Abstract

The Decentralised Autonomous Organisation (DAOs) run by the holders of the governance tokens performs the role similar to the upper management of an organisation. They vote on strategic decisions, democratically altering the protocol to perform and grow in a fast-developing ecosystem. Blockchain systems are constantly changing with new users, needs and applications, and code needs human intervention to keep up. DAOs and governance tokens transparently coordinate this human effort and align the interests of all stakeholders.

In this edition of the Bridge, we cover how governance in blockchain has evolved from its nascent disorganised beginnings with the ideal of perfect sanctity of code to multibillion-dollar DAOs that coordinate and incentivise the human elements needed for success. We cover how governance tokens confer certain rights and responsibilities on their holders. We discuss the mechanics of a DAO and the process of proposing and implementing change. Finally, we cover how governance models may be improved in the future to represent the broader community better.

“Code is law”

The ideal case for blockchains is that “code is law”, that is, the rules of the open-source code of the blockchain or smart contract solely define the scope of what is possible, and everything done within it is fair play. This is derived from the trustless ethos of blockchain, where any interested individual can read and verify the source code themselves, requiring no middle party or mediator to transact. In the early days of crypto, this philosophy worked well when the primary use of crypto assets was as a medium of exchange and there were a smaller number of users to support. “User-beware” and “not your key, not your coin” worked well as the simple rules of the game.

Governance and discussions on improvement happened in an unorganised fashion on online forums and chats. Iterative upgrades to the protocols were suggested by contributing developers and implemented by the miners. The space was small enough to allow early developers and users to voice their opinions and move the protocol in the direction they wished.

Forks

However, as the crypto ecosystem grew with more diverse use-cases and more significant sums of money became involved, differing factions with differing interests and priorities came to be. Any irreconcilable difference among these factions would result in the splitting up of the protocol through a fork. Two of the most prominent examples of this is the Ethereum fork of 2016 and the Bitcoin fork of 2017.

In 2016, the very first DAO, which was simply called “The DAO”, ran a very successful initial coin offering (ICO) of about USD 150 mn. It was later exploited and lost USD ~60 mn worth of ether. Vitalik Buterin and the Ethereum developers proceeded with a very contentious fork to refund the investors when Ethereum was only a year old. The fork created two chains that we now call Ethereum (ETH) and Ethereum Classic (ETC).

In 2017, the discussion on how to scale Bitcoin to support the growing user base also led to a fork. Bitcoin Core (BTC) chose to scale with layer-2 solutions like Lightning, and Bitcoin Cash (BCH) increased the block size to support more transactions, sacrificing decentralisation for scalability (see our report on the blockchain trilemma).

The dilemmas and the subsequent forks were very contentious solutions and adversely affected the BTC and ETH brand, even though there were the eventual winners. However, at the time, there were doubts on who among the developers, miners or users were really in charge.

Currently, the Ethereum Foundation, a non-profit, coordinates the efforts of the developers with miners signal their intent to accept or reject the proposal. EIP (Ethereum Improvement Proposal) 1559 is an improvement to make gas fees on Ethereum more predictable and was accepted in the “All Core Developer Meeting”, but there is a growing movement among the miners to fork it as their revenues will be affected.

Utility and Governance Tokens

As decentralised applications (dapps) became popular during the Ethereum ICO boom of 2017, utility tokens first gained prominence. These tokens are used as currency within a protocol in exchange for the service the protocol provides. For example, for every data request to the ChainLink Oracle, a fee in LINK has to be paid. Utility tokens provide no other rights or risks and therefore suffer from the problem of value accrual. A protocol’s success does not mean that the utility token will have any share in the value generated. Protocols have tried to solve this by burning the tokens earned, decreasing the overall supply, and indirectly increasing the value of remaining tokens. While the problem of value accrual may be partially addressed, utility tokens still do not give the holders any control over the protocol or its direction. Investors remain dependent on the development team, who may not be as motivated to maximise the value of utility tokens as much as the company’s equity shares.

The decentralised finance (DeFi) boom in 2020 saw the popularisation of governance tokens where holders have certain rights over the protocol, its treasury and direction but also underwrite certain risks. Like equity shareholders of a company, governance token holders of a protocol take the opposite side of its users. Whenever the users incur a cost on the protocol, the protocol’s treasury accumulates it. Similarly, the token holders underwrite protocol risk for users through either reimbursement from the treasury or dilution of tokens.

