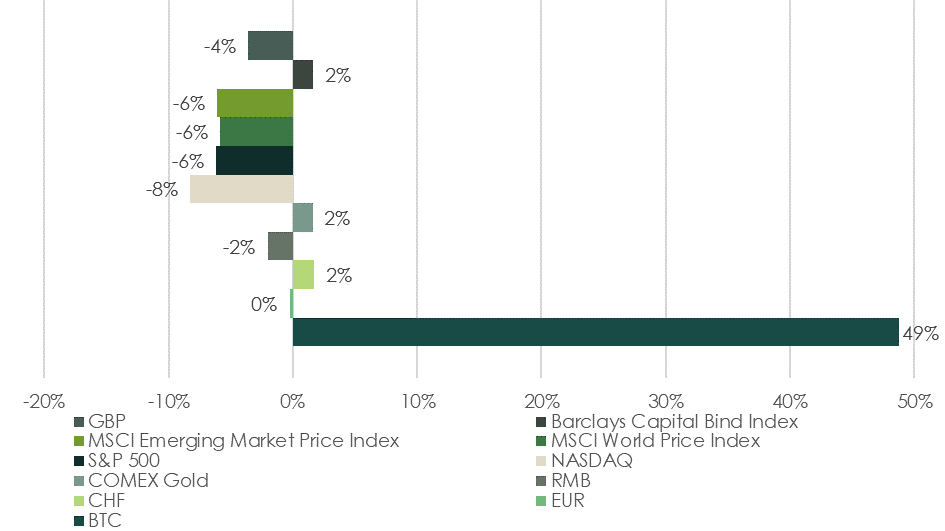

4. Trade War (6th May 2019 – 31st May 2019)

Trade tensions between the US and China first emerged in 2017. The dispute escalated in May 2019 as both the countries raised their import tariffs significantly. During this period bitcoin posted a return of 49% versus an average of -2.7% for the other markets5.

Exhibit 7: Trade War (6th May 2019 – 31st May 2019), performance measured in USD

The four scenarios show that bitcoin offers an attractive portfolio hedge against macroeconomic uncertainty as it is uncorrelated with the traditional markets.

A new source of return

The increase in expected portfolio return in our calculations is also a direct consequence of bitcoin’s high historical return. We consider the median 12-month rolling return for bitcoin over the past four years as its expected return (Exhibit 8). While this estimate may seem aggressive, a repeat of this performance is quite probable given the unique value drivers of the asset class and rising adoption on the ground.

Exhibit 8: 12 Month Rolling Return of Bitcoin

Unique value drivers

Crypto assets, unlike other traditional assets (except for security tokens and asset-backed tokens), do not give ownership rights or a yield in terms of coupons or dividends. They are also significantly different from fiat currencies as they are not controlled by any central authority and have a pre-coded monetary policy. Instead, the value of crypto assets is directly linked to their utility, i.e. the service they provide to community. With the growing use of blockchain, the demand for tokens also increases, leading to a higher monetary value of the respective tokens. As a consequence, the size of the underlying blockchain network becomes an important driver of the value of a crypto asset.

