Abstract

- Proof of Stake cryptocurrencies are taking the main stage, replacing the older energy intensive Proof of Work coins

- Cryptocurrencies do not solve the problem of world poverty. However, they do lower the barriers to entry for financial inclusion in terms of easy access to capital

- The share of illicit crypto transactions has declined over the years. This would decrease even further due to incoming regulations

- Gender diversity is low in the space, and several groups are trying to drive a change on this front

- Innovation in governance is hard to come by. Nonetheless, it exists in the web three-space. It offers transparency that is rarely seen in the traditional world

- While it is tough to quantify how ESG-friendly cryptocurrencies currently are, we think the overall trend is towards a more ESG-friendly nature of the space

Introduction

- Glaciers are melting, sea levels are rising around the globe, rainfall is becoming less predictable, oceans are warming and becoming more acidic, and the risk of wildfires is increasing. The evidence makes it clear: the environment is warming rapidly, humans are the cause, and a failure to act today will profoundly affect the planet’s future

- Historically, socially excluded people have suffered the most in economic and social development. Incorporating a socially inclusive view when operating in global markets is more critical than ever

- For market participants to move in line with a vision that pays attention to the two factors above, the way things are run and managed, a.k.a. governance, is equally, if not more important

These three components form ESG – Environmental, Social (inclusion), and Governance. ESG investing has gained traction in the last few years, and the question of whether cryptocurrency is compatible with it has been raised many times. In this edition of The Bridge, we address this topic. We conclude that many cryptocurrencies are aligned with the ESG standards and can be included in a well-diversified portfolio.

Environment

Proof-of-Work and Bitcoin’s energy problem

The first issue with cryptocurrencies is often related to energy consumption. As Bitcoin is the most famous cryptocurrency of all, it is often believed that what is true with bitcoin is valid for all cryptocurrencies. This is a huge misconception.

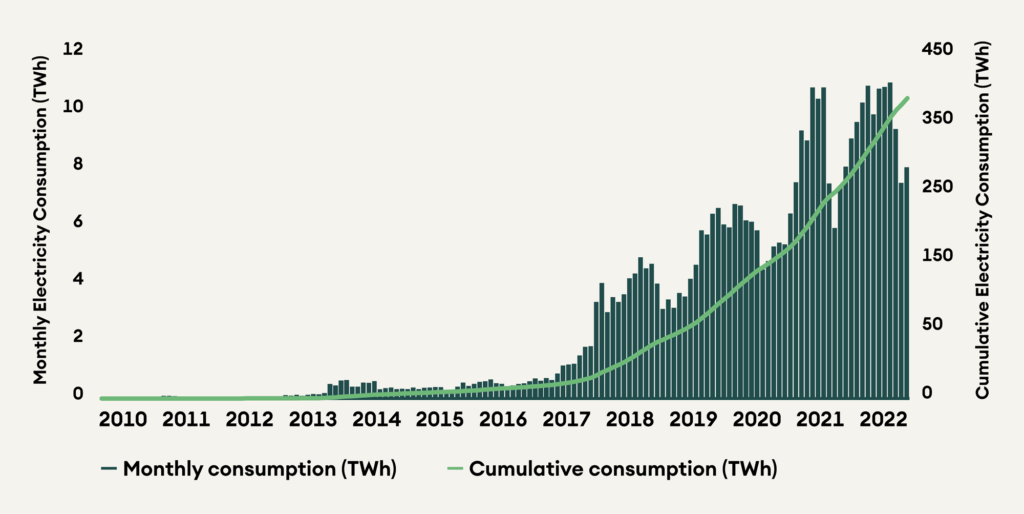

According to Bloomberg, Bitcoin’s energy consumption is estimated to have increased from 6.6 terawatt-hours in 2017 to 138 terawatt-hours in early 2022. Its annual power consumption is greater than that of the whole country of Norway. Bitcoin’s carbon footprint is around 114 million tons of carbon dioxide of annualized emissions. (Comparable to that of Belgium.)