The developer organisation is usually incorporated in the form of a trust, with a certain amount of governance tokens vested to them, ensuring that the goal of value maximisation of the token is shared between the investors and developers. As the protocol matures, an inflation rate rewards active contributors and participants, and the governance is expected to become more decentralised. The trust can then play a minor role, leaving the governance holders to decide the direction of the protocol.

One of the most prominent examples of a governance token is Maker DAO’s MKR. MakerDAO is a lending platform and the issuer of the largest decentralised stable coin, DAI. It was initially founded in 2014 before Ethereum went live and has been in its current form since 2017. To receive DAI, users can lock crypto assets in over-collateralised vaults, effectively leveraging their position. When users repay their loan, they pay a stability fee which is accumulated in the protocol treasury. In case there is under-collateralised DAI, MKR holders have to pay through dilution and new MKR is auctioned to meet the shortfall. This happened once in March 2020 when the crypto markets crashed and caused a shortfall of collateral for 5.4 mn DAI.

The Rise of Decentralised Autonomous Organisation

DAOs have come up to coordinate the efforts of governance token holders and manage the protocol to be more effective in tackling the changing needs of the ecosystem. A DAO enable its governance token holders to participate in a voting mechanism to make decisions when the underlying code is silent or itself needs to be changed. The rules of the DAO define the scope, rights and responsibilities of governance token holders. It also establishes the process by which changes can be implemented. For protocols that earn revenue like some DeFi applications or retained some tokens during distribution, the DAO also controls how the treasury is utilised.