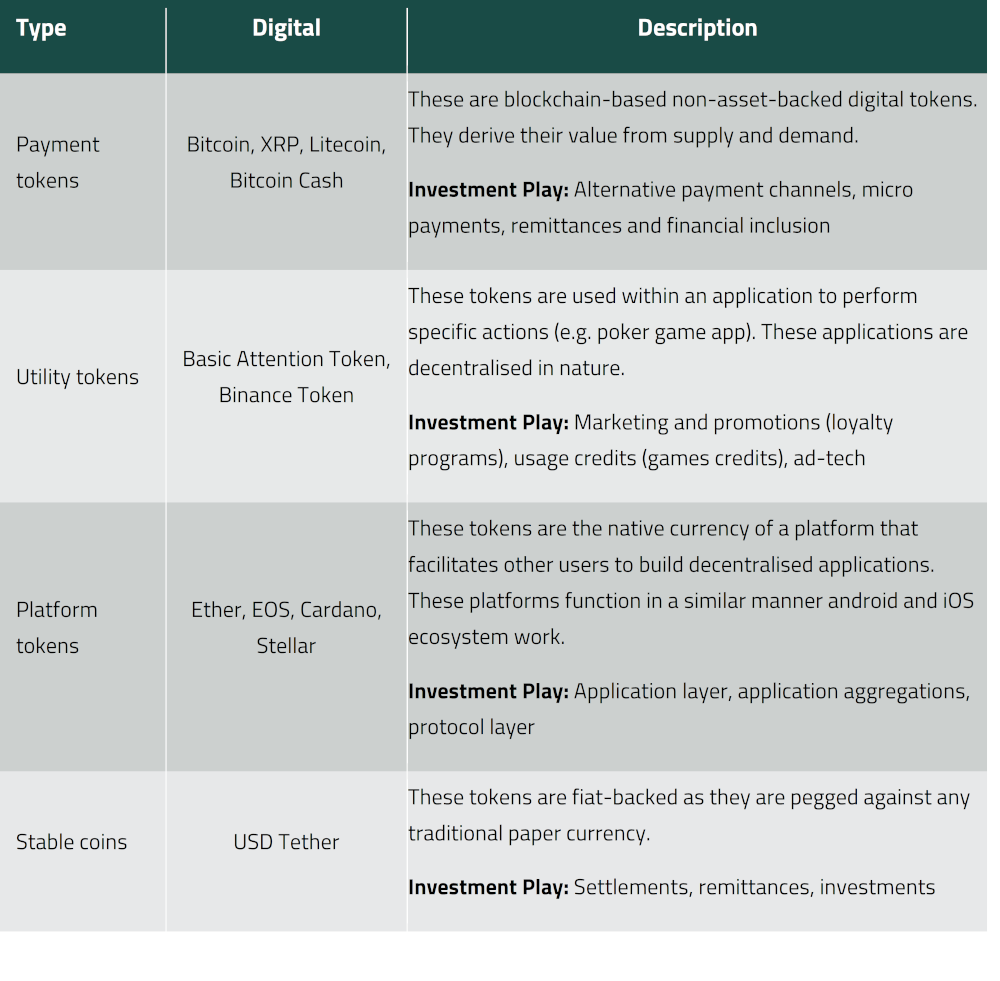

Emerging use cases

Over the years, crypto assets have evolved to find multiple use cases many of which are supported by standalone investment theses (Exhibit 9). These crypto assets impact different industries and act as new sources of returns.

Exhibit 9: Types of crypto tokens and their uses

Other Factors

In spite of a muted initial response, regulatory acceptance of crypto assets across the globe is increasing. Many jurisdictions have started implementing regulatory frameworks, creating clarity for both institutional and retail investors. The Swiss Financial Monetary Authority (FINMA) for instance has issued two documents which lay down the guidelines for initial Coins Offering (ICO) and stable coins.

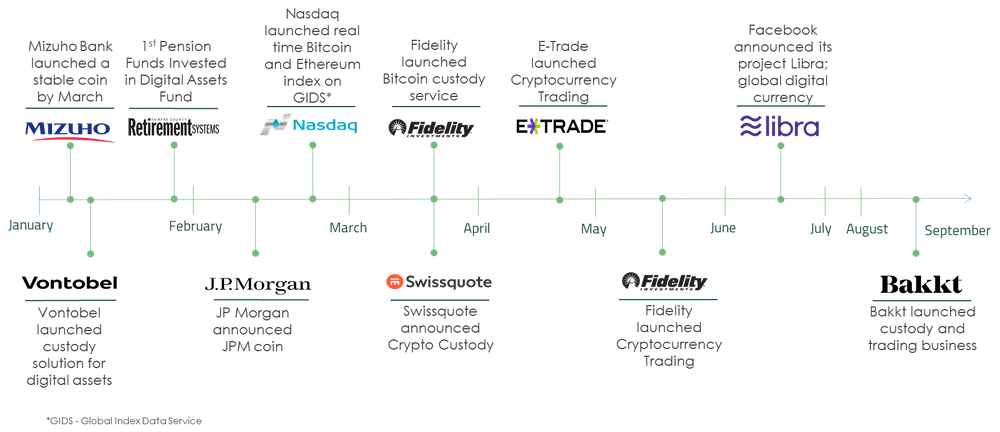

Second, infrastructure development across the crypto universe has also seen rapid improvement this year. Several financial institutions across the globe have launched offerings related to crypto custody storage, trading and crypto derivative products (Exhibit 10).

Exhibit 10: Institutional interest gathering momentum in 2019

Finally, the deteriorating global macroeconomic environment is also acting as a potential tail-wind for crypto assets. Interest rates are expected to remain low at time when valuations of risk assets are stretched. This makes a compelling case for crypto assets to be included into investment portfolios.

Conclusion

Our analysis concludes that a small exposure of crypto assets in a traditional portfolio is likely to improve portfolio risk-adjusted return through increased diversification. Historical scenario analysis shows that crypto assets, such as bitcoin, are not as affected by macroeconomic uncertainty as are traditional assets. However, these factors make crypto assets an attractive investment alternative. While past performance is no guarantee of future performance, they are indicative of the unique behaviour of crypto assets. Finally, rapid improvements in crypto market infrastructure along with the increasing regulatory acceptance across the globe have resulted in higher acceptance and accessibility. These tail-winds are creating an environment for a faster and wider adoption of crypto assets as an emerging asset class.

1The proxies considered for the various traditional asset classes are MSCI All Country World Index (global equities), Barclays Global Aggregate Bond Index (global bonds), Bloomberg Commodity Total Return Index (commodities). We consider a four-year history for the calculation of expected returns which are 6.23%, 4.27%, 0.52% for the respective asset classes mentioned above. ↵

2Even though bitcoin came into existence in 2009 its volume saw a significant increase only in the last 5 years. Due to this reason we are not considering any event older than past 5 years. ↵

3From the date of announcement of bank closing to the date of bank reopening. ↵

4From the day of the announcement and the trough of the drawdown. ↵

5From the day of the announcement and the trough of the drawdown. ↵