Figure 1: Total Bitcoin Electricity Consumption

Bitcoin intensive energy use comes directly from the consensus mechanism and the way blocks are produced. Bitcoin uses a Proof-of-Work (PoW) mechanism. This mechanism is designed in a way that miners compete to mine the next block and get the rewards paid in bitcoin. As the fastest miners get the rewards, mining has become an industry where thousands of mining racks run parallel to solve the cryptographic puzzle that unlocks the reward.

Notice that the energy spent is used to secure the bitcoin network and create a decentralized, open network that everyone can use worldwide. The energy is thus not wasted.

The source of energy used to mine bitcoin has changed over time. According to the consulting firm Roland Berger, 57% of mining comes from renewable energy. In another report from another consultant, PWC states that “the bitcoin network can serve as a flexible energy buyer of last resort to balance fluctuations in renewable energy power generation and demand”, participating in the energy revolution.

The crypto community is aware of the energy issue. It has come out with its solution, called the Crypto Climate Accord.

Crypto Climate Accord

The Crypto Climate Accord (CCA) is a private sector-led initiative for the entire crypto community focused on decarbonizing the cryptocurrency industry. A consortium of private players announced it in April 2021. It wants to transition all blockchains to renewable energy by 2030 and reach net-zero greenhouse gas emissions by 2040. The initiative is led by three non-profit companies — the Rocky Mountain Institute, the Energy Web Foundation, and the Alliance for Innovative Regulation. The first two are non-profits focused on sustainability and transition to low-carbon footprints. At the same time, the Alliance for Innovative Regulation is an international advocacy group that speaks for implementing fair financial systems.

The accord currently has two objectives:

- Achieve net-zero emissions from electricity consumption for CCA Signatories by 2030

- Develop standards, tools, and technologies with CCA Supporters to accelerate the adoption of and verify progress toward 100% renewably-powered blockchains by the 2025 UNFCCC COP30 conference

Proof-of-Stake

There is an alternative to PoW, which is the Proof-of-Stake (PoS) consensus mechanism. Networks functioning on this mechanism are increasingly being used. At the time of writing, only two of the top 20 coins run on a PoW consensus, namely Bitcoin and Dogecoin. All others use consensus mechanisms related to PoS.

To appreciate the energy efficiency potential of PoS compared to the PoW mechanism, note that the Ethereum network’s transition from PoW to PoS, called The Merge, reduced energy consumption by a staggering 99.95%.

The reason behind PoS efficiency comes from the incentives to secure the network. Contrary to PoW, where miners compete to mine the next block, PoS validators are randomly chosen to validate the next block. As a result, PoS validators don’t need fast computers to get higher rewards; they need to lock more coins in the network to increase their chance of being selected in the next validating round.

In addition to energy efficiency, PoS allows anyone to contribute to network security via delegation and earn rewards. It is worth noting, however, that the PoW chains are considered more secure against a 51% attack than the PoS chains.

Social Inclusion

Financial Inclusion

According to the World Bank, 76% of the world’s population has a bank account. Economic development, access to financial services, and poverty are all interconnected. Critics argue that cryptocurrencies only claim to bring financial inclusion but do not do so. Maybe yes, cryptocurrencies cannot solve the problem of poverty. However, cryptocurrencies lower the barriers to entry into the financial system. There is no minimum amount to open a wallet, no KYC requirement, no maintenance fees, but only transaction costs.

To access cryptocurrency services, the minimum requirement is to have a smartphone and an internet connection. By 2023, 85% of the global population is expected to have a smartphone, making cryptocurrencies very attractive for individuals from developing countries regarding financial operations. Again, the percentage of smartphone ownership in developing countries is low and will see exponential growth with time.