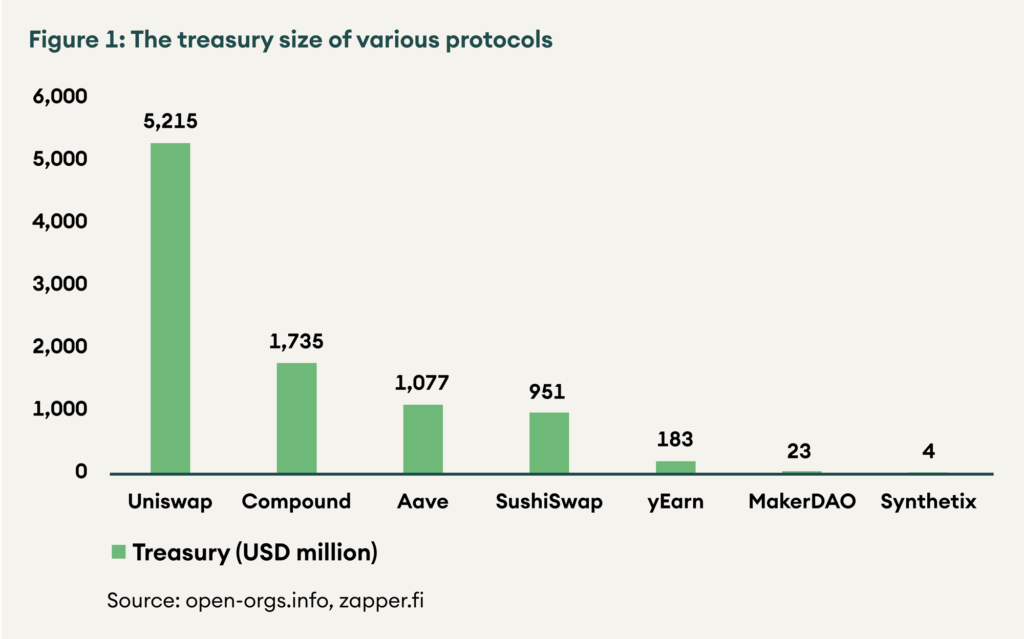

Figure 1 – The treasury size of various protocols

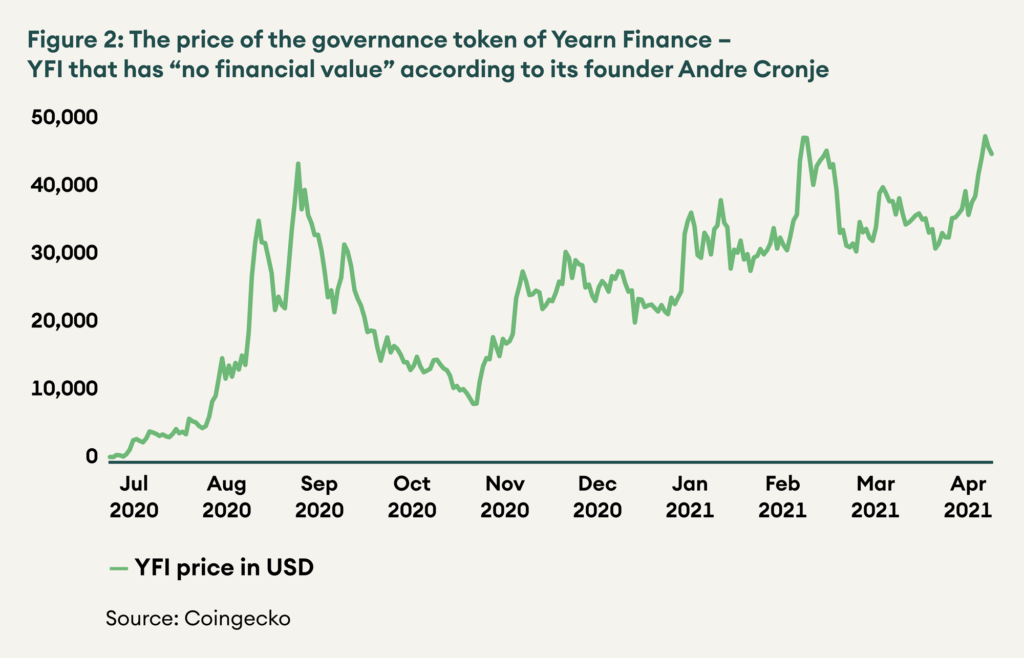

Instead of raising funds through an ICO, governance tokens are usually distributed to users and contributors of the protocol to incentivise protocol adoption and decentralise the governance among the most interested participants. During the fair launch of YFI tokens, Andre Cronje, the founder of Yearn Finance, famously called it to have “no financial value” as no payment had to be made to acquire YFI. However, control over the direction of a multibillion-dollar protocol and its treasury is desirable, and therefore the tokens are valuable.

Figure 2 – The price of the governance token of Yearn Finance – YFI that has “no financial value” according to its founder Andre Cronje

In effect, DAOs perform the role of the upper management of an organisation. Governance token holders vote on strategic decisions, democratically altering the protocol to perform and grow in a fast-developing ecosystem. Blockchain systems are constantly changing with growing users and needs, and code needs human intervention to keep up. DAOs and governance tokens transparently coordinate this human effort and align the interests of all stakeholders.

Let us see some DAO proposals to understand better the scope of their powers and when human intervention is required –

YFI dilution – Yearn Finance’s token YFI had a fixed supply that was already fully distributed. As a result, it did not have a good mechanism to reward contributors and was lacking innovation. To overcome this, the DAO voted to mint an additional 22% tokens to reward contributors and fund future growth. The original code, in this case, had a fixed supply, but the DAO increased the limit to meet the shared objective.

Uniswap governance thresholds – Currently, Uniswap DAO needs 10 mn UNI tokens or USD ~300 mn to propose a vote and 40 mn UNI tokens or about USD ~1.2 bn to pass a vote. This proposal was to reduce the limits to propose a vote to 3 mn UNI tokens and achieve a quorum to 30 mn UNI tokens. This proposal was defeated as it was short by 400k UNI votes at 39.6 mn UNI votes in favour. While it would have perhaps allowed for more decentralised governance, there was a concern among UNI holders that lower thresholds might mean lower demand for the tokens and consequently lower price.

Fei Protocol refund – FEI token is supposed to function as an algorithmic stable coin pegged to USD. However, due to code and design issues, the peg is not established, and FEI currently trades at USD ~0.8. There is an ongoing vote to decide whether to refund FEI at USD 1, USD 0.9 or not at all from the protocol treasury.