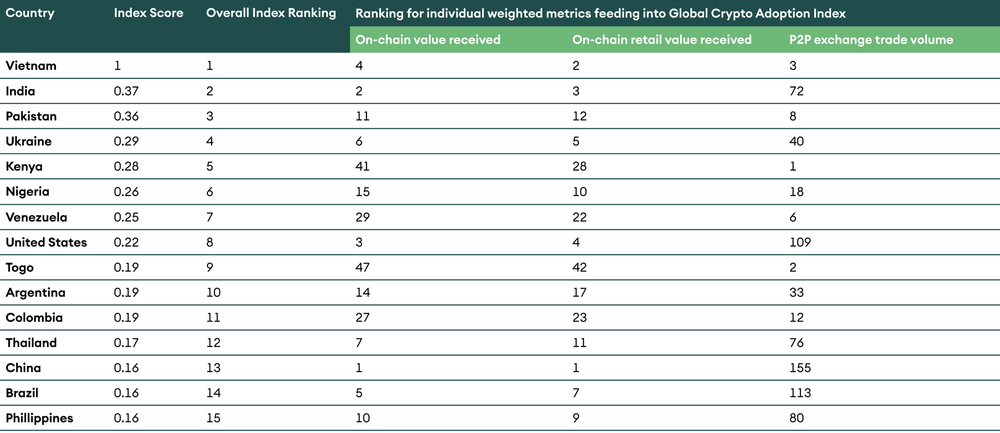

According to a 2021 Chainalysis Report, emerging economies rank the highest in cryptocurrency adoption, with Vietnam, India, and Pakistan being the top three. More than 80% of the top 15 users of cryptocurrency are from developing countries, as shown in the table below. This suggests that cryptocurrencies offer services these people cannot access otherwise

Table 1: Geographical distribution of cryptocurrency adoption

Cross-border transaction time has been an issue for entities and individuals who frequently send and receive money from other countries. According to the SWIFT payment network, wire transfers typically take several days as cash flows via several banks.

Cryptocurrencies offer a convenient alternative. Settlement times for cryptocurrency payments are significantly lower than for traditional currency payments. For example, Bitcoin and Ethereum provide average transaction times between 12 seconds and 60 minutes. By comparison, wire transfers might take between four hours and five days, and credit/debit card transactions could take up to 9 days, according to a Morgan Stanley Report.

Cryptocurrency transaction costs are also lower than traditional payment methods. According to Morgan Stanley, Bitcoin and Ethereum offer average transaction fees between USD 2-4, whereas a cheque transfer fee is USD 15-20 and wire transaction fee is USD 25-50. Moreover, transactions in newer PoS blockchains are quasi-instantaneous (sub-second finality), and transaction costs are as low as USD 0.3 in case of Avalanche, USD 0.1 in Polygon, and USD 0.00025 in Solana.

One can argue that the high price volatility of cryptocurrencies makes them unsuitable for daily operations. Therefore, the existence of stable coins solves this issue.

Illicit activities

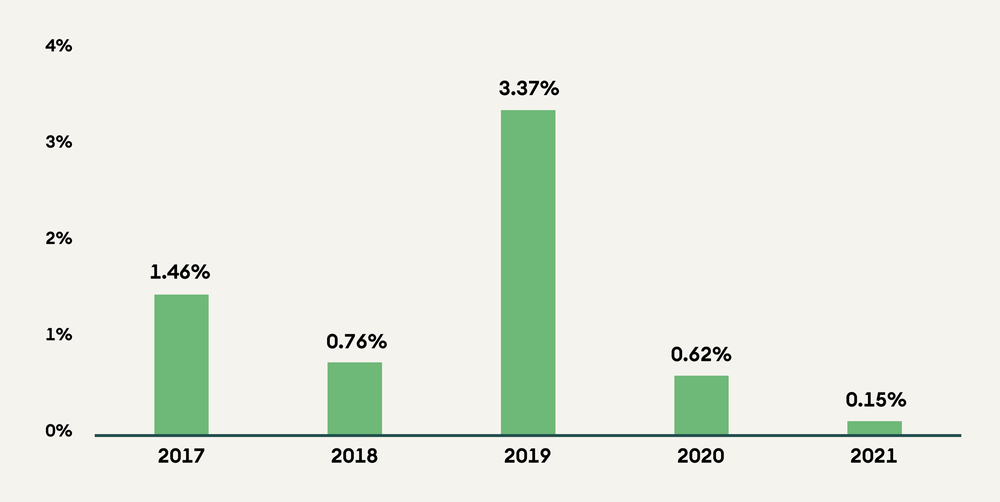

According to a 2022 Chainalysis Report, cryptocurrency-based crime hit an all-time high in 2021, with over USD 14 billion of funds moved into illicit wallets. However, when comparing the USD 14 billion to the total cryptocurrency transaction volume, the share is only 0.15%. and has declined from previous years.

Figure 2: Share of Illicit cryptocurrency volume

This puts the percentage of identified illicit activity among all cryptocurrencies lower than the broader economy, which is 2-4% of global GDP (according to the United Nations). This puts global corruption at USD 2 trillion (going by World Bank’s estimates), a figure significantly higher than that for cryptocurrencies.

The decline in the share of illicit activities financed with cryptocurrencies results from the increasing global regulation affecting digital exchanges. Notice also that blockchain is an open technology. All transactions are directly observable on the chain, making the traceability of money flows easy.

Governance

Blockchain protocols are software, and those who can change the software code have the power to make and break the network. Governance plays a vital role as a small group of developers often have the right to change the code. As they say, with great power comes great responsibility.

Protocol changes are not decided by a single party or a fixed group of “shareholders”, as with traditional companies. There is greater fluidity regarding protocol management, as everyone has the right to make proposals. This approach’s benefit is broadening the decision base to include more stakeholders. There is greater fluidity regarding protocol management, as everyone has the right to make proposals. This approach’s benefit is broadening the decision base to include more stakeholders. However, the difficulty is ensuring that decisions taken ensure the longevity and prosperity of the protocol.

As far as protocol management is concerned, governance is either off-chain or on-chain. The old blockchains, such as Bitcoin and Ethereum, have off-chain governance. It means it is unnecessary to hold the protocol coin to have the right to change it. You can imagine it as a company where non-shareholders have the right to participate in the general assembly and to make proposals.

In the case of Ethereum, the various entities involved in Ethereum governance are:

- Ether holders

- Users who have interacted with Ethereum applications

- Application and tooling developers

- Ethereum node operators

- EIP Authors (the individual who proposes the EIP on the governance forum)

- Miners/Validators of the network

- Protocol Developers a.k.a. “Core Developers”

To propose a protocol change called EIP for Ethereum Improvement Proposals, there are clear rules. More importantly, all the EIPs are listed publicly and reviewed by all the participants wanting to have their say.

The way it works is as follows. A member usually proposes an EIP on the governance forum. It includes an in-depth description of the technological changes being proposed and the reasoning behind the proposal. The community then provides feedback, which is shared with the core developers, usually over the “AllCoreDevs call”. It is then decided whether to go ahead with it, shelf it for the time being, or reject it. Suppose it passes this stage and is considered. In that case, the EIP is iterated towards a final proposal incorporating the feedback gathered from the relevant members. It is then tested on test nets before it is scheduled for deployment on the Ethereum Mainnet.

In the Bitcoin Network’s case, proposals are referred to as Bitcoin Improvement Proposals (BIPs). BIPs are informal proposals and ideas usually generated in community chats or through social media engagement. Before becoming a “BIP”, the recommendation is shared via email or other communication channels where the community provides initial feedback. Once the proposal receives significant support, the author can progress it to the next stage and turn it into a BIP. Once a BIP is submitted as a draft to the BIP GitHub, the proposal is reviewed and worked on transparently by the developer community so everyone can view its progress and consequent testing outcomes. As the Bitcoin blockchain is based on code, protocol changes will immediately reflect. Because of the severe implications, some changes might inflict a cost to miners. Hence, a change in the code requires the acceptance of around 95% of miners unless the author gives a reasonable motive for a lower threshold.