DAO governance process

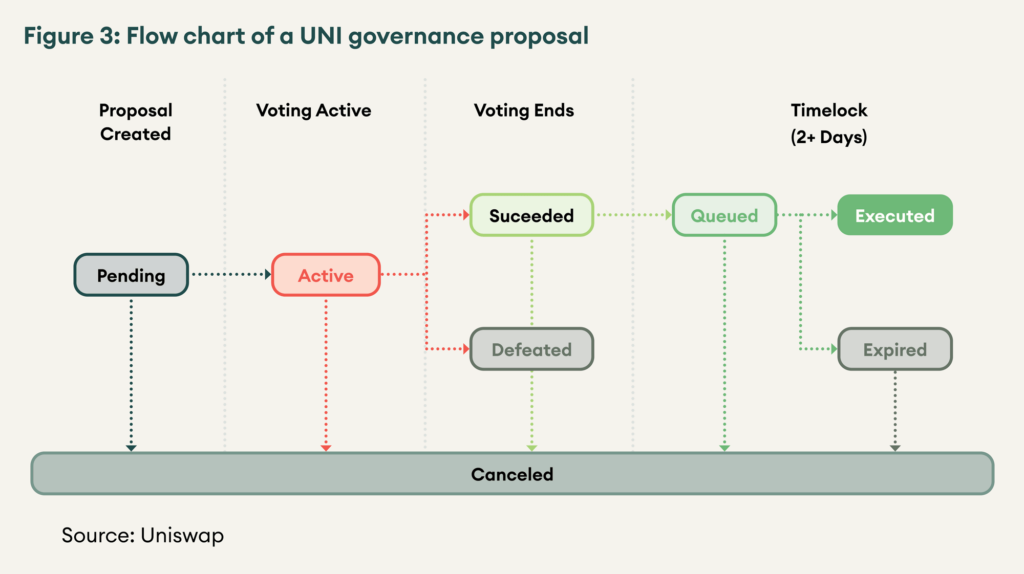

The DAO defines a process that must be followed for changes to proposed and implemented. We will use the example of Uniswap governance. All token holders get one vote for each UNI token held. This has a dual purpose – large token holders are more invested in the success of the protocol and therefore should have a higher say, and attacking the governance process through acquisition of majority tokens becomes expensive. To propose a change, the individual typically posts it first on the discussion forum to get feedback and gauge whether there is enough interest. Then they must collect the support of holders of 10 mn UNI or 1% of total supply to propose a vote officially. Once the vote is proposed along with the new code, it will pass if it has both a majority and at least holders of 4 mn UNI tokens voting in favour. If it passes, there is a minimum of two-day time lock to ensure the code is safe to deploy, after which it is deployed to the contract. Some DAOs have a non-binding signalling vote before the actual vote to gauge whether there is interest in a proposed change and towards which direction it is leaning.

Figure 3 – Flow chart of a UNI governance proposal

Limitations of DAOs and the Future

DAOs function well when the tokens are evenly distributed. However, in most cases, a few large wallets control a significant part of the tokens. For example, for Compound, just six addresses control more than 52% of the voting power. These six addresses can out vote more than 150,000 total addresses that have a positive balance. While it makes sense as they are the ones most invested in the protocol, adequate representation of minority investors is also a must-have for good governance and to achieve the blockchain ethos of decentralisation. Quadratic voting, where the number of votes granted per unit of token held decreases exponentially, may be a solution. This gives small voters more meaningful participation in a proposal, and the cost to a single large entity to control the majority of votes becomes much higher. However, this requires proof-of-humanity to be successful, as without it the system can be gamed by breaking up large wallets into multiple smaller wallets to gain disproportionate voting power.

As described above, governance through DAOs is a slow process. Therefore, the founding developer team usually has a multi-sig backdoor wallet that can bypass the need for a proposal in case of emergencies. Such a system is needed while the ecosystem is still evolving, and with real values at stake, speed is sometimes necessary to tackle urgent threats. However, this goes against the blockchain ethos of trustless systems and should be phased out as the protocols mature.<br

While it may seem that the present solutions are imperfect and require a great degree of trust, the users still have some protection as they always have the last resort option of forking the protocol and going in their own direction. The side with a higher claim to legitimacy should be the winner, and in previous cases, the side with the users has won, whether it is BTC or ETH.

Conclusion

Governance tokens provide a way to coordinate the human effort required in running a multibillion-dollar decentralised autonomous organisation. The token holders underwrite the protocol risk, and the token accrues value based on the revenue earned by the protocol. Governance tokens have been able to align the interest of all stakeholders, but their distribution and control often lie with a few large players. We look forward to a future where these problems are programmatically solved, and governance tokens and DAOs become the fair controllers of the largest value-creating protocols in the world.