The process is similar for Dapps (decentralized applications) built on top of these base layers, except that the network’s core developers are not involved in that process. Almost all Dapps have a governance token for this process (usually either airdropped to the app’s early users or can also be bought off exchanges at market price). There is an on-chain voting process generally using a tool like snapshot.org. The weighted average of the votes (weighted corresponding to each voter’s respective holding of the governance token) decides what happens to the proposed implementation for the Dapp.

A form of on-chain governance is through DAOs (Decentralized Autonomous Organizations). Voting in DAOs is like on-chain voting for protocols. Here, the token holders need to “stake” their tokens to be able to participate in governance. The greater the number of tokens the voter holds, the higher the weightage given to the vote. These tokens will remain staked until voting closes. For more on DAOs, read our previous article here.

While transparency is welcome, not all governance is perfect. Protocol governance is often obscure and not always as transparent as presented above. One primary concern is that because of the anonymous identities of many market participants, we cannot know whether governance is truly decentralized, or most of the votes are from just a few whales owning protocol tokens being held across multiple wallets. In this context, the initial distribution of coins is a vital variable in analyzing the governance as knowing who owns what help to understand the short and long-term incentives of the token holders.

The more transparent the process and the more participants participate in decision-making, the slower the governance is. In case of emergencies (for instance, a bug), an elaborate proposal and voting procedure must be done appropriately.

Diversity

Cryptocurrency exchange Gemini’s 2021 report said that women represent only 26% of investors in the crypto space, showing low gender diversity. This result is not surprising as blockchain and cryptocurrencies are an amalgam of finance and technology, two male-dominated sectors. A 2021 McKinsey study showed that 64% of financial services executives are white men, and 23% are white women. The gap is significant in tech sector as well, with data showing that women hold only 24% of computing jobs.

Multiple women-led groups tackle this problem in the web 3 space. Below are a few.

- HER DAO is a decentralized organization focusing on increasing gender diversity in the space. It sponsors “hacker-houses”, meetups, and conferences for women on web 3 worldwide. It is building a “women first” culture to increase female involvement in the industry. It even created its own NFT collection on OpenSea

- Women in Web3 is a vetted community and a DAO for women entrepreneurs who want to learn, prototype, and venture together, focusing on web 3 entrepreneurs

- Women in Blockchain is another such DAOs advocating for more female inclusion in web 3

- World of Women is an NFT collection that celebrates women and is a cultural movement to bring more women into the space. The community celebrates representation, inclusivity, and equal opportunities for all.

Conclusion

In this publication, we have covered some aspects of ESG investing. We have focused on climate change and carbon emissions, financial and social inclusions, illicit activities, and governance. The ESG standards have broader coverage than the one we discussed here. A list of the ESG factors can be found on the CFA website.

We have focused on a few factors as they are the ones that repeatedly come up in our discussions with clients, and we realized that there were some misconceptions in the market.

Whether cryptocurrencies are aligned with ESG standards cannot be answered definitively in this publication. In our view, many of them are, and the general trend is towards more ESG-friendly protocols.

With the notable exception of Bitcoin, energy-intensive PoW protocols are slowly losing traction. Energy-efficient PoS protocols are replacing them. Regarding Bitcoin, the energy mix has improved, as 57% of it is renewable.

Cryptocurrencies alone cannot solve poverty. However, data suggests that cryptocurrencies are broadly used in developing countries where the financial infrastructure is not as developed as in the Western world, leading to some financial inclusion.

The share of illicit activities is declining as the cryptoverse is preparing for coming regulation. Diversity is still low, but groups are working on it. Finally, innovation in governance is taking place and offers a level of transparency rarely seen in the traditional